Price levels that the market reversed from are often market swings, which could either be a swing high or a swing low. These are critical price points because the market has already rejected these price levels in the past. There will always be a probability that the price may reject that price level again as the market revisits those levels. As such, major swing highs and swing lows can be considered support or resistance levels which the price may bounce from.

This strategy is a reversal trading strategy that trades on reversals coming from support or resistance levels based on swing highs and swing lows. It also makes use of signals based on divergences as a means to confirm a reversal setup to add a layer of confluence on each reversal trade setup.

Swing Lows and Swing Highs as Horizontal Support or Resistance Levels

Most traders would describe support and resistance lines as lines that can be connected by more than two points in which the price would typically bounce off, with support lines being connected by swing lows, and resistance lines being connected by swing highs. This is probably the textbook definition of what a support or resistance line is. However, we could also argue that there could be other features on a price chart that we could also consider as support or resistance levels since price tends to bounce off of these levels.

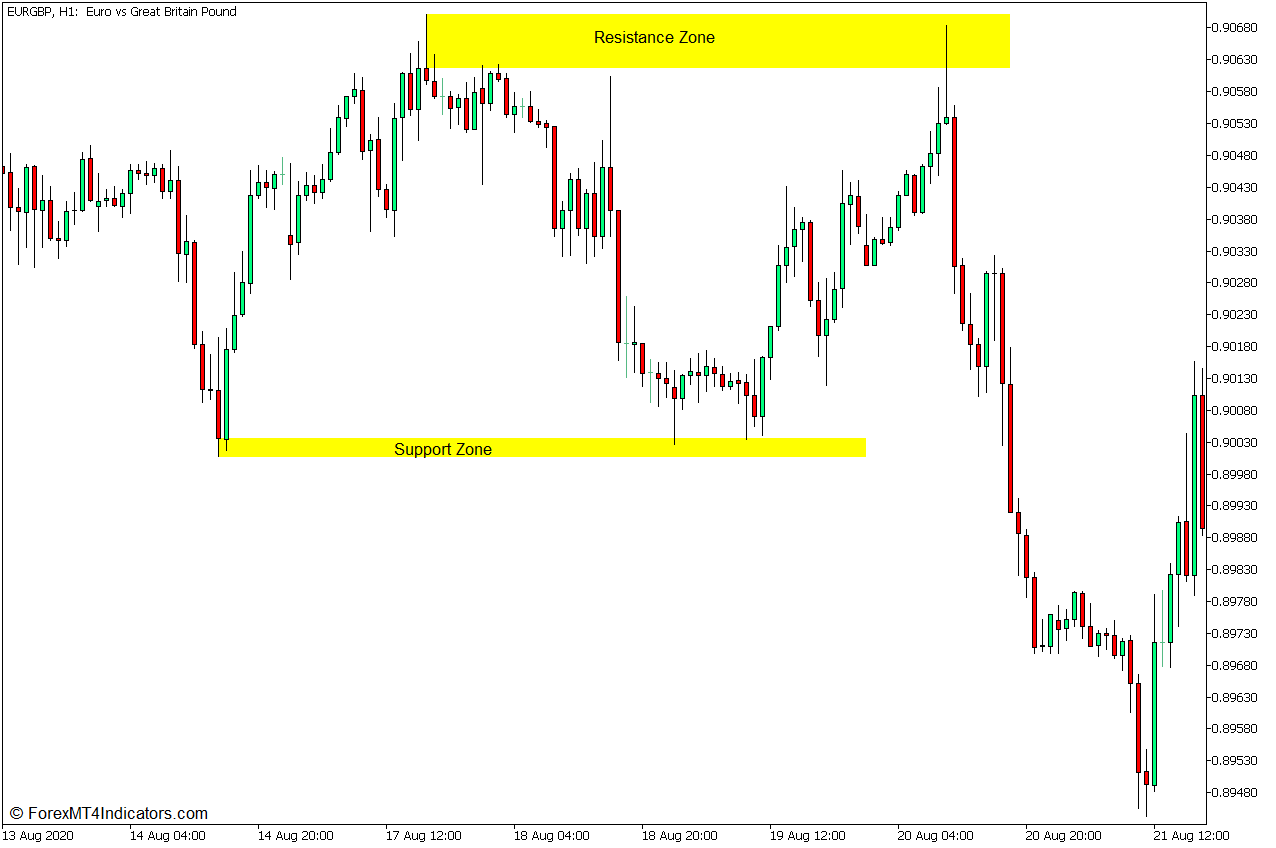

Major swing highs and swing lows can be considered horizontal support or resistance levels. The idea is that the market already rejected these levels. So, if the price revisits the same levels, there would always be a high chance that the price could reverse from there. The difference is that these levels are not yet confirmed as support or resistance levels until the price bounces off of them.

We could also say that one probable reason why reversal price patterns such as double tops and double bottoms work is that the market is just reversing from a major horizontal support or resistance level. The same reason could also be said of ranging markets. Notice how the major price swings on the chart below were respected as support or resistance levels even before a clear line connecting the swing points was available.

Reversal Signals from Divergences

As mentioned above, price action would typically form swing highs and swing lows as the price oscillates up and down the price chart. Oscillator type of indicators typically mimics the movements of price action only that it is plotted on its indicator window. As such, oscillators would often have peaks and troughs that would somehow coincide with the swing highs and swing lows of price action.

Normally, the height and depth of the peaks and troughs of an oscillator would have roughly the same intensity as that of the height and depth of the swing highs and swing lows of price. However, there are also many scenarios wherein the intensity of the peaks and troughs of the swing and swing lows would vary with that of an oscillator. This scenario is what we call divergences.

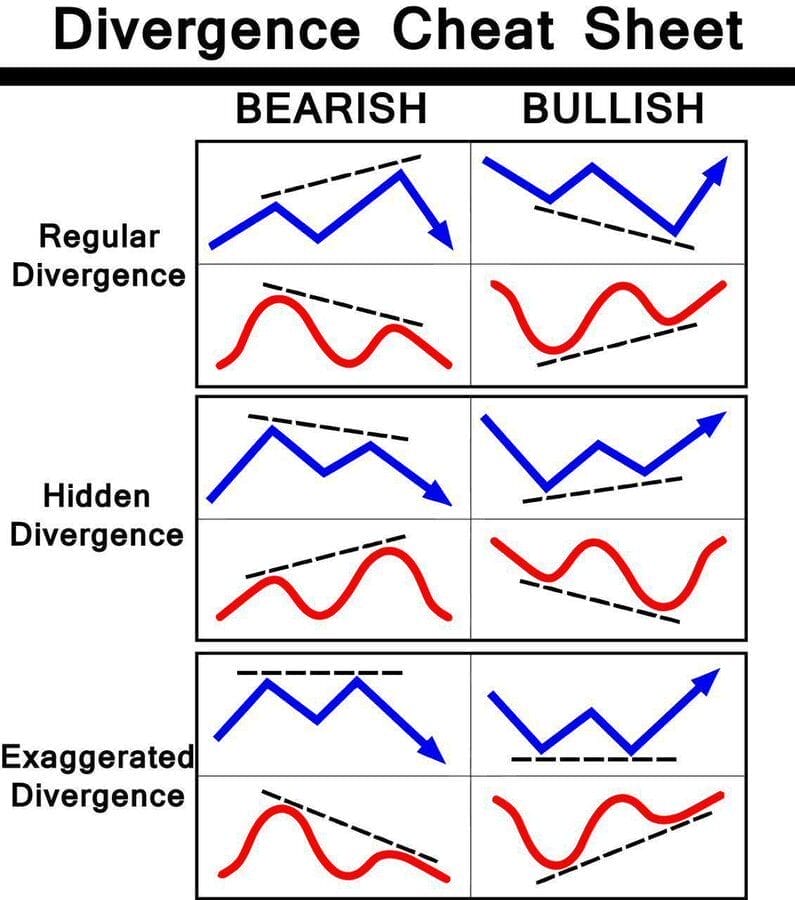

Divergences are good indications of a probable reversal. As such, many profitable traders use this as a basis for their trade setups.

Below is a chart of the various types of divergences.

Moving Average Convergence and Divergence

Moving Average Convergence and Divergence (MACD) is a popular oscillator type of technical indicator. This oscillator is a momentum technical indicator that is based on the concept of moving average crossovers.

The MACD computes for the difference between two Exponential Moving Average (EMA) lines. The difference between the two EMA lines is then plotted on its indicator window either as the MACD line or as bars. Positive MACD lines indicate a bullish trend bias, while negative MACD lines indicate a bearish trend bias.

A Simple Moving Average (SMA) is then derived from the MACD line. It is also plotted on the indicator window as a signal line. Crossovers between the MACD line and the signal line can be considered as a potential reversal signal.

MACD Divergence Indicator

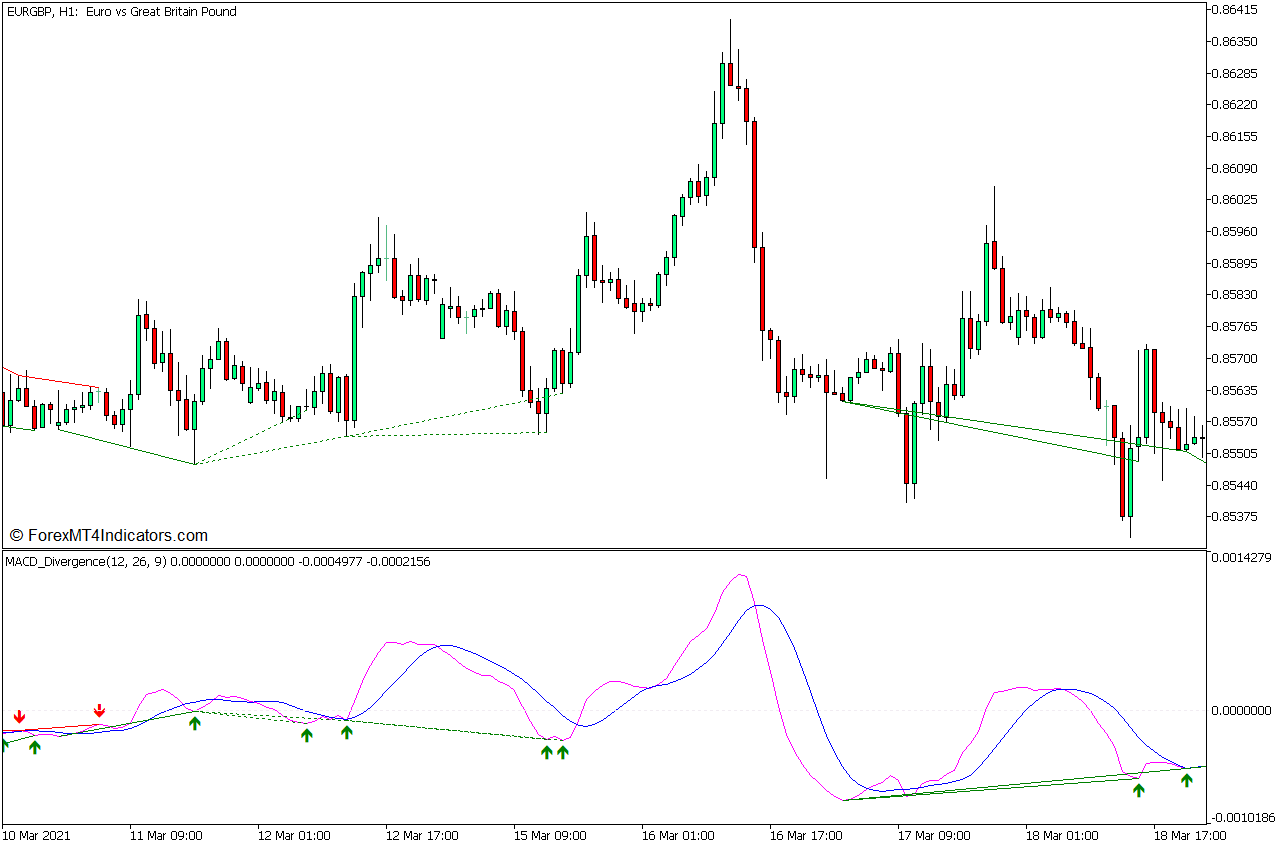

The MACD Divergence Indicator is a custom technical indicator that automatically detects divergences between the MACD and price action. It has an algorithm that compares the peaks and dips of the oscillations of the MACD line with its corresponding swing highs and swing lows on price action for it to detect divergences.

This indicator plots an arrow pointing up on the MACD line to indicate a bullish divergence, and an arrow pointing down on the MACD line to indicate a bearish divergence. It also plots a dashed line to indicate a hidden divergence and a solid line to indicate a regular divergence.

Trading Strategy Concept

This strategy trades on a confluence of a support and resistance reversal and a divergence reversal indication.

Support and resistance zones are identified manually based on the wicks of a swing high or swing low. These zones will be the areas where we will be anticipating potential reversals.

The MACD Divergence Indicator would then be used as the trade entry signal based on a valid divergence. However, traders should still visually confirm if the indicated divergence is an actual divergence.

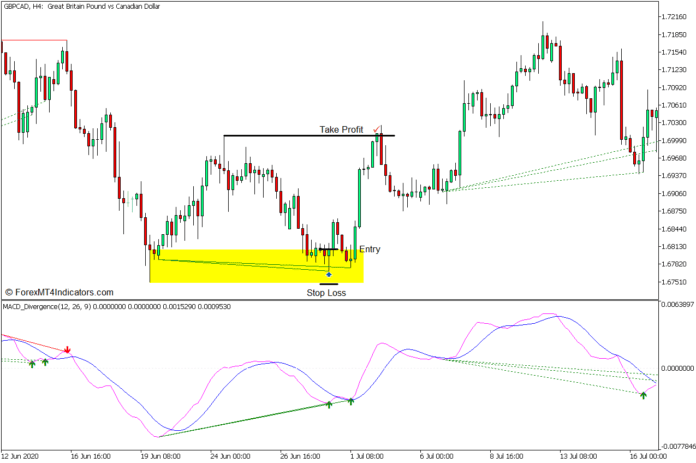

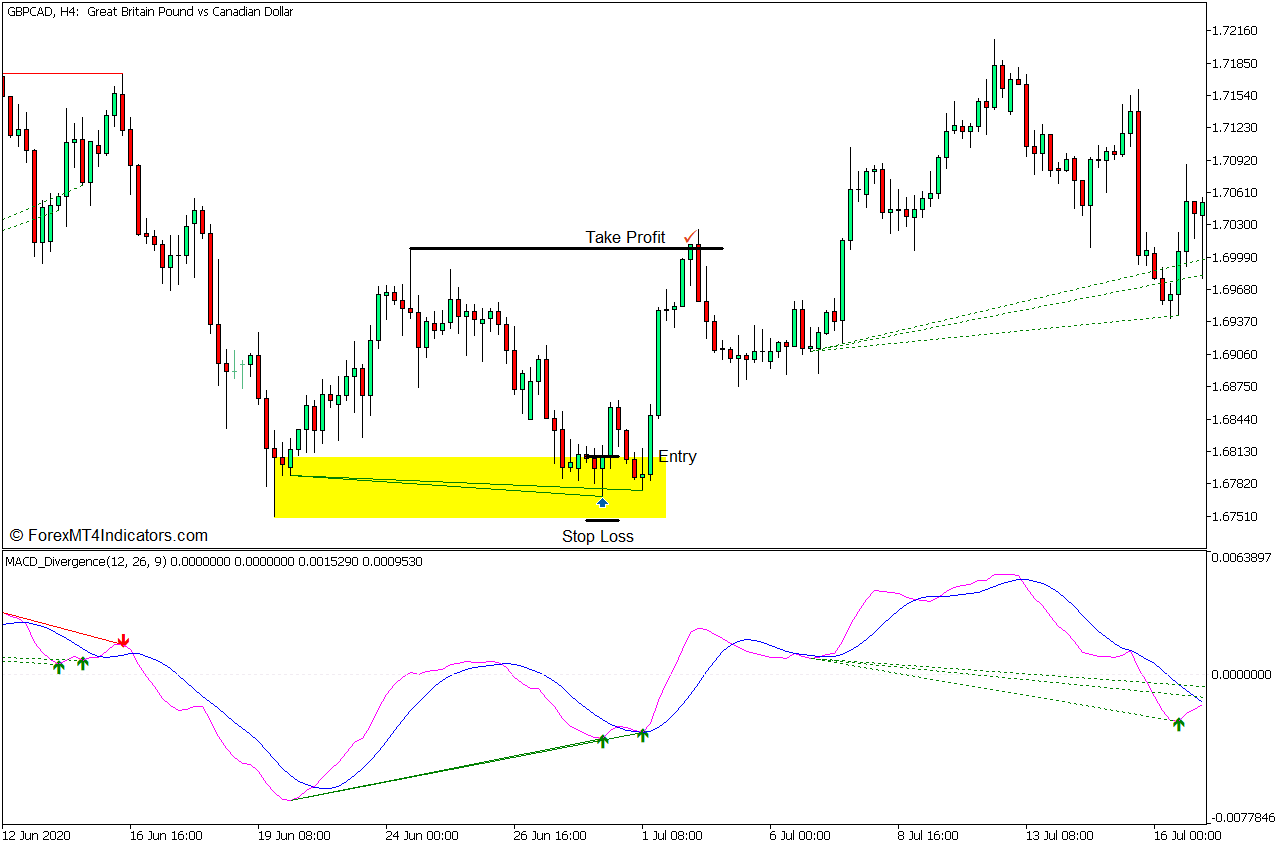

Buy Trade Setup

Entry

- A support zone should be identified based on the wicks of price rejection candles coming from a swing low.

- Price should revisit the support zone and show signs of price rejection.

- Enter a buy order as soon as the MACD Divergence indicator identifies a bullish divergence.

Stop Loss

- Set the stop loss below the support zone.

Exit

- Set the take profit target on the next swing high.

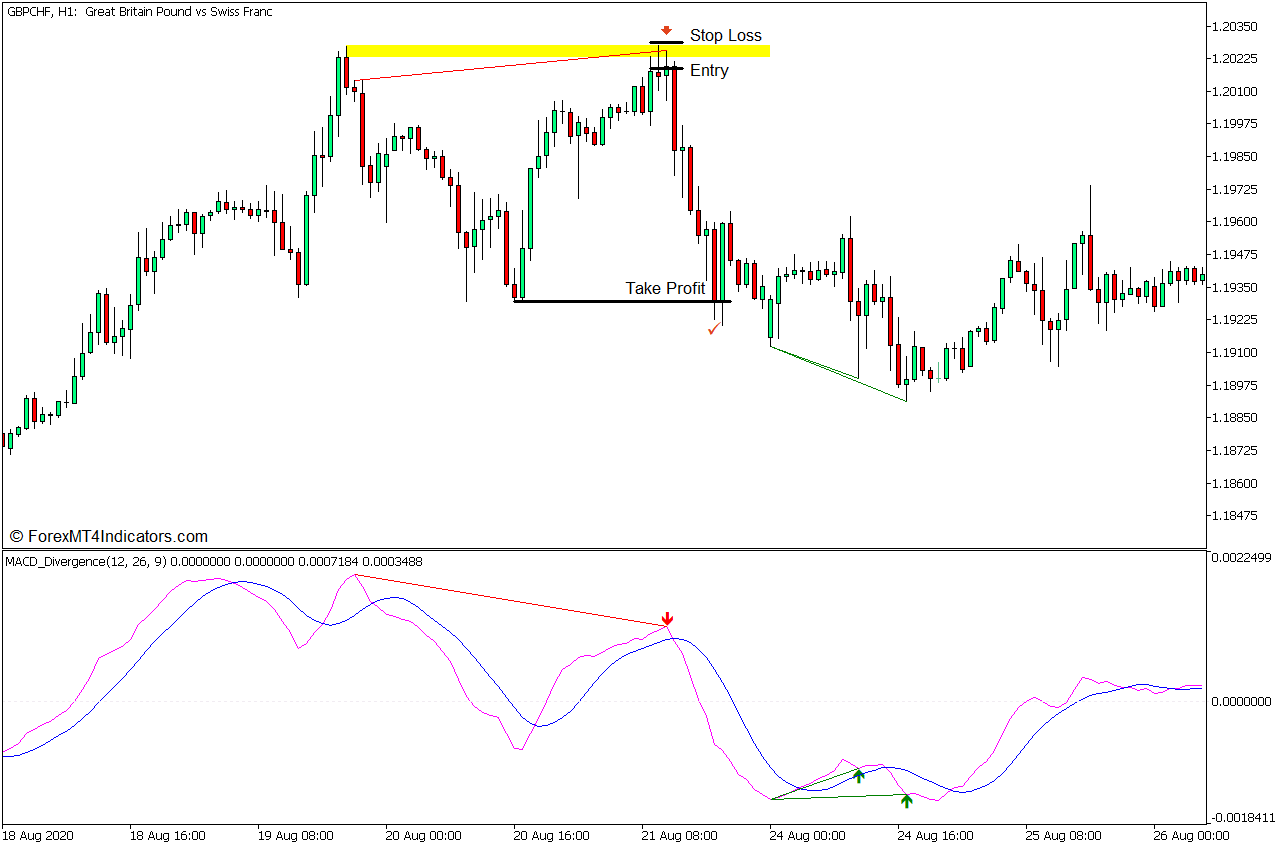

Sell Trade Setup

Entry

- A resistance zone should be identified based on the wicks of price rejection candles coming from a swing high.

- Price should revisit the resistance zone and show signs of price rejection.

- Enter a sell order as soon as the MACD Divergence indicator identifies a bearish divergence.

Stop Loss

- Set the stop loss above the resistance zone.

Exit

- Set the take profit target on the next swing low.

Conclusion

Reversal setups coming from support or resistance zones can be a very viable trading strategy. Some traders would anticipate reversals coming from these support or resistance levels without any confirmation of a reversal signal. Some would even go as far as placing limited entry orders on these levels.

This strategy however is a more conservative approach since we are still using a confirmation of a probable reversal using divergences.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: