Wanneer nieuwe handelaren voor het eerst naar grafieken kijken, zien ze vaak een betekenisloze beweging van staven en lijnen die op en neer gaan. Kansen worden niet gemakkelijk opgemerkt door nieuwe handelaren, omdat de meesten nog steeds niet de vaardigheid hebben ontwikkeld om deze te zien. Maar waar zijn we in de eerste plaats naar op zoek? Hoe zien traders kansen in een ogenschijnlijk chaotische grafiek?

De geschiedenis herhaalt zich. Dit is het concept waarmee technische handelaren consequent geld kunnen verdienen aan de forexmarkt. De markt beweegt zich in patronen en cycli. Deze patronen en cycli zorgen voor voorspelbaarheid. Hierdoor kunnen doorgewinterde handelaren een intelligente inschatting maken van waar de markt naartoe zou kunnen gaan. Voor hen is elke keer dat deze patronen en cycli zich voordoen een kans om geld te verdienen.

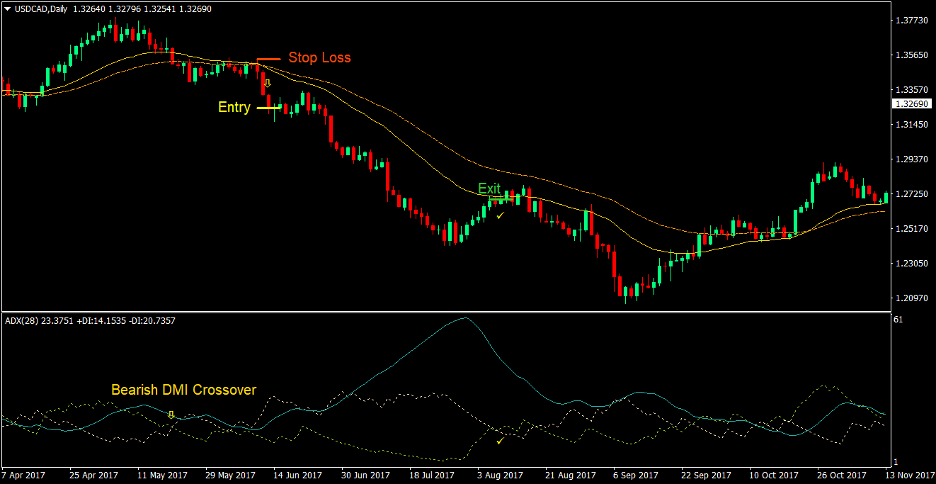

Met de Directional Modified Moving Average Forex Trading Strategy kunnen handelaren deze cycli gemakkelijk identificeren met behulp van een reeks technische indicatoren. Deze indicatoren kunnen gemakkelijk de punten laten zien waar de trendcycli omkeren, waardoor traders inzicht kunnen krijgen in een anderszins chaotische grafiek.

Gemiddelde richtingbewegingsindex

De Average Directional Movement Index (ADX) is een technische indicator ontwikkeld door Welles Wilder. Deze indicator helpt handelaren bij het bepalen van de trendrichting op basis van momentum en trendsterkte.

De gemiddelde directionele bewegingsindex bestaat uit de plus-directionele indicator (+DI), min-directionele indicator (-DI) en de gemiddelde directionele index (ADX). De plus-richtingsindicator (+DI) en de min-richtingsindicator (-DI) worden gezamenlijk de richtingsbewegingsindicator (DMI) genoemd.

De DMI wordt gebruikt om de trendrichting te bepalen. Dit is gebaseerd op de locatie van de +DI ten opzichte van de -DI. In een bullish trend zou de +DI-lijn boven de -DI-lijn liggen, terwijl de -DI-lijn tijdens een bearish trend boven de +DI-lijn zou liggen. Als zodanig worden crossovers tussen de twee lijnen beschouwd als een trendomkeringssignaal.

De ADX-lijn vertegenwoordigt de trendsterkte. Technische handelaren interpreteren ADX-cijfers boven de 25 als een sterke trend, terwijl cijfers onder de 20 worden beschouwd als marktomstandigheden zonder trend.

De i-AMA Optimum en i-AMMA-indicator

Hoewel deze indicatoren vrijwel dezelfde namen hebben, verschillen ze wel qua aanpak. Deze twee indicatoren zijn praktisch een aangepaste versie van een voortschrijdend gemiddelde. Hun aanpassingen zijn echter bedoeld om een ander kenmerk te bieden in vergelijking met andere voortschrijdende gemiddelden.

De i-AMA Optimum is een adaptief voortschrijdend gemiddelde (AMA). Dit type voortschrijdend gemiddelde wordt aangepast om te zorgen voor een minder gevoelige voortschrijdend gemiddelde lijn. Dit maakt de lijn minder gevoelig voor schokkerige marktbewegingen. Dit maakt de i-AMA ook tot een uitstekende trendfilter-voortschrijdend-gemiddeldelijn.

De i-AMMA-indicator daarentegen is een Average Modified Moving Average (AMMA). Deze versie van een voortschrijdend gemiddelde is erop gericht beter te reageren op prijsactiebewegingen. Dit zorgt ervoor dat de lijn de prijsactie veel nauwer volgt in vergelijking met andere voortschrijdende gemiddelden. Het biedt ook een minder traag signaal. Deze kenmerken maken de i-AMMA-indicator tot een uitstekend voortschrijdend gemiddelde van de signaallijn.

Trading strategie

Deze strategie is een cross-over strategie voor trendomkering, gebaseerd op twee voortschrijdende gemiddelden die voor tegengestelde doeleinden zijn ontworpen. De i-AMA Optimum-indicator zou worden gebruikt als het achterblijvende voortschrijdend gemiddelde, terwijl de i-AMMA-indicator zou worden gebruikt als de leidende voortschrijdende gemiddelde lijn. Handelssignalen worden gegenereerd wanneer de twee lijnen elkaar kruisen.

De handelssignalen geproduceerd door de twee voortschrijdende gemiddelden hierboven zouden echter in overeenstemming moeten zijn met de DMI-lijnen van de ADX-indicator. Bullish crossover-signalen moeten samenvallen met een bullish DMI-crossover, terwijl bearish crossover-signalen moeten samenvallen met een bearish DMI-crossover.

De ADX-lijn zou dienen als bevestiging van het handelssignaal. Winstgevende transacties zouden doorgaans resulteren in een ADX-lijn die boven de 25 uitkomt. We zullen onze transacties echter niet op basis daarvan beperken. Dit komt omdat de markt de neiging heeft om voorafgaand aan een trend in de krimpfase te beginnen. Tijdens de contractiefasen ligt de ADX-lijn gewoonlijk onder de 25.

Indicatoren:

- Gemiddelde richtingbewegingsindex

- Periode: 28

- ik-AMMA

- MA-periode: 14

- i-AMA-Optimaal

Tijdsbestek: bij voorkeur 4-uurs- en daggrafieken

Valutaparen: grote en kleine paren

Handelssessie: Tokio, Londen en New York

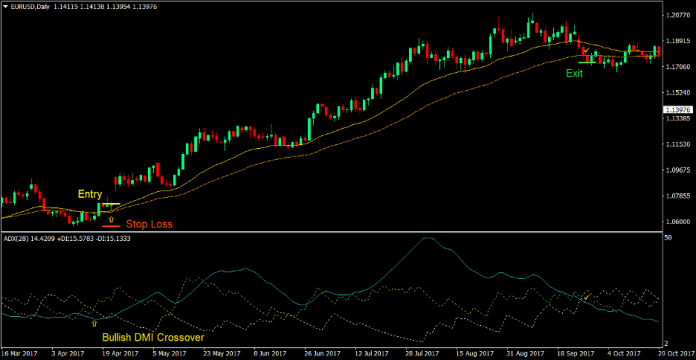

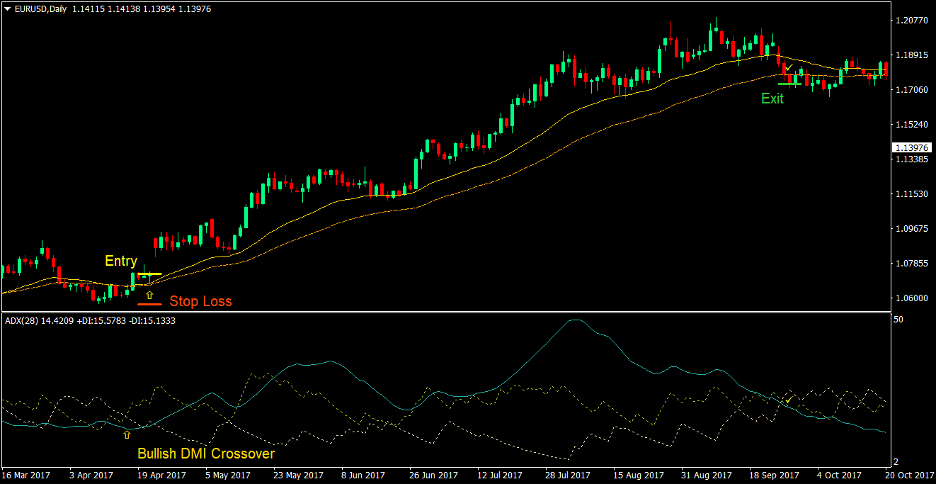

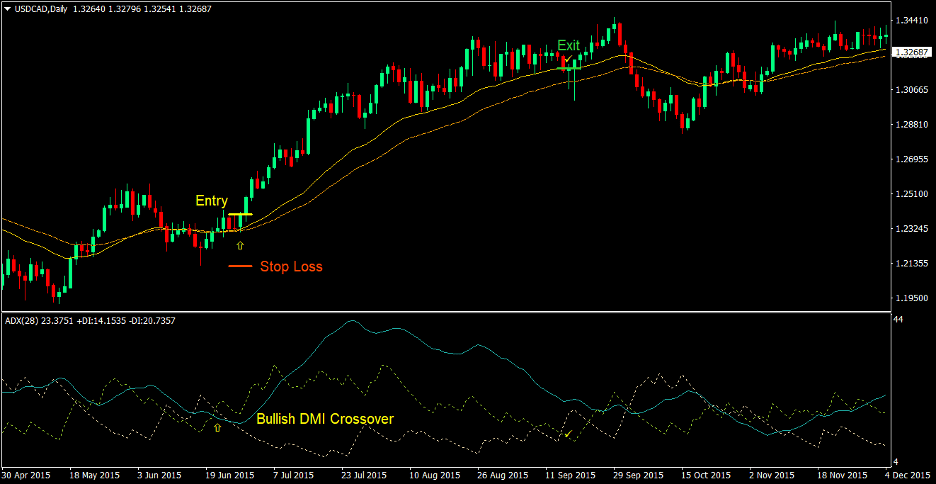

Koop Trade Setup

binnenkomst

- De +DI-lijn (geelgroen) zou boven de -DI-lijn (tarwe) moeten uitkomen, wat een bullish trendomkering aangeeft

- De i-AMMA-lijn (ononderbroken lijn) zou boven de i-AMA Optimum-lijn (stippellijn) moeten uitkomen, wat een bullish trendomkering aangeeft

- De bullish trendomkeringssignalen zouden enigszins op één lijn moeten liggen

- Voer een kooporder in op het samenvloeien van de bovenstaande voorwaarden

Stop Loss

- Stel de stop loss in op het ondersteuningsniveau onder de entry-kaars

afrit

- Sluit de transactie zodra de DMI-lijnen omkeren

- Sluit de transactie zodra de prijs onder de i-AMA Optimum-lijn sluit

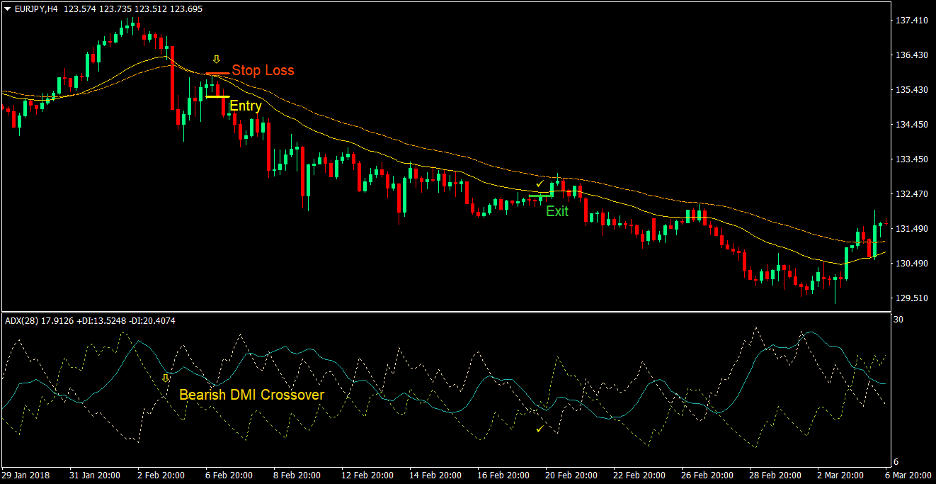

Verkoop handelsconfiguratie

binnenkomst

- De +DI-lijn (geelgroen) zou onder de -DI-lijn (tarwe) moeten komen, wat een bearish trendomkering aangeeft

- De i-AMMA-lijn (ononderbroken lijn) zou onder de i-AMA Optimum-lijn (stippellijn) moeten kruisen, wat een bearish trendomkering aangeeft

- De bearish trendomkeringssignalen zouden enigszins op één lijn moeten liggen

- Voer een verkooporder in op basis van de samenloop van de bovenstaande voorwaarden

Stop Loss

- Stel de stop loss in op het weerstandsniveau boven de entry-kaars

afrit

- Sluit de transactie zodra de DMI-lijnen omkeren

- Sluit de transactie zodra de prijs boven de i-AMA Optimum-lijn sluit

Conclusie

Deze handelsstrategie is een werkende crossover-strategie die handelssignalen van goede kwaliteit produceert. Veel van de handelssignalen die door deze strategie worden geproduceerd, kunnen tot een trend leiden. Dit zou handelaren in staat stellen geld te verdienen met hoogrenderende transacties die een belonings-risicoverhouding van maar liefst 2:1 tot 5:1 zouden kunnen opleveren.

Deze strategie werkt goed in een valutapaar met veel volatiliteit en heeft een sterke trendneiging. Vermijd het handelen in deze strategie in een valutapaar of markt die de neiging heeft schokkerig of vlak te zijn.

De DMI-crossover neigt soms ook responsiever te zijn dan de voortschrijdend-gemiddelde lijnen. Er zouden momenten zijn waarop een tijdelijke terugslag een kruising op de DMI-lijnen zou kunnen veroorzaken. Deze scenario's zouden tot een voortijdige exit uit de handel kunnen leiden en de winsten korter kunnen maken dan mogelijk was geweest. Het is echter beter om eerder te stoppen dan alle winst terug te geven als de DMI-crossover inderdaad tot een daadwerkelijke trendomkering leidt. Handelaren die ervoor kiezen om de transactie aan te houden, kunnen gebruik maken van een slimme strategie voor handelsbeheer, waarbij gebruik wordt gemaakt van trailing stops en het verplaatsen van stopverliezen naar break-even.

Aanbevolen MT4-makelaars

XM-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Meld u hier aan voor een XM Broker-account <

FBS-makelaar

- Handel 100 Bonus: Gratis $ 100 om uw handelsreis een vliegende start te geven!

- 100% Deposit Bonus: Verdubbel uw storting tot $10,000 en handel met meer kapitaal.

- Gebruik maximaal 1: 3000: Maximaliseren van potentiële winsten met een van de hoogste beschikbare hefboomopties.

- Award voor 'Beste Klantenservicemakelaar Azië': Erkende uitmuntendheid op het gebied van klantenondersteuning en service.

- Seizoensgebonden promoties: Geniet het hele jaar door van een verscheidenheid aan exclusieve bonussen en promotie-aanbiedingen.

>> Meld u hier aan voor een FBS-brokeraccount <

Klik hieronder om te downloaden: