Insta Trend Forex handelsstrategie

“Handel met de trend!” Dit afgezaagde gezegde hoor je vaak van veel handelaren. Maar wat betekent het werkelijk?

Handelen met de trend is een zeer logische strategie. Het is omdat handelen met de trend betekent dat je niet tegen de markt vecht. Je probeert niet je wil op te dringen aan de markt. In plaats daarvan ga je mee met de stroom van de markt. De markt laten vertellen waar hij heen wil en daarin meegaan. Zie het als peddelen in een boot op een rivier. Stel je voor dat je stroomopwaarts peddelt op een rivier met een zeer sterke stroming. De kans is groot dat je jezelf uitput. Als de stroming niet te sterk is, bereikt u misschien uw bestemming, maar het duurt lang voordat u deze bereikt. Als de huidige zeer grote kans groot is dat u uw bestemming nooit zult bereiken. Aan de andere kant, stel je voor dat je peddelt in een rivier die stroomafwaarts gaat. Het zou veel gemakkelijker zijn om dat te doen, toch? Misschien hoef je niet eens te hard te peddelen. Een kleine inspanning zou voldoende zijn. Een paar slagen hier en daar om uw boot in balans te brengen, zijn voldoende. Hetzelfde geldt voor de handel. Als u bij het handelen betrokken raakt bij een transactie die tegen de stroom van de markt ingaat, is de kans groot dat u zich in een zeer stressvolle situatie bevindt. Uw transactie zal op en neer gaan en bijna nooit uw doel bereiken. Het zou zelfs een groot deel van de tijd op rood kunnen blijven staan. Aan de andere kant, als je in een transactie zit die met de trend meegaat, zou alles veel gemakkelijker zijn. Het enige dat u hoeft te doen, is de transactie vaak meteen met winst beheren.

Hoe je een trend kunt vangen

Trendhandel is gemakkelijker gezegd dan gedaan. Maar er zijn veel manieren om een golf te vangen. Eén daarvan is door het gebruik van voortschrijdende gemiddelden. Een handelaar kan eenvoudig de trend identificeren op basis van een voortschrijdend gemiddelde. Dit wordt gedaan door te identificeren waar de prijs zich bevindt ten opzichte van een voortschrijdend gemiddelde. Anderen gebruiken meerdere voortschrijdende gemiddelden. Dit wordt gedaan door te identificeren waar een voortschrijdend gemiddelde zich bevindt ten opzichte van een ander langzamer voortschrijdend gemiddelde. Als het snellere voortschrijdend gemiddelde boven het langzamere ligt, is de markt bullish. Als deze onder het langzamere voortschrijdende gemiddelde ligt, is de markt bearish. Anderen gaan nog een stapje verder en ruilen de crossover in. Hierbij wordt ervan uitgegaan dat de kruising van het voortschrijdend gemiddelde een begin zou zijn van een nieuwe trend die lang zou kunnen aanhouden.

Een andere methode is het gebruik van oscillerende indicatoren. Er zijn bepaalde indicatoren die prijsbewegingen in een ander venster kunnen nabootsen. Sommige van deze oscillerende indicatoren gebruiken meerdere lijnen die elkaar ook kunnen kruisen. Een voorbeeld hiervan is de MACD en de Stochastic Oscillator. Beide kunnen een indicatie geven van waar de trend naartoe gaat, gebaseerd op het overschrijden van de lijnen of histogrammen.

Er zijn ook mensen die prijsactie op naakte grafieken gebruiken. Ze zouden trends identificeren op basis van de schommelingen van de prijs, of deze nu nieuwe hoogtepunten of nieuwe dieptepunten bereikt.

Er zijn veel verschillende manieren om de trend te verhandelen, verschillende manieren om winst uit de markt te halen. Er is niet één juiste manier om dit te doen. Er zijn alleen winstgevende manieren en verliezende manieren.

Handelsstrategieconcept

Deze strategie probeert trends te vangen zodra deze zich voordoen. Het doet dit op dezelfde manier als het overschrijden van de prijs en een voortschrijdend gemiddelde en het gebruik van een oscillerende indicator. In plaats van het gebruikelijke voortschrijdend gemiddelde en vooraf ingestelde oscillerende indicatoren te gebruiken, zullen we echter aangepaste indicatoren gebruiken.

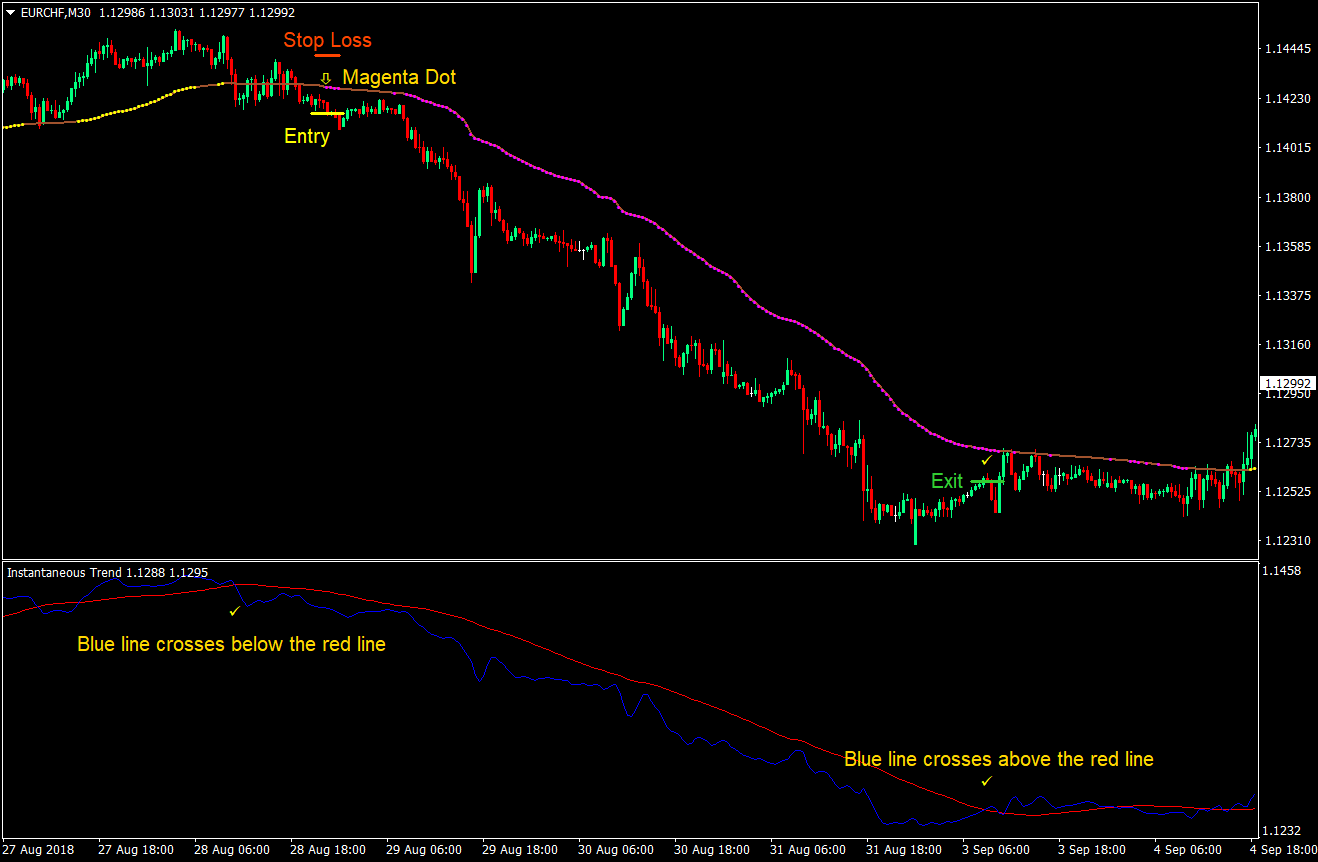

Wat de oscillerende indicator betreft, zullen we de gebruiken Onmiddellijke trend aangepaste indicator. Deze indicator heeft ook twee lijnen. De rode lijn is de langzamere lijn en de blauwe lijn is de snellere lijn. Als de blauwe lijn boven de rode lijn ligt, wordt gezegd dat de markt bullish is. Als deze onder de rode lijn ligt, wordt gezegd dat de markt bearish is. Dit zal dienen als ons filter.

Wat ons signaal betreft, zullen we de Var_Mov_Avg aangepaste indicator. Deze indicator is afgeleid van een voortschrijdend gemiddelde; Er worden echter stippen langs de lijn afgedrukt om de trendrichting aan te geven. Deze indicator drukt gele stippen af om een bullish markt aan te geven en magenta dots om een bearish markt aan te geven. Dit valt meestal ook samen met een sterke koersdoorslag door het voortschrijdend gemiddelde.

indicatoren

- Onmiddellijke trend

- Var_Mov_Avg

Tijdsbestek: grafieken van 5 minuten, 15 minuten, 30 minuten en 1 uur

Valutapaar: elk

Handelssessie: sessie in Tokio, Londen en New York

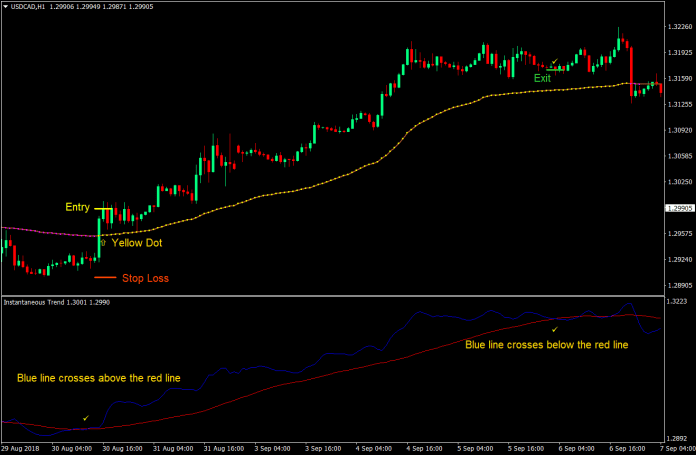

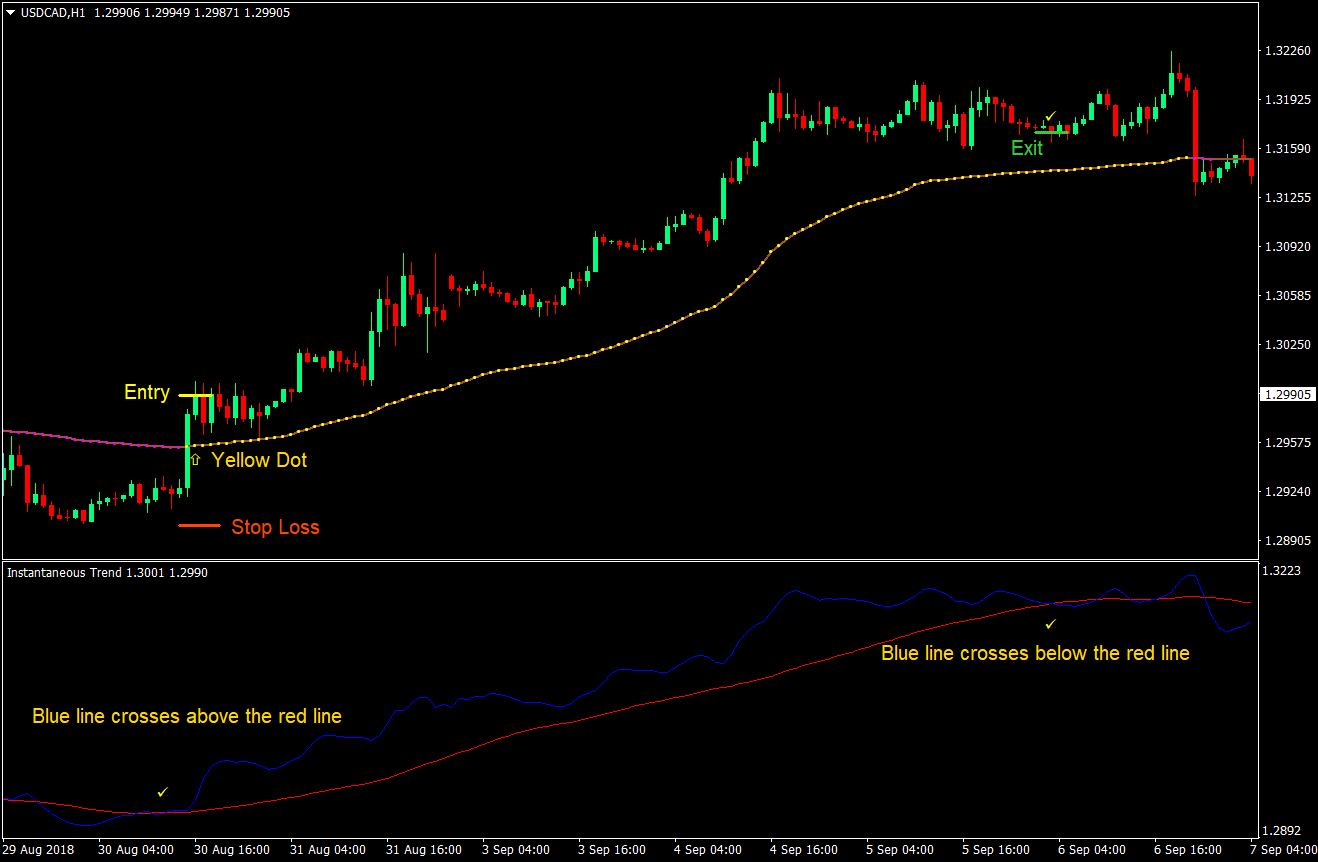

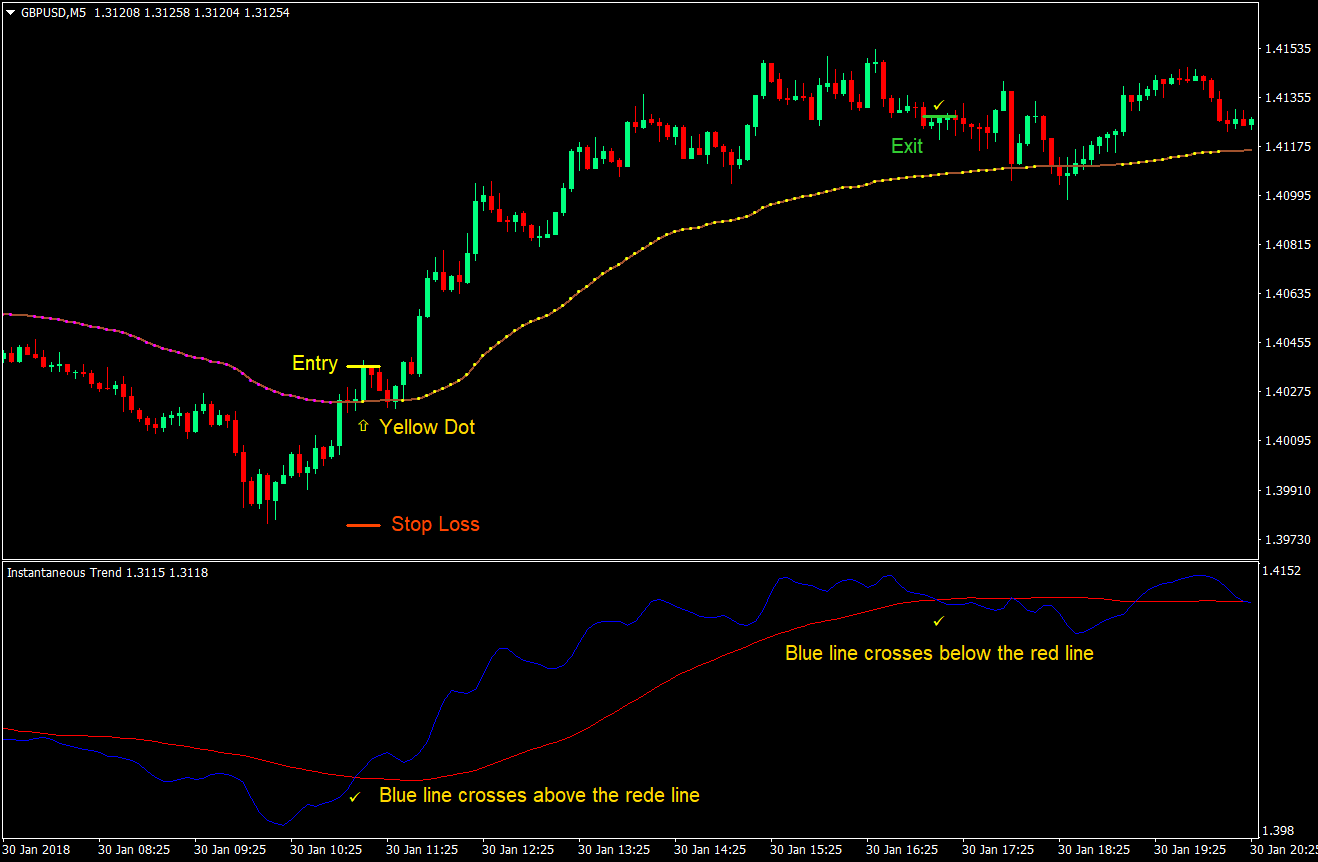

Koop (lange) handelsconfiguratie

binnenkomst

- Op de Onmiddellijke trend indicatievenster moet de blauwe lijn de rode lijn overschrijden

- De prijs moet boven de Var_Mov_Avg indicator

- De Var_Mov_Avg indicator moet een gele stip afdrukken

- Voer een kooptransactie in op de eerste gele stip

Stop Loss

- Zet de stop loss op de swing laag onder de entry-kaars

afrit

- Sluit de transactie als de Onmiddellijke trend De blauwe lijn van de indicator kruist onder de rode lijn

- Optioneel: volg de stop loss onder de Var_Mov_Avg indicator tot gestopt

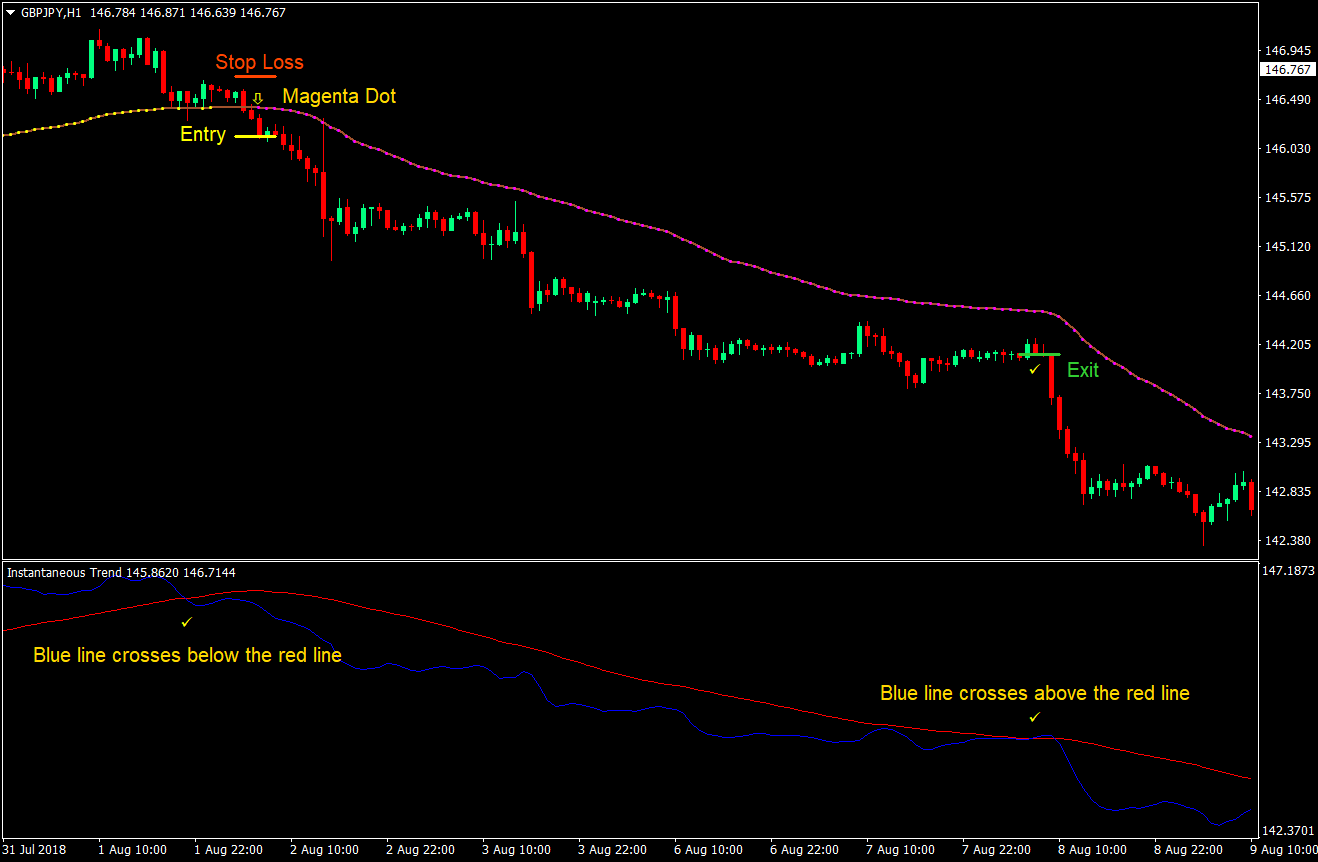

Verkoop (korte) handelsconfiguratie

binnenkomst

- Op de Onmiddellijke trend indicatievenster moet de blauwe lijn onder de rode lijn kruisen

- De prijs moet onder de grens liggen Var_Mov_Avg indicator

- De Var_Mov_Avg indicator moet een magenta stip afdrukken

- Voer een kooptransactie in op de eerste magenta stip

Stop Loss

- Stel de stop loss op de schommel hoog boven de instapkaars in

afrit

- Sluit de transactie als de Onmiddellijke trend De blauwe lijn van de indicator kruist boven de rode lijn

- Optioneel: volg de stop loss boven de Var_Mov_Avg indicator tot gestopt

Conclusie

Deze strategie is een trendvangende strategie. Door te handelen op basis van de samenloop van de bovenstaande regels, vergroten we de kans dat de prijs de richting van onze handelsopstelling zou volgen. De kans is groot dat de prijs nog geruime tijd winstgevend zal zijn. Dan zullen er momenten zijn waarop de markt sterk in de richting van de handelsopstelling zou gaan en een trend zou beginnen. Dit zijn het soort trendmarkten met grote golven die we graag zouden willen vangen. Het is gewoon aan de handelaar om de transactie goed te beheren. Dit betekent dat je op de juiste manier omgaat met hebzucht en angst.

Aanbevolen MT4-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (Opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Claim hier uw bonus van $ 50 <

Klik hieronder om te downloaden: