There are many ways to trade the forex market. Different sets of eyes see the forex chart differently. Different traders have different takes and outlooks as they look at a forex chart. Some traders prefer to trade supply and demand, so they see charts based on supply and demand zones. Other traders trade based on market flow, and that is what they see. Others prefer to use moving averages and it makes sense to them. Because of these differences in perspectives, many different types of trading strategies were developed.

Although most traders see a forex chart differently, there is one type of chart that many traders could easily identify no matter their trading preference. Trending markets are probably one of the easiest types of market to identify. Traders could tell if a market is trending up if price started from the lower left portion of their screen and ended on the upper right portion. If price started from the upper left portion and ended on the lower right portion, then that would easily be a downtrend. Because of this, trend following strategies are probably one of the easiest types of strategies to trade.

Daybreak Trend Forex Trading Strategy is a trend following strategy that systematically helps traders identify a trending market and rule out non-trending or weak trending markets. It also provides precise entries based on confluences and exits that are not too lagging.

Ichimoku Kinko Hyo

Few indicators could claim that it could provide a complete strategy as a standalone indicator. The Ichimoku Kinko Hyo is one of these. This is precisely why it is called “Ichimoku”. In Japanese, “ichimoku” means “one look”. Traders who are used to the Ichimoku Kinko Hyo indicator could easily spot trading opportunities with one look of a chart.

The Ichimoku Kinko Hyo indicator is a trend following indicator which incorporates the long-term, mid-term and short-term trends. On top of this, it also plots a trailing line that represents price action.

Ichimoku is composed of five lines called the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B and Chikou Span.

Tenkan-sen, also called the Conversion Line, is computed by adding the highest high and lowest low of price over the past nine periods and dividing it by two. This represents the short-term trend.

The Kikun-sen or Base Line, is computed the same way only that instead of looking at the past 9 periods it bases its computation on the last 26 periods. This line represents the mid-term trend.

Senkou Span A or Leading Span A is computed by adding the Tenkan-sen and Kijun-sen and dividing the result by two. The result is then plotted 26 periods ahead.

Senkou Span B or Leading Span B is computed by adding the highest high and lowest low of the last 52 periods and dividing the result by two. The result is also plotted 26 periods ahead.

Both the Senkou Span A and Senkou Span B make up the Kumo or Cloud, and represent the long-term trend.

Chikou Span, or Lagging Span, is the current period’s closing price plotted 26 periods back.

These lines represent the full spectrum of a trend. Traders could easily identify a trending market based on whether the direction of these lines are aligned and are pointing in the same direction. Traders could then look for opportunities whenever there is a clear trending market.

Awesome Oscillator

The Awesome Oscillator (AO) was developed to help traders identify trend and momentum strength.

The AO is a simple oscillating indicator based on moving average crossovers. It basically computes for the difference between a 5 bar Simple Moving Average (SMA) and a 34 bar Simple Moving Average (SMA). However, instead of using the closing price of each bar, it uses the midpoints of each bar. The results are then plotted as histogram bars.

Positive green bars indicate a strengthening bullish trend bias, while negative green bars indicate a weakening bullish trend bias. On the other hand, negative red bars indicate a strengthening bearish bias, while negative green bars indicate a weakening bearish bias.

Traders could use this information to identify trend biases and filter out trades that are not aligned with the trend or take trade signals based on trend bias reversals. Trade entries could be based on the shifting of the bars from positive to negative or vice versa.

Trading Strategy

This trading strategy is a trend following strategy that trades on retracements based on the confluence of the Ichimoku Kinko Hyo indicator and the Awesome Oscillator.

Traders first have to identify trending markets based on how the lines of the Ichimoku are aligned. First, the Kumo should indicate the long-term trend. Then both the Tenkan-sen and Kijun-sen should also trend while being on the correct side of the Kumo based on the trend.

On the Awesome Oscillator, the histogram bars should also align with the trend of the Ichimoku indicator.

Price action should also show a clear trending market. Non-trending markets also tend to have a chart that looks too messy to trade.

Then, we wait for retracements. Retracements should cause the Tenkan-sen and Kijun-sen to temporarily reverse. The AO should also temporarily reverse along with the two lines. Trades are taken as soon as the short-term and mid-term trend resumes the direction of the long-term trend.

Indicators:

- Ichimoku Kinko Hyo

- Awesome

Preferred Time Frames: 15-minute, 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

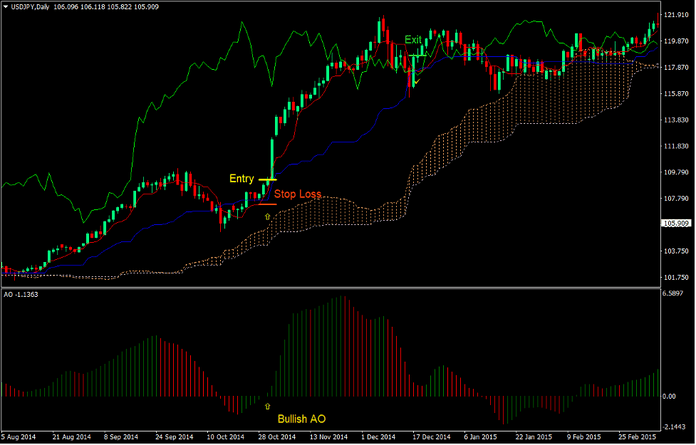

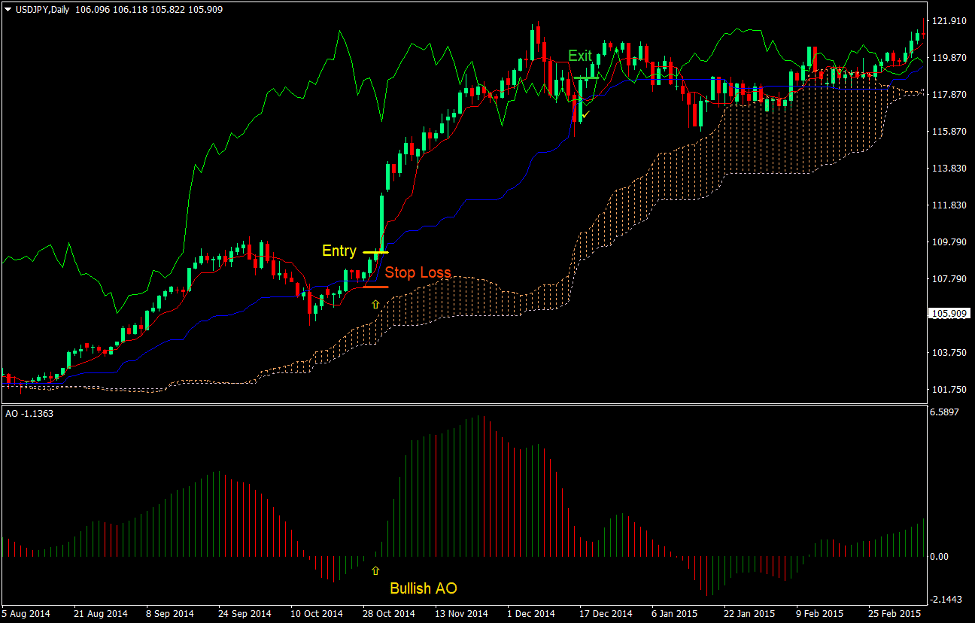

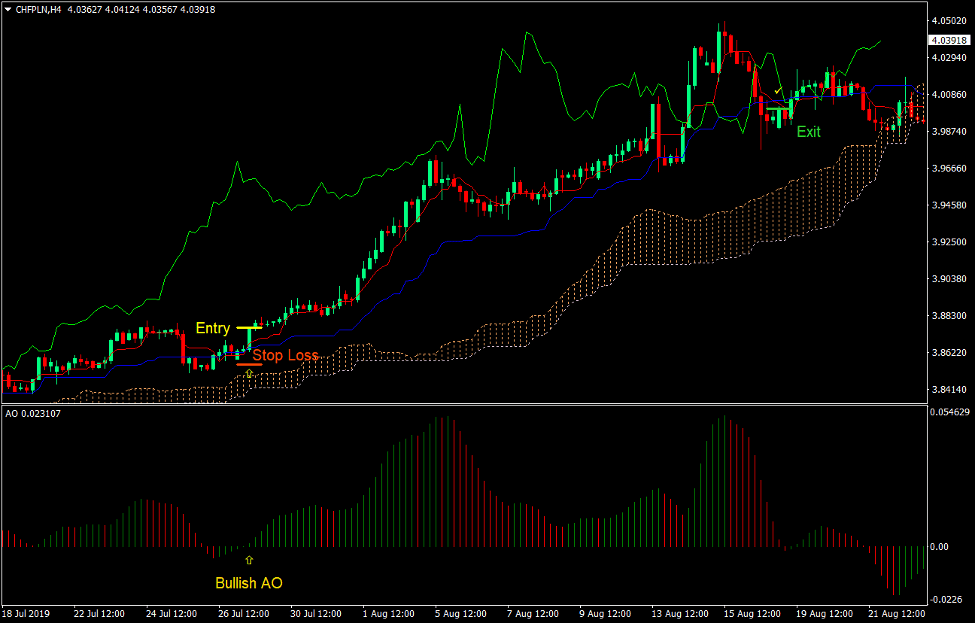

Buy Trade Setup

Entry

- Senkou Span A should be above Senkou Span B.

- The Tenkan-sen line should be above the Kijun-sen line.

- Both the Tenkan-sen and Kijun-sen lines should be above the Kumo.

- The Awesome Oscillator bars should be positive.

- The Tenkan-sen and Kijun-sen lines should temporarily reverse.

- The Awesome Oscillator bars should temporarily be negative.

- Enter a buy order as soon as the Tenkan-sen crosses above the Kijun-sen and the AO bars shift to positive.

Stop Loss

- Set the stop loss on the fractal below the entry candle.

Exit

- Close the trade as soon as the Tenkan-sen line crosses below the Kijun-sen.

- Close the trade as soon as the AO bars shift to negative.

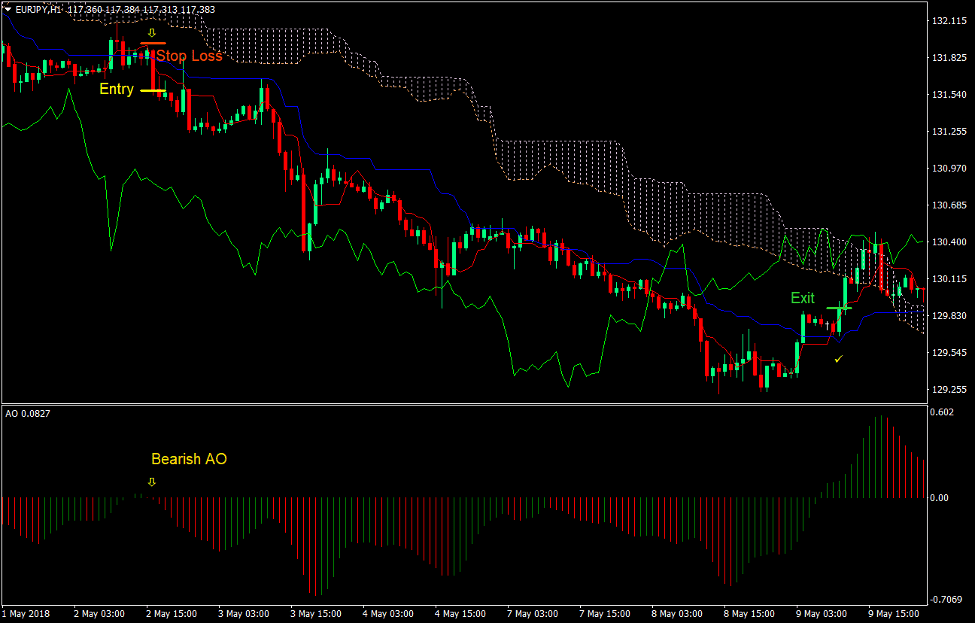

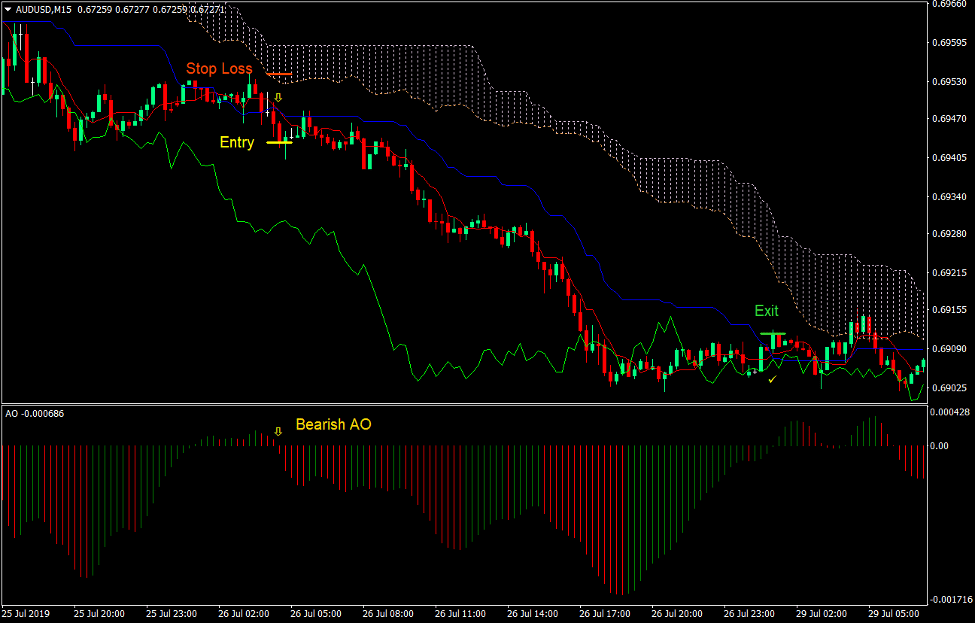

Sell Trade Setup

Entry

- Senkou Span A should be below Senkou Span B.

- The Tenkan-sen line should be below the Kijun-sen line.

- Both the Tenkan-sen and Kijun-sen lines should be below the Kumo.

- The Awesome Oscillator bars should be negative.

- The Tenkan-sen and Kijun-sen lines should temporarily reverse.

- The Awesome Oscillator bars should temporarily be positive.

- Enter a sell order as soon as the Tenkan-sen crosses below the Kijun-sen and the AO bars shift to negative.

Stop Loss

- Set the stop loss on the fractal above the entry candle.

Exit

- Close the trade as soon as the Tenkan-sen line crosses above the Kijun-sen.

- Close the trade as soon as the AO bars shift to positive.

Conclusion

The Ichimoku Kinko Hyo strategy is a working trading strategy that has proven to be very effective over the long run. It is probably one of the few indicators that could claim this.

This strategy simply refines it by adding the confirmation of the AO, which is also a very reliable technical indicator used by many profitable retail traders.

Combining these two complementary indicators provide a robust strategy that could produce consistent profits if used correctly.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: