Momentumuitbraken zijn uitstekende handelsvoorwaarden waarin handelaren goede handelsmogelijkheden kunnen vinden. Dit komt omdat momentumuitbraken de neiging hebben om de prijs in één algemene richting te laten bewegen en vaak kunnen resulteren in een trend.

Momentumhandel is een technische handelstechniek waarbij handelaren een verhandelbaar instrument zouden kopen of verkopen op basis van de sterkte van een trend. Kortom, handelaren die momentumstrategieën verhandelen, handelen met een sterke kracht achter een prijsbeweging. Deze sterke prijsbewegingen zorgen er vaak voor dat de prijs in dezelfde richting beweegt en kunnen vaak resulteren in een trending markt.

Momentum buiten de handel is het resultaat van massa en snelheid. In de handel kunnen massa en snelheid worden geïdentificeerd op basis van volume en de afgelegde afstand per prijs binnen een korte periode.

Een manier om een sterk momentum te identificeren, is door te kijken naar momentumkaarsen. Momentum-kaarsen zijn lange, volle kaarsen met weinig tot geen lonten. Dit geeft aan dat de prijs binnen die kaarsperiode in één richting is bewogen. Dit gaat vaak gepaard met handel in grote volumes binnen die kaars.

In deze strategie zullen we kijken naar het gebruik van een aantal technische indicatoren om het momentum te bevestigen.

Dynamisch prijskanaal

Dynamic Price Channel is een aangepaste kanaaltype-indicator die is gebaseerd op de Average True Range (ATR).

De ATR is in feite het gemiddelde bereik van prijskaarsen binnen een vooraf bepaalde periode.

Het Dynamic Price Channel bevat de ATR met voortschrijdende gemiddelden om trend, volatiliteit, momentum en gemiddelde omkeringen te identificeren.

Het Dynamic Price Channel zet de voortschrijdend gemiddelde lijn uit als hoofdlijn en wordt weergegeven door een gele stippellijn. Deze lijn kan een eenvoudig voortschrijdend gemiddelde (SMA), exponentieel voortschrijdend gemiddelde (EMA) of een afgevlakt voortschrijdend gemiddelde (SMMA) zijn. Handelaren kunnen de optie selecteren op het parametertabblad van de indicator.

Vervolgens stralen zes lijnen uit de voortschrijdend-gemiddelde lijn. Drie boven en drie beneden. Deze lijnen zijn uitgezet op een afstand van de middelste lijn, de voortschrijdend gemiddelde lijn, gebaseerd op een factor van de ATR.

De indicator kan worden gebruikt als volatiliteitsindicator. Handelaren kunnen de volatiliteit identificeren op basis van de samentrekking en uitbreiding van de banden weg van de middellijn.

Het kan ook worden gebruikt om trendrichting te identificeren, gebaseerd op hoe de middelste lijn schuin loopt en op basis van het feit of bepaalde lijnen fungeren als een dynamische ondersteuning of weerstand in de richting van de trend.

Het kan ook duiden op overbought of oversold markten op basis van hoe de prijs reageert ten opzichte van de buitenste banden. Als prijsactie tekenen van prijsafwijzing op de buitenste banden vertoont, kan de markt overbought of oversold zijn. Deze voorwaarden zijn uitstekend voor een gemiddelde omkering.

Aan de andere kant kunnen dezelfde buitenste lijnen worden gebruikt om een sterk momentum te bepalen. Als prijsactie tekenen vertoont van een sterke uitbraak van het momentum tegen de buitenste lijnen, zou de markt een sterk momentum kunnen krijgen, wat zou kunnen resulteren in een trend.

Relative Strength Index

De Relative Strength Index (RSI) is een veelzijdige technische indicator die deel uitmaakt van de oscillatorfamilie van indicatoren. Het kan worden gebruikt om trends, momentum en overbought of oversold prijscondities te bepalen.

De RSI plot een lijn die oscilleert binnen het bereik van 0 tot 100. Het heeft meestal ook markeringen op niveau 50, wat de middellijn is. Als de RSI-lijn boven de 50 ligt, is de marktbias bullish, terwijl als de lijn onder de 50 ligt, de marktbias bearish is.

Het heeft ook markeringen op niveau 30 en 70. Een RSI-lijn die onder de 30 zakt, kan duiden op een oververkochte toestand, terwijl een RSI-lijn boven de 70 op een overboughttoestand kan duiden. Beide voorwaarden zijn prime voor een gemiddelde omkering.

Momentumtraders kunnen een doorbraak boven de 70 echter ook zien als een bullish momentumindicatie en een daling onder de 30 als een bearish momentumindicatie. Het is een kwestie van hoe prijsactie reageert als de RSI-lijn deze niveaus overschrijdt.

Handelaren voegen ook niveau 45 en 55 toe om een trending marktindicatie te ondersteunen. Het niveau 45 fungeert als een ondersteuningsniveau in een bullish trending markt, terwijl het niveau 55 fungeert als een weerstand in een bearish trending markt.

Trading strategie

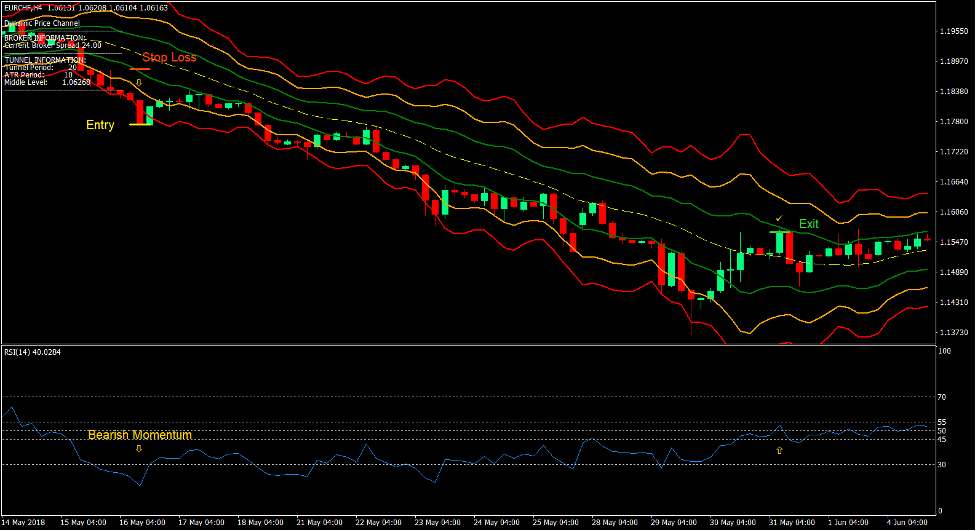

Dynamic Channel Momentum Breakout Forex Trading Strategy is een momentum breakout-strategie die handelt op samenvloeiingen tussen het momentum breakout-signaal afkomstig van de Dynamic Price Channel-indicator en de RSI.

Op het Dynamic Price Channel wordt momentum geïdentificeerd op basis van een sterke momentumkaars die buiten de buitenste lijnen van het Dynamic Price Channel breekt. Dit wordt weergegeven door de rode lijnen boven en onder de middelste gele lijn.

Op de RSI wordt het momentum bevestigd op basis van de RSI-lijn die doorbreekt boven de 70 in het geval van een bullish momentum of onder de 30 in het geval van een bearish momentum.

Samenvloeiingen tussen de twee momentumsignalen zijn meestal momentumsignalen met een hoge waarschijnlijkheid die kunnen resulteren in een trend.

Indicatoren:

- Dynamisch_prijs_kanaal

- Relative Strength Index

Voorkeurstermijnen: 1 uur en 4 uur grafieken

Valutaparen: FX majors, minors en crosses

Handelssessies: Sessies Tokio, Londen en New York

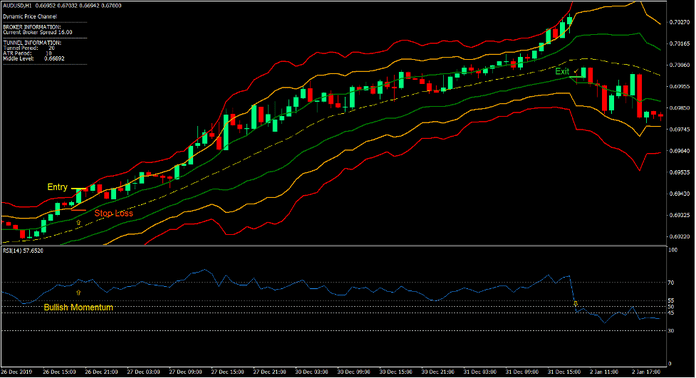

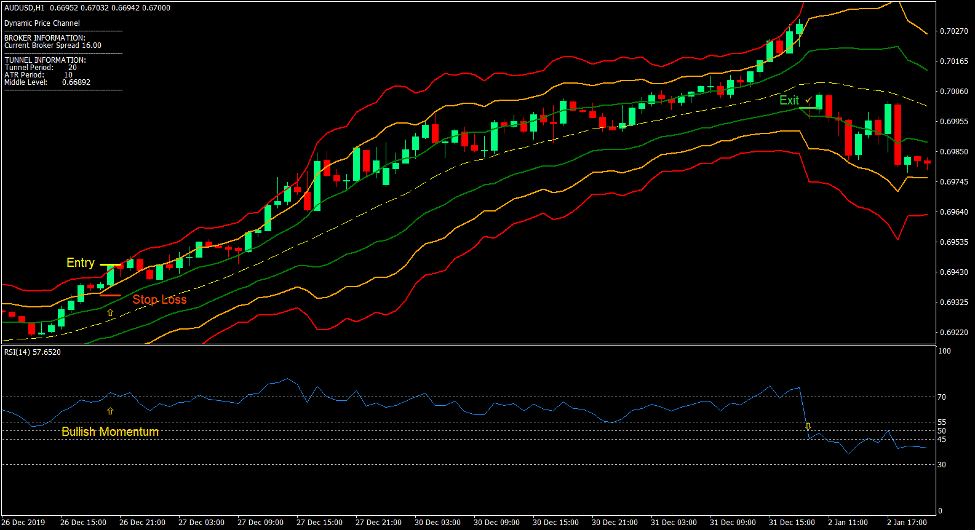

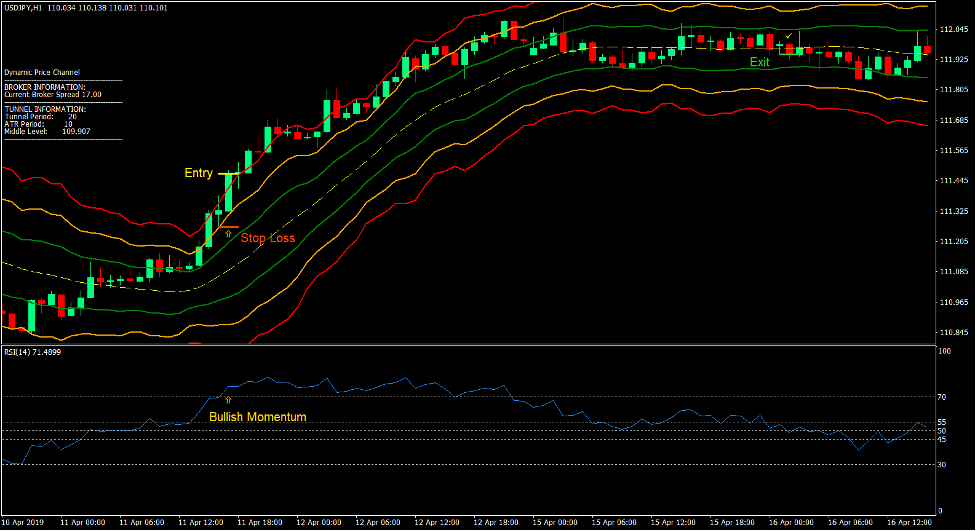

Koop Trade Setup

binnenkomst

- Een bullish momentum-kaars zou boven de bovenste rode lijn van het Dynamic Price Channel moeten breken.

- De RSI-lijn zou boven 70 moeten doorbreken.

- Voer een kooporder in op de samenvloeiing van beide signalen.

Stop Loss

- Stel de stop loss in op een ondersteuningsniveau iets onder de instapkaars.

afrit

- Sluit de transactie zodra de RSI-lijn onder de 50 zakt.

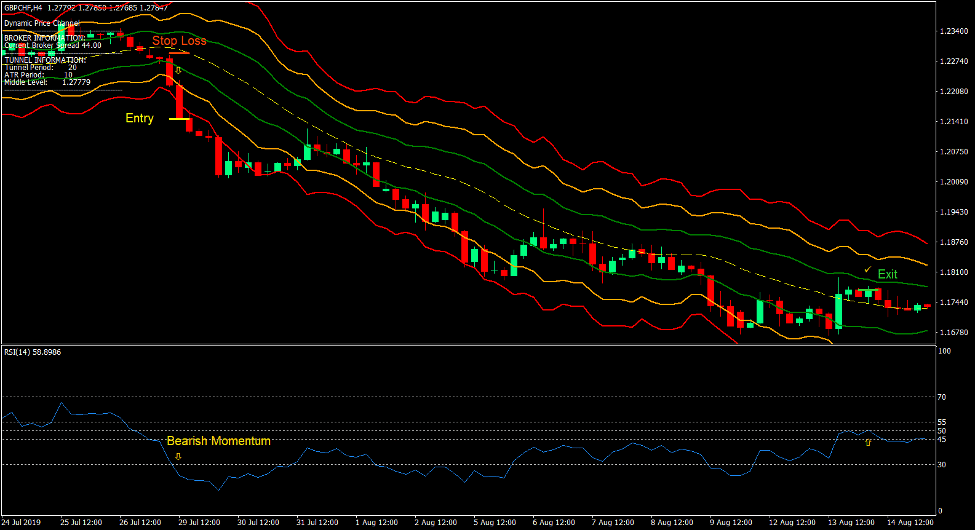

Verkoop handelsconfiguratie

binnenkomst

- Een bearish momentum-kaars zou onder de onderste rode lijn van het Dynamic Price Channel moeten doorbreken.

- De RSI-lijn zou onder de 30 moeten komen.

- Voer een verkooporder in op de samenvloeiing van beide signalen.

Stop Loss

- Stel de stop loss in op een weerstandsniveau iets boven de instapkaars.

afrit

- Sluit de transactie zodra de RSI-lijn boven de 50 komt.

Conclusie

Deze momentum-uitbraakstrategie produceert momentum-handelsopstellingen die zijn gebaseerd op twee hoogwaardige momentumsignalen.

Er zijn veel professionele handelaren die deze methode gebruiken met verschillende parameters en met samenvloeiingen die uit meerdere tijdsbestekken komen. Als een op zichzelf staand momentumsignaal zou deze strategie echter al handelsopstellingen van hoge kwaliteit kunnen opleveren.

Het is ook belangrijk op te merken dat deze handelsopstellingen vaak goed werken wanneer de uitbraken voortkwamen uit een krappe marktcongestie.

Handelaren kunnen met deze strategie oefenen als onderdeel van een algemene momentumstrategie met meerdere samenvloeiingen van tijdsbestekken.

Aanbevolen MT4-makelaars

XM-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Meld u hier aan voor een XM Broker-account <

FBS-makelaar

- Handel 100 Bonus: Gratis $ 100 om uw handelsreis een vliegende start te geven!

- 100% Deposit Bonus: Verdubbel uw storting tot $10,000 en handel met meer kapitaal.

- Gebruik maximaal 1: 3000: Maximaliseren van potentiële winsten met een van de hoogste beschikbare hefboomopties.

- Award voor 'Beste Klantenservicemakelaar Azië': Erkende uitmuntendheid op het gebied van klantenondersteuning en service.

- Seizoensgebonden promoties: Geniet het hele jaar door van een verscheidenheid aan exclusieve bonussen en promotie-aanbiedingen.

>> Meld u hier aan voor een FBS-brokeraccount <

Klik hieronder om te downloaden: