Satu perkara tentang pasaran yang ramai peniaga tidak dapat serta-merta ialah ia dinamik. Ia tidak mempunyai peraturan. Ia sentiasa berubah. Ia tidak pernah berhenti berkembang. Kerana ciri-ciri ini, tiada peniaga boleh memaksakan kehendaknya di pasaran, kecuali mungkin peniaga institusi terbesar dari bank-bank besar. Kita boleh menyediakan semua peraturan dan parameter yang kita mahu, tetapi ia tidak akan sentiasa berfungsi. Ia mungkin berfungsi 50%, 60%, 70% malah 80% masa, tetapi ia tidak akan menjadi sempurna sepenuhnya. Begitulah cara pasaran berfungsi.

Mengetahui perkara ini, adalah juga bijak untuk melihat penunjuk yang dinamik. Terdapat penunjuk yang mempunyai nombor atau baris tetap di mana kebanyakan peraturan akan memanggil perdagangan apabila penunjuk memecahkan nombor tetap itu. Ini adalah benar terutamanya dengan pengayun. Ambil dagangan apabila harga mencecah 80, 20, 100, sifar, dsb. Walau bagaimanapun, walaupun nombor ini entah bagaimana berfungsi, dan ia juga memberi perintah kepada strategi dagangan, sering kali harga akan melakukan perkara yang bertentangan dengan apa yang kita jangkakan pada bila-bila masa. harga mencapai tahap ini, atau ada kalanya membuat langkah yang sangat menguntungkan sebelum penunjuk mencapai tahap ini.

Pengayun Harga Sintetik Detrended

Pengayun Harga Sintetik Detrended (DSP) ialah penunjuk berayun yang sangat dinamik. Ia tidak terhad, yang bermaksud bahawa angka yang terhasil boleh dilukis di seluruh tempat berdasarkan pergerakan harga berbanding dengan disimpan dalam julat tetap. Walaupun terdapat banyak penunjuk yang mempunyai ciri-ciri ini, di mana DSP bersinar adalah garis isyaratnya adalah dinamik. Kebanyakan penunjuk berayun menjana isyarat apabila harga melintasi tahap tetap tertentu. Walau bagaimanapun, DSP membenarkan garisan pencetus bergerak di sekitar tahap pertengahan bersama-sama dengan garis isyarat. Apabila kedua-dua garisan ini bersilang pada arah tertentu, walau apa pun tahapnya, isyarat dijana.

DynamicRS_C

Penunjuk DynamicRS_C ialah penunjuk tersuai yang berdasarkan median harga. Walaupun asas matematik untuk melukis garisannya tidak dibincangkan dengan jelas, ia adalah salah satu penunjuk yang nampaknya berkesan. Walaupun ia tidak sempurna, tetapi ia berfungsi dengan baik sebagai pengesahan tambahan untuk menentukan arah aliran jangka pendek.

Konsep Strategi Dagangan

Kedua-dua penunjuk tersuai yang disebutkan di atas adalah percuma antara satu sama lain. Penunjuk ini nampaknya bersetuju antara satu sama lain pada tahap tertentu, yang menghasilkan perdagangan kebarangkalian tinggi yang juga boleh menghasilkan keuntungan ganjaran yang tinggi.

Sebelum kami sampai ke isyarat kemasukan sebenar berdasarkan penunjuk di atas, kami akan menapis dagangan yang tidak bersetuju dengan arah aliran jangka pertengahan. Untuk melakukan ini, kami akan menggunakan Purata Pergerakan Eksponen (EMA) 50 tempoh sebagai asas untuk aliran pertengahan. Kami akan melihat lokasi harga berhubung dengan EMA 50 dan cerun EMA 50.

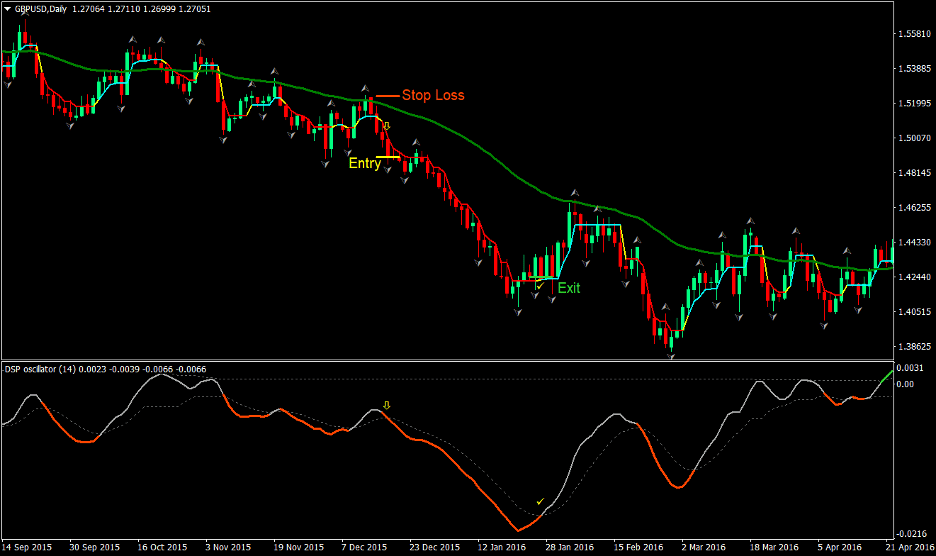

Bagi penyertaan, kami akan mencari pertemuan Pengayun Harga Sintetik Detrended dan DynamicRS_C. Isyarat DSP akan berdasarkan sama ada garis isyarat (garisan pepejal) mencecah melebihi garisan pencetus (garis putus-putus), menunjukkan bahawa pasaran boleh mula arah aliran pada arah tertentu. Penunjuk khusus ini juga bertukar warna apabila kedua-dua penunjuk bersilang, yang menunjukkan isyarat kemasukan sebenar dengan mudah.

Penunjuk DynamicRS_C juga menentukan arah aliran jangka pendek. Ia melakukan ini dengan menukar warna apabila ia menukar arah. Ia melukis garisan berwarna aqua apabila pasaran menjadi menaik dan garis merah apabila pasaran menjadi menurun.

Petunjuk:

- 50 EMA (hijau)

- DynamicRS_C

- Detrended_Synthetic_Price_goscillators

- Fraktal

Tempoh masa: Carta 15 minit, 30 minit, 1 jam, 4 jam dan harian

Pasangan Mata Wang: mana-mana

Sesi Dagangan: mana-mana

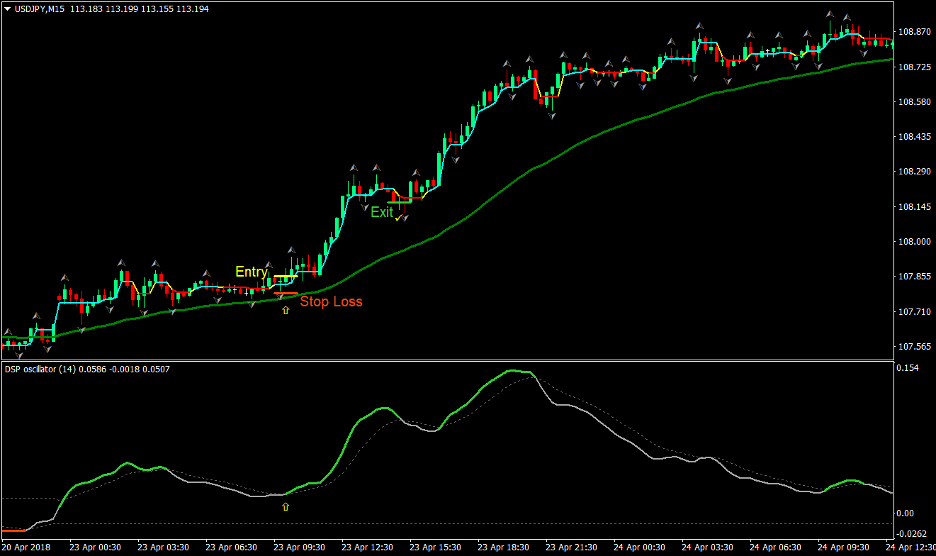

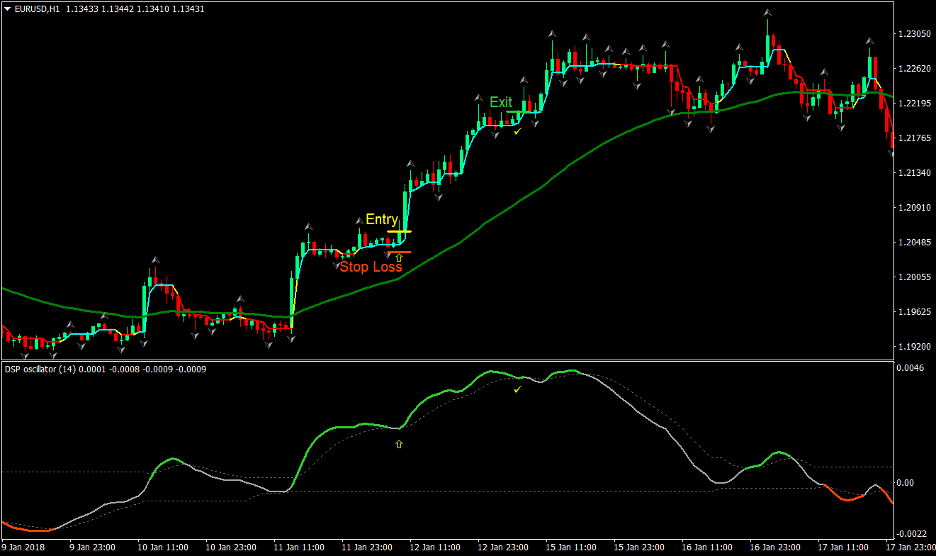

Beli Persediaan Perdagangan (Panjang).

Kemasukan

- Harga harus melebihi 50 EMA

- EMA 50 sepatutnya condong ke atas

- Penunjuk DynamicRS_C harus bertukar kepada warna aqua

- Garis pepejal penunjuk Detrended_Synthetic_Price_goscillators harus pecah di atas garis putus-putus atas dan bertukar kepada warna hijau limau

- Buka pesanan beli pada pertemuan peraturan di atas

Stop Loss

- Tetapkan stop loss pada fraktal di bawah lilin masuk

Keluar

- Tutup dagangan jika penunjuk DynamicRS_C bertukar kepada warna merah

- Tutup dagangan jika garisan pepejal Detrended_Synthetic_Price_goscillators terputus di bawah garis putus-putus atas dan bertukar kepada warna kelabu

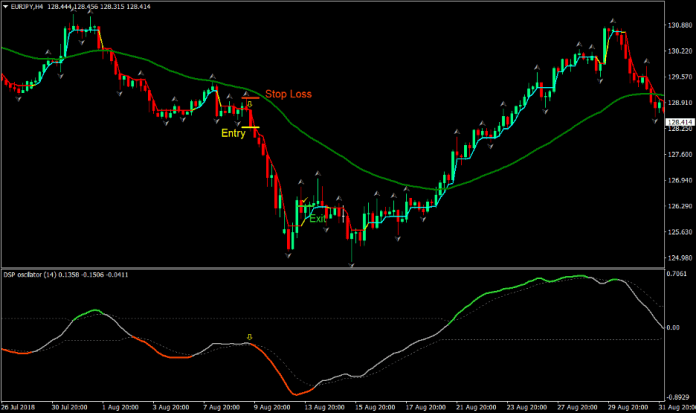

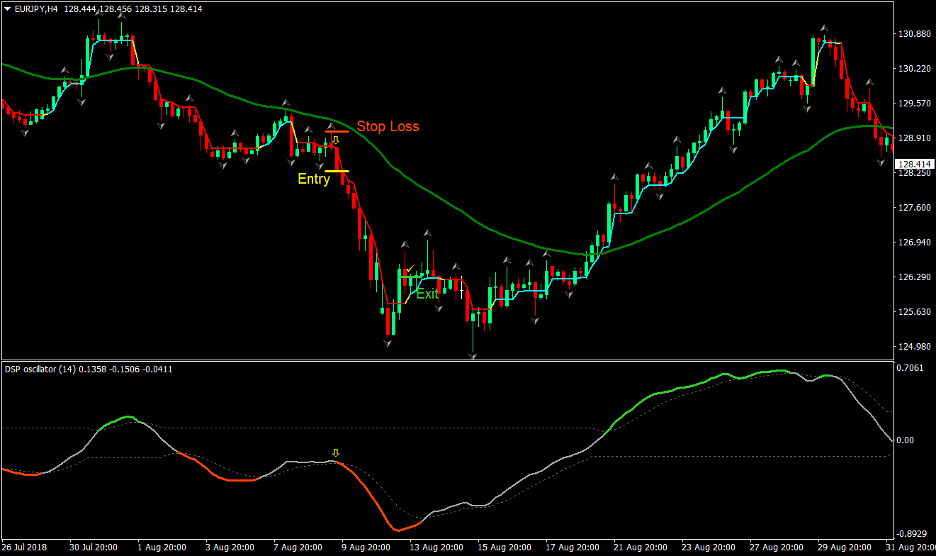

Persediaan Perdagangan Jual (Pendek).

Kemasukan

- Harga mestilah di bawah 50 EMA

- EMA 50 sepatutnya condong ke bawah

- Penunjuk DynamicRS_C harus bertukar kepada warna merah

- Garis pepejal penunjuk Detrended_Synthetic_Price_goscillators harus pecah di bawah garis putus-putus bawah dan bertukar kepada warna merah oren

- Buka pesanan jual pada pertemuan peraturan di atas

Stop Loss

- Tetapkan stop loss pada fraktal di atas lilin masuk

Keluar

- Tutup dagangan jika penunjuk DynamicRS_C bertukar kepada warna aqua

- Tutup dagangan jika garisan pepejal Detrended_Synthetic_Price_goscillators terputus di atas garis putus-putus bawah dan bertukar kepada warna kelabu

Kesimpulan

Strategi ini membolehkan strategi mengikuti aliran yang bersetuju dengan aliran jangka pertengahan yang diwakili oleh 50 EMA.

Pertemuan DynamicRS_C dan Detrended_Synthetic_Price_goscillators membolehkan persediaan perdagangan kebarangkalian tinggi dan ganjaran yang tinggi. Tidak semua persediaan perdagangan akan menguntungkan tetapi banyak perdagangan yang dibuka berdasarkan strategi ini boleh berfungsi. Selain itu, terdapat kemungkinan tinggi harga boleh berjalan untuk beberapa waktu yang membolehkan nisbah risiko ganjaran lebih daripada 2:1.

Kunci kepada strategi ini ialah menggunakannya semasa keadaan pasaran yang sedang trend. Ini tidak akan berfungsi dengan baik pada pasaran yang berbeza. Untuk menentukan sama ada pasaran sememangnya dalam arah aliran, anda boleh melihat betapa cerunnya 50 EMA. Semakin curam cerun, semakin kuat alirannya. Semakin kuat trend, semakin tinggi kebarangkalian perdagangan.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: