Momentum breakout adalah keadaan perdagangan utama di mana pedagang boleh mencari peluang perdagangan yang baik. Ini kerana pecahan momentum cenderung menyebabkan harga bergerak ke satu arah umum dan selalunya boleh mengakibatkan arah aliran.

Perdagangan momentum ialah teknik perdagangan teknikal di mana pedagang akan membeli atau menjual instrumen boleh didagangkan berdasarkan kekuatan arah aliran. Pada asasnya, strategi momentum dagangan pedagang adalah berdagang dengan kekuatan yang kuat di sebalik pergerakan harga. Pergerakan harga yang kukuh ini selalunya menyebabkan harga bergerak ke arah yang sama dan selalunya boleh mengakibatkan pasaran arah aliran.

Momentum di luar dagangan adalah hasil daripada jisim dan kelajuan. Dalam perdagangan, jisim dan kelajuan boleh dikenal pasti berdasarkan volum dan jarak yang dilalui mengikut harga dalam tempoh yang singkat.

Satu cara untuk mengenal pasti momentum yang kuat adalah dengan memerhatikan lilin momentum. Lilin momentum ialah lilin yang panjang dan penuh dengan sumbu yang sedikit atau tiada. Ini menunjukkan bahawa harga bergerak ke satu arah dalam tempoh lilin tersebut. Ini selalunya disertai dengan dagangan volum tinggi dalam lilin itu.

Dalam strategi ini, kami akan melihat menggunakan beberapa penunjuk teknikal untuk mengesahkan momentum.

Saluran Harga Dinamik

Saluran Harga Dinamik ialah penunjuk jenis saluran tersuai yang berdasarkan Average True Range (ATR).

ATR pada asasnya ialah julat purata lilin harga dalam tempoh yang telah ditetapkan.

Saluran Harga Dinamik menggabungkan ATR dengan purata bergerak untuk mengenal pasti arah aliran, turun naik, momentum dan min pembalikan.

Saluran Harga Dinamik memplot garis purata bergerak sebagai garis utamanya dan diwakili oleh garis kuning putus-putus. Baris ini boleh sama ada Purata Pergerakan Mudah (SMA), Purata Pergerakan Eksponen (EMA) atau Purata Pergerakan Lancar (SMMA). Peniaga boleh memilih pilihan dalam tab parameter penunjuk.

Kemudian, enam baris terpancar dari garis purata bergerak. Tiga di atas dan tiga di bawah. Garisan ini diplotkan jarak dari garis tengah, iaitu garis purata bergerak, berdasarkan faktor ATR.

Penunjuk boleh digunakan sebagai penunjuk turun naik. Pedagang boleh mengenal pasti turun naik berdasarkan penguncupan dan pengembangan jalur dari garis tengah.

Ia juga boleh digunakan untuk mengenal pasti arah aliran, berdasarkan cara garis tengah dicerunkan dan berdasarkan sama ada garisan tertentu bertindak sebagai sokongan atau rintangan dinamik dalam arah aliran.

Ia juga boleh menunjukkan pasaran terlebih beli atau terlebih jual berdasarkan cara harga bertindak balas terhadap jalur luar. Jika tindakan harga menunjukkan tanda-tanda penolakan harga pada jalur luar, maka pasaran boleh sama ada terlebih beli atau terlebih jual. Syarat ini adalah utama untuk pembalikan min.

Sebaliknya, garis luar yang sama boleh digunakan untuk menentukan momentum yang kuat. Jika tindakan harga menunjukkan tanda-tanda penembusan momentum yang kuat terhadap garis luar, pasaran mungkin mendapat momentum yang kuat yang boleh mengakibatkan arah aliran.

Relative Strength Index (Indeks Kekuatan Relatif)

Indeks Kekuatan Relatif (RSI) ialah penunjuk teknikal serba boleh yang merupakan sebahagian daripada keluarga pengayun penunjuk. Ia boleh digunakan untuk menentukan arah aliran, momentum dan keadaan harga terlebih beli atau terlebih jual.

RSI memplot garisan yang berayun dalam julat 0 hingga 100. Ia juga biasanya mempunyai penanda pada tahap 50, iaitu garis tengah. Jika garisan RSI berada di atas 50, maka kecenderungan pasaran adalah menaik, manakala jika garisan di bawah 50, maka berat sebelah pasaran adalah menurun.

Ia juga mempunyai penanda pada tahap 30 dan 70. Garisan RSI yang jatuh di bawah 30 boleh menunjukkan keadaan terlebih jual, manakala garisan RSI di atas 70 boleh menunjukkan keadaan terlebih beli. Kedua-dua syarat adalah utama untuk pembalikan min.

Walau bagaimanapun, pedagang momentum juga boleh melihat pelanggaran di atas 70 sebagai petunjuk momentum kenaikan harga, dan penurunan di bawah 30 sebagai petunjuk momentum menurun. Ia adalah soal bagaimana tindakan harga bertindak balas apabila garisan RSI melanggar tahap ini.

Pedagang juga menambah tahap 45 dan 55 untuk menyokong petunjuk pasaran arah aliran. Tahap 45 bertindak sebagai tahap sokongan dalam pasaran aliran menaik, manakala tahap 55 bertindak sebagai rintangan dalam pasaran aliran menurun.

Strategi Trading

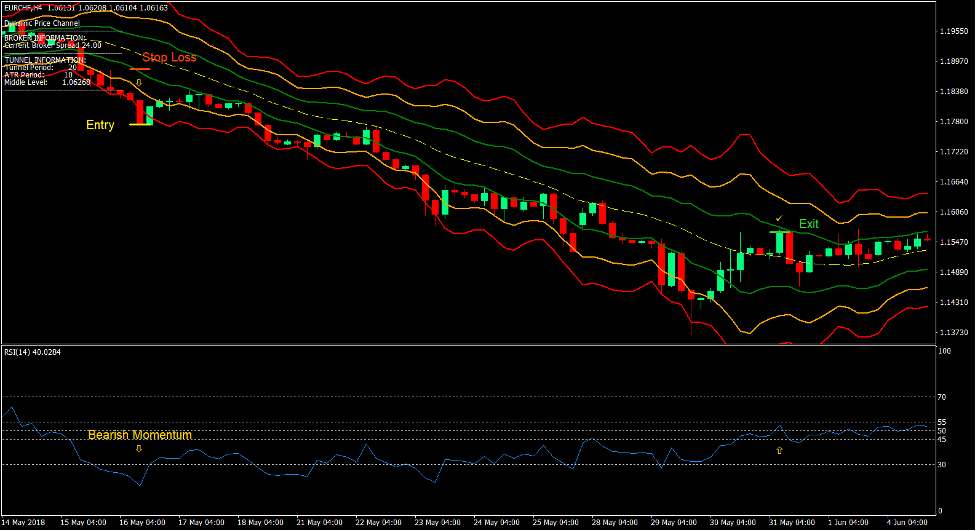

Strategi Dagangan Forex Pecah Momentum Saluran Dinamik ialah strategi pemecahan momentum yang berdagang pada pertemuan antara isyarat pemecahan momentum yang datang daripada penunjuk Saluran Harga Dinamik dan RSI.

Pada Saluran Harga Dinamik, momentum dikenal pasti berdasarkan momentum yang kuat yang menembusi garisan luar Saluran Harga Dinamik. Ini diwakili oleh garis merah di atas dan di bawah garis kuning tengah.

Pada RSI, momentum disahkan berdasarkan garisan RSI yang menembusi melebihi 70 dalam kes momentum kenaikkan atau di bawah 30 dalam kes momentum menurun.

Pertemuan antara dua isyarat momentum cenderung kepada isyarat momentum kebarangkalian tinggi yang boleh mengakibatkan arah aliran.

Petunjuk:

- Saluran_Harga_Dinamik

- Relative Strength Index (Indeks Kekuatan Relatif)

Rangka Masa Pilihan: Carta 1 jam dan 4 jam

Pasangan Mata Wang: Jurusan FX, bawah umur dan salib

Sesi Dagangan: sesi Tokyo, London dan New York

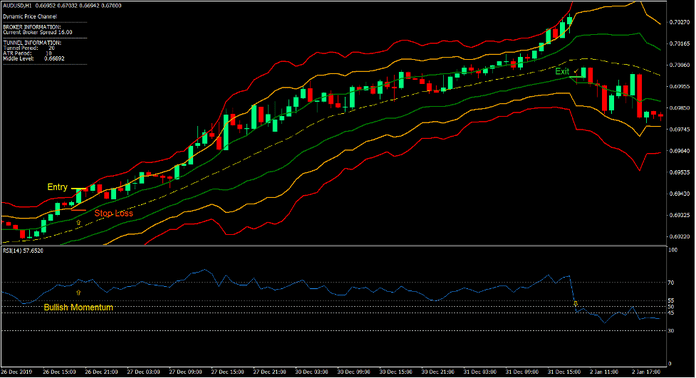

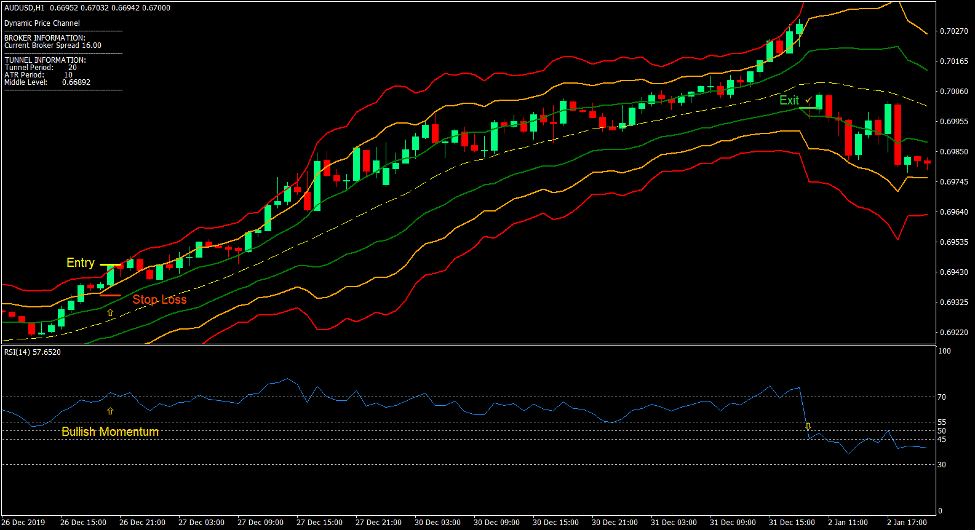

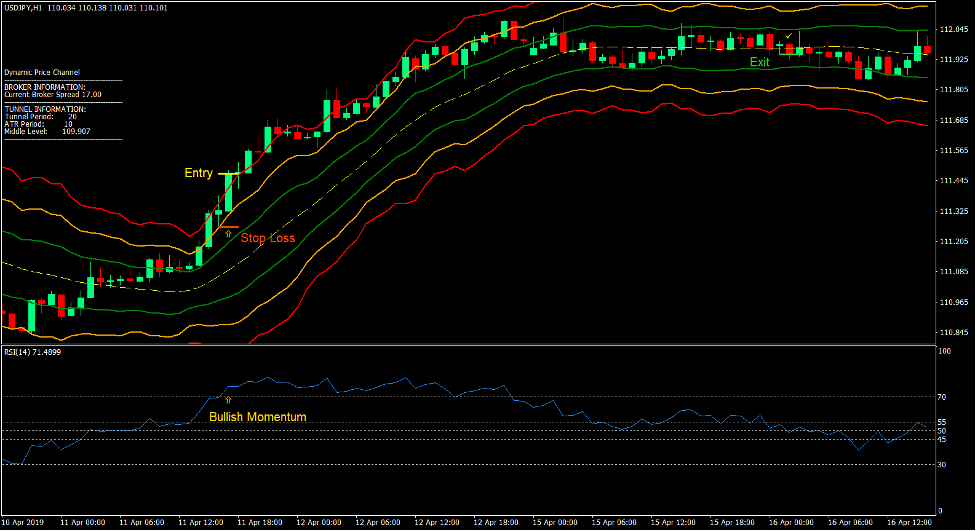

Beli Persediaan Perdagangan

Kemasukan

- Lilin momentum kenaikkan sepatutnya menembusi di atas garis merah atas Saluran Harga Dinamik.

- Garisan RSI sepatutnya melanggar melebihi 70.

- Masukkan pesanan beli pada pertemuan kedua-dua isyarat.

Stop Loss

- Tetapkan stop loss pada tahap sokongan sedikit di bawah lilin kemasukan.

Keluar

- Tutup dagangan sebaik garis RSI turun di bawah 50.

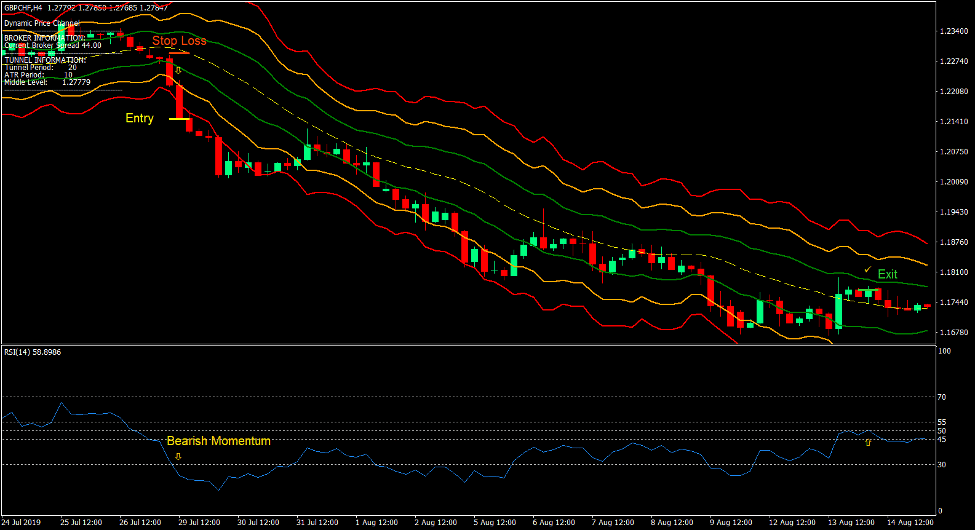

Jual Persediaan Perdagangan

Kemasukan

- Lilin momentum menurun sepatutnya menembusi di bawah garis merah bawah Saluran Harga Dinamik.

- Barisan RSI sepatutnya turun di bawah 30.

- Masukkan pesanan jual pada pertemuan kedua-dua isyarat.

Stop Loss

- Tetapkan stop loss pada tahap rintangan sedikit di atas lilin masuk.

Keluar

- Tutup dagangan sebaik sahaja garisan RSI menembusi melebihi 50.

Kesimpulan

Strategi pelarian momentum ini menghasilkan persediaan perdagangan momentum yang berdasarkan dua isyarat momentum berkualiti tinggi.

Terdapat ramai peniaga profesional yang berdagang menggunakan kaedah ini dengan parameter yang berbeza-beza dan dengan pertemuan yang datang dari pelbagai rangka masa. Walau bagaimanapun, sebagai isyarat momentum kendiri, strategi ini sudah boleh menghasilkan persediaan perdagangan berkualiti tinggi.

Ia juga penting untuk ambil perhatian bahawa persediaan perdagangan ini cenderung berfungsi dengan baik apabila pecahan datang daripada kesesakan pasaran yang ketat.

Pedagang boleh berlatih dengan strategi ini sebagai sebahagian daripada strategi momentum keseluruhan dengan pelbagai pertemuan jangka masa.

Broker MT4 yang disyorkan

Broker XM

- Percuma $ 50 Untuk Mula Berdagang Dengan Segera! (Keuntungan yang boleh dikeluarkan)

- Bonus Deposit sehingga $5,000

- Program Kesetiaan Tanpa Had

- Broker Forex Pemenang Anugerah

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar untuk Akaun Broker XM di sini <

Broker FBS

- Berdagang 100 Bonus: Percuma $100 untuk memulakan perjalanan dagangan anda!

- 100% Bonus Deposit: Gandakan deposit anda sehingga $10,000 dan berdagang dengan modal yang dipertingkatkan.

- Leverage hingga 1: 3000: Memaksimumkan potensi keuntungan dengan salah satu pilihan leveraj tertinggi yang ada.

- Anugerah 'Broker Perkhidmatan Pelanggan Terbaik Asia': Kecemerlangan yang diiktiraf dalam sokongan dan perkhidmatan pelanggan.

- Promosi bermusim: Nikmati pelbagai bonus eksklusif dan tawaran promosi sepanjang tahun.

>> Daftar untuk Akaun Broker FBS di sini <

Klik di sini di bawah untuk memuat turun: