Pedagang yang berbeza mempunyai pendekatan yang berbeza apabila ia datang untuk berdagang pasaran forex. Ramai yang melihat dagangan forex sebagai sains tetap. Mereka akan mencari senario berulang dalam pasaran forex, mengenal pasti pertemuan biasa antara senario ini berdasarkan penunjuk teknikal, dan mengumpul data dan mengenal pasti sama ada persediaan perdagangan yang telah mereka kenal pasti adalah persediaan perdagangan berkemungkinan tinggi atau tidak. Kemudian, mereka akan menukar persediaan ini jika kebarangkalian itu cukup baik.

Sebaliknya, sesetengah peniaga juga mendekati perdagangan pasaran forex seperti seni. Daripada menggunakan data objektif tetap sebagai asas untuk persediaan perdagangan, mereka akan mencari corak berulang yang boleh mereka asaskan perdagangan mereka. Sesetengah akan berdagang pada corak harga atau corak candlestick, manakala yang lain akan berdagang berdasarkan sokongan dan rintangan aliran pasaran. Walaupun persediaan ini mungkin dikenal pasti secara subjektif, ia boleh berfungsi dengan baik untuk pedagang yang betul.

Salah satu corak berulang yang paling popular dalam pasaran dagangan ialah penarikan semula harga ke arah Nisbah Fibonacci sebelum menolak penembusan yang lain. Walaupun tiada asas saintifik atau logik mengenai mengapa harga melakukan ini, ia nampaknya berfungsi dengan baik untuk kebanyakan pedagang.

Nisbah Fibonacci

Nisbah Fibonaci ialah siri nombor yang mewakili nisbah yang bersifat berulang. Nisbah dan perkadaran ini terdapat dalam heliks cengkerang, urat daun, fraktal dalam kepingan salji, anggota badan dalam tubuh manusia dan banyak lagi. Ia juga dikatakan sebagai nisbah standard yang paling menarik minat ramai orang.

Nisbah ini juga berlaku dalam penarikan balik tindakan harga dalam carta harga. Walaupun tiada asas saintifik mengapa ia berlaku, harga cenderung melantun pada anjakan yang merupakan Nisbah Fibonacci yang ketara. Antara nisbah ini, yang paling popular ialah Nisbah Emas, yang bersamaan dengan 1.618. Adalah diperhatikan bahawa harga melantun pada tahap sekitar 61.8% daripada ayunan harga. Dan selalunya boleh menolak lebih jauh pada 161.8% daripada ayunan harga sebelumnya.

Alat carta teknikal yang tersedia dalam kebanyakan platform dagangan, termasuk MT4, termasuk pembaris Fibonacci Retracement. Alat ini digunakan secara meluas oleh ramai pedagang untuk mengenal pasti titik penarikan balik tersebut.

Pin Bar

Pin Bar ialah corak lilin berulang yang sangat popular di kalangan banyak pedagang tindakan harga. Ia mewakili pembalikan mendadak yang berlaku dalam satu bar batang lilin. Pembalikan secara tiba-tiba ini membentuk batang lilin dengan badan yang sangat kecil di satu sisi dan sumbu panjang atau ekor di sisi yang lain.

Corak candlestick ini menunjukkan petunjuk pembalikan yang sangat kuat. Malah, ramai peniaga menggunakannya sebagai pencetus kemasukan. Mereka akan menggunakan corak ini sebagai asas untuk persediaan perdagangan.

Penunjuk Pin Bar ialah penunjuk teknikal tersuai yang membantu pedagang mengenal pasti corak sedemikian dengan mudah. Ia merancang anak panah menghala ke atas apabila ia mengesan bar pin menaik dan anak panah menghala ke bawah apabila ia mengesan bar pin menurun.

Keluar Chandelier

Penunjuk Candelier Exit ialah arah aliran tersuai mengikut penunjuk teknikal yang berdasarkan Average True Range (ATR).

Penunjuk ini mengenal pasti arah aliran semasa. Ia kemudian memplot garisan yang menjejaki tindakan harga oleh gandaan ATR. Arah aliran menaik jika garisan itu berada di bawah tindakan harga. Sebaliknya, arah aliran menurun jika garisan itu berada di atas tindakan harga. Warna garisan juga berubah bergantung pada arah aliran. Garis oren menunjukkan arah aliran menaik, manakala garis magenta menunjukkan arah aliran menurun.

Penunjuk ini boleh digunakan sebagai penunjuk pembalikan arah aliran berdasarkan peralihan garisan Candelier Exit, trailing stop loss di mana pedagang boleh meletakkan stop loss mereka di belakang garisan, dan penapis bias arah aliran di mana pedagang hanya akan berdagang ke arah arah aliran yang ditunjukkan oleh garisan Candelier Exit.

Strategi Trading

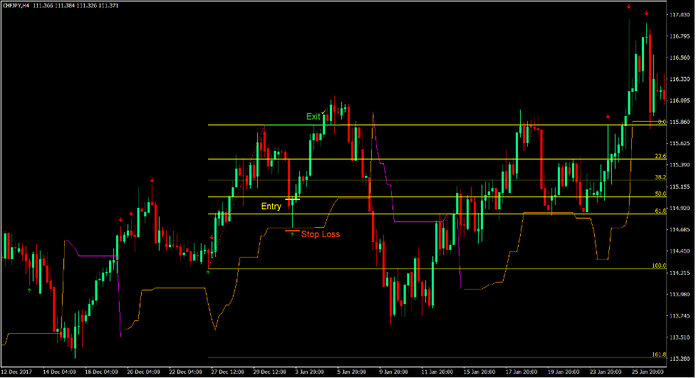

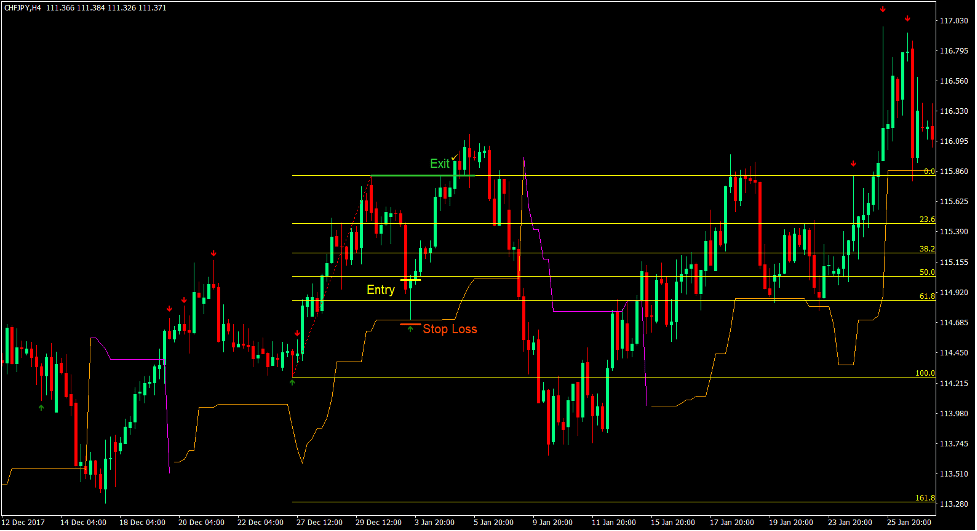

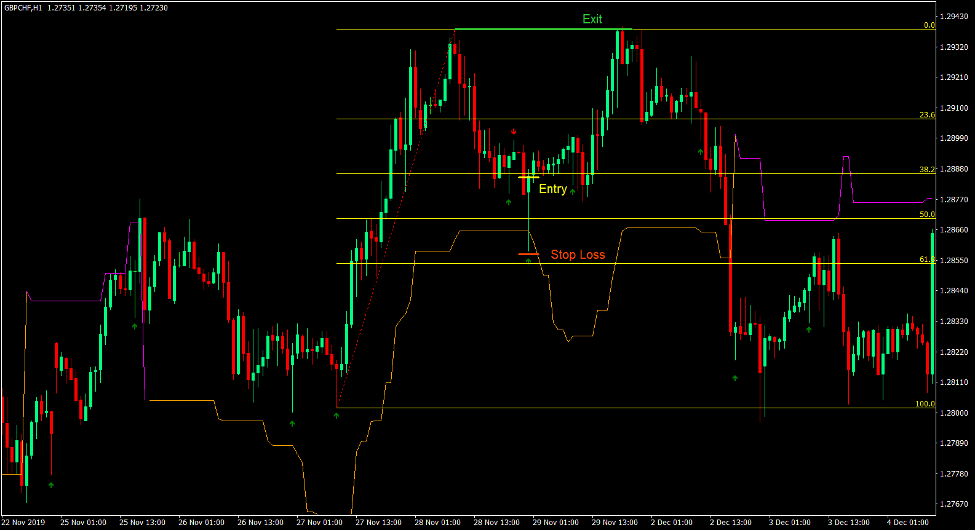

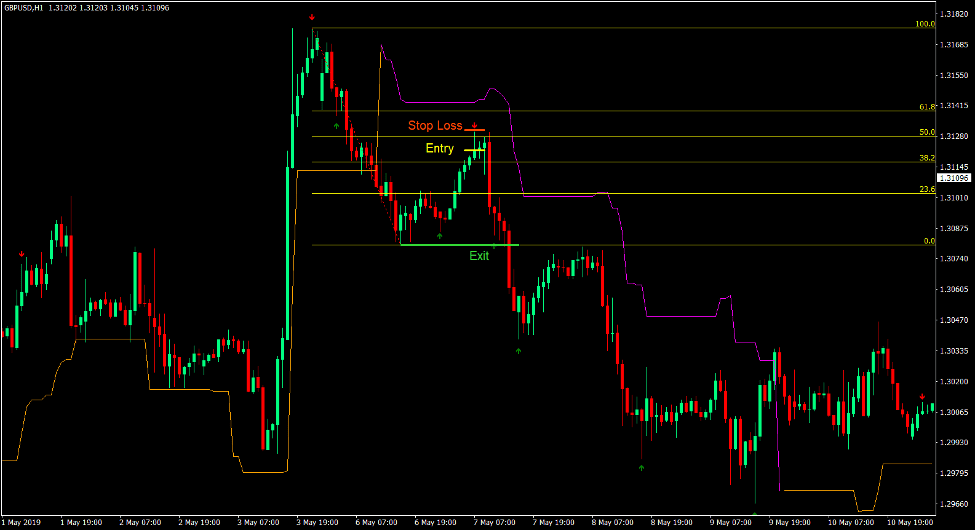

Strategi Dagangan Forex Pullback Nisbah Emas ialah strategi penarikan balik Fibonacci Retracement yang berdagang berdasarkan penarikan balik dan penolakan harga yang berlaku pada kawasan antara 50% dan 61.8% daripada Nisbah Fibonacci.

Mula-mula, kita harus mengenal pasti mata ayunan dan menyambungkan pembaris Fibonacci Retracement antara mata ayunan.

Kemudian, kami harus mengesahkan jika kecenderungan arah aliran yang ditunjukkan oleh garisan Candelier Exit bersetuju dengan arah perdagangan kami.

Kemudian, kita menunggu corak bar pin berlaku pada kawasan antara 50% dan 61.8% pembaris Fibonacci Retracement. Penunjuk Pin Bar akan memudahkan kita mengenal pasti corak ini kerana ia sepatutnya melukis anak panah yang menunjukkan arah corak bar pin.

Kami kemudiannya memasuki dagangan dengan sasaran kami pada titik ayunan lawan sebelumnya.

Petunjuk:

- Pinbar

- CandelierKeluar

Rangka Masa Pilihan: Carta 1 jam dan 4 jam

Pasangan Mata Wang: Jurusan FX, bawah umur dan salib

Sesi Dagangan: sesi Tokyo, London dan New York

Beli Persediaan Perdagangan

Kemasukan

- Sambungkan pembaris Fibonacci Retracement dari ayunan rendah ke ayunan tinggi.

- Tindakan harga hendaklah di atas garisan Keluar Candelier.

- Harga harus menarik balik ke arah kawasan antara 50% dan 61.8% daripada pembaris Fibonacci Retracement dan menolak kawasan tersebut.

- Penunjuk Pin Bar harus melukis anak panah menghala ke atas.

- Masukkan pesanan beli pada pengesahan syarat ini.

Stop Loss

- Tetapkan henti rugi pada sokongan di bawah lilin masuk.

Keluar

- Tetapkan sasaran ambil untung pada ayunan tinggi sebelumnya.

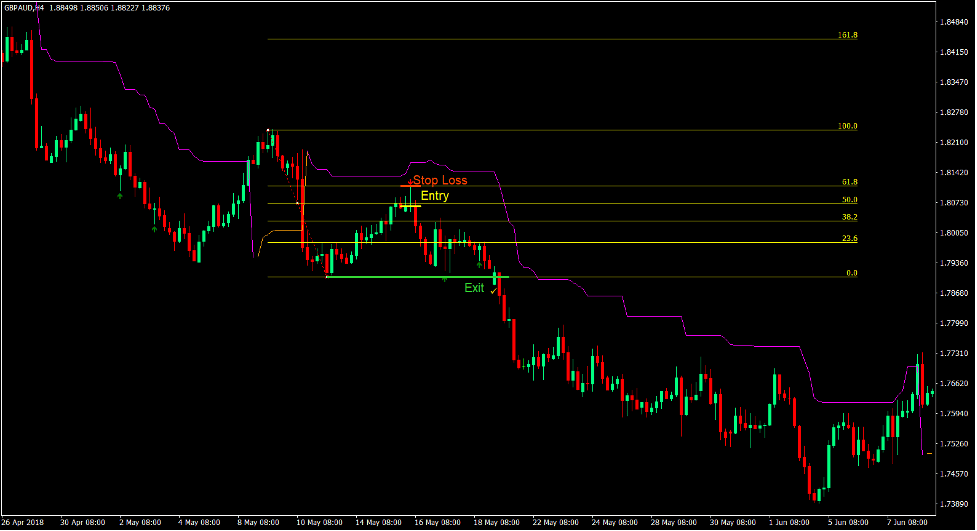

Jual Persediaan Perdagangan

Kemasukan

- Sambungkan pembaris Fibonacci Retracement dari ayunan tinggi ke ayunan rendah.

- Tindakan harga hendaklah di bawah garisan Keluar Candelier.

- Harga harus menarik balik ke arah kawasan antara 50% dan 61.8% daripada pembaris Fibonacci Retracement dan menolak kawasan tersebut.

- Penunjuk Pin Bar harus memplot anak panah menunjuk ke bawah.

- Masukkan pesanan jual pada pengesahan syarat ini.

Stop Loss

- Tetapkan stop loss pada rintangan di atas lilin masuk.

Keluar

- Tetapkan sasaran ambil untung pada ayunan rendah sebelumnya.

Kesimpulan

Dagangan berdasarkan penarikan semula Fibonacci Retracement ialah strategi dagangan yang digunakan secara meluas. Ramai peniaga profesional berdagang mengikut jenis persediaan ini. Sesetengah akan berdagang semata-mata pada penolakan tindakan harga pada 61.8%, manakala yang lain akan berdagang pada tahap 50% dan 38.2%. Lebih dalam anjakan, lebih baik nisbah risiko-ganjaran. Sesetengah peniaga akan bersikap konservatif dan hanya menyasarkan titik ayunan sebelumnya, manakala yang lain akan menyasarkan tahap 161.8%. Pedagang boleh menyesuaikan mengikut selera risiko mereka menggunakan strategi jenis ini.

Kemasukan penunjuk Candelier Exit membolehkan pedagang menapis dagangan berdasarkan kecenderungan arah aliran. Ini membolehkan pedagang mempunyai kebarangkalian kemenangan yang lebih baik.

Walaupun persediaan perdagangan ini tidak mudah dicari, persediaan ini cenderung sangat berkesan dan digunakan oleh ramai pedagang profesional di seluruh dunia.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: