Nowadays, trading seems to be divided into two camps, those who trade on indicators and those who trade on price action or candlestick patterns. Both sides believe that their method is the best. Some even believe that their method is the only way to trade the markets profitably.

On one end, we have the traders who use technical indicators. These traders believe that trading with technical indicators provide clarity which is very elusive for many traders. It allows them to see things which they would not have seen if they were trading on a naked chart. It also adds to it the benefit of providing objective mathematical based criteria for taking a trade. This allows traders to filter out trades that do not pass the standards set by a trader. It removes subjective decision making which is susceptible to greed and fear. It also allows traders to trade algorithmically, taking trades only if a set of criteria have been met using technical indicators.

On the other end of the spectrum are naked chart traders. These traders believe that technical indicators are lagging and therefore produce worse results than a naked chart. They believe that everything could be observed on a naked chart and price is all you need in order to take a trade. These traders trade on candlestick patterns, price action, swing high and swing low patterns, support and resistances and the like.

Although many traders are trading based on either method, there are also ways to combine both methods. Traders could trade based on price action and technical indicators. Precision Triangulated Crossover Forex Trading Strategy provides trade signals based on a confluence of technical indicator signals and price action.

Awesome Oscillator

The Awesome Oscillator (AO) is a trend-following technical indicator. It is an oscillating indicator used to measure market momentum.

It measures market momentum by computing for the difference between two moving averages. The standard moving averages used by the Awesome Oscillator is a 5-period Simple Moving Average (SMA) and a 34-period Simple Moving Average (SMA).

It displays the difference as histograms bars. Positive bars indicate a bullish trend while negative bars indicate a bearish trend. Positive green bars indicate a strengthening bullish trend, while positive red bars indicate a weakening bullish trend. On the other hand, negative red bars indicate a strengthening bearish trend, while negative red bars indicate a weakening bearish trend.

The Awesome Oscillator is generally used to confirm trend direction or anticipate possible trend reversals. Trades could be filtered based on trend direction by identifying whether the bars are positive or negative. Possible trend reversals could be identified by the crossing over of the bars from negative to positive or vice versa.

Triangulated Moving Average

The Triangulated Moving Average (TMA) is a modified version of a moving average. Like most moving averages, it also indicates trend direction by identifying the average of price over a specified number of data points. However, it is quite unique compared to most moving averages because it is significantly smoother compared to other versions of the moving average.

TMA was developed in order to create a smoother moving average line. It does this by averaging out price twice. While the regular Simple Moving Average (SMA) is a simple average of the close of price for a certain number of periods, TMA averages out the several Simple Moving Averages in order to smoothen out the moving average line further. This creates a moving average line that is very smooth, which could be less susceptible to market spikes and volatility yet could also be lagging.

Trading Strategy

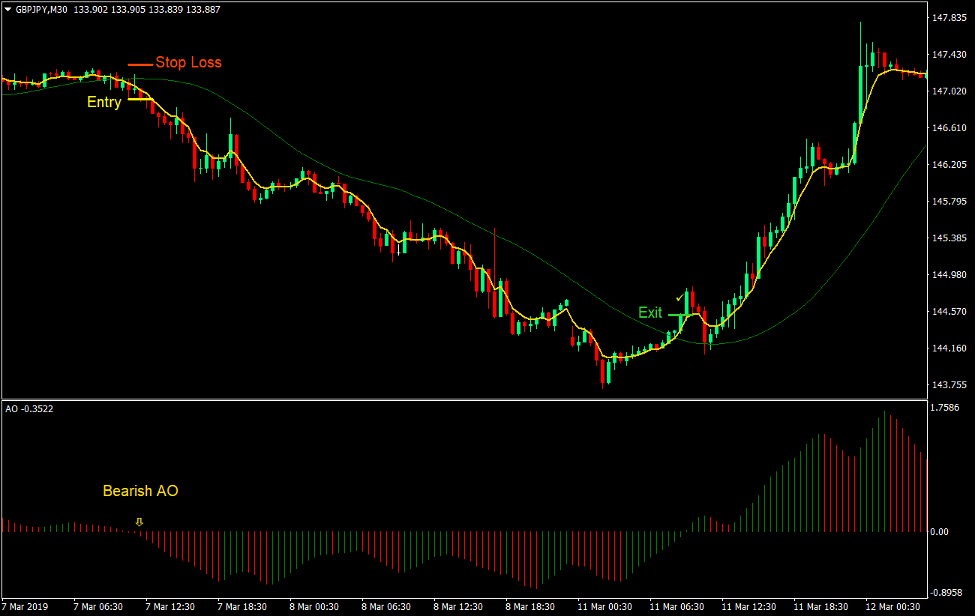

This trading strategy is a simple trading strategy which provides trade signals based on the crossover of an Exponential Moving Average (EMA) line and a TMA line, which is in confluence with a trend reversal signal from an Awesome Oscillator and is confirmed by price action.

First, the EMA line (gold) should cross over the TMA line (green). This would indicate a probable trend reversal.

Next, the Awesome Oscillator should confirm the trend reversal. This is based on the crossing over of its bars from negative to positive or vice versa.

Lastly, price action should confirm the trend reversal. Upon the crossing over of the two moving average lines, the price candles on the crossover should have wicks pushing against the TMA line. This would signify that price retrace towards the TMA line only to reject it right after. Then, a momentum or engulfing candle should appear confirming the trend reversal.

Indicators:

- TMA

- Periods: 30

- EMA (Gold)

- Periods: 5

- Awesome (default settings)

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

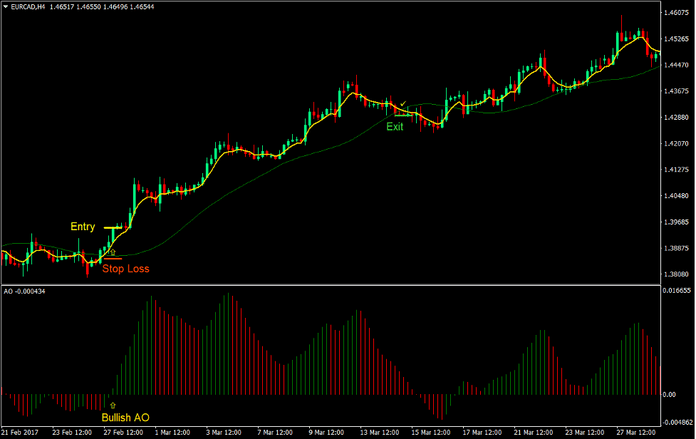

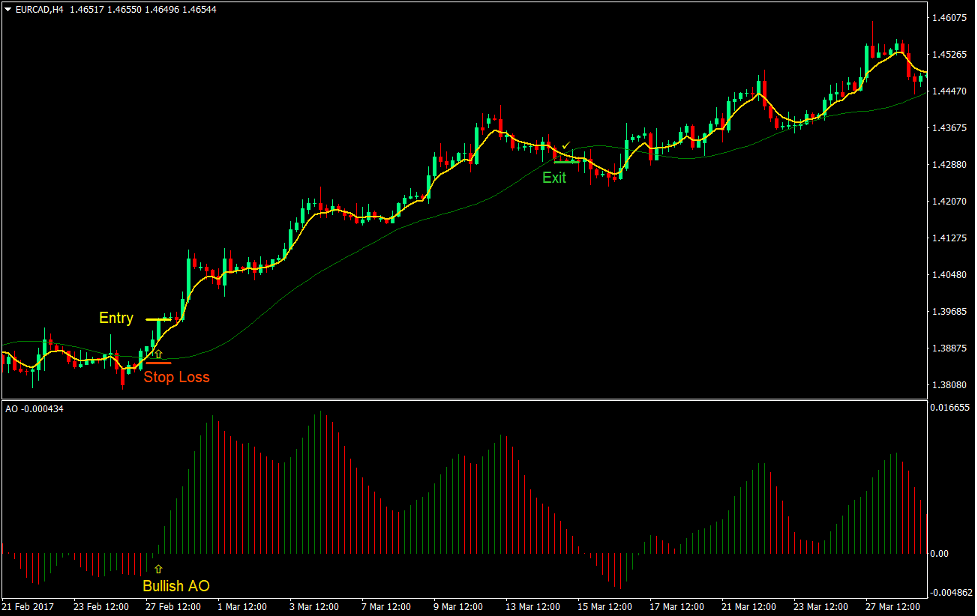

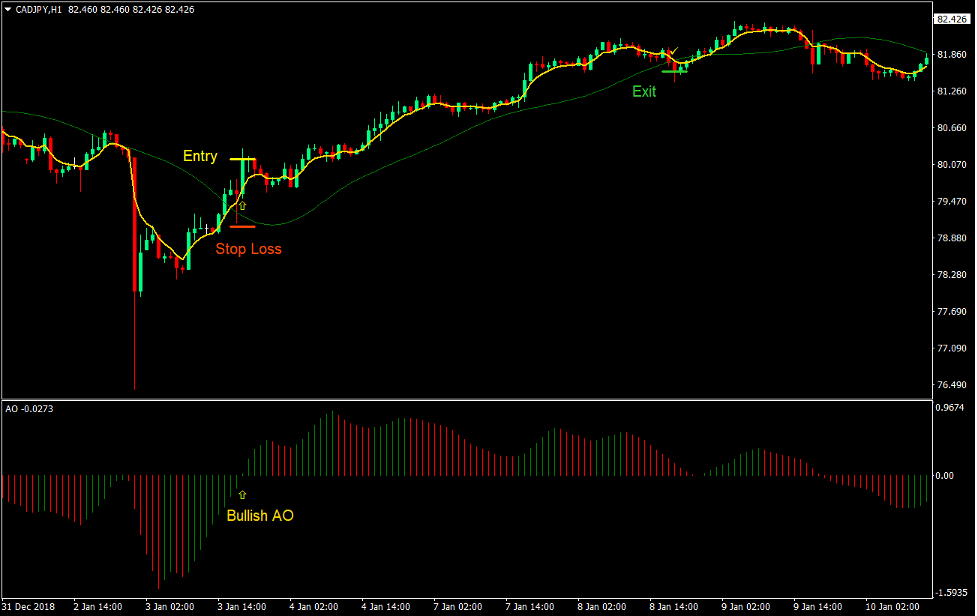

Buy Trade Setup

Entry

- The EMA line (gold) should cross above the TMA line (green).

- The Awesome Oscillator bars should cross above zero.

- Price action should show signs of rejection towards the TMA line.

- A bullish momentum or engulfing should occur.

- Enter a buy order upon the confirmation of the conditions above.

Stop Loss

- Set the stop loss below the TMA line.

Exit

- Close the trade as soon as the EMA line crosses below the TMA line.

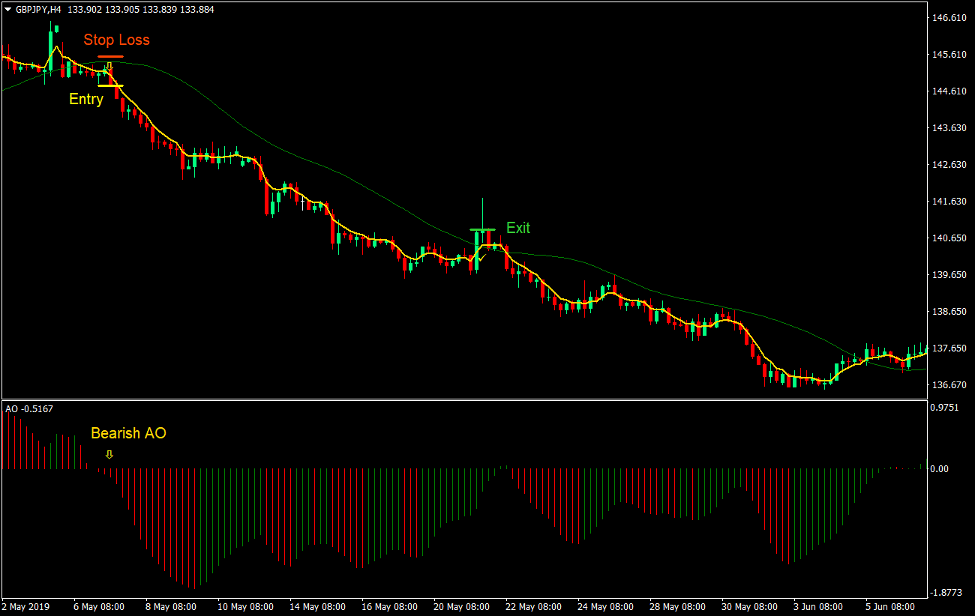

Sell Trade Setup

Entry

- The EMA line (gold) should cross below the TMA line (green).

- The Awesome Oscillator bars should cross below zero.

- Price action should show signs of rejection towards the TMA line.

- A bearish momentum or engulfing should occur.

- Enter a sell order upon the confirmation of the conditions above.

Stop Loss

- Set the stop loss above the TMA line.

Exit

- Close the trade as soon as the EMA line crosses above the TMA line.

Conclusion

Crossover strategies, when used as a standalone signal could be a hit or miss. At times it would produce good returns on an entry setup. On some instances, it would reverse instantly after a crossover. This is why crossover strategies should be confirmed with confluences coming from other indicators. This is where the Awesome Oscillator comes in.

On top of this, we are also looking for confirmations based on price action. Retest and rejection are the basic price action indications that many traders look for when entering a trade.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: