Trading does not really need to be overly complicated. Sometimes it is the simple stuff that works. Many professional profitable traders can trade the market without worrying too much or taking so much time analyzing where the market is moving. In fact, there are many professional traders who use simple techniques and strategies that work and can be done repeatedly.

One of the most popular ways to trade the forex market is by trading crossovers of moving averages. Moving average crossover strategies are simple and systematic. Even newbie traders can easily follow the rules behind a crossover strategy and make some profits.

Moving average crossovers assume that a trend is reversing because the average price of a certain forex pair is also reversing. This can be observed by plotting two moving average lines on the price chart. If you would observe trend reversal setups, you would also notice that at a certain point the moving averages did crossover on that area.

Not all moving average setups work. In fact, there is still a high chance that price could reverse for a loss if a trade is held on to until the moving average lines signal another reversal. Traders can either combine crossover strategies with other trading signals or with price action in order to increase their win rate, or traders can also anticipate the reversal of a trend against their current position instead of waiting for the moving average lines to crossover against their trade.

Custom Moving Average Cross Forex Trading Strategy is a simple crossover strategy which makes use of two custom moving average lines. It also makes use of confluences from other indicators in order to confirm a trend.

Jurik Moving Average

Jurik Moving Average (JMA) is a custom moving average line that was developed with the aim of decreasing lag.

Moving averages are useful trading technical indicators. Many traders use it to identify trends and spot trend reversals. However, most moving average lines suffer the same disadvantage. Most moving average lines are lagging. Moving average lines tend to respond slowly whenever price creates drastic significant moves such as gaps and momentum candles.

Compared to most moving average lines, JMA tends to be very responsive. It follows price movements closely even when there are huge momentum or gapping moves. This makes the JMA line an excellent trend reversal signal whenever traders need to respond to quick momentum changes.

Kaufman Adaptive Moving Average

Kaufman Adaptive Moving Average (KAMA) is another custom moving average line which was developed in order to improve on the classic moving average lines.

Moving average lines have two common disadvantages, lag and susceptibility to market noise. KAMA on the other hand follows price action quite closely when the market is showing clear directions and there is low noise. However, whenever the market starts to become choppy, KAMA smoothens out the noise whenever price is fluctuating. This creates a moving average line that is less susceptible to noise yet is also very responsive to price movements.

KAMA can be used to identify trend direction and trend reversals, much like most moving average lines. This can be based on crossovers of price action and the KAMA line or other moving average line. It can also be used as a dynamic support or resistance line.

Relative Strength Index

Relative Strength Index (RSI) is a classic technical indicator which provides a variety of information for traders. It can be used to identify trend direction, momentum and mean reversals.

The RSI is an oscillator type of indicator. It plots a line that oscillates within the range of 0 to 100. It also typically has markers on level 30, 50 and 70.

Trend direction is usually based on the location of the RSI line in relation to its midline. If the line is above 50, then the trend bias is bullish. If the line is below 50, then the trend bias is bearish. Some traders add levels 45 and 55 to act as supports and resistances during a trending market condition.

The levels 30 and 70 are typically used to identify mean reversals. If the RSI line drops below 30, then the market may be oversold. If the line breaches above 70, then the market may be overbought.

On the other hand, momentum traders view the 30 and 70 signals differently. They interpret a breach above 70 as a bullish momentum and a drop below 30 as a bearish momentum.

Trading Strategy

This trading strategy is a simple moving average crossover strategy which trades in the direction of the long-term trend and confirms the trend momentum using the RSI.

The 200 EMA line will be used to filter trades for the long-term trend. This will be based on where price action is in relation to the 200 EMA line, as well as the slope of the 200 EMA line.

Then, we will confirm the trend using the RSI. This will be based on the RSI line breaching above 55 or dropping below 45.

As soon as the trend is confirmed, we then wait for the JMA line to cross the KAMA line. Price candles should also show momentum in the direction of the trend reversals.

Indicators:

- KAMA

- KAMA_Period: 24

- JMA

- 200 EMA

- Relative Strength Index

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

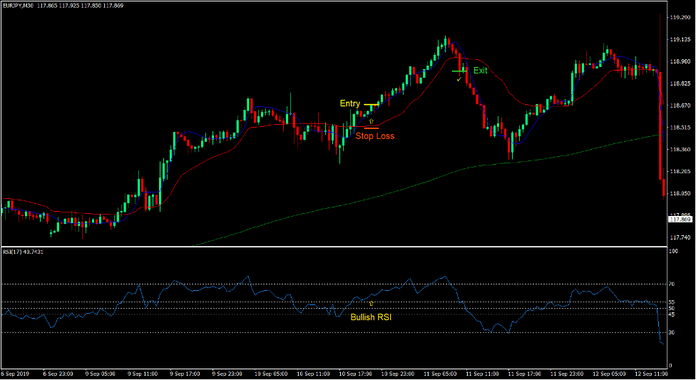

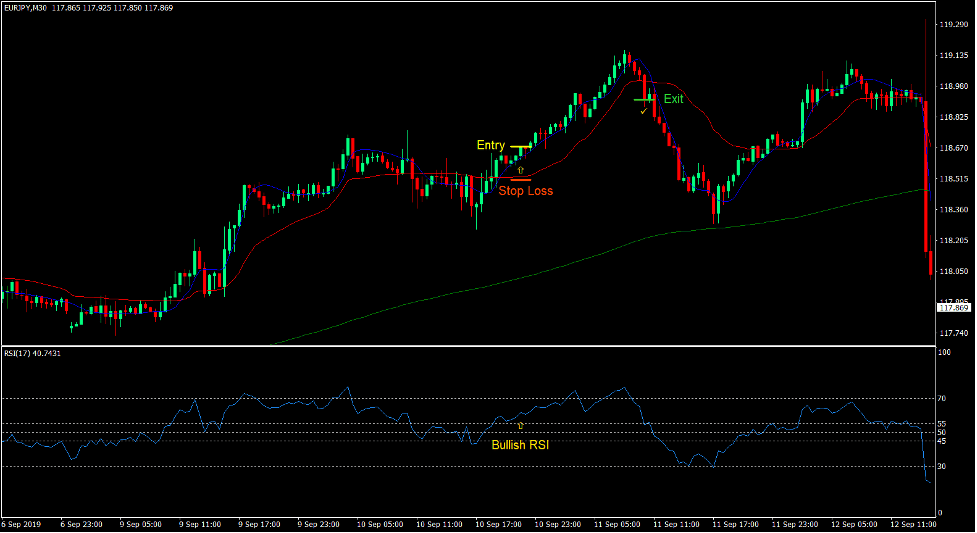

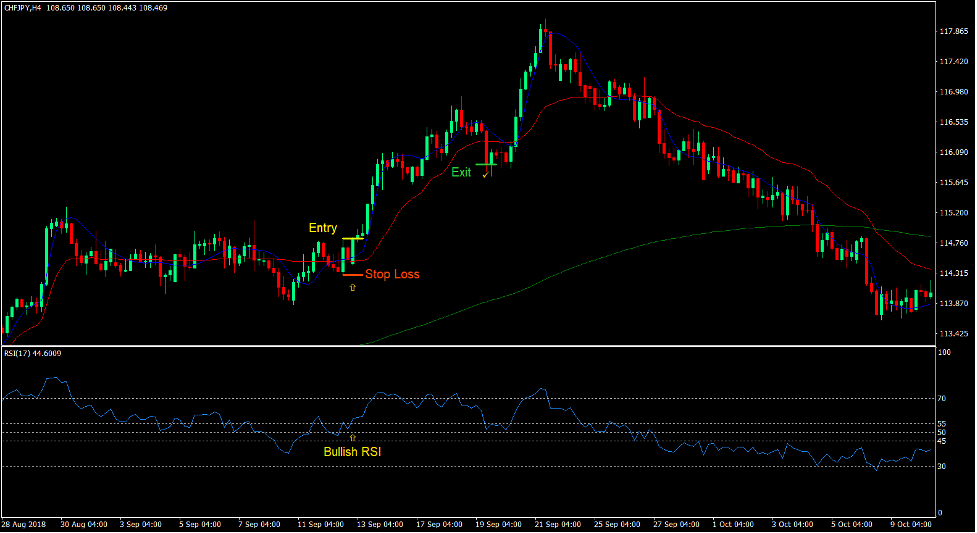

Buy Trade Setup

Entry

- Price action should be above the 200 EMA line.

- The 200 EMA line should slope up.

- The RSI line should be above 55.

- The JMA line should cross above the KAMA line.

- Price candles should show bullish characteristics.

- Enter a buy order upon the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support level below the entry candle.

Exit

- Close the trade as soon as a candle closes below the KAMA line.

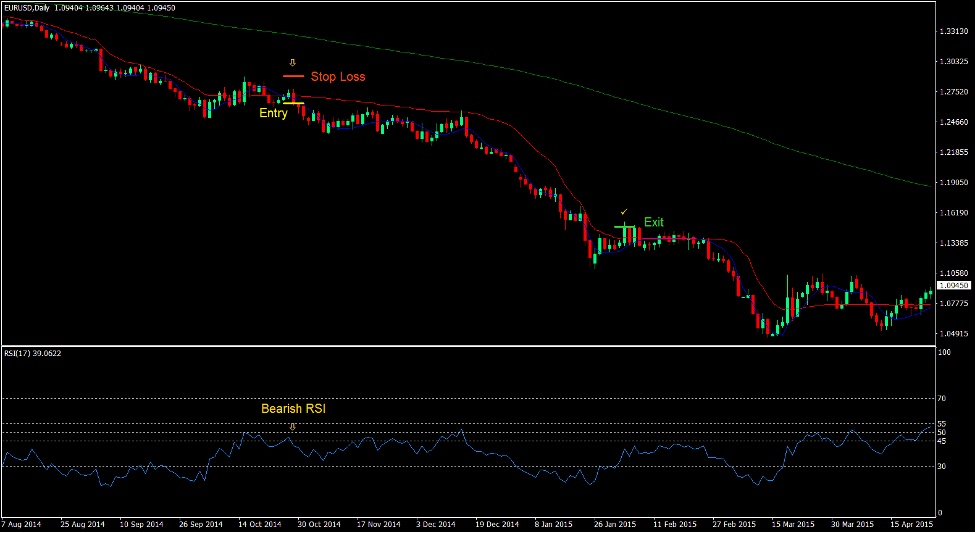

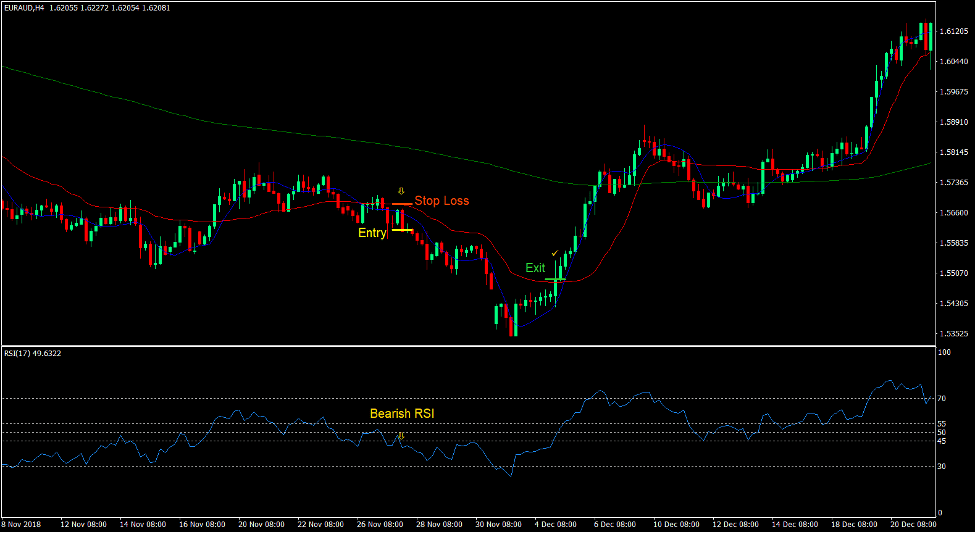

Sell Trade Setup

Entry

- Price action should be below the 200 EMA line.

- The 200 EMA line should slope down.

- The RSI line should be below 45.

- The JMA line should cross below the KAMA line.

- Price candles should show bearish characteristics.

- Enter a sell order upon the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance level above the entry candle.

Exit

- Close the trade as soon as a candle closes above the KAMA line.

Conclusion

Crossover strategies such as this one does work if done right. However, trading crossovers based on lagging moving averages might not be beneficial.

This strategy uses moving averages that are designed to be responsive to price movements, giving this strategy an edge.

Traders can profit consistently from the forex market using this strategy provided that they could also get a feel on what the market is doing based on price action and candlestick patterns.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: