Swing highs and swing lows are key areas where market reactions may occur. It could either be a reversal or a strong momentum breakout. This is because swing highs and swing lows can also be considered as support and resistance zones.

The strategy discussed below shows a method in which traders can trade the second assumption around a swing high or swing low level, which is a momentum breakout.

Swing Highs and Swing Lows as Breakout Zones

Although price may seem to move in an unstructured manner, technical traders who observe price action closely would notice that the market oscillates across the price chart in a series of runs formed by short-term momentum. These short-term runs do not last long and would often reverse quickly. This kind of characteristic by the market forms the market swings. A bullish swing followed by a quick reversal to the downside would form a swing high. Inversely, a bearish swing followed by a reversal to the upside would form a swing low.

Swing highs and swing lows may be considered as support and resistance areas because these are areas where price had quickly reversed from in the past. It is a logical assumption that there are still many major market players who are willing to take a trade in that area. There might be pending orders that are left unfilled around that area, which might cause price to reverse once price would revisit the area.

On the flip side, the same swing highs and swing lows that are considered as support and resistance areas may also be levels where strong momentum breakouts may occur. This is because the same traders who opened their trades at the level of the price swing would also usually have stop losses on the area a little beyond the swing high or swing low. These stop losses are also pending orders that are unfilled. If institutional traders would decide that they would want to break through the swing highs or lows, these stop losses are areas of liquidity which if filled, could also fuel the strong momentum breakout. Either way, major swing highs and swing lows are areas where there could be so much trading opportunity for traders who knows how to follow the market.

TASSKIT Indicator

The TASSKIT Indicator is a momentum technical indicator which is based on the Average Directional Movement Index (ADX) indicator and the Average True Range (ATR) indicator.

Individually, these two indicators can be excellent tools for identifying trend direction. The ADX was developed for the purpose of identifying trending markets, as well as trend direction. The ATR on the other hand can also be used to identify trend direction by using a multiple of the ATR as a threshold in which the current trend would be invalidated if price would move beyond the threshold. The TASSKIT Indicator combines these two indicators and incorporates them within its program.

Using the confluence of the two underlying indicators, the TASSKIT Indicator identifies and indicates trend direction by plotting arrows on the price chart. It plots a lime arrow pointing up whenever it detects a bullish momentum, and a magenta arrow pointing down whenever it detects a bearish momentum. It also shades the color of the candle where it detects a strong momentum. It shades the candle green to indicate a bullish momentum, and magenta to indicate a bearish momentum. Aside from this, the indicator also plots a line on key areas which can be used as levels of support or resistance, or as levels where stop losses may be trailed on.

Trading Strategy Concept

TASSKIT Momentum Breakout Signal Forex Trading Strategy for MT5 is a momentum breakout strategy which uses the TASSKIT Indicator as a momentum confirmation tool.

Traders would first have to identify the major swing highs or swing lows which price can breakout out of as it starts to reverse in the opposite trend direction. We are taking the assumption that price may break through the levels. As such, we should observe if there is a strong momentum that is starting to break through the identified swing high or swing low.

The TASSKIT arrows are then used as a confirmation of the momentum breakout. These momentum breakout signals should be in confluence with a momentum candle closing beyond the swing high or swing low level.

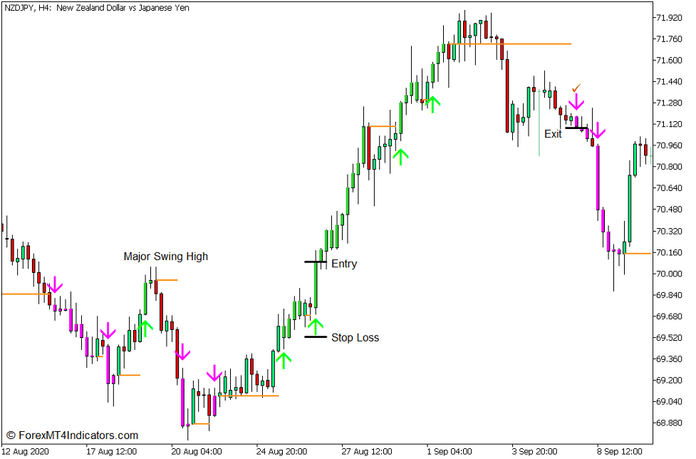

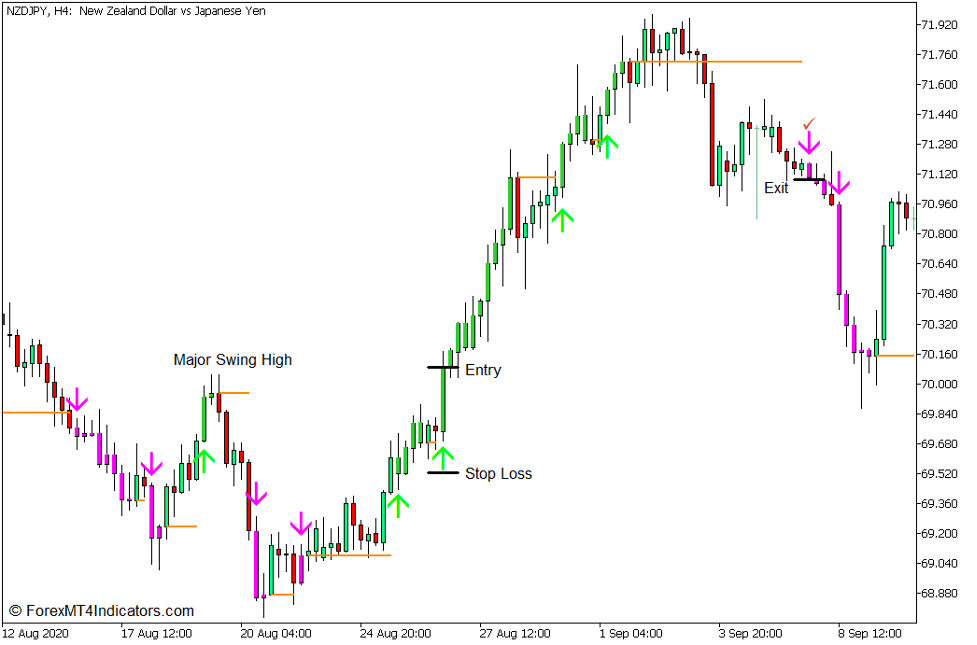

Buy Trade Setup

Entry

- Identify a major swing high level.

- Wait for a strong bullish momentum breakout that would close above the major swing high.

- Open a buy order if the momentum breakout candle is in confluence with a bullish signal coming from the TASSKIT Indicator, which is a lime arrow pointing up.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the TASSKIT Indicator plots a magenta arrow pointing down.

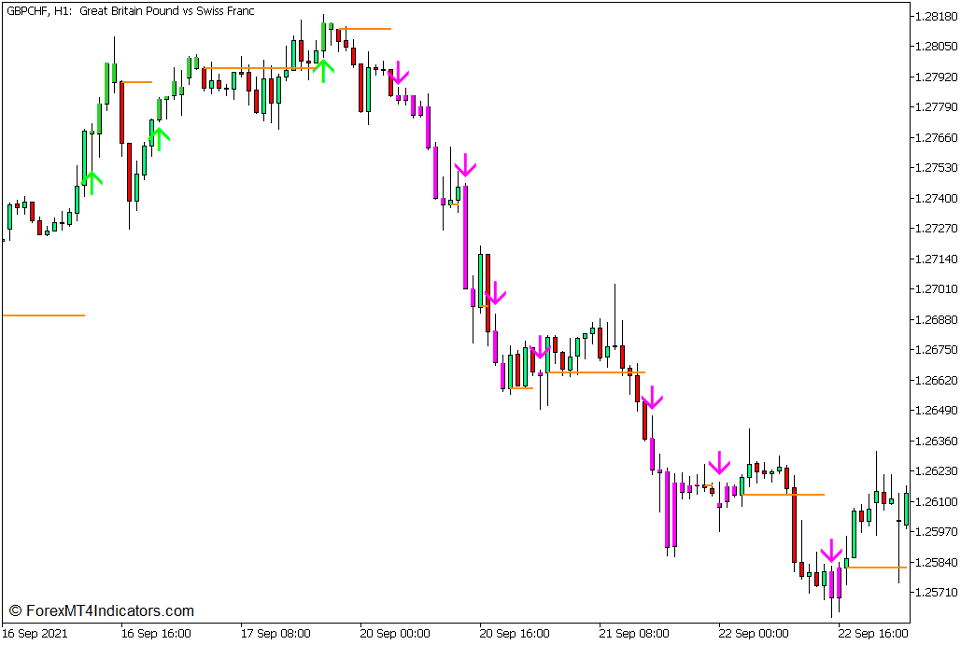

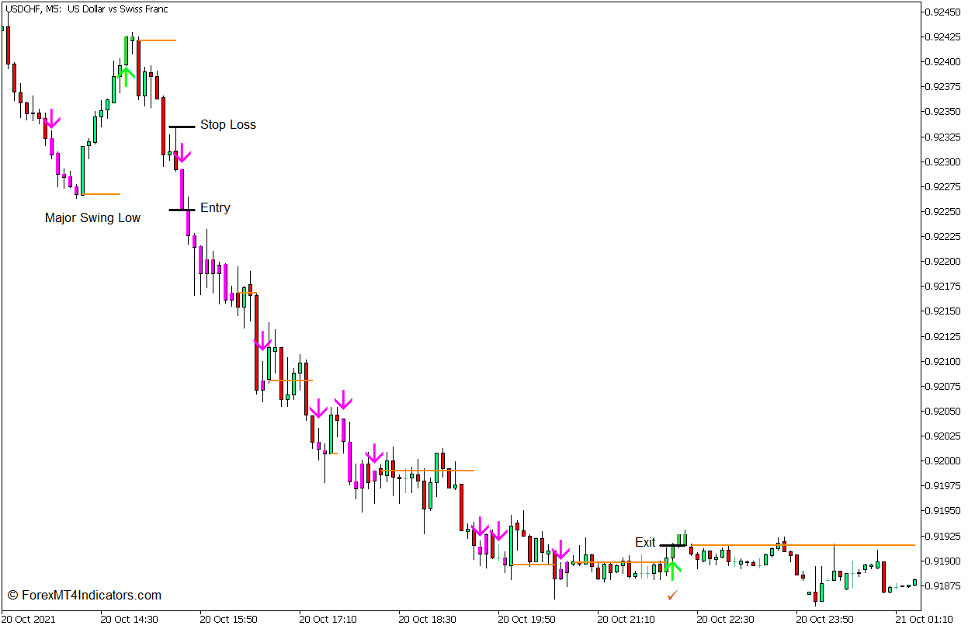

Sell Trade Setup

Entry

- Identify a major swing low level.

- Wait for a strong bearish momentum breakdown that would close below the major swing low.

- Open a sell order if the momentum breakout candle is in confluence with a bearish signal coming from the TASSKIT Indicator, which is a magenta arrow pointing down.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the TASSKIT Indicator plots a lime arrow pointing up.

Conclusion

Momentum Breakout strategies are a staple trading strategy for many traders. It is a trading strategy which assumes that the market will continue its strong momentum if it breaks through a major support or resistance level.

There are many ways to trade momentum breakouts. Some would trade on the pullback which occurs right after the breakout. While this is a logical approach to trading momentum breakouts, there are cases wherein price would not pullback, but instead would continue in the direction of the momentum without giving some traders an opportunity to enter on a pullback price. The strategy discussed here avoids that scenario because it uses the momentum breakout itself as the trade signal.

This strategy is also a simplified momentum breakout strategy because it uses the TASSKIT Indicator as the momentum breakout confirmation, which removes the subjectivity of the trade decision.

Traders may use this strategy to trade momentum breakouts. However, there are also other momentum breakout concepts that traders can use and incorporate with this strategy for better results.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: