Een van de criteria die een professionele handelaar definiëren, is consistentie. Professionele handelaren verdienen geld met handelen als hun belangrijkste bron van inkomsten. Veel handelaren dromen daarvan. Niet alle handelaren kunnen dit echter doen, omdat de meeste handelaren niet consistent genoeg zijn om hun hoop op een maandelijks inkomen uit de handel vast te stellen. Professionele handelaren zijn daarentegen zeer consistent als het gaat om hun handelen. Natuurlijk zullen er hier en daar een paar periodes zijn waarin ze op rood kunnen staan. De meeste professionele handelaren bevinden zich echter meestal op de green. Het betekent niet dat al hun transacties winstgevend zijn. Het betekent gewoon dat professionele handelaren van periode tot periode meestal op de green zijn, waardoor ze inkomsten uit de handel kunnen verwachten waarmee ze kunnen leven.

Consistentie in de handel komt voort uit een systematische manier van handelen op de markt, waardoor handelaren hetzelfde proces keer op keer kunnen herhalen, zolang een handelsopstelling aan hun criteria voldoet. Met de juiste handelsconfiguratie kunnen handelaren transacties die een lage kans hebben om te winnen aanzienlijk verminderen en meestal transacties met een hoge waarschijnlijkheid uitvoeren.

Een van de beste soorten handelsconfiguraties die handelaren kunnen gebruiken om te handelen met een relatief hoge winstkans, is een trendvolgende of trendvoortzettingsconfiguratie. Dit komt omdat setups voor trendvoortzetting worden verhandeld in de richting van de hoofdtrend, wat de kans op een winnende transactie aanzienlijk vergroot.

Alligator

De Alligator-indicator van Bill William is een populaire trendvolgende technische indicator die is ontwikkeld om handelaren te helpen bij het identificeren van trends.

Deze indicator is gebaseerd op een reeks gewijzigde voortschrijdende gemiddelden, met name een afgevlakt voortschrijdend gemiddelde. De lijn met voortschrijdend gemiddelde op lange termijn wordt de kaaklijn genoemd, de lijn met voortschrijdend gemiddelde op middellange termijn is de tanden en de lijn met voortschrijdend gemiddelde op korte termijn wordt de lippen genoemd.

Trendrichting is gebaseerd op hoe de lijnen elkaar overlappen. Als de kortetermijnlijn boven de andere twee lijnen ligt, wordt de markt als bullish beschouwd. De markt wordt echter als bearish beschouwd als de kortetermijnlijn onder de andere twee lijnen ligt. Als de lijnen niet goed zijn gestapeld, kan die markt in een variërende toestand verkeren. Crossovers tussen de lijnen duiden op een waarschijnlijke trendomkering.

De markt wordt geacht zich in een versterkende trendfase te bevinden wanneer de drie lijnen met voortschrijdend gemiddelde beginnen uit te breiden. Als de drie lijnen echter naar elkaar toe zouden gaan samentrekken, wordt aangenomen dat de markt zich in een fase van marktcontractie bevindt. Het is verstandig voor handelaren om alleen te handelen wanneer de markt zijn trendrichting begint te versterken en transacties te beëindigen wanneer de markt begint af te koelen.

CCI op Step-kanaal

De CCI op Step Channel is een aangepaste technische indicator die precies is zoals de naam doet vermoeden. Het is gebaseerd op de Commodity Channel Index (CCI) maar wordt aangepast op basis van de Step Channel-indicator.

De klassieke CCI-indicator is een op momentum gebaseerde oscillator die wordt gebruikt om handelaren te helpen de cyclische bewegingen van prijsactie te identificeren, inclusief overbought- en oversold-condities, die vaak leiden tot een gemiddelde omkering. De CCI is een oscillator die is afgeleid van een voortschrijdend gemiddelde van een typische prijs.

De Step Channel-indicator daarentegen is een trendvolgende technische indicator en is een on-chart-indicator die een kanaalachtige structuur in kaart brengt op basis van de volatiliteit van prijsactie.

De CCI on Step Channel-indicator combineert beide concepten tot één. Het plot een CCI-oscillator, net als de basis-CCI. In plaats van de standaardprijs als basis te gebruiken, berekent het echter met behulp van de mediaan van de Step Channel-indicator.

Deze indicator geeft staven weer die kunnen oscilleren van positief naar negatief of vice versa. Positieve balken geven een bullish momentum bias aan, terwijl negatieve bars een bearish momentum bias aangeven. Het heeft ook markeringen op niveaus +/-80. Staven die buiten dit bereik komen, kunnen wijzen op een versterkende trend of momentum.

PPO-indicator

De PPO-indicator, ook wel bekend als de procentuele prijsoscillator, is een technische momentumindicator die ook deel uitmaakt van de oscillatorfamilie van indicatoren. Het lijkt ook erg op de populaire MACD-oscillator.

Net als de MACD is deze indicator gebaseerd op de relatie tussen twee voortschrijdende gemiddelden, die in procenten wordt berekend. Het heeft ook een signaallijn die ook is afgeleid van de originele PPO-lijn. Wat het uniek maakt, is dat het is gebaseerd op Exponential Moving Average (EMA) lijnen, waardoor het zeer snel reageert op prijsbewegingen.

Deze indicator plot twee lijnen die rond nul oscilleren. Trendbias kan worden geïdentificeerd op basis van het feit of de lijnen positief of negatief zijn. Omkeersignalen kunnen ook worden gegenereerd op basis van de kruising van de hoofd-PPO-lijn en de signaallijn.

Trading strategie

Alligator CCI Step Forex Trading Strategy is een trendvolgende strategie die handelt op samenvloeiingen van trendvoortzettingssignalen afkomstig van de CCI on Step Channel-indicator en de PPO-indicator.

Trendrichting wordt geïdentificeerd op basis van de Alligator-indicator. Dit is gebaseerd op hoe de drie gemodificeerde voortschrijdend-gemiddeldelijnen zijn gestapeld.

Tijdens dergelijke trends treden marktcontractiefasen en retracements op. Dit zou er vaak voor zorgen dat de CCI op Step Channel een verzwakkende trend aangeeft en dat de PPO-indicator tijdelijke tekenen van omkering vertoont.

Handelsconfiguraties worden als geldig beschouwd zodra de CCI on Step Channel-indicator een hervatting van trendsterkte of -momentum aangeeft, en de PPO-indicator tekenen vertoont van een mogelijke voortzetting van de trend op basis van het overschrijden van de twee lijnen.

Indicatoren:

- Alligator

- Cci_

- PPO

Voorkeurstermijnen:Grafieken van 15 minuten, 30 minuten, 1 uur en 4 uur

Valutaparen: FX majors, minors en crosses

Handelssessies: Sessies Tokio, Londen en New York

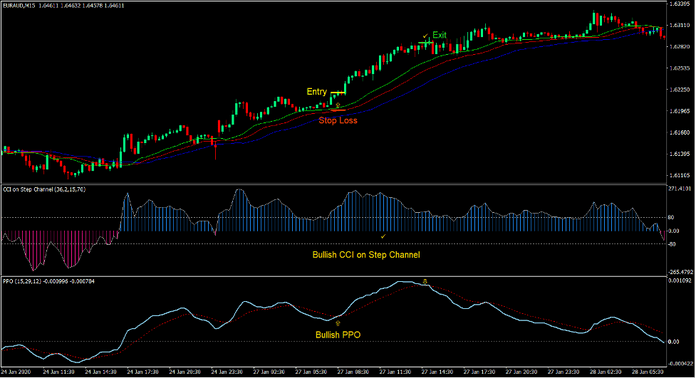

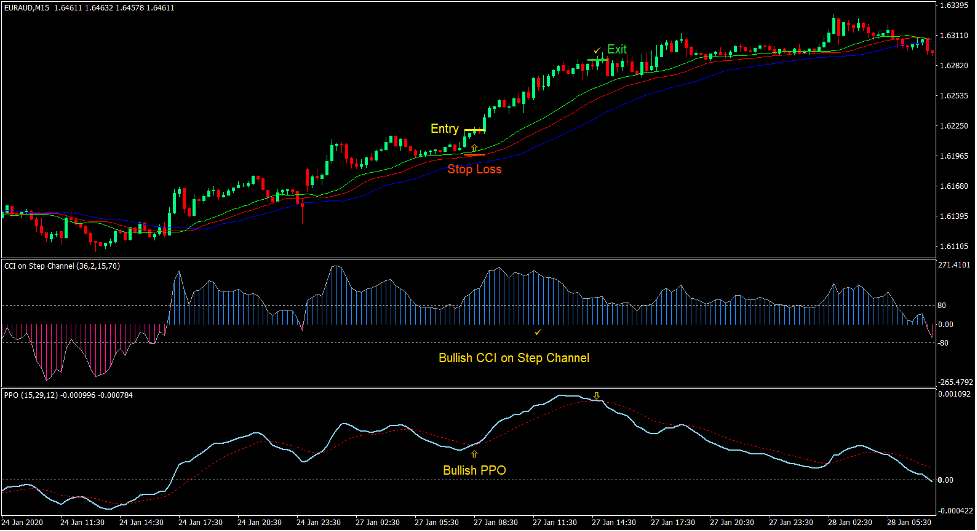

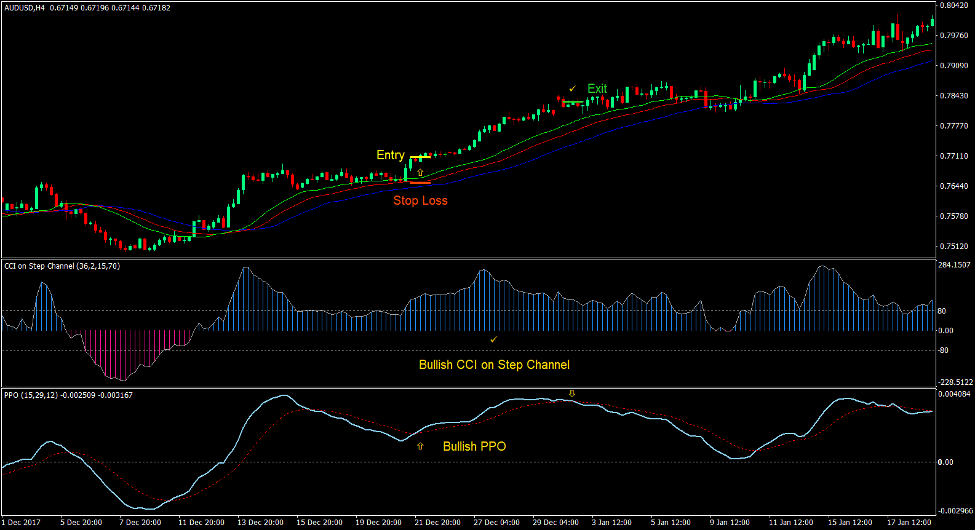

Koop Trade Setup

binnenkomst

- De Alligator-lijnen moeten in de volgende volgorde worden gestapeld:

- Lippen: top

- Tanden: midden

- Kaak: onderkant

- De CCI op Step Channel-balken moet positief zijn.

- De PPO-lijnen moeten positief zijn.

- De prijs zou zich moeten terugtrekken in de richting van de Alligator-lijnen, waardoor de CCI op Step Channel-balken onder de 80 daalt en de PPO-lijn onder de signaallijn komt.

- De CCI op Step Channel-balken moet boven de 80 komen.

- De PPO-lijn moet boven de signaallijn kruisen.

- Voer een kooporder in bij de bevestiging van deze voorwaarden.

Stop Loss

- Stel de stop loss in op een steun onder de instapkaars.

afrit

- Sluit de transactie zodra de PPO-lijn onder de signaallijn komt.

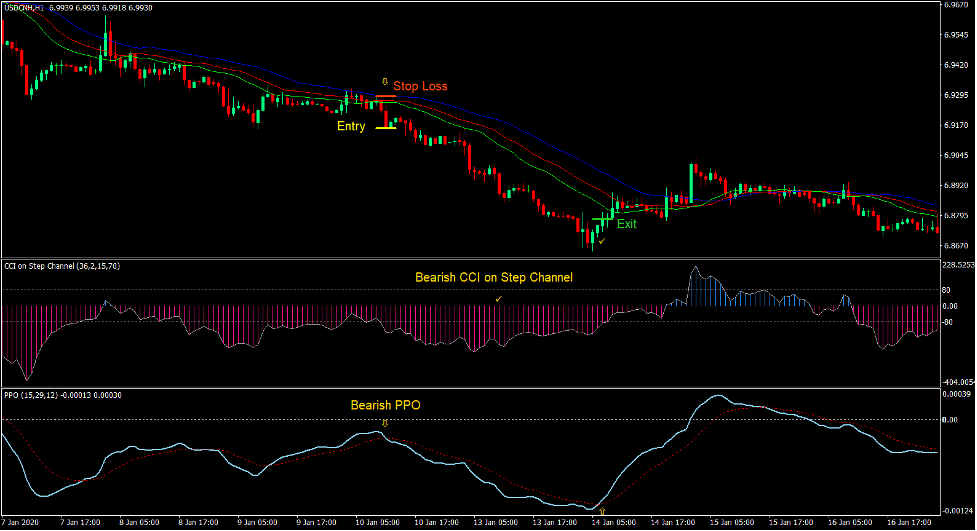

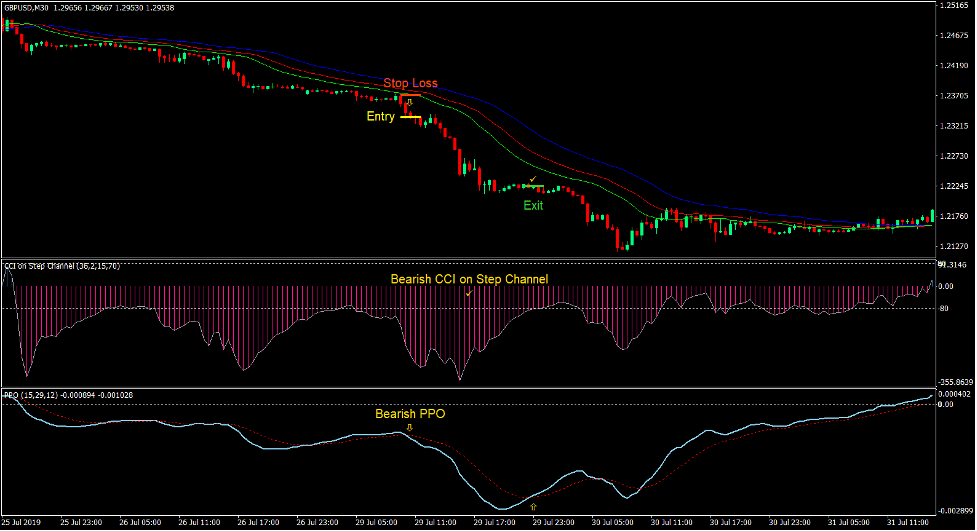

Verkoop handelsconfiguratie

binnenkomst

- De Alligator-lijnen moeten in de volgende volgorde worden gestapeld:

- Lippen: onderkant

- Tanden: midden

- Kaak: top

- De CCI op Step Channel-balken moet negatief zijn.

- De PPO-lijnen moeten negatief zijn.

- De prijs zou zich moeten terugtrekken in de richting van de Alligator-lijnen, waardoor de CCI op Step Channel-balken boven -80 doorbreekt en de PPO-lijn boven de signaallijn kruist.

- De CCI op Step Channel-balken moet onder de -80 komen.

- De PPO-lijn moet onder de signaallijn doorkruisen.

- Voer een verkooporder in bij de bevestiging van deze voorwaarden.

Stop Loss

- Stel de stop loss in op een weerstand boven de instapkaars.

afrit

- Sluit de transactie zodra de PPO-lijn boven de signaallijn komt.

Conclusie

Deze handelsstrategie is een eenvoudige trendvolgende strategie die is gebaseerd op samenvloeiingen van zeer waarschijnlijke aangepaste technische indicatoren.

De setups die door deze strategie kunnen worden geproduceerd, resulteren vaak in hoge winstpercentages, op voorwaarde dat de strategie in de juiste marktomgeving wordt gebruikt.

Als zodanig kan deze strategie het beste alleen worden gebruikt tijdens duidelijk trending marktomstandigheden, omdat het handelaren een systematische manier biedt om een trending markt in de richting van de trend te betreden.

Aanbevolen MT4-makelaars

XM-makelaar

- Gratis $ 50 Om direct te beginnen met handelen! (opneembare winst)

- Stortingsbonus tot $5,000

- Onbeperkt loyaliteitsprogramma

- Bekroonde Forex Broker

- Extra exclusieve bonussen Door het jaar heen

>> Meld u hier aan voor een XM Broker-account <

FBS-makelaar

- Handel 100 Bonus: Gratis $ 100 om uw handelsreis een vliegende start te geven!

- 100% Deposit Bonus: Verdubbel uw storting tot $10,000 en handel met meer kapitaal.

- Gebruik maximaal 1: 3000: Maximaliseren van potentiële winsten met een van de hoogste beschikbare hefboomopties.

- Award voor 'Beste Klantenservicemakelaar Azië': Erkende uitmuntendheid op het gebied van klantenondersteuning en service.

- Seizoensgebonden promoties: Geniet het hele jaar door van een verscheidenheid aan exclusieve bonussen en promotie-aanbiedingen.

>> Meld u hier aan voor een FBS-brokeraccount <

Klik hieronder om te downloaden: