Few indicators could claim being a complete trading strategy by itself. Most would need another indicator to filter out bad trades, identify trends or provide a specific entry trigger.

The Ichimoku Kinko Hyo indicator, however, is one of those few indicators that could claim being a complete strategy using a standalone indicator. This is because it has all the elements needed for a complete trading strategy. It identifies the long-term trend and the mid-term trend using several modified moving average lines which are very effective and reliable. This allows traders to align the long-term trend with the mid-term trend. Using the same lines to identify the mid-term and short-term trend, the indicator also provides a specific entry signal which traders could use as their basis to enter or exit a trade. Finally, it also has another line which could help traders identify choppy market conditions based on price action, which would nullify trade setups that transpire during a bad market condition.

The Ichimoku Kinko Hyo indicator is composed of five lines, the Kijun Sen (Base Line), Tenkan Sen (Turning Line), Chikou Span (Lagging Line), Senkou Span A and Senkou Span B forming the Kumo (Cloud).

First, the Kijun Sen or the Base Line. It is simply the median of the highest high and the lowest low for the past 26 periods. This line represents the short- to mid-term trend.

The Tenkan Sen or the Turning Line is the line paired with the Kijun Sen. It is the median of the past nine periods and represents the short-term trend.

Trade signals are typically generated whenever the two lines intersect. However, trades are filtered based on the long-term trend and whether the market is choppy or not.

The Chikou Span or the Lagging Line is the line used to identify choppy markets. It is simply the closing price of each candle plotted 26 periods behind the current price action. During choppy markets, this line would typically be moving erratically and would often intersect with the current price action and the other lines.

Senkou Span A is simply the average of the Tenkan Sen and the Kijun Sen plotted 26 periods ahead of the current price action. Senkou Span B on the other hand is computed by averaging the highest high and the lowest low for the past 52 periods and plotted 26 periods ahead of the current price action. The long-term trend is based on how these two lines are stacked. If Senkous Span A is above Senkou Span B, then the market is said to be in an uptrend. If the lines are stacked inversely, then the market is said to be in a downtrend.

Ichimoku Kinko Hyo Trading Strategy

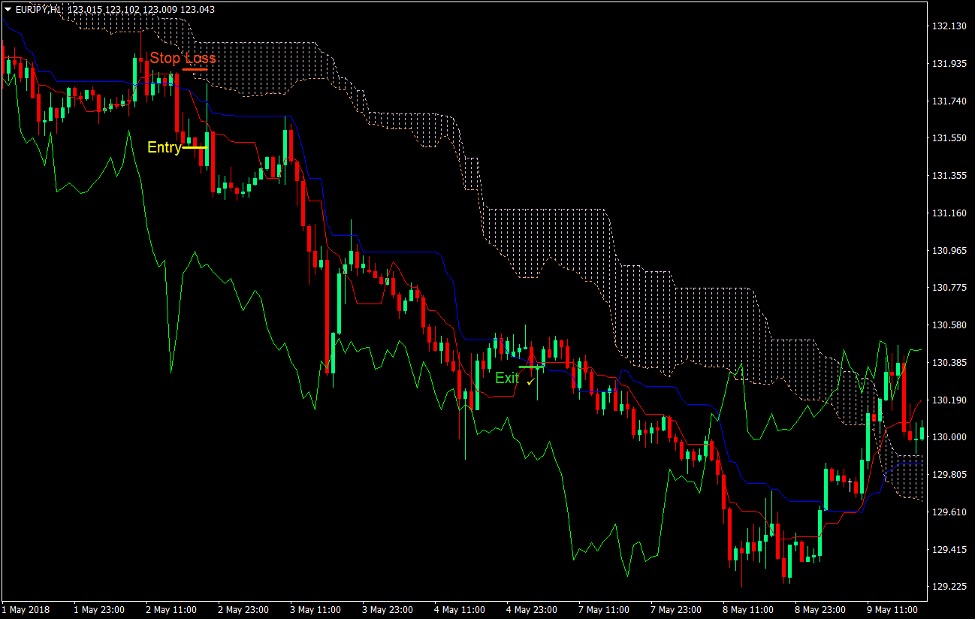

This trading strategy is one of the ways traders use the Ichimoku Kinko Hyo indicator to identify trade setups. It is mainly centered around aligning the long-term trend direction indicated by the Senkou Span A and B, and the crossover signals of the Kijun Sen and Tenkan Sen line.

Trades will be filtered based on the long-term trend. This will be based on how the Senkou Span A and B (dotted lines) are stacked as discussed above.

During the expansion phase of a trend, the Kijun Sen (blue line) and Tenkan Sen (red line) will be stacked in a way which is in line with the long-term trend. However, during retracements, the two lines will temporarily reverse.

Traders should also check if the Chikou Span (lime line) is crossing over the other lines or is aggressively crossing price action as this indicates a choppy market condition. If so, then trading should be avoided.

Indicators: Ichimoku (default setting)

Preferred Time Frames: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

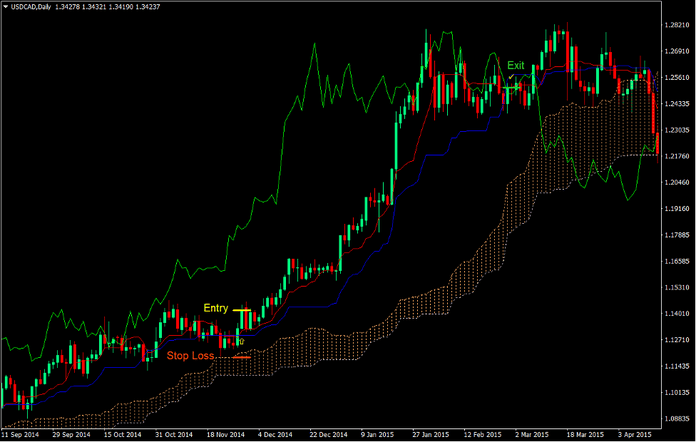

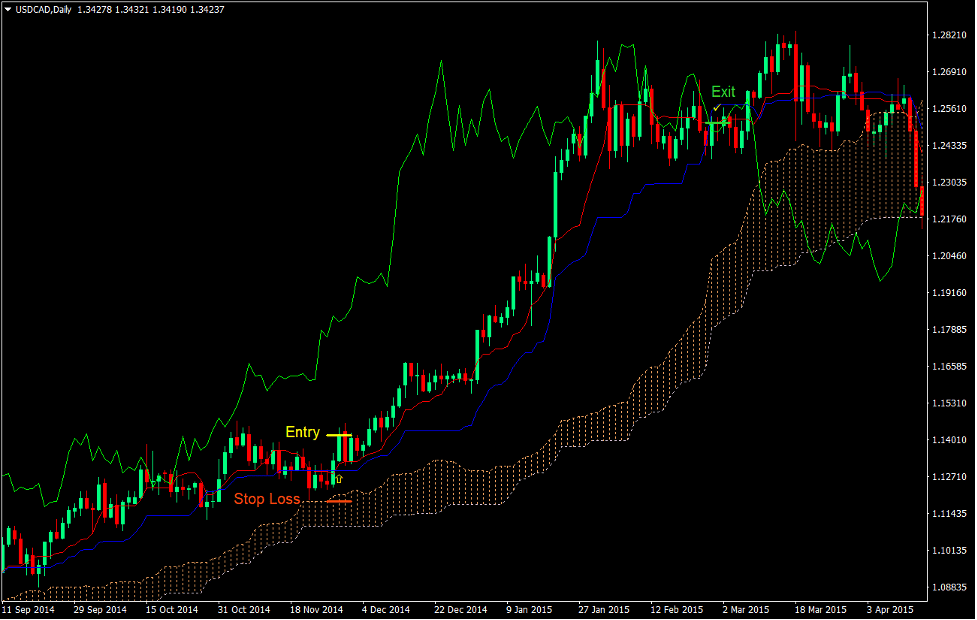

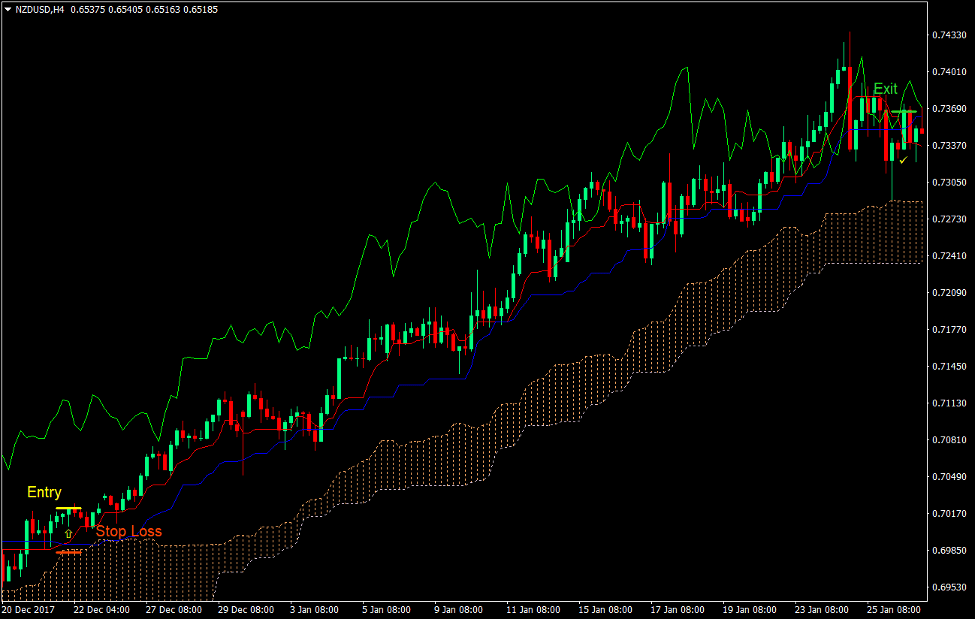

Buy Trade Setup

Entry

- Senkou Span A should be above Senkou Span B.

- Price should retrace causing the Kijun Sen (blue line) and the Tenkan Sen (red line) to temporarily reverse.

- The Tenkan Sen line should cross above the Kijun Sen line.

- The Chikou Span (lime line) should not cross the other lines.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Tenkan Sen line crosses below the Kijun Sen line.

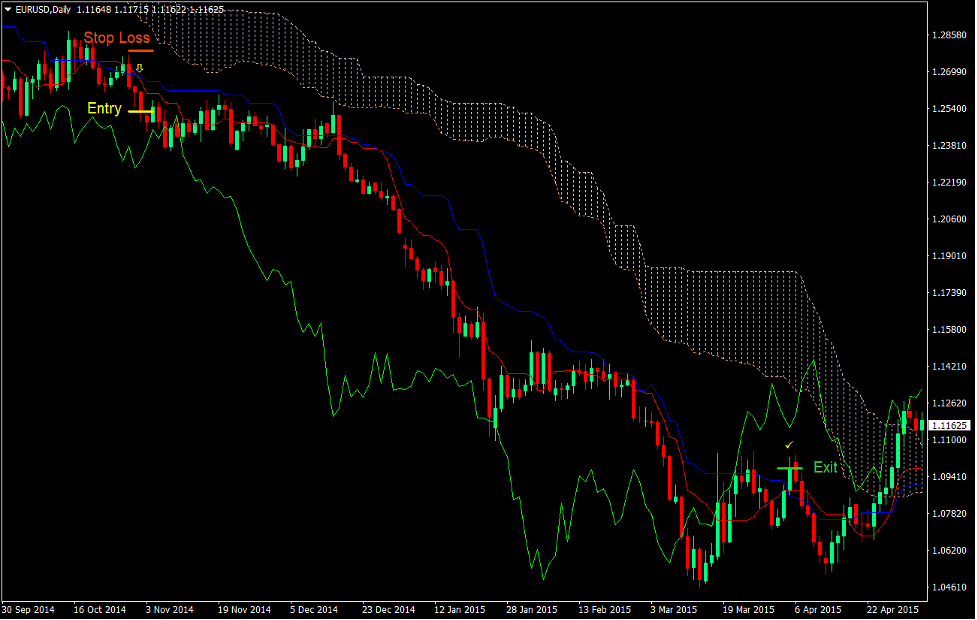

Sell Trade Setup

Entry

- Senkou Span A should be below Senkou Span B.

- Price should retrace causing the Kijun Sen (blue line) and the Tenkan Sen (red line) to temporarily reverse.

- The Tenkan Sen line should cross below the Kijun Sen line.

- The Chikou Span (lime line) should not cross the other lines.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Tenkan Sen line crosses above the Kijun Sen line.

Conclusion

Many new traders avoid the Ichimoku Kinko Hyo indicator when the first see it because of the many lines that are presented to them. It often gives an impression that using this indicator is very difficult and could be very confusing.

Although it could take time for new traders to get used to it, the Ichimoku Kinko Hyo is one of the very few indicators that have been proven to be profitable based on a long-term back test.

Traders who use this indicator as the focal point of their strategy and even those who use it as their only indicator consistently make profits over the long run.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: