Bicycle Scalping Forex Trading Strategy

There are two very important components of a trading setup – the trade direction and the entry. These are like the two wheels of a bicycle. You can’t have just one or you’re not going anywhere.

Trade direction simply means the decision to either buy or sell, either direction is up or down. This is pretty much a very simple choice, you’ve only got to pick one out of two. Even if a child would decide, he or she should get a 50% accuracy on this. We are not babies, so we should get higher than 50%, right? But why is it that most traders still fail?

According to brokers, traders usually get trade direction right. I’d even argue that many could even get it up to more than 90% right. Where we fail though is on the second wheel, the entry. Having the right entry is just a little bit harder to get right. Why? Because unlike trade direction where we get only two choices, trade entry levels have multiple choices. So much so, any level on the price chart is one of the many choices we have. This right here dramatically drops our accuracy down.

Now, many traders wise up. They realize it is quite hard to pick the right entry, so they turn to exotic strategies – martingales, reverse martingales, zone recovery, hedging, grid averaging, no stop losses, etc. But all these strategies are just a way to hide the fact that you have to work on getting that one wheel right – trade entry. You could get away with it for quite some time, especially if you are getting up to more than 90% accuracy on trade direction, but out of the thousands of trades that you would be making in your lifetime, there is still that chance that you would get that trade that wipes out everything you’ve worked hard for if you are using any of those that I’ve mentioned above. Now, I’m not saying that traders doing any of these are in the wrong, it is just that they have a higher degree of risk of losing everything in just one trade.

So, here is a quick tip on how you get the two wheels right. Trade direction is to trend, while trade entry is to mean reversal.

To get the trade direction right, it would be wise to take the direction of the main trend. This should get your trade direction accuracy to more than 60%.

Onto the hard part, trade entry. To get trade entry right, it would be wise to be looking into mean reversal entries on the micro level. Remember, your mean reversal cues should be more minute than your trend cues. This would allow you to enter at a level where price would just turn going to your direction within a few candles after you enter the trade.

The Setup

To apply this concept, we will be using two indicators. One is the Parabolic SAR, which is a good indicator to identify medium-term trend. Another is the Stochastic Oscillator, which is good at identifying mean reversals on the micro level.

For those who are new to trading or are not quite familiar with the Parabolic SAR, we will be identifying trade direction by identifying where the Parabolic SAR is in relation to price. If the Parabolic SAR is below price, then we will only look for buying opportunities. If it is above price, then we will only look to sell.

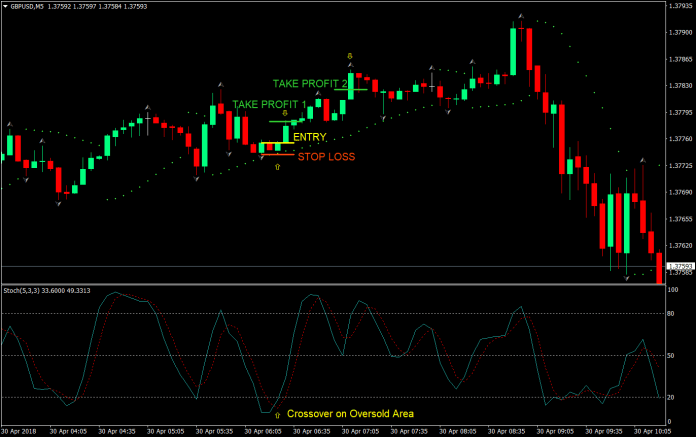

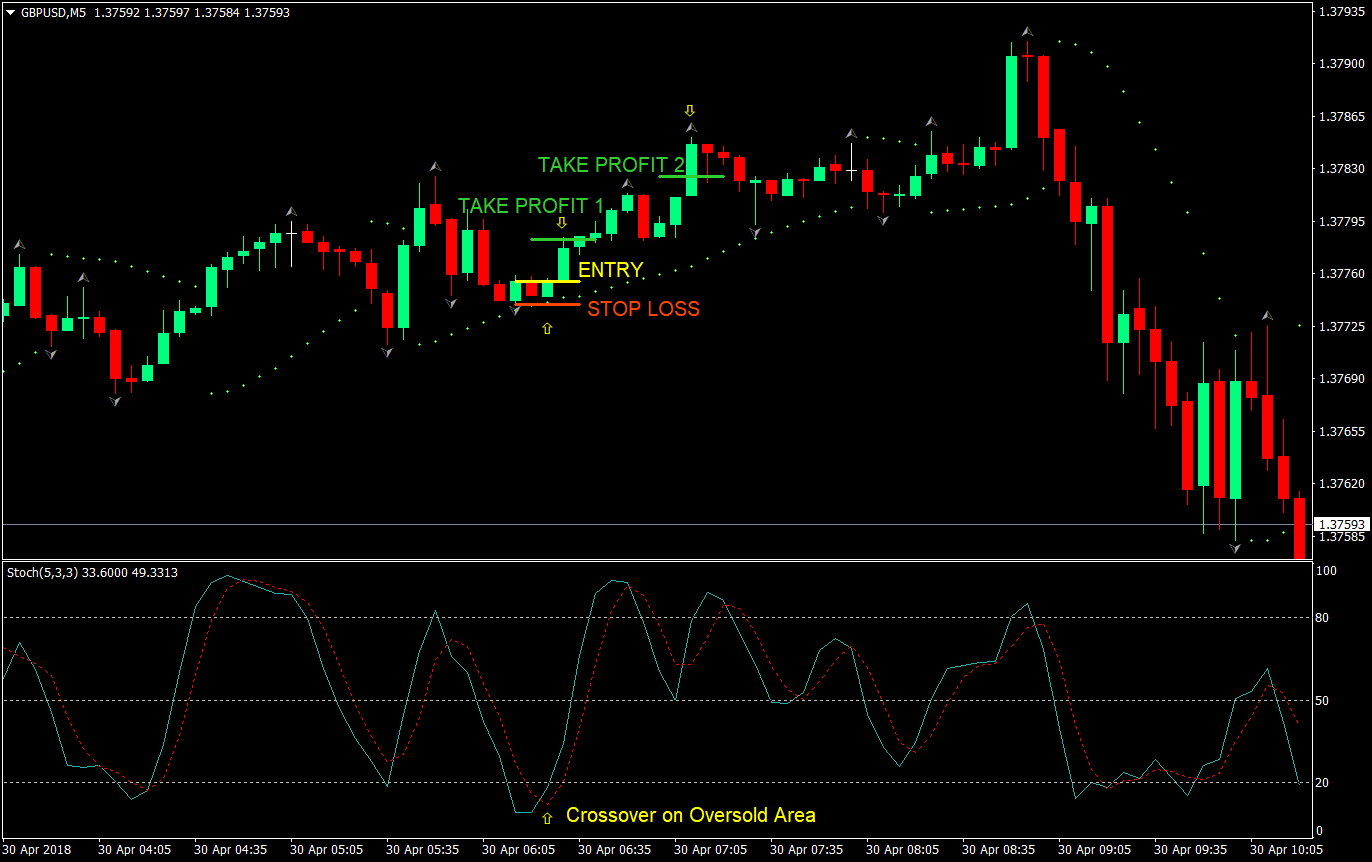

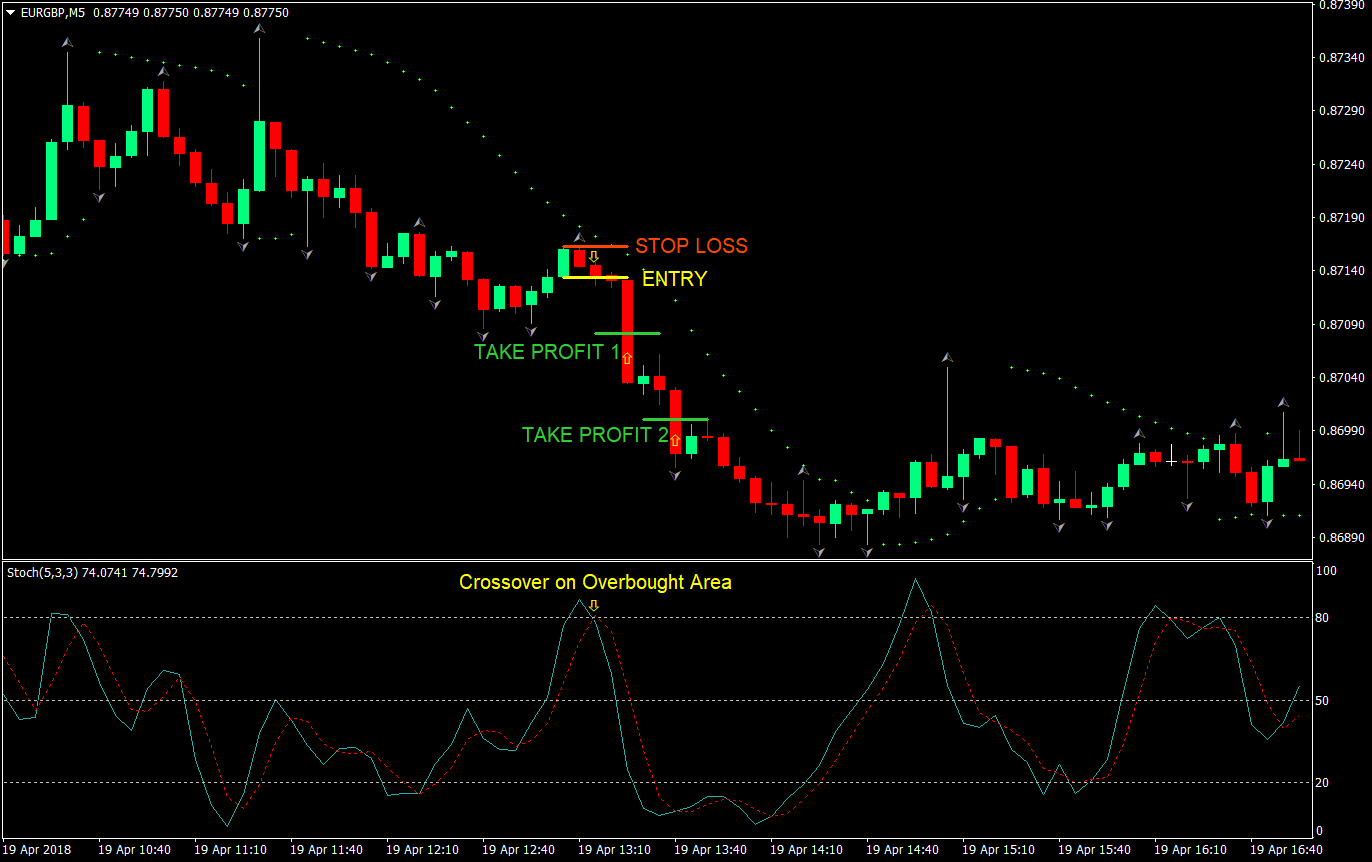

As for the Stochastic Oscillator, we will be using the common fast setting of 5-3-3 on the Stochastic Oscillator’s parameters. We will use it the usual way, where our buy entries will be the crossovers on the oversold area, while our sell entries will be the crossovers on the overbought area. This will be our entry signal.

Timeframe: 5-minute chart

Buy Entry:

- Price should be above the Parabolic SAR

- Wait for the fast stochastic to cross above the slow stochastic on or below the 20 level (oversold)

- Enter a buy market order at the close of the candle corresponding to the crossover

Stop Loss: Set the stop loss at the fractal below the entry price

Take Profit 1: Set the take profit for the first half of the position size at 2x the risk on the stop loss

Take Profit 2: Set the take profit for the remaining half of the position size at 5x the risk on the stop loss

Sell Entry:

- Price should be below the Parabolic SAR

- Wait for the fast stochastic to cross below the slow stochastic on or above the 80 level (overbought)

- Enter a sell market order at the close of the candle corresponding to the crossover

Stop Loss: Set the stop loss at the fractal above the entry price

Take Profit 1: Set the take profit for the first half of the position size at 2x the risk on the stop loss

Take Profit 2: Set the take profit for the remaining half of the position size at 5x the risk on the stop loss

Conclusion

Having the two main components down, trade direction and entry, we get to have a high accuracy trading strategy.

This strategy would work well on a trending market with a deep retrace on the micro level. However, if the trend is too strong, no entries will be generated since the Stochastic Oscillator won’t be printing overbought or oversold levels.

However, if the market is ranging, this strategy would more likely keep you out of a trade. This is because the signals generated by the Stochastic Oscillator won’t coincide with the trend direction indicated by the Parabolic SAR, which is a good thing.

Where this strategy would fail however is on a reversal market. During reversal markets, price could continue going the wrong direction even if the Stochastic Oscillator is on an overbought or oversold market condition.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: