Pasaran forex adalah unik. Tidak seperti pasaran saham, yang merupakan pasaran dagangan paling popular, pasaran forex beroperasi 24 jam sehari selama lebih daripada 5 hari seminggu. Ia tidak pernah ditutup. Selagi terdapat negara yang menukar pasangan mata wang, pasangan mata wang tertentu itu akan tetap bergerak.

Mempunyai pasaran yang tidak ditutup pada penghujung hari bermakna terdapat peluang tanpa had yang boleh dimanfaatkan oleh peniaga. Peniaga mempunyai pilihan untuk tidak berehat dan cuba mengaut keuntungan daripada pasaran selagi mereka mahu. Peluang yang kelihatan tidak terhad ini menyebabkan ramai pedagang percaya bahawa ia adalah demi kepentingan terbaik mereka untuk berdagang 24 jam sehari untuk keseluruhan minggu dagangan.

Walaupun secara teorinya, peniaga sepatutnya dapat memperoleh lebih banyak keuntungan jika mereka berdagang dalam pasaran forex dengan lebih kerap, bagi kebanyakan peniaga runcit manual, ini tidak mendatangkan faedah kepada mereka. Keletihan boleh menyebabkan peniaga melakukan kesilapan dan kehilangan wang. Sesetengah menggunakan robot dagangan atau algoritma untuk berdagang untuk mereka tanpa henti. Walau bagaimanapun, anda juga bergantung pada algoritma yang tidak membuat kesilapan.

Satu pilihan yang baik adalah untuk berdagang pasaran forex hanya pada masa hari di mana peluang paling banyak dibentangkan. Sesi dagangan London mungkin merupakan salah satu masa paling aktif dalam hari dagangan. Ini kerana pasaran London adalah pasaran terbesar dalam forex. Pembukaan London juga biasanya mempunyai momentum penembusan yang kuat yang membawa kepada arah aliran intrahari yang akan menentukan arah waktu pasaran yang tinggal.

Strategi Perdagangan Forex Kesinambungan Trend London berkisar pada idea perdagangan berdasarkan potensi letupan terbuka London. Ia menggunakan beberapa penunjuk untuk membantu pedagang mengenal pasti momentum jangka masa yang lebih tinggi dan titik masuk khusus di mana pedagang boleh memasuki pasaran.

Penunjuk Sesi

Penunjuk sesi telah dibangunkan untuk membantu pedagang dalam mengenal pasti pasaran terbuka atau sesi dagangan apabila mereka berdagang.

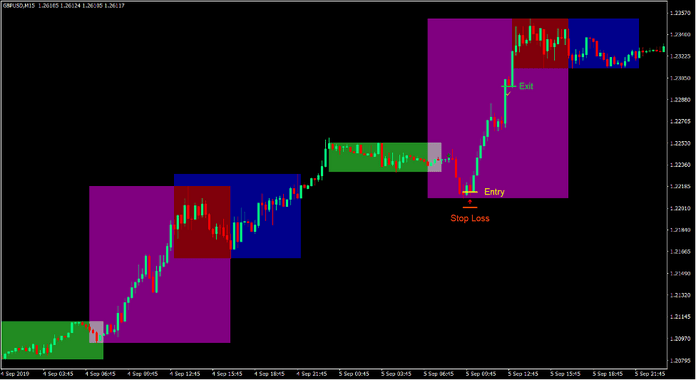

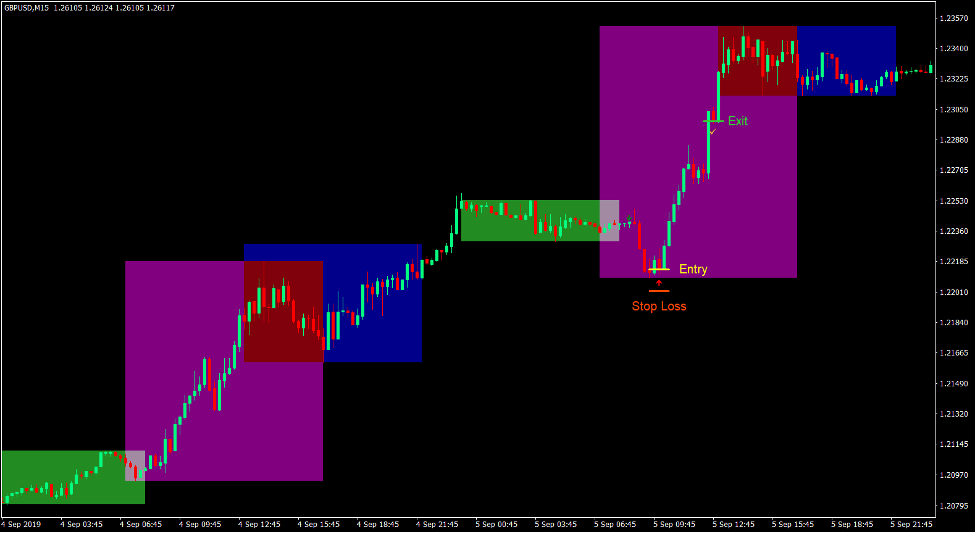

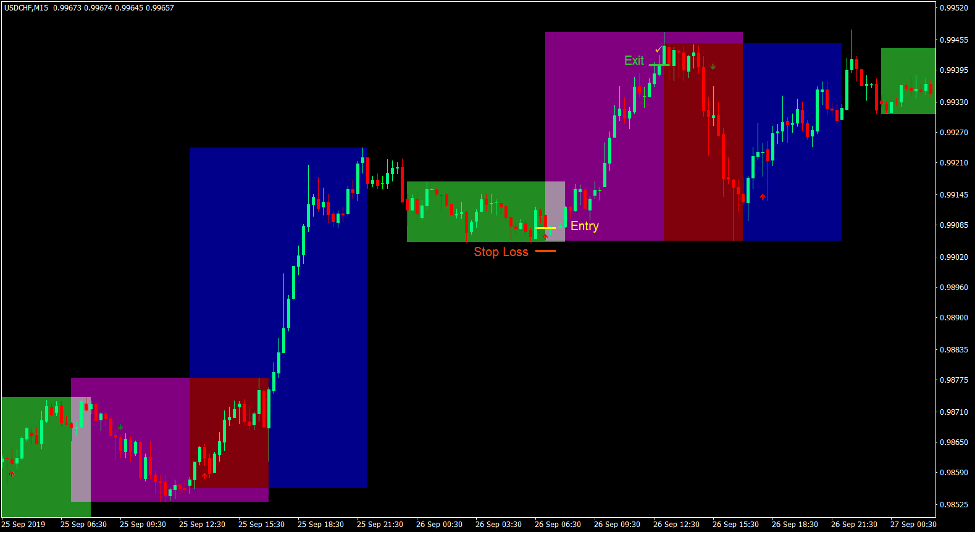

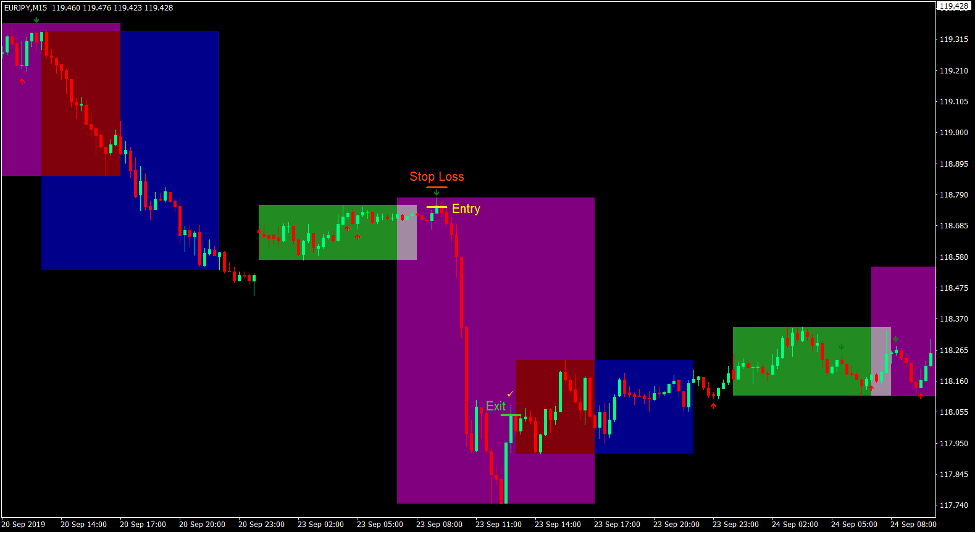

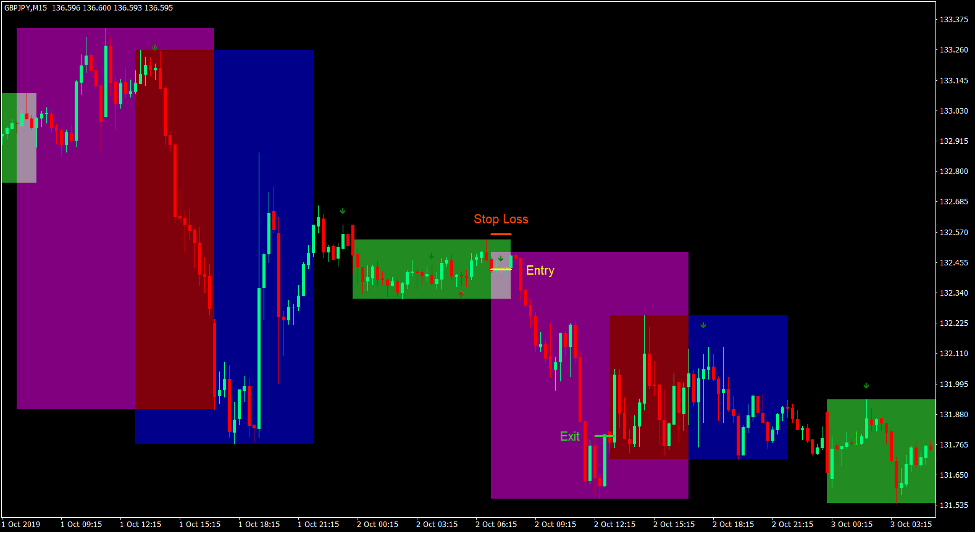

Penunjuk ini mengenal pasti dan menunjukkan pasaran terbuka dengan memplot kotak dengan warna berbeza untuk menunjukkan sesi pasaran. Sesi Asia diwarnai dengan warna hijau hutan. Sesi Eropah atau London diwarnai dengan warna ungu. Sesi AS diwarnai dengan warna biru.

Pedagang kemudian boleh menggunakan maklumat ini untuk membantu mereka menentukan masa bila mereka harus berdagang dan bila mereka harus berhenti berdagang. Sesetengah peniaga lebih suka berdagang hanya semasa pembukaan London. Yang lain berdagang hanya apabila sesi London dan AS bertindih. Yang lain berdagang hanya semasa sesi Asia. Yang lain akan mengelak daripada berdagang semasa sesi Asia yang tenang. Ia bergantung pada strategi yang anda gunakan dan logik di sebalik masa perdagangan.

3 MA Cross dengan Makluman

3 MA Cross ialah penunjuk arah aliran yang menyediakan isyarat kemasukan pembalikan arah aliran berdasarkan persilangan purata bergerak.

Purata bergerak ialah salah satu penunjuk teknikal yang paling banyak digunakan dalam hal strategi mengikut arah aliran dan pembalikan arah aliran. Pedagang kebanyakannya menggunakannya untuk mengenal pasti arah aliran. Walau bagaimanapun, satu lagi cara popular untuk menggunakan purata bergerak adalah dengan menggunakan persilangan purata bergerak sebagai isyarat pembalikan arah aliran.

Persilangan purata bergerak menunjukkan bahawa purata bergerak yang lebih pantas melintasi purata bergerak yang lebih perlahan. Ini bermakna aliran atau momentum jangka pendek sedang beralih atau berbalik menyebabkan ia melintasi arah aliran jangka panjang.

Sesetengah peniaga menggunakan silang dua purata bergerak, yang lain menggunakan silang tindakan harga dan garis purata bergerak, manakala yang lain menggunakan silang berbilang garis purata bergerak.

3 MA Cross with Alert menggunakan tiga purata bergerak yang diubah suai untuk membantu pedagang mengenal pasti titik masuk pembalikan arah aliran yang ideal. Penunjuk hanya memplot anak panah yang menunjukkan pembalikan arah aliran. Pedagang boleh menggunakan isyarat ini untuk masuk dan keluar perdagangan.

Strategi Trading

Strategi dagangan ini ialah strategi berikutan momentum yang berdagang ke arah arah aliran yang ditetapkan pada hari sebelumnya.

Untuk mengenal pasti arah momentum, kita akan melihat di mana lokasi sesi Asia berhubung dengan sesi AS. Jika sesi Asia berada di atas separuh bahagian atas sesi AS pada hari sebelumnya, maka momentum dianggap menaik. Jika ia pada bahagian bawah, maka momentum dianggap menurun.

Selain daripada ini, kami juga akan mempertimbangkan julat sesi Asia semasa. Jika sesi Asia menguncup, kita boleh mengandaikan bahawa pasaran masih mempunyai potensi kukuh untuk mendapatkan momentum sekali lagi apabila sesi London dibuka.

Jika kriteria di atas dipenuhi, kita boleh menunggu isyarat pembalikan arah aliran yang datang daripada penunjuk 3 MA Cross dengan Alert untuk menunjukkan arah momentum. Ini sepatutnya berlaku semasa bahagian awal sesi London. Dagangan kemudiannya ditutup sebelum AS dibuka kerana mungkin terdapat beberapa siaran berita yang boleh menyebabkan momentum berbalik.

Petunjuk:

- 3_MA_Cross_w_Alert_v2

- Sesyen

Rangka Masa Pilihan: Carta 15 minit sahaja

Pasangan Mata Wang: FX jurusan dan bawah umur

Sesi Dagangan: sesi Tokyo, London dan New York

Beli Persediaan Perdagangan

Kemasukan

- Kotak sesi Asia sepatutnya berada di bahagian atas kotak sesi AS.

- Kotak sesi Asia sepatutnya mempunyai julat yang ketat.

- Penunjuk 3 MA Cross harus melukis anak panah menghala ke atas semasa peringkat awal sesi London.

- Masukkan pesanan beli selepas pengesahan syarat ini.

Stop Loss

- Tetapkan stop loss di bawah kotak Asia dan London.

Keluar

- Tutup dagangan sebelum permulaan sesi New York.

Jual Persediaan Perdagangan

Kemasukan

- Kotak sesi Asia sepatutnya berada di bahagian bawah kotak sesi AS.

- Kotak sesi Asia sepatutnya mempunyai julat yang ketat.

- Penunjuk 3 MA Cross harus melukis anak panah yang menunjuk ke bawah semasa peringkat awal sesi London.

- Masukkan pesanan jual selepas pengesahan syarat ini.

Stop Loss

- Tetapkan stop loss di atas kotak Asia dan London.

Keluar

- Tutup dagangan sebelum permulaan sesi New York.

Kesimpulan

Strategi pelarian London adalah beberapa strategi dagangan yang paling popular.

Ini kerana strategi pelarian London berpotensi untuk menghasilkan pulangan yang besar sambil membenarkan pedagang mengambil risiko sedikit menggunakan stop loss yang ketat. Ini kerana peralihan daripada sesi Asia yang ketat kepada pasaran penembusan momentum yang kukuh pada sesi London membolehkan pedagang meletakkan stop loss yang ketat sambil membenarkan harga berjalan mengikut kekuatan aliran.

Pedagang yang boleh mengenal pasti arah aliran, tindakan harga dan momentum secara logik boleh menggunakan strategi ini untuk mengeksploitasi momentum mendadak yang berlaku semasa pembukaan London.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: