Total Power MT5 Indicator, a valuable tool for MetaTrader 5 users. We’ll explore its inner workings, decipher its readings, and unlock its potential to enhance your trading strategies. So, buckle up and get ready to empower your trading decisions!

Understanding the Total Power MT5 Indicator

The Total Power MT5 Indicator is a custom indicator designed to gauge the relative strength of buyers (bulls) and sellers (bears) within a specific timeframe. Imagine it as a window into the ongoing tug-of-war between these market forces. By analyzing this power struggle, traders can gain valuable insights into potential trend direction and identify entry and exit points for their trades.

Here’s a quick breakdown of the benefits of using the Total Power MT5 Indicator:

- Improved Market Sentiment Analysis: The indicator provides a visual representation of bullish and bearish dominance, helping traders understand the overall market mood.

- Enhanced Trend Identification: By pinpointing shifts in power between bulls and bears, the indicator can offer clues on potential trend reversals or continuations.

- Confirmation of Trading Signals: The Total Power MT5 Indicator can be used alongside other technical indicators to confirm trade signals and reduce the risk of false positives.

- Customizable Parameters: The indicator allows traders to adjust its parameters to suit their specific trading styles and preferred timeframes.

While the Total Power MT5 Indicator offers valuable insights, it’s important to acknowledge its limitations. Like any technical analysis tool, it’s not a crystal ball that guarantees future market movements. Here are some points to consider:

- Market Noise: Short-term fluctuations in price can create “noise” in the indicator’s readings, making it challenging to interpret at times.

- Overreliance: Solely relying on the Total Power MT5 Indicator can lead to missed opportunities if not combined with other technical analysis methods and fundamental analysis.

- False Signals: Just like any indicator, the Total Power MT5 Indicator can generate false signals, especially in volatile markets.

By understanding both the strengths and limitations of this tool, traders can leverage its insights to make more informed trading decisions.

How Does the Total Power MT5 Indicator Work?

Now that we’ve grasped the essence of the Total Power MT5 Indicator, let’s delve into the technical aspects of its calculations. Two key parameters influence the indicator’s output:

Lookback Period

This parameter defines the number of past bars used to calculate the relative strength of bulls and bears. A longer lookback period provides a broader perspective on market sentiment but might be less sensitive to recent price changes. Conversely, a shorter lookback period reacts more readily to current market dynamics but can be susceptible to short-term noise.

Power Period

This parameter determines the calculation method used within the lookback period. The indicator calculates the average number of bullish and bearish bars within this timeframe. A higher Power Period smooths out the indicator’s readings, while a lower Power Period offers a more granular view of the power struggle.

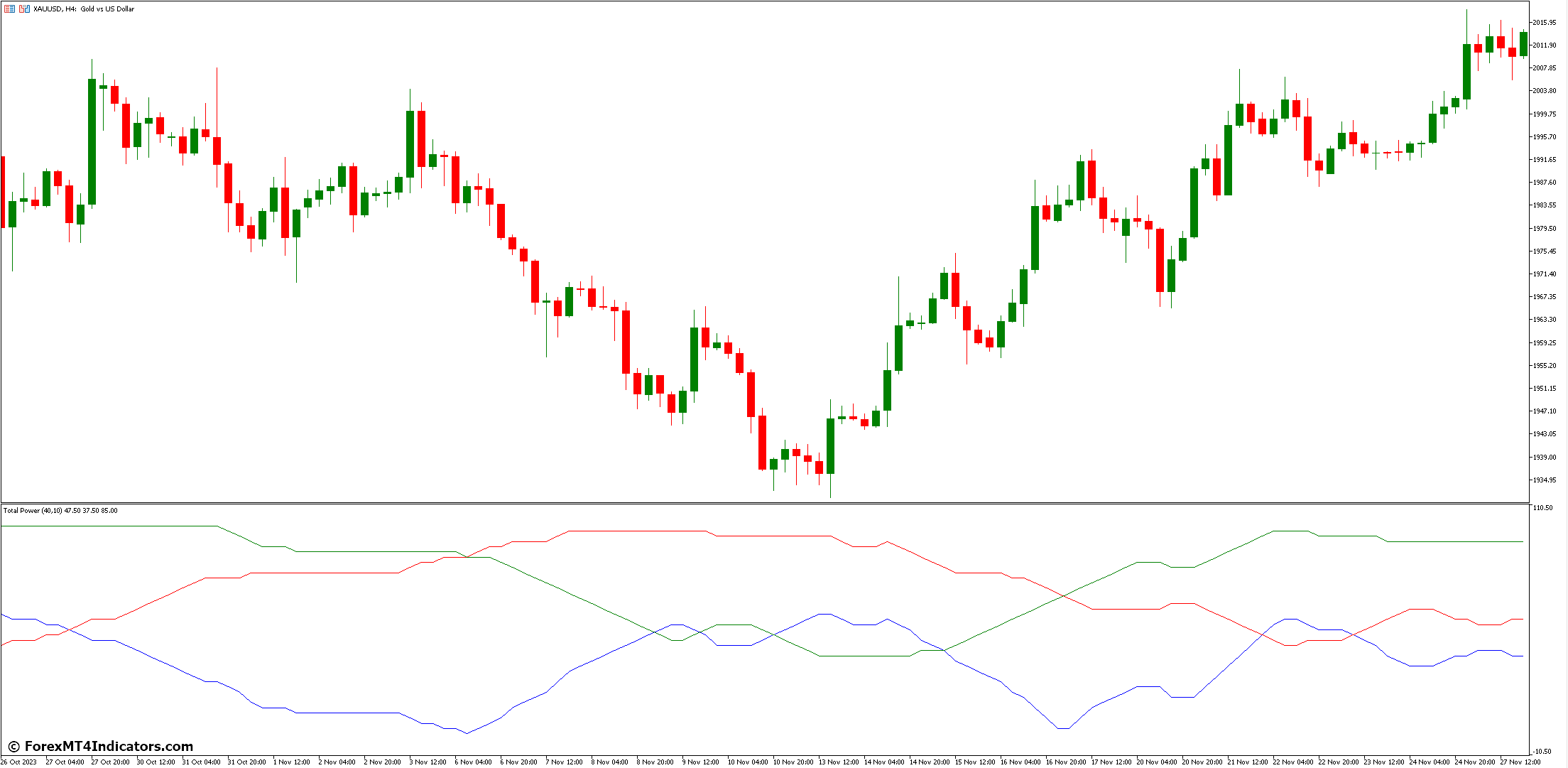

The indicator translates these calculations into three lines:

- Bull Power Line: This line represents the relative strength of buyers within the lookback period.

- Bear Power Line: This line represents the relative strength of sellers within the lookback period.

- Total Power Line: This line reflects the absolute difference between the Bull Power Line and the Bear Power Line, indicating the overall dominance in the market.

Understanding how these lines interact forms the core of interpreting the Total Power MT5 Indicator’s readings. We’ll explore this further in the next section.

Interpreting the Total Power MT5 Indicator Readings

Now that we understand the inner workings of the Total Power MT5 Indicator, let’s learn how to decipher its signals. By analyzing the position and interaction of the three lines, traders can gain valuable insights into market sentiment:

Identifying Bullish and Bearish Dominance

When the Bull Power Line is consistently above the Bear Power Line, it suggests a potential bullish bias in the market. Conversely, a Bear Power Line consistently above the Bull Power Line might indicate a bearish bias.

Analyzing Crossovers of Bull And Bear Lines

When the Bull Power Line crosses above the Bear Power Line, it can be interpreted as a bullish signal, suggesting a potential shift in power towards buyers. Conversely, a crossover of the Bear Power Line above the Bull Power Line can be interpreted as a bearish signal, suggesting a potential shift in power towards sellers.

Utilizing the Total Power Line for Confirmation

The Total Power Line provides additional confirmation for the signals generated by the crossover of the Bull and Bear Power Lines. A rising Total Power Line alongside a bullish crossover strengthens the bullish signal, while a falling Total Power Line alongside a bearish crossover reinforces the bearish signal.

Tailoring it to Your Needs

The beauty of the Total Power MT5 Indicator lies in its customizability. Traders can adjust their parameters to suit their trading styles and preferred timeframes. Here’s a breakdown of the customization options:

Adjusting the Lookback Period

As mentioned earlier, the lookback period determines the historical data used to calculate the indicator’s readings. Experiment with different lookback periods to find one that aligns with your trading style. For instance, day traders might prefer a shorter lookback period to capture recent market sentiment, while swing traders might opt for a longer lookback period for a broader perspective.

Building a Strategy

While the Total Power MT5 Indicator offers valuable insights, it’s crucial to integrate it into a comprehensive trading strategy. Here are some popular strategies that leverage the indicator’s signals:

Reversal Trading with Extreme Readings

When the Bull Power Line or the Bear Power Line reaches extreme highs or lows outside their typical range, it can signal a potential trend reversal. For instance, an exceptionally high Bull Power Line reading might suggest overbought conditions, potentially leading to a price retracement.

Crossover Trading for Entry Signals

As discussed earlier, crossovers between the Bull and Bear Power Lines can indicate potential entry points for trades. Traders can combine these signals with other technical indicators, such as moving averages or support/resistance levels, to confirm the validity of the entry signal before placing a trade.

Confirmation with other Indicators

The Total Power MT5 Indicator is a valuable tool, but it shouldn’t be used in isolation. Combining it with other technical indicators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, can provide a more well-rounded perspective on market sentiment and strengthen the validity of trading signals.

Advanced Techniques with the Total Power MT5 Indicator

For experienced traders seeking to squeeze the most out of the Total Power MT5 Indicator, here are some advanced techniques to consider:

Divergence Between Price and the Indicator

Sometimes, the Total Power MT5 Indicator’s readings might diverge from the price action. For instance, the indicator might show a bullish signal while the price continues to decline. This divergence can be a warning sign of a potential trend reversal, but it should be confirmed with other technical indicators before acting upon it.

Combining with Volume Analysis

Volume analysis plays a crucial role in understanding market sentiment. By incorporating volume data alongside the Total Power MT5 Indicator readings, traders can gain a more comprehensive picture of the power struggle between bulls and bears. For example, a bullish crossover signal on the indicator accompanied by high trading volume strengthens the validity of the bullish signal.

Filtering Trades with Additional Indicators

The Total Power MT5 Indicator can be used as a filter for trading signals generated by other indicators. For instance, a trader might only consider acting on a buy signal from another indicator if it coincides with a bullish crossover on the Total Power MT5 Indicator. This approach helps to reduce the risk of false positives and identify trades with a higher probability of success.

How to Trade with Total Power Indicator

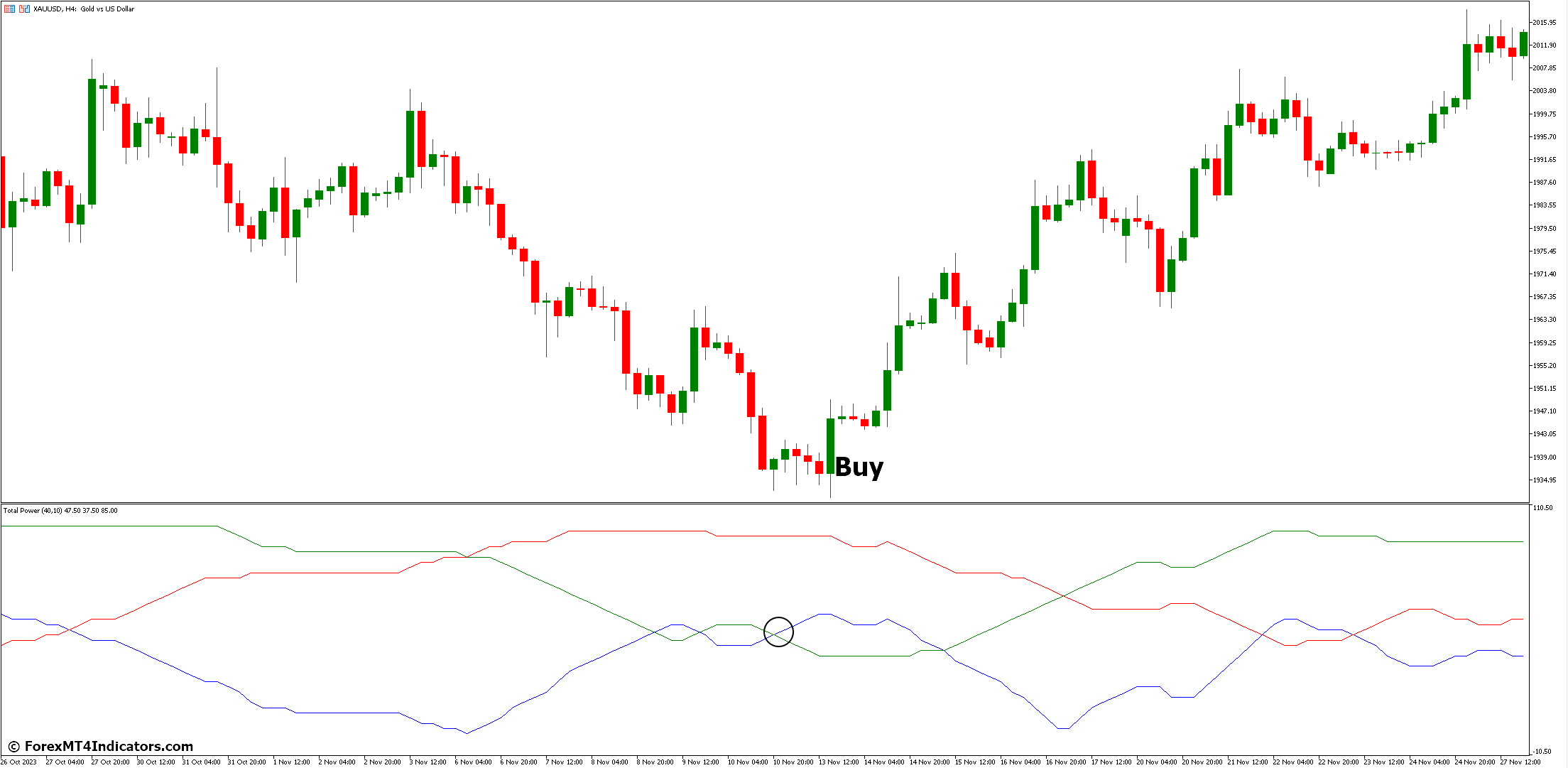

Buy Entry

- Bullish Crossover: Open a long (buy) position when the Bull Power Line crosses above the Bear Power Line. This signals a potential shift in power towards buyers.

- Extreme Low Bear Power: Consider a long (buy) position if the Bear Power Line reaches exceptionally low levels, potentially indicating oversold conditions and a bounce-back.

- Confirmation with Price Action: Look for additional confirmation from price action, such as a break above a key resistance level, to strengthen the buy signal from the Total Power MT5 Indicator.

Stop-Loss

- Place a stop-loss order below the recent swing low before entering a long (buy) position. This limits potential losses if the price reverses unexpectedly.

Take-Profit

- Target a take-profit level based on technical analysis tools such as Fibonacci retracements or support levels. Alternatively, you can exit the trade when the Total Power MT5 Indicator generates a bearish signal, such as a crossover of the Bear Power Line above the Bull Power Line.

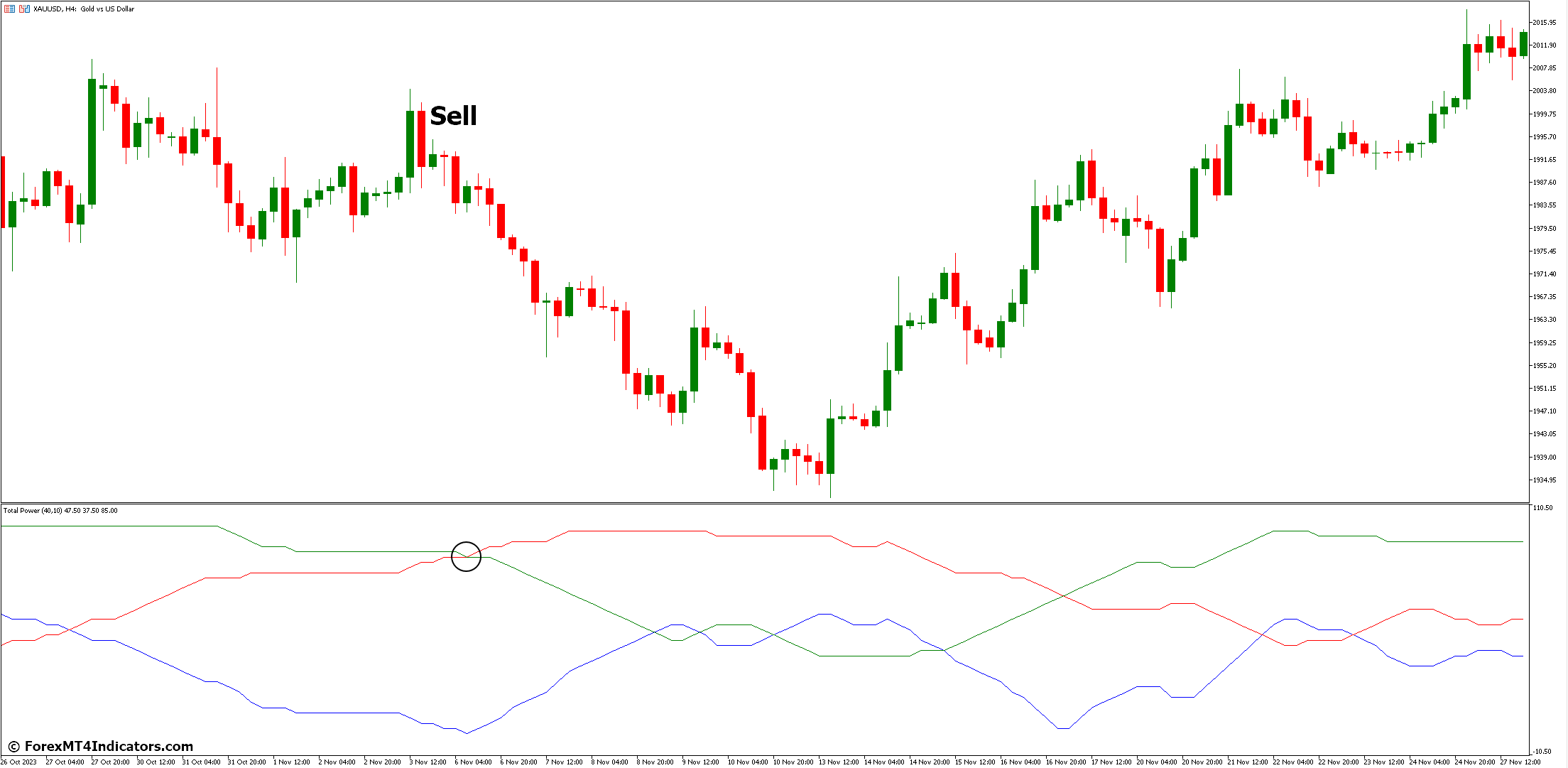

Sell Entry

- Bearish Crossover: Open a short (sell) position when the Bear Power Line crosses above the Bull Power Line. This signals a potential shift in power towards sellers.

- Extreme High Bull Power: Consider a short (sell) position if the Bull Power Line reaches exceptionally high levels, potentially indicating overbought conditions and a price correction.

- Confirmation with Price Action: Look for additional confirmation from price action, such as a break below a key support level, to strengthen the sell signal from the Total Power MT5 Indicator.

Stop-Loss

- Place a stop-loss order above the recent swing high before entering a short (sell) position. This limits potential losses if the price rallies unexpectedly.

Take-Profit

- Target a take-profit level based on technical analysis tools such as Fibonacci retracements or resistance levels. Alternatively, you can exit the trade when the Total Power MT5 Indicator generates a bullish signal, such as a crossover of the Bull Power Line above the Bear Power Line.

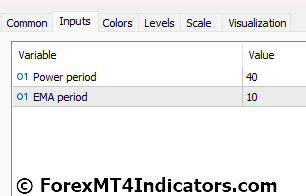

Total Power Indicator Settings

Conclusion

Total Power MT5 Indicator can be a valuable asset for traders seeking to gauge market sentiment and identify potential trading opportunities. By understanding its calculations, interpreting its readings effectively, and integrating it into a robust trading strategy, you can enhance your ability to make informed trading decisions.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: