Toptahlil Bounce Forex Swing Forex Trading Strategy

Terdapat banyak cara untuk mendekati atau menyerang pasaran, jenis strategi dagangan yang berbeza dan cara yang berbeza untuk melaksanakan strategi tersebut. Sesetengah peniaga melakukan penembusan sokongan dan rintangan, yang lain lebih suka untuk berdagang lantunan daripada garis arah aliran, yang lain berdagang arah aliran mengikut strategi, yang lain berdagang bermakna pembalikan. Walau apa pun pendekatan yang anda ambil, selagi anda telah menguasai kemahiran anda, anda boleh menggunakannya untuk menjana wang dari pasaran. Walau bagaimanapun, dengan strategi ini, kami akan melihat untuk mengambil dagangan berdasarkan lantunan sokongan dan rintangan dinamik menggunakan variasi Bollinger Band.

Band dan Penunjuk Berasaskan Saluran

Bollinger Bands mungkin merupakan salah satu penunjuk paling popular yang menggunakan saluran atau jalur walaupun terdapat juga penunjuk berasaskan jalur yang berbeza. Ia mungkin berbeza dengan cara jalur dikira dan diplot, tetapi ia berfungsi berdasarkan parameter yang betul.

Penunjuk berasaskan jalur adalah hebat kerana atas banyak sebab, tetapi apa yang saya dapati paling menarik ialah kerana jalur luar yang ada pada penunjuk ini, mereka cenderung mempunyai sokongan dan rintangan dinamik yang bergerak bersama dengan harga purata. Jalur luar ini boleh digunakan dengan cara yang berbeza tetapi cara paling asas untuk menggunakan jalur luar adalah sebagai kawasan di mana kita boleh mempertimbangkan harga untuk dipanjangkan dan oleh itu boleh berbalik kepada min atau membalikkan arah aliran sepenuhnya.

Konsep Strategi Dagangan

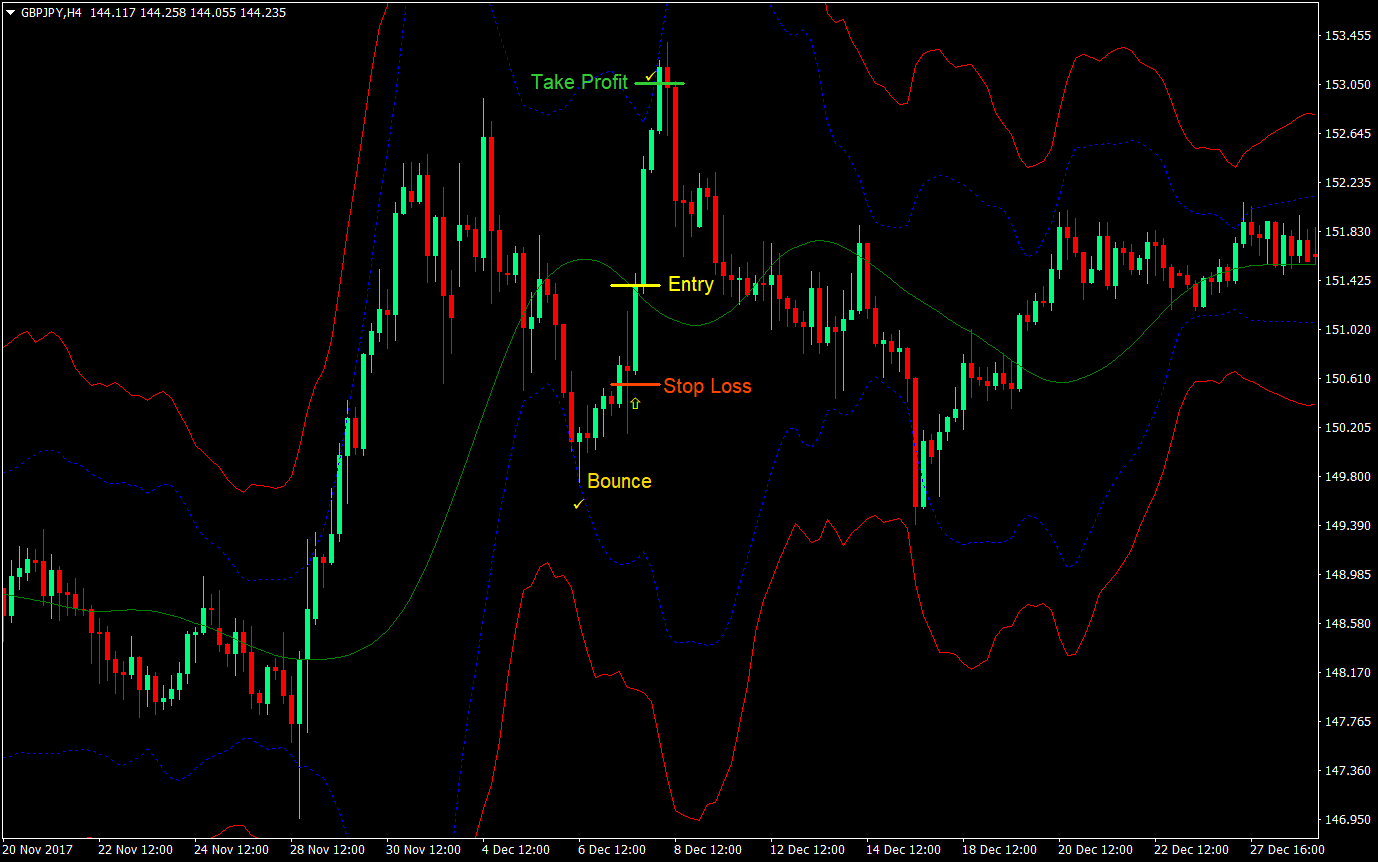

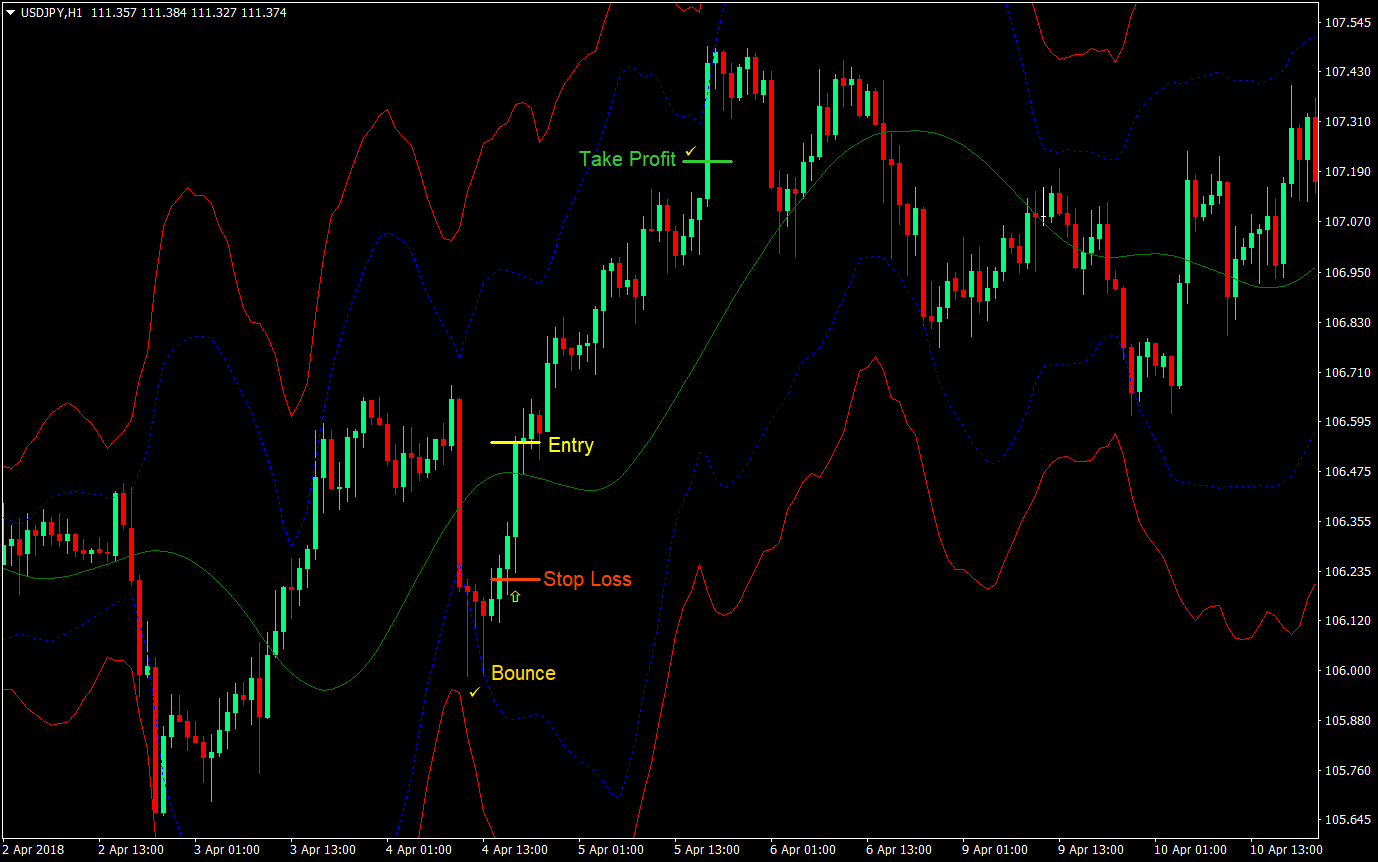

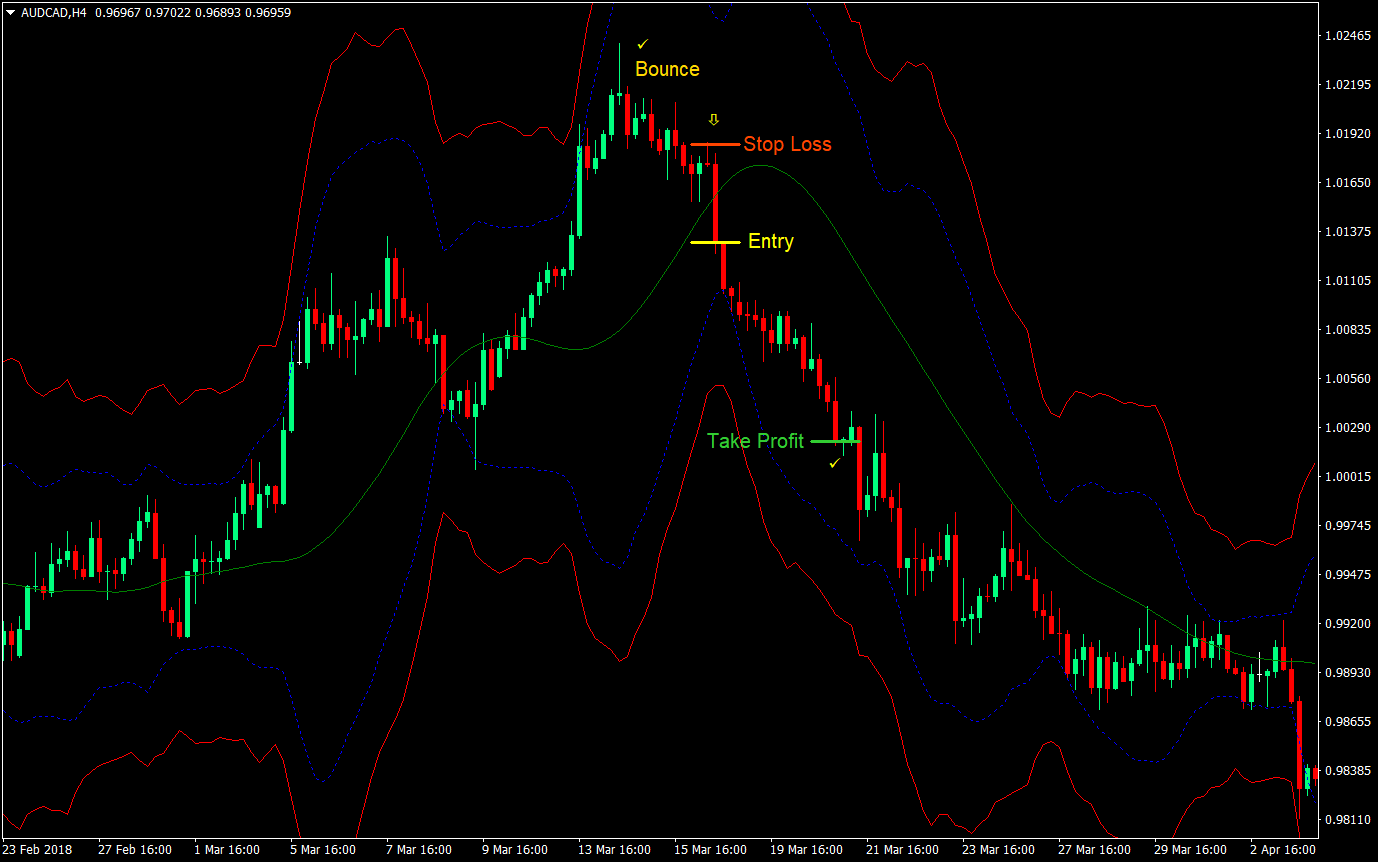

Ramai pedagang sudah biasa dengan Bollinger Bands dan cara menggunakannya. Walau bagaimanapun, dengan strategi ini, kami akan menggunakan variasi Bollinger Band, iaitu toptahlil_bollinger_and_atr_band penunjuk tersuai. Penunjuk ini mempunyai Bollinger Band biasa, tetapi ia juga mempunyai set kedua jalur luar, yang berdasarkan Average True Range (ATR). Ini memberikan penunjuk ini dua set jalur luar yang boleh kita gunakan sebagai kawasan sokongan atau rintangan dinamik.

Kami akan berdagang melantun dari kawasan ini apabila kami melihat batang lilin yang baik dengan sumbu menandakan penolakan kawasan ini. Kami hanya akan melakukan dagangan dengan sumbu panjang kerana lilin ini menandakan peralihan pantas sentimen pasaran, peralihan yang berlaku dalam hanya satu tempoh atau lilin.

Walau bagaimanapun, kami tidak akan mengambil dagangan serta-merta apabila lilin bar pin muncul. Kami akan menunggu harga untuk menyilang harga purata. The toptahlil_bollinger_and_atr_band tidak mempunyai garis tengah. Atas sebab ini, kami akan menggunakan penunjuk yang berbeza sebagai asas untuk harga purata kami, iaitu TMA penunjuk tersuai. Penunjuk ini ialah sejenis purata bergerak yang boleh dicirikan sebagai penunjuk bergerak lancar.

Walaupun kami mengambil perhatian tentang kemungkinan perdagangan apabila harga melantun dari jalur luar toptahlil_bollinger_and_atr_band, jika kita mengambil dagangan terlalu awal, kita masih boleh berdagang melawan arah aliran. Daripada berdagang serta-merta sebaik sahaja harga melantun dari jalur luar, kami akan mengambil dagangan apabila perubahan arah aliran disahkan dengan menunggu harga melintasi dan menutup melepasi TMA penunjuk tersuai.

petunjuk

- toptahlil_bollinger_and_atr_band: parameter lalai

- TMA: parameter lalai

Jangka masa: Carta 1 jam atau 4 jam

Pasangan Mata Wang: mana-mana

Peraturan Persediaan Perdagangan Beli (Panjang).

Kemasukan

- Harga sepatutnya melantun dari kawasan yang lebih rendah toptahlil_bollinger_and_atr_bands

- Harus ada lilin bar pin kenaikkan atau batang lilin dengan sumbu panjang di bahagian bawah, menandakan penolakan harga

- Tunggu harga melepasi dan tutup di atas TMA penunjuk tersuai

- Masukkan pesanan pasaran beli pada penutupan lilin

Stop Loss

- Tetapkan stop loss di bawah lilin masuk

Take Profit

- Tetapkan harga sasaran take profit pada 2x risiko pada stop loss

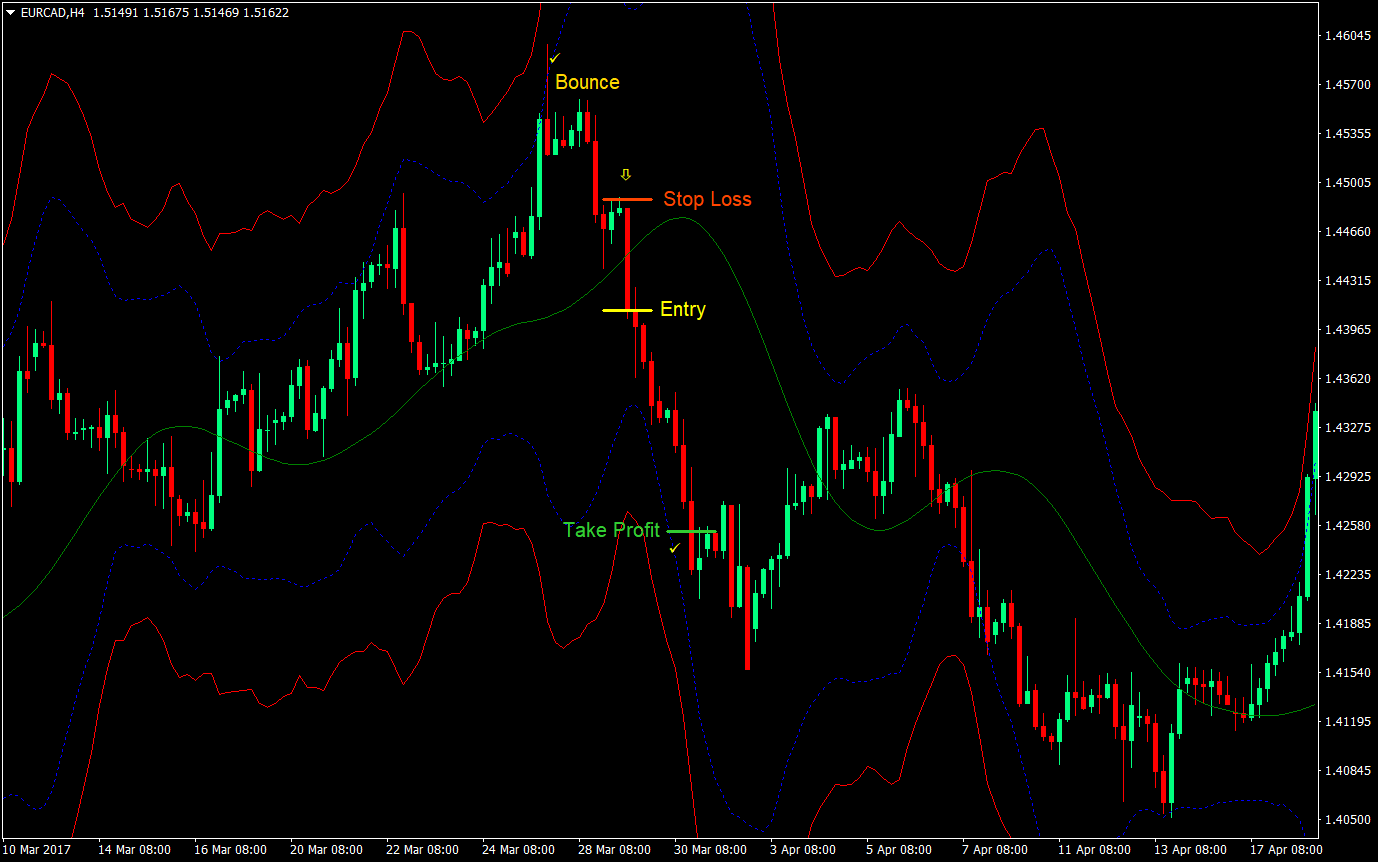

Peraturan Persediaan Perdagangan Jual (Pendek).

Kemasukan

- Harga sepatutnya melantun dari kawasan bahagian atas toptahlil_bollinger_and_atr_bands

- Harus ada lilin bar pin menurun atau batang lilin dengan sumbu panjang di bahagian atas, menandakan penolakan harga

- Tunggu harga melepasi dan tutup di bawah TMA penunjuk tersuai

- Masukkan pesanan pasaran jual pada penutupan lilin

Stop Loss

- Tetapkan stop loss di atas lilin masuk

Take Profit

- Tetapkan harga sasaran take profit pada 2x risiko pada stop loss

Kesimpulan

Strategi yang mengambil lantunan dari jalur luar Bollinger Bands biasa ialah strategi biasa dan ramai pedagang telah mendapat keuntungan melakukan perkara itu. Walau bagaimanapun, terdapat banyak kes di mana lantunan dari jalur luar bukan sahaja cukup kuat untuk membalikkan arah aliran. Ini boleh berfungsi jika anda berdagang dengan strategi pengembalian min mudah yang menyasarkan hanya pada pertengahan Jalur Bolling atau harga purata.

Jika anda ingin mengambil dagangan dengan lebih banyak jus di dalamnya, anda sepatutnya mengambil dagangan yang sebenarnya mengakibatkan pembalikan arah aliran. Strategi ini membolehkan anda melakukan ini dengan mempunyai entri selepas salib TMA penunjuk tersuai, iaitu harga purata kami.

Terdapat banyak keadaan di mana harga boleh memulakan aliran yang kukuh dan jika anda membiarkan keuntungan berjalan, anda boleh memperoleh lebih daripada dua kali ganda risiko anda. Jika anda berasa lebih agresif dan memilih untuk menyasarkan pulangan yang lebih tinggi, bukannya menggunakan sasaran ambil untung tetap, anda sebaliknya boleh menggunakan untuk trailing stop loss, atau menutup dagangan berdasarkan tanda-tanda tindakan harga membalikkan. Walau bagaimanapun, ini akan menjadi laluan yang lebih agresif untuk diambil kerana harga juga boleh berbalik kepada anda atau mula membentuk julat, bukannya membalikkan arah aliran sepenuhnya.

Selamat berniaga!!!

Broker MT4 yang disyorkan

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan Boleh Keluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Tuntut Bonus $50 Anda Di Sini <

Klik di sini di bawah untuk memuat turun: