Bij het handelen op de markten draait alles om sentimenten. Het gaat over de menselijke natuur en de psychologie van de menigte. Of het nu gaat om aandelenhandel, goud, olie, grondstoffen, cryptocurrencies of forex. Er zullen altijd mensen zijn die optimistisch zijn over een bepaald goed, en mensen die er pessimistisch over zijn. Ze worden de stieren en de beren genoemd. Wie op een bepaalde periode sterker blijkt te zijn, wint. Als handelaren is het niet onze taak om te raden welke kant de markt op gaat. Het is onze taak om een gevoel te krijgen van de markt. Wie is momenteel sterker? Zijn het de stieren of de beren?

De Bulls Bears Stop Forex Trading Strategie is een handelsstrategie waarbij het idee om het marktsentiment te bepalen centraal staat. Deze strategie heeft tot doel te profiteren van de forexmarkt door objectief de kracht van de bulls en die van de bears te meten. Dit geeft ons een indicatie welke richting we moeten inslaan om consistent te kunnen profiteren van de forexmarkt. Zolang we een idee hebben welke kant de markt op wil, is de strijd al half gestreden.

Stieren en beren machtsindicatoren

De Bulls en Bears-indicatoren zijn indicatoren die proberen de kracht van de Bulls en de Bears in een markt te meten. Door dit te doen, krijgen we een idee van waar de markt naartoe gaat op basis van hun respectievelijke sterke punten.

De Bulls en Bears-indicator zijn eenvoudige oscillerende indicatoren die de afstand tussen hoog en laag meten en vergelijken met een exponentieel voortschrijdend gemiddelde (EMA). Positieve bulls en bears geven aan dat zowel de hoogtepunten als de dieptepunten van de prijs stijgen in vergelijking met de gemiddelde prijs. Dit betekent dat het marktsentiment bullish is. Aan de andere kant, als de Bulls en Bears-indicator negatief zijn, betekent dit dat de hoogte- en dieptepunten van prijsactie dalen in vergelijking met de gemiddelde prijs, wat betekent dat de markt bearish is.

Kroonluchter stopt of kroonluchter verlaat

De Chandelier Stops-indicator, ook wel bekend als de Chandelier Exits, is een trailing stop-indicator die handelaren helpt bij het vaststellen van de ideale plaatsing van stop-verliezen. Het lijkt veel op de Parabolic Stop and Reverse-indicator (PSAR), maar het is een eenvoudigere versie ervan.

De Chandelier Stops-indicator meet stopverliespunten op basis van de maximale waarde van hoog en laag. Andere versies gebruiken de maximale waarde van de afsluiting. Vervolgens plaatst het een buffer tussen de maximale waarde door het Average True Range (ATR) voor een bepaalde periode te berekenen en dit op te tellen boven de maximale waarde of af te trekken van de maximale laagste waarde. Hierdoor kunnen handelaren de veilige afstand identificeren waarop ze hun stopverliezen kunnen volgen. Het argument is dat als de prijs ooit een veelvoud van de ATR zou omkeren, wordt aangenomen dat de trend al is omgekeerd.

Trading strategie

Deze handelsstrategie is een op marktsentiment gebaseerde strategie die probeert de trend te bepalen op basis van de kracht van de Bulls en de Bears. Het doet dit door gebruik te maken van de Bulls en Bears Power-indicatoren.

Transacties worden uitgevoerd op basis van de richting van zowel de Bulls- als de Bears-indicatoren. Als de Bulls en Bears-indicatoren positief zijn, kan een kooptransactie worden geactiveerd. Aan de andere kant, als deze indicatoren negatief zijn, kan er sprake zijn van een verkooptransactie.

De Chandelier Stops-indicator, een trailing stop-indicator, zou worden gebruikt als trendrichtingindicator. Deze specifieke versie van de Chandelier Stops trekt alleen de lijn tegengesteld aan de richting van de trend. Wanneer de trend bullish is, trekt de indicator alleen de onderste lijn. Wanneer de trend bearish is, zou deze alleen de bovenste lijn trekken. Dit vertelt ons handig in welke richting de trend is gebaseerd op de indicator.

Hoewel de bovenstaande instapsignalen van hoge kwaliteit zijn, zullen we ten slotte nog steeds transacties uitfilteren die tegen de langetermijntrend ingaan. Om dit te doen, zullen we het Exponential Moving Average (EMA) over 200 perioden gebruiken. Dit voortschrijdend gemiddelde is een veelgebruikte langetermijntrendindicator. Transacties mogen alleen worden uitgevoerd als de andere drie indicatoren in overeenstemming zijn met de 200 EMA.

Indicatoren:

- 200 EMA (goud)

- KroonluchterStops-v1

- Lengte: 28

- ATR-periode: 18

- Kv: 3.5

- Bulls

- Periode: 50

- beren

- Periode: 50

Tijdsbestek: 4-uurs en dagelijkse grafieken

Valutaparen: grote en kleine paren

Handelssessie: Tokio, Londen en New York

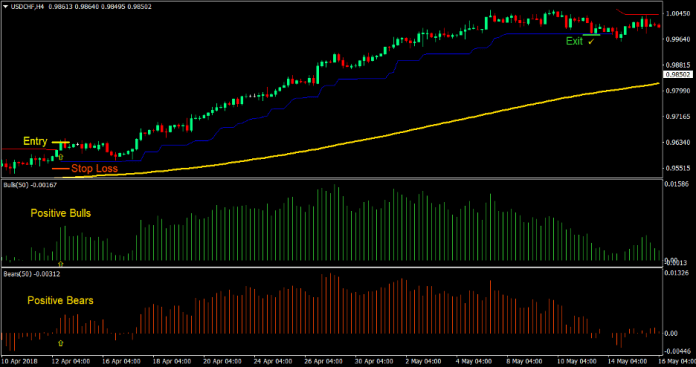

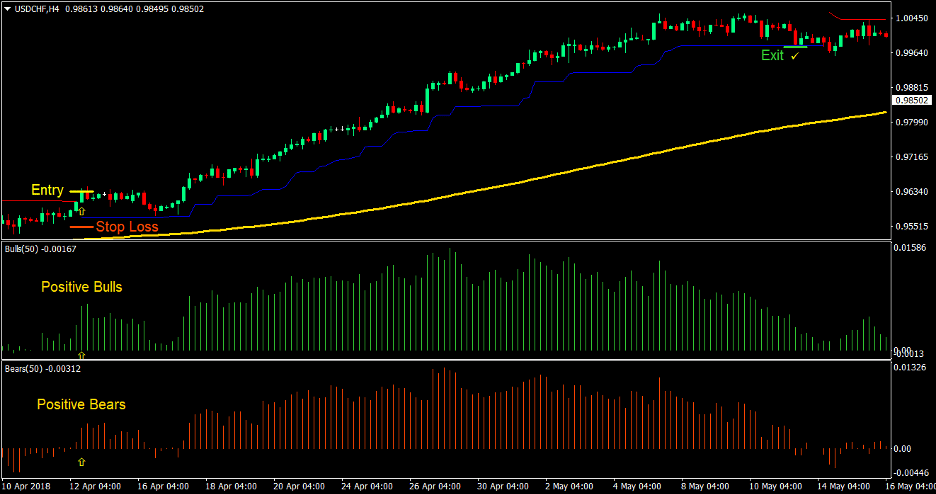

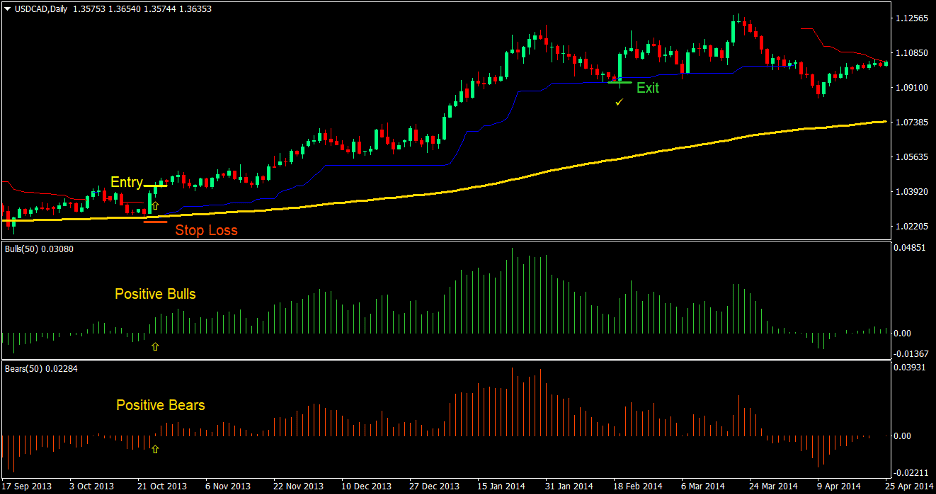

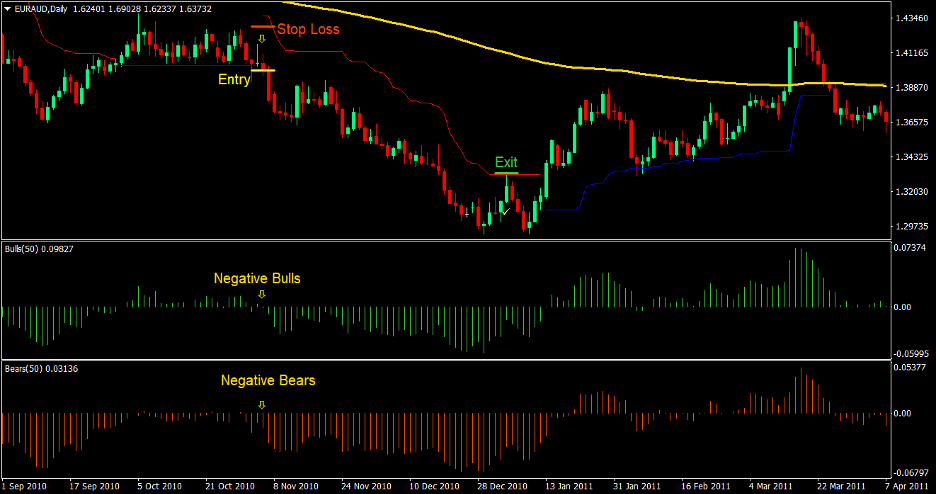

Koop Trade Setup

binnenkomst

- De prijs zou boven de 200 EMA moeten liggen, wat wijst op een bullish langetermijntrend

- De Bulls en Bears Power-indicatoren zouden positief moeten zijn, wat wijst op een bullish marktsentiment

- De Chandelier Stops-indicator zou een blauwe lijn onder de prijsactie moeten afdrukken, wat een bullish trend aangeeft

- Voer een kooporder in op het moment dat de bovenstaande marktomstandigheden samenkomen

Stop Loss

- Stel de stop loss in op het ondersteuningsniveau onder de entry-kaars

afrit

- Volg de stop loss onder de blauwe Chandelier Stops-lijn totdat u stopt met winst

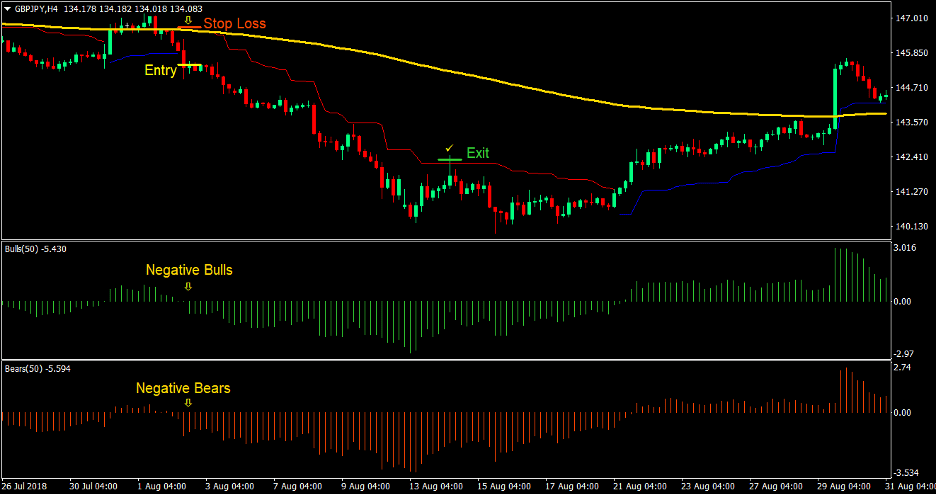

Verkoop handelsconfiguratie

binnenkomst

- De prijs zou onder de 200 EMA moeten liggen, wat wijst op een bearish langetermijntrend

- De Bulls en Bears Power-indicatoren zouden negatief moeten zijn, wat wijst op een bearish marktsentiment

- De Chandelier Stops-indicator zou een rode lijn boven de prijsactie moeten afdrukken, wat een bearish trend aangeeft

- Voer een verkooporder in op het moment dat de bovenstaande marktomstandigheden samenkomen

Stop Loss

- Stel de stop loss in op het weerstandsniveau boven de entry-kaars

afrit

- Volg de stop loss boven de rode Chandelier Stops-lijn totdat u stopt met winst

Conclusie

Deze handelsstrategie is een behoorlijk winstgevende handelsstrategie. Het heeft een redelijk behoorlijk winstpercentage vanwege het feit dat de trend gebaseerd is op het marktsentiment en dat transacties worden gefilterd om aan te sluiten bij de langetermijntrend. Door dit te doen, nemen we transacties aan waarvan de kans groter is dat ze in de richting van onze handel evolueren, omdat er minder dynamische steun en weerstanden zijn die de transacties moeten overwinnen. Deze handelsstrategie heeft ook een eerlijke beloning-risicoverhouding die kan stijgen van 2:1 naar 4:1, afhankelijk van de marktomstandigheden.

Aanbevolen MT4-makelaars

XM-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Meld u hier aan voor een XM Broker-account <

FBS-makelaar

- Handel 100 Bonus: Gratis $ 100 om uw handelsreis een vliegende start te geven!

- 100% Deposit Bonus: Verdubbel uw storting tot $10,000 en handel met meer kapitaal.

- Gebruik maximaal 1: 3000: Maximaliseren van potentiële winsten met een van de hoogste beschikbare hefboomopties.

- Award voor 'Beste Klantenservicemakelaar Azië': Erkende uitmuntendheid op het gebied van klantenondersteuning en service.

- Seizoensgebonden promoties: Geniet het hele jaar door van een verscheidenheid aan exclusieve bonussen en promotie-aanbiedingen.

>> Meld u hier aan voor een FBS-brokeraccount <

Klik hieronder om te downloaden: