Strategi mengikut arah aliran ialah salah satu strategi paling berkuasa yang tersedia untuk pedagang. Ia membolehkan peniaga peluang untuk mengambil dagangan yang berpotensi untuk memperoleh pulangan yang tinggi. Jika digunakan dengan penapis yang betul, mengambil kira arah aliran jangka panjang, menggunakan strategi keluar yang membolehkan dagangan menguntungkan dijalankan, dan menggunakan entri yang tepat dan berkemungkinan tinggi, strategi mengikut arah aliran sebenarnya boleh menghasilkan keuntungan yang besar.

Strategi Dagangan Forex Awan Trend ialah strategi mengikut arah aliran yang cuba menanda semua kotak yang dinyatakan di atas. Ia memerlukan dagangan yang sejajar dengan arah aliran jangka panjang, membolehkan dagangan yang menguntungkan dijalankan, dan menggunakan penyertaan kebarangkalian yang tinggi. Ia dilakukan dengan menggunakan gabungan penunjuk tersuai yang memenuhi keperluan ini.

Penunjuk Pengurus iTrend

Penunjuk Pengurus iTrend ialah penunjuk tersuai yang bertindak sebagai penanda zon. Secara visual, mereka yang biasa dengan penunjuk Awan Ichimoku akan melihat persamaannya dengan ciri awan Ichimoku.

Ia pada asasnya kelihatan seperti awan yang menukar warna apabila trend berubah. Lorek biru mewakili keadaan pasaran menaik, manakala lorekan merah mewakili keadaan pasaran menurun.

Penunjuk Pengurus iTrend juga bertindak sebagai sokongan dan rintangan. Harga akan cenderung melantun apabila ia melawat kawasan di sekelilingnya. Memandangkan penunjuk Pengurus Trend mewakili arah aliran jangka pertengahan, arah aliran cenderung untuk berbalik apabila harga menembusi dan menembusinya.

Penunjuk Kuasa Trend FX

FX Trend Power ialah penunjuk tersuai yang cuba meramalkan arah aliran dan dengan mudah menunjukkan arah aliran jangka pertengahan umum kepada pedagang. Ia melakukan ini dengan melukis garisan berwarna pada tetingkap di bawah carta harga. Jika pasaran menaik, penunjuk menunjukkan garis biru. Sebaliknya, jika pasaran menurun, ia menunjukkan garis emas.

Konsep Strategi Dagangan

Strategi Dagangan Forex Awan iTrend ialah strategi mengikut arah aliran yang sejajar dengan arah aliran jangka panjang dan pada masa yang sama menggunakan entri yang tepat. Dengan berbuat demikian, strategi tersebut membolehkan pedagang mempunyai kebarangkalian yang lebih baik berbanding dengan kebanyakan strategi mengikut arah aliran.

Untuk menyelaraskan dagangan dengan arah aliran jangka panjang, strategi ini menggunakan Purata Pergerakan Eksponen (EMA) 200 tempoh. Purata bergerak ini biasanya digunakan dalam kalangan pedagang profesional sebagai alat untuk menentukan arah aliran jangka panjang. Untuk menentukan arah aliran menggunakan EMA 200, kami akan mengenal pasti lokasi harga yang berkaitan dengannya. Jika harga secara amnya di atas EMA 200, maka pasaran dikatakan menaik, manakala jika harga secara amnya di bawahnya, maka pasaran dikatakan menurun. Walaupun EMA 200 adalah arah aliran jangka panjang dan biasanya tidak mengubah arah terlalu curam, masih penting untuk diperhatikan cerun EMA 200. Aliran cenderung menjadi lebih kukuh apabila EMA 200 sedang condong. Oleh itu, hanya persediaan dagangan dengan cerun yang besar harus didagangkan, manakala 200 EMA yang lebih rata harus dielakkan kerana ia mungkin menunjukkan bahawa arah aliran tidak begitu kukuh.

Penyertaan adalah berdasarkan dua penunjuk tersuai, penunjuk Pengurus iTrend dan penunjuk Kuasa Trend FX. Secara individu, kedua-dua penunjuk ini nampaknya menghasilkan isyarat perdagangan yang baik, namun, apabila digunakan secara serentak, isyarat perdagangan yang dihasilkan nampaknya mempunyai kadar kemenangan yang lebih baik. Penunjuk Kuasa Trend FX biasanya akan bertindak balas lebih awal daripada penunjuk Pengurus iTrend. Oleh itu, kami akan melihatnya untuk menentukan isyarat kemasukan yang mungkin. Kemudian, kami menunggu penunjuk Trend Manager bersetuju dengan penunjuk Kuasa Trend Forex. Dagangan akan diambil sebaik sahaja kedua-dua penunjuk ini sejajar, bersama-sama dengan arah 200 EMA.

Pengurus iTrend bukan sekadar isyarat masuk. Ia juga bertindak sebagai zon sokongan dan rintangan. Dagangan biasanya tidak sah apabila harga menembusinya. Oleh itu, kami akan meletakkan stop loss kami di sisi lain penunjuk Trend Manager dan membenarkan dagangan berjalan sehingga berhenti. Ini memastikan bahawa kita dapat kekal dengan perdagangan sehingga arah aliran itu pupus.

petunjuk

- iTrendManager

- 200 EMA (emas)

- fxtrendpower

Tempoh masa: Carta 1 jam, 4 jam dan harian

Pasangan Mata Wang: pasangan major dan minor

Sesi Dagangan: sesi Tokyo, London dan New York

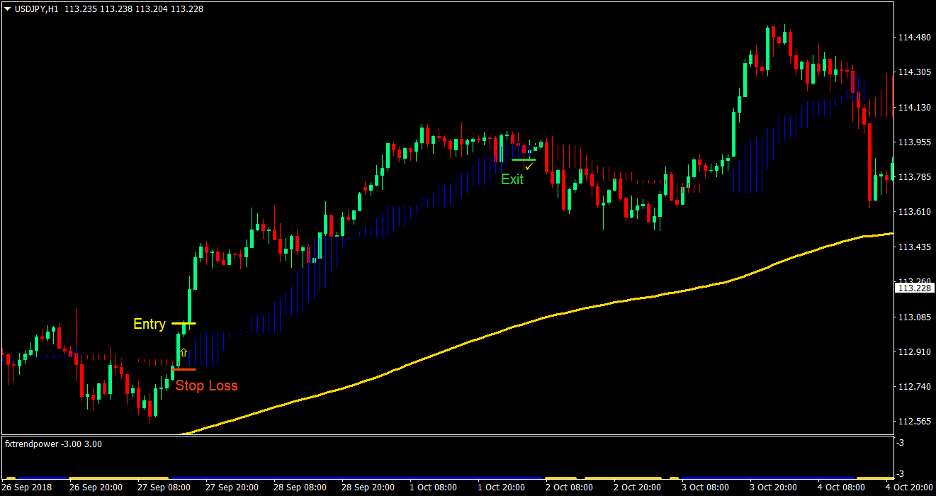

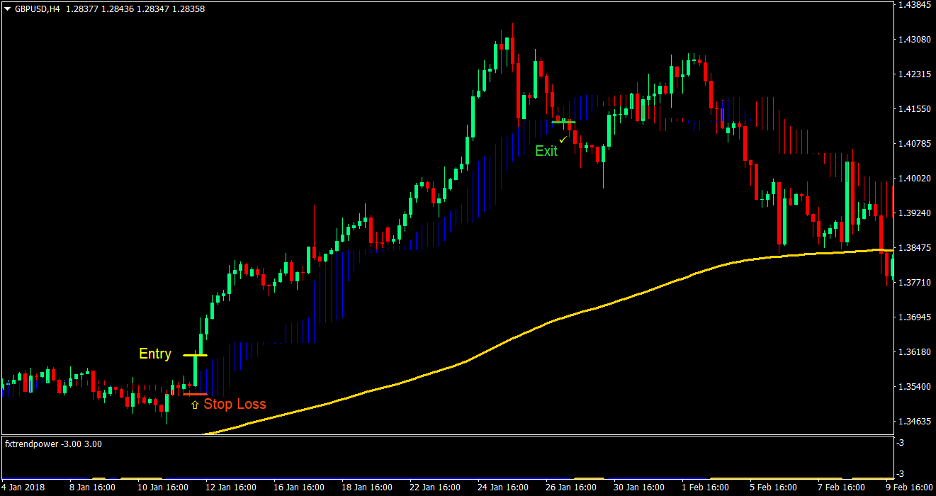

Beli Persediaan Perdagangan (Panjang).

Kemasukan

- Harga sepatutnya melebihi EMA 200 yang menunjukkan arah aliran jangka panjang yang menaik

- Penunjuk Pengurus Trend hendaklah melebihi EMA 200

- Penunjuk Kuasa Aliran FX harus mencetak garis biru yang menunjukkan arah aliran jangka pertengahan yang menaik

- Masukkan pesanan belian sebaik sahaja penunjuk Pengurus Trend bertukar kepada biru yang mengesahkan permulaan arah aliran jangka pertengahan yang menaik

Stop Loss

- Tetapkan Stop Loss di bawah penunjuk Trend Manager

Keluar

- Jejaki stop loss di bawah penunjuk Trend Manager sehingga berhenti

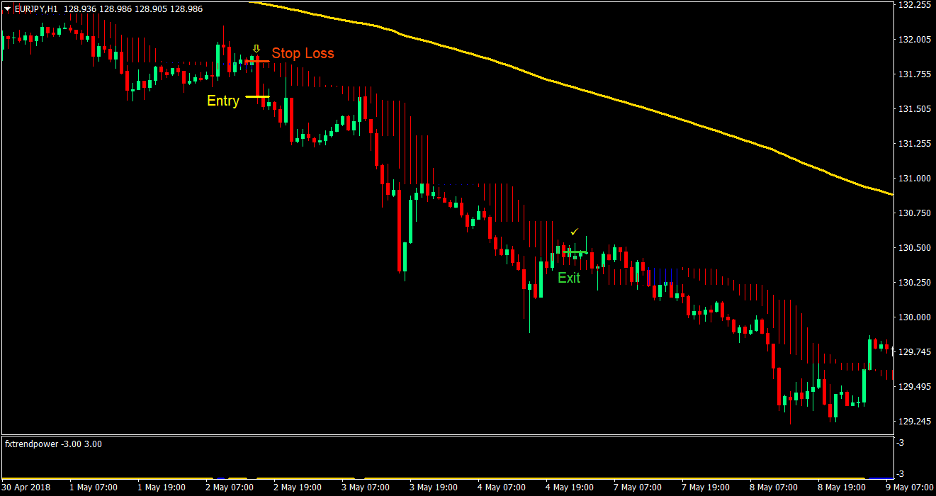

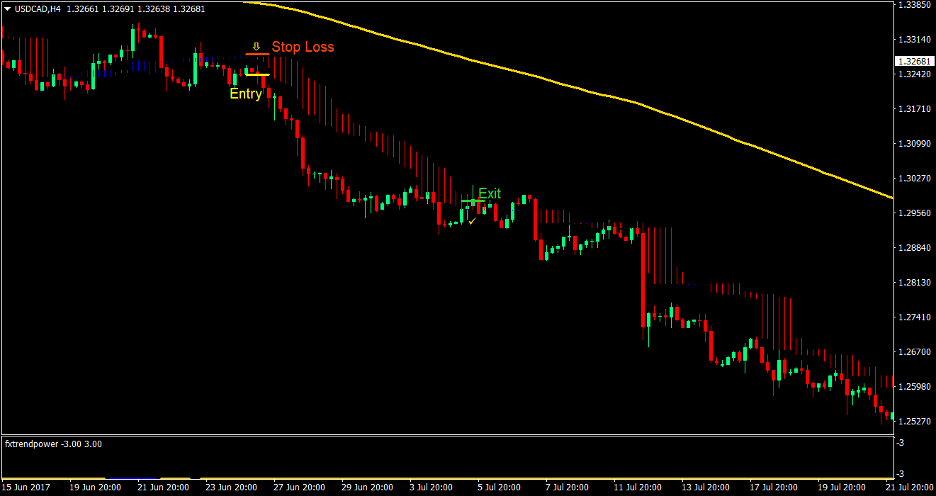

Persediaan Perdagangan Jual (Pendek).

Kemasukan

- Harga harus berada di bawah EMA 200 yang menunjukkan arah aliran jangka panjang yang menurun

- Penunjuk Pengurus Trend harus berada di bawah EMA 200

- Penunjuk Kuasa Trend FX harus mencetak garis emas yang menunjukkan arah aliran jangka pertengahan menurun

- Masukkan pesanan jual sebaik sahaja penunjuk Pengurus Trend bertukar kepada merah yang mengesahkan permulaan aliran jangka pertengahan menurun

Stop Loss

- Tetapkan Stop Loss di atas penunjuk Trend Manager

Keluar

- Jejaki stop loss di atas penunjuk Trend Manager sehingga berhenti

Kesimpulan

Strategi ini ialah strategi mengikut arah aliran dengan nisbah kemenangan yang baik dan nisbah risiko ganjaran yang tinggi. Kebanyakan strategi mengikut arah aliran cenderung mempunyai nisbah kemenangan yang rendah. Ini mungkin kerana kebanyakan strategi mengikut arah aliran membawa dagangan ke mana-mana arah tanpa mengambil kira arah aliran jangka panjang. Strategi mengikut arah aliran hanya mendapat keuntungan kerana ia biasanya mempunyai nisbah ganjaran-risiko yang baik.

Strategi Dagangan Forex Awan iTrend bagaimanapun mempunyai nisbah kemenangan yang lebih baik daripada kebanyakan strategi mengikut trend sementara masih mempunyai nisbah risiko ganjaran yang sangat baik. Ia biasanya menghasilkan pulangan 4:1 dan ke atas.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: