Trendvoortzettingsopstellingen kunnen worden verhandeld in combinatie met een momentum breakout-opstelling.

Bij het handelen in dit soort strategieën is het belangrijk dat we de richting van de trend duidelijk identificeren, evenals de marktkrimpfase die plaatsvindt voorafgaand aan de meeste uitbraken. We moeten ook de steun- en weerstandsniveaus identificeren die moeten worden doorbroken, zodat we effectiever kunnen reageren naarmate de momentumuitbraak zich ontwikkelt.

Deze strategie laat zien hoe we momentum breakout-opstellingen in de richting van de trend kunnen verhandelen met behulp van de Bollinger Bands, 50 EMA en RSI.

50 Exponentieel voortschrijdend gemiddelde

Voortschrijdende gemiddelden zijn waarschijnlijk de meest basale technische indicatoren. Het zijn eenvoudige hulpmiddelen die handelaren kunnen gebruiken om trendrichtingen en waarschijnlijke trendomkeringen te identificeren.

Handelaren kunnen de trendrichting of trendbias gemakkelijk identificeren met behulp van voortschrijdend-gemiddelde lijnen door te kijken naar waar prijsactie over het algemeen plaatsvindt in relatie tot de voortschrijdend-gemiddelde lijn. Afgezien hiervan hebben voortschrijdend gemiddelde lijnen ook de neiging in de richting van de trend te hellen. De helling van de lijn van het voortschrijdend gemiddelde kan dus ook visueel de door de handelaar geïdentificeerde trendrichting of trendbias bevestigen.

Bepaalde lijnperioden met voortschrijdend gemiddelde worden op grotere schaal gebruikt dan andere. Sommige worden algemeen aanvaard als een indicatie van de trendrichting op basis van verschillende tijdshorizonten.

Het voortschrijdend gemiddelde van 50 bar wordt algemeen aanvaard als trendindicator voor de middellange termijn. In feite handelen veel handelaren uitsluitend in de richting die wordt aangegeven door de 50 voortschrijdend gemiddelde lijn.

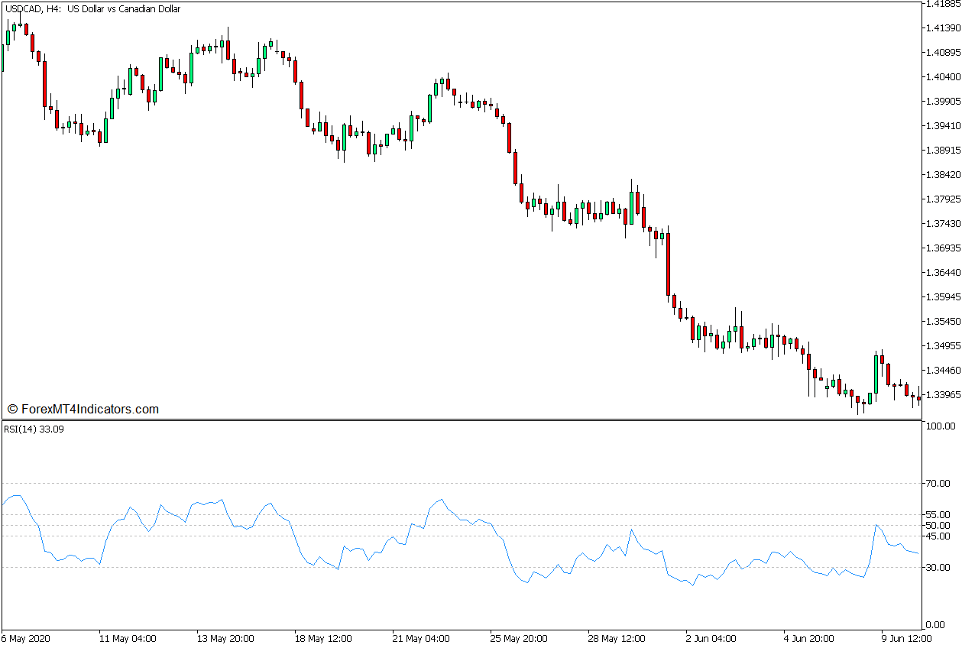

Relative Strength Index

De Relative Strength Index (RSI) is een technische indicator van het oscillatortype die zeer veelzijdig is. Het wordt voornamelijk gebruikt voor het identificeren van overbought- en oververkochte marktomstandigheden. Het kan echter ook worden gebruikt om het momentum en de trendrichting te identificeren.

De RSI tekent een lijn die schommelt binnen het bereik van nul tot 100. De schommeling van deze lijn is gebaseerd op de gemiddelde prijswinst en het gemiddelde prijsverlies op basis van recente historische prijsgegevens.

Het bereik van de RSI heeft doorgaans markeringen op niveau 30 en 70. Deze markers vertegenwoordigen de oververkochte en overboughtniveaus op het RSI-bereik. Een RSI-lijn die onder de 30 zakt, duidt op een oververkochte markt, terwijl een RSI-lijn die boven de 70 uitkomt, duidt op een overboughtmarkt. Beide scenario’s zijn uitstekende voorwaarden voor een gemiddelde omkering. Aan de andere kant kan de RSI-lijn ook buiten het bereik van 30 en 70 blijven wanneer het momentum sterk in een bepaalde richting beweegt. De RSI kan blijven duiden op een oververkochte of overgekochte markt, maar dit kan te wijten zijn aan een sterke uitbraak van het momentum.

Veel handelaren voegen ook een marker toe op niveau 50. Deze marker wordt voornamelijk gebruikt als basis voor trendbias. De RSI-lijn blijft doorgaans boven de 50 in een opwaartse markt en onder de 50 in een neerwaartse markt. Sommige handelaren voegen ook markeringen toe op niveau 45 en 55. Niveau 45 fungeert doorgaans als ondersteuningsniveau voor de RSI-lijn in een opwaartse markt, terwijl niveau 55 ook kan fungeren als weerstandsniveau voor de RSI in een neerwaartse markt.

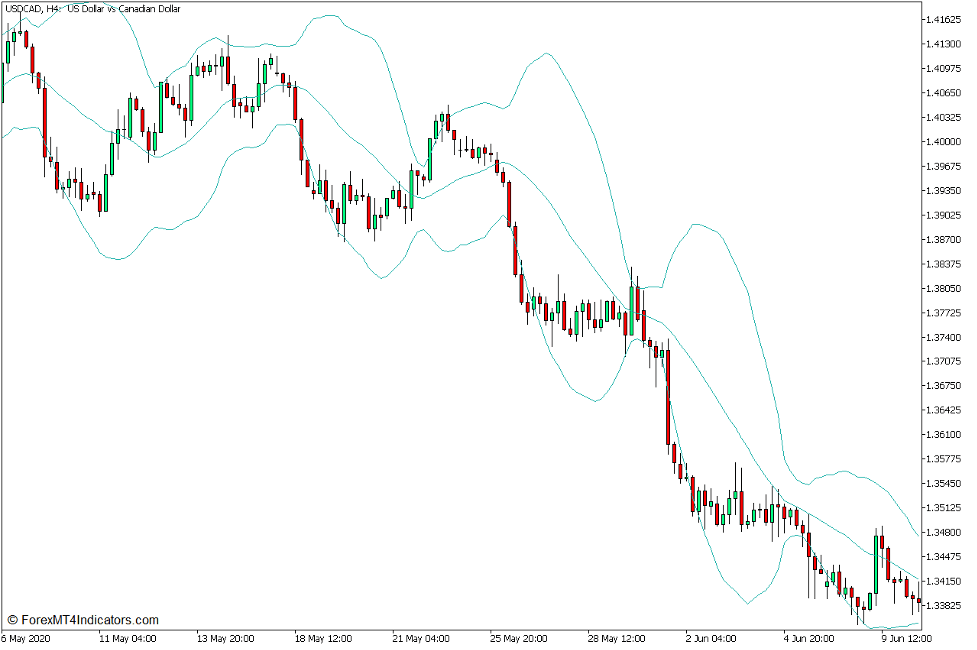

Bollinger Bands

De Bollinger Bands is een technische indicator die ook voor verschillende doeleinden kan worden gebruikt. Het kan de trendrichting, de volatiliteit, het momentum en de overbought- en oversold-marktomstandigheden aangeven.

De Bollinger Bands tekent drie lijnen op de prijsgrafiek. De middelste lijn is een Simple Moving Average (SMA)-lijn van 20 maten, terwijl de twee buitenste balken die boven en onder de middelste lijn zijn verschoven, standaardafwijkingen van de gemiddelde prijs zijn.

Omdat de middelste lijn een lijn met voortschrijdend gemiddelde is, kunnen de Bollinger Bands worden gebruikt als trendrichtingindicator, net zoals elke lijn met voortschrijdend gemiddelde dat zou kunnen. Prijsactie blijft over het algemeen in de bovenste helft van de band in een opwaartse markt, en in de onderste helft van de band in een neerwaartse markt.

De buitenste lijnen kunnen worden gebruikt om de volatiliteit visueel aan te geven, omdat ze gebaseerd zijn op standaarddeviaties. De buitenste banden breiden zich uit wanneer de volatiliteit toeneemt en krimpen wanneer de volatiliteit afneemt.

De buitenste lijnen worden ook voornamelijk gebruikt om overbought- en oververkochte prijsniveaus te identificeren. Het gebied boven de bovenste lijn wordt als overbought beschouwd, terwijl het gebied onder de onderste lijn als oververkocht wordt beschouwd. Dezelfde buitenste lijnen kunnen echter ook worden gebruikt om sterke momentumuitbraken te identificeren. Het verschil tussen elk scenario zou gebaseerd zijn op hoe prijsactie ontstaat als de prijs de lijnen raakt. Prijsafwijzing die optreedt in het gebied van de buitenste lijnen is indicatief voor een waarschijnlijke gemiddelde omkering, terwijl sterke momentumuitbraken voorbij de buitenste lijnen, afkomstig van een lage volatiliteit, indicatief zijn voor een waarschijnlijke sterke momentumuitbraak.

Handelsstrategieconcept

Deze handelsstrategie is een momentum-breakout-strategie die samen met de trend handelt met behulp van de Bollinger Bands, 50 EMA-lijn en de RSI.

De 50 EMA-lijn wordt gebruikt als het belangrijkste trendrichtingfilter. Transacties worden alleen uitgevoerd in de trendrichting aangegeven door de 50 EMA-lijn.

We zullen de RSI gebruiken als een nieuwe laag voor trendbevestiging. Dit zal gebaseerd zijn op waar de RSI-lijn zich doorgaans bevindt ten opzichte van de markeringen op niveaus 45, 50 en 55.

De Bollinger Bands worden vervolgens gebruikt als basis voor het identificeren van momentumuitbraken die voortkomen uit de krimpfases van de markt.

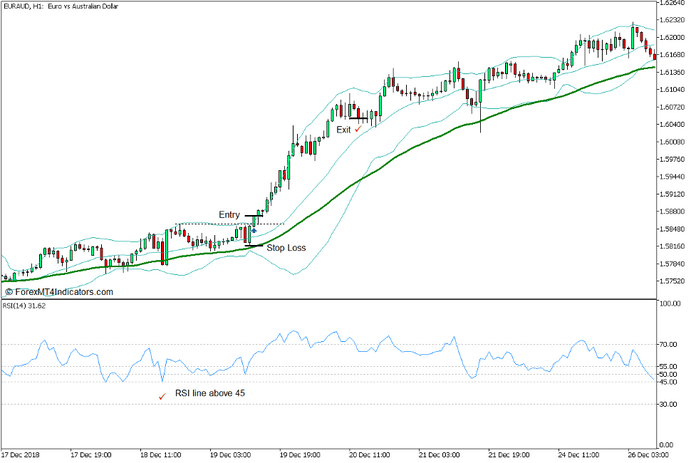

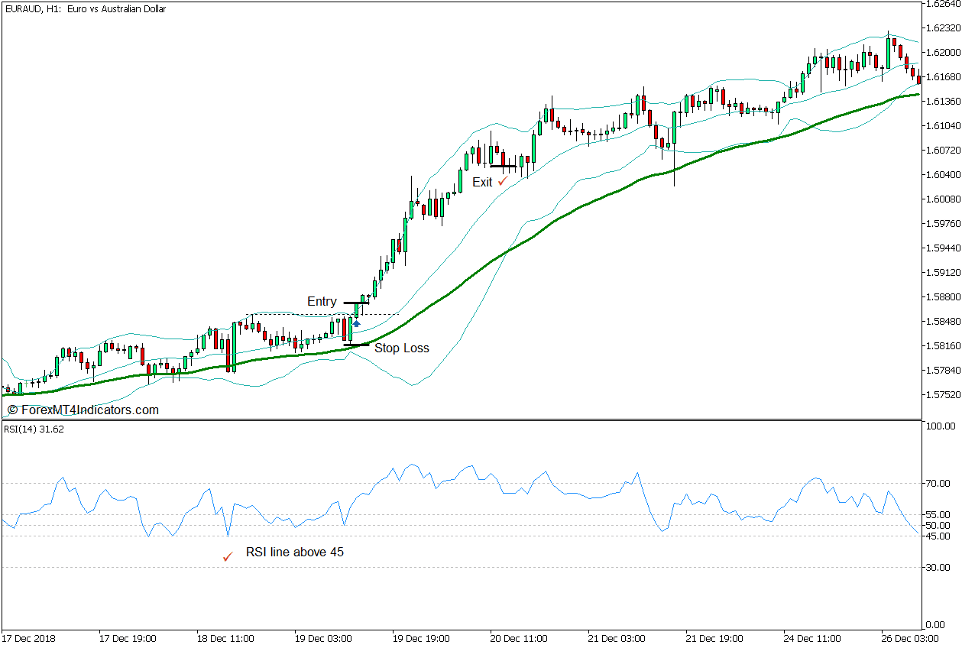

Koop Trade Setup

binnenkomst

- De middelste lijn van de Bollinger Bands moet boven de 50 EMA-lijn liggen.

- De RSI-lijn moet boven de 45 blijven.

- De Bollinger Bands zouden moeten contracteren.

- Prijsactie zou boven de bovenste Bollinger Bands-lijn en de geïdentificeerde weerstandslijn moeten breken.

- Voer een kooporder in bij de bevestiging van deze voorwaarden.

Stop Loss

- Stel de stop loss in op de steun onder de instapkaars.

afrit

- Sluit de transactie zodra prijsactie tekenen vertoont van een mogelijke bearish omkering.

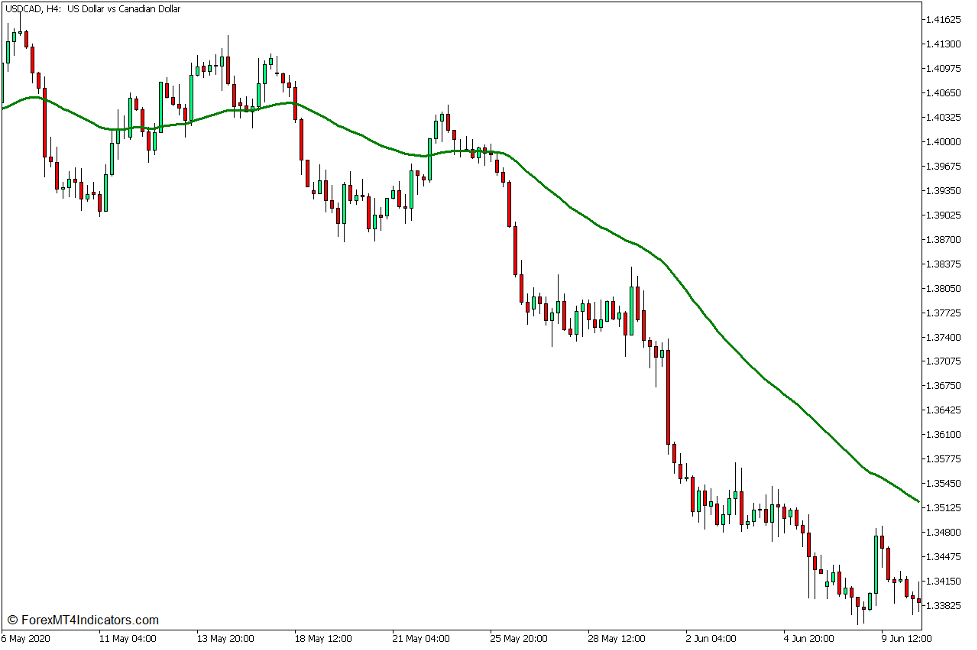

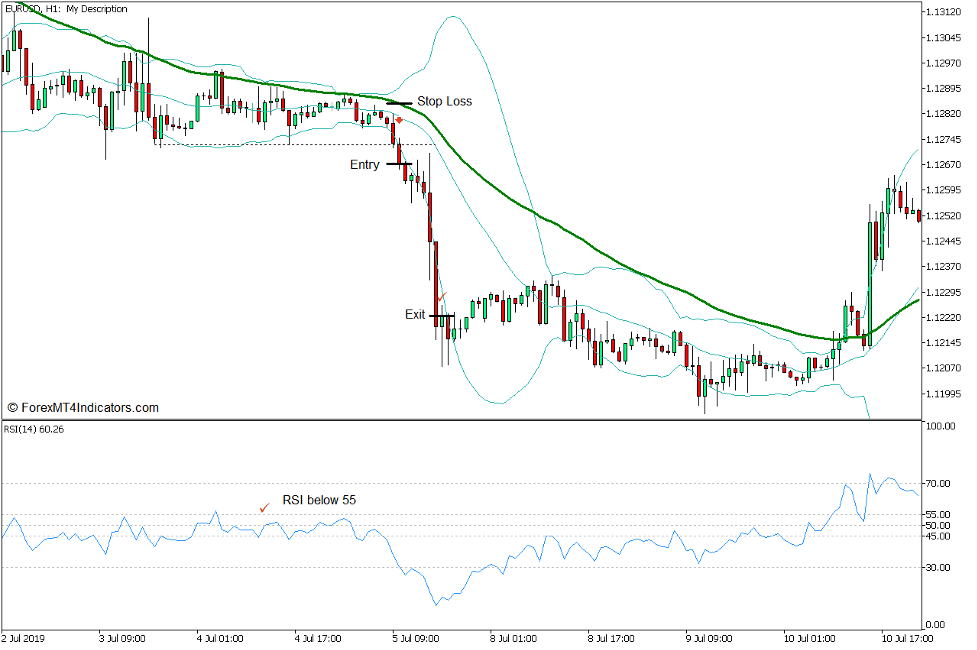

Verkoop handelsconfiguratie

binnenkomst

- De middelste lijn van de Bollinger Bands moet onder de 50 EMA-lijn liggen.

- De RSI-lijn moet onder de 55 blijven.

- De Bollinger Bands zouden moeten contracteren.

- Prijsactie zou onder de onderste Bollinger Bands-lijn en de geïdentificeerde ondersteuningslijn moeten breken.

- Voer een verkooporder in bij de bevestiging van deze voorwaarden.

Stop Loss

- Stel de stop loss in op de weerstand boven de instapkaars.

afrit

- Sluit de transactie zodra prijsactie tekenen vertoont van een mogelijke bullish omkering.

Conclusie

Momentum breakout-strategieën gebaseerd op de Bollinger Bands zijn een goede momentum breakout-opzet die voortkomt uit een marktkrimpfase. Deze strategie brengt eenvoudigweg de momentum-breakout-opstelling in lijn met de trendrichting met behulp van de RSI- en de 50 EMA-lijn.

Aanbevolen MT5-makelaars

XM-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Meld u hier aan voor een XM Broker-account <

FBS-makelaar

- Handel 100 Bonus: Gratis $ 100 om uw handelsreis een vliegende start te geven!

- 100% Deposit Bonus: Verdubbel uw storting tot $10,000 en handel met meer kapitaal.

- Gebruik maximaal 1: 3000: Maximaliseren van potentiële winsten met een van de hoogste beschikbare hefboomopties.

- Award voor 'Beste Klantenservicemakelaar Azië': Erkende uitmuntendheid op het gebied van klantenondersteuning en service.

- Seizoensgebonden promoties: Geniet het hele jaar door van een verscheidenheid aan exclusieve bonussen en promotie-aanbiedingen.

>> Meld u hier aan voor een FBS-brokeraccount <

Klik hieronder om te downloaden: