B Bands Trend trading strategy is a trend-based strategy that takes trades on retracements. It is a simple strategy that allows traders to easily identify the medium-term trend direction and capitalize on the trend’s momentum during retracements.

The B Bands Stop BO Indicator

The B Bands Stop BO indicator is a custom indicator that acts much like the SAR indicator. It paints dots on the chart depending on the direction of the trend.

The B Bands Stop indicator is typically used as a basis for placing stop losses, hence the “stop” indicated on the name of the indicator. This indicator tries to identify the direction of the trend then marks the dots accordingly. If the trend is bullish, then the dots are placed significantly below the candlesticks. If the trend is bullish, then the dots are placed above the candlesticks. The stop losses are then placed a little below or above the dots. The idea behind this is that as long as the trend stays the same, price should not be touching the lines.

Stochastic Oscillators

The Stochastic Oscillator is a staple among traders. Probably all trading platforms and charting tools available today have the stochastic oscillator built in. The MT4 platform is no exception.

Although the stochastic oscillator is a common indicator and not a custom indicator, this should not take away anything from its usability. It is an effective tool that has its place in many profitable trading strategies.

The stochastic oscillator is a bounded oscillating indicator with a range of zero to 100, and a midline at 50. It is composed of two lines, a fast and a slow line. These two lines crisscross each other within the range. Each time these two lines crosses could be considered an entry signal. However, some signals are better than others.

Because the stochastic oscillator is bounded, an overbought and oversold line could also be marked on its range. These would usually be 20 and 80, or 25 and 75. If the lines go below 25, then the market is said to be oversold and could be pressured to reverse to the mean. On the other hand, if the lines go above 75, then the market could be considered overbought and could reverse to the mean. Crossovers around these levels could be considered high probability because price usually tends to revert back to its mean.

Trading Strategy Concept

The idea behind this strategy is to make use of the B Bands Stop BO indicator as a basis for the trend. If the dots are below price, then we should be looking for buy trade setups. On the other hand, if the dots are above price, then we would only be taking sell trade setups.

After identifying the medium-term trend direction using the B Bands Stop BO indicator, we wait for price to retrace causing a short-term oversold or overbought condition using the Stochastic Oscillator. The parameters on the stochastic oscillator would be set at “5, 3, 3” to allow for a fast stochastic oscillator. This would allow us to identify oversold and overbought conditions on the short-term. Signals during these market conditions would be our entry point.

Indicators:

- BBands_Stop_BO

- Stochastic Oscillator

- %K period: 5

- %D period: 3

- Slowing: 3

Timeframe: 5-min, 15-min, 30-min, 1-hour, 4-hour and daily charts

Currency Pair: any major and minor pairs plus some crosses; stick with pairs with enough volatility if day trading

Trading Session: any; trade on London and New York session if day trading

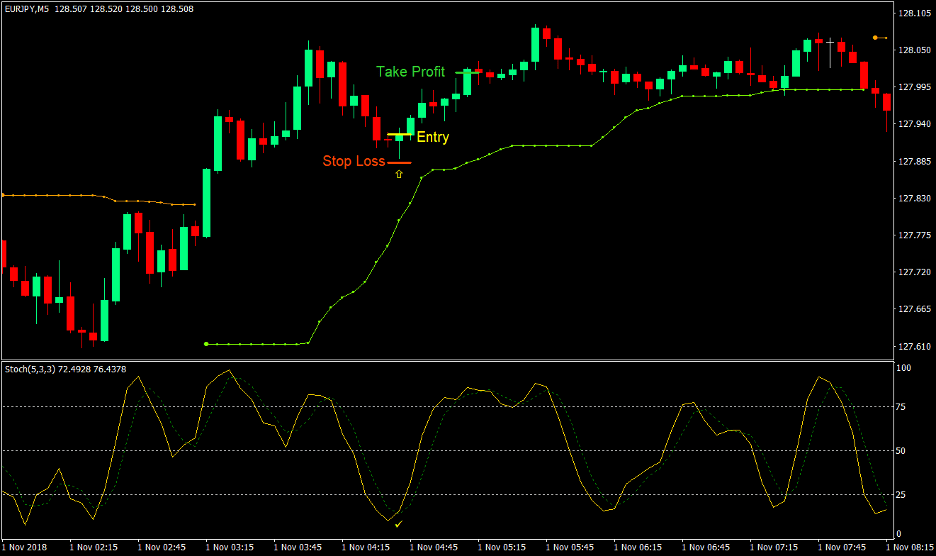

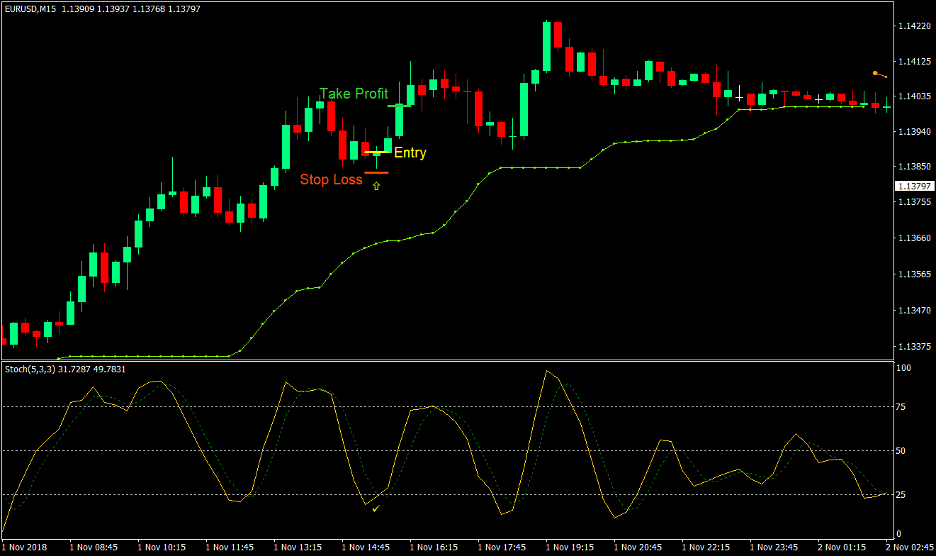

Buy (Long) Trade Setup

Entry

- Price should be below the B Bands Stop BO indicator signifying that the mid-term trend is bullish

- Wait for price to retrace

- Wait for the stochastic oscillators to go below 25 during the retracement indicating an oversold market condition on the short-term

- Enter a buy market order as the fast stochastic line crosses above the slow stochastic line below the 25 mark

Stop Loss

- Set the stop loss a little below the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

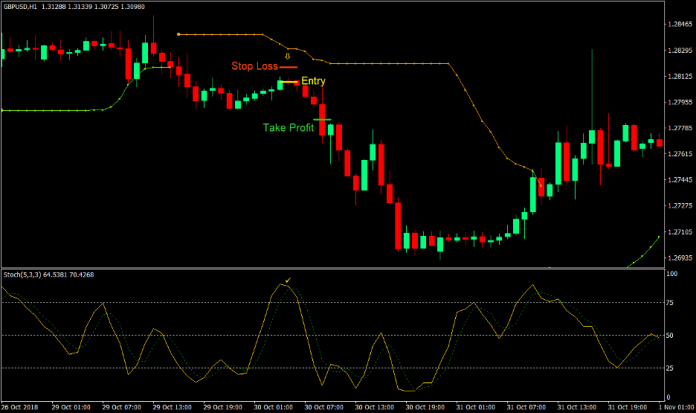

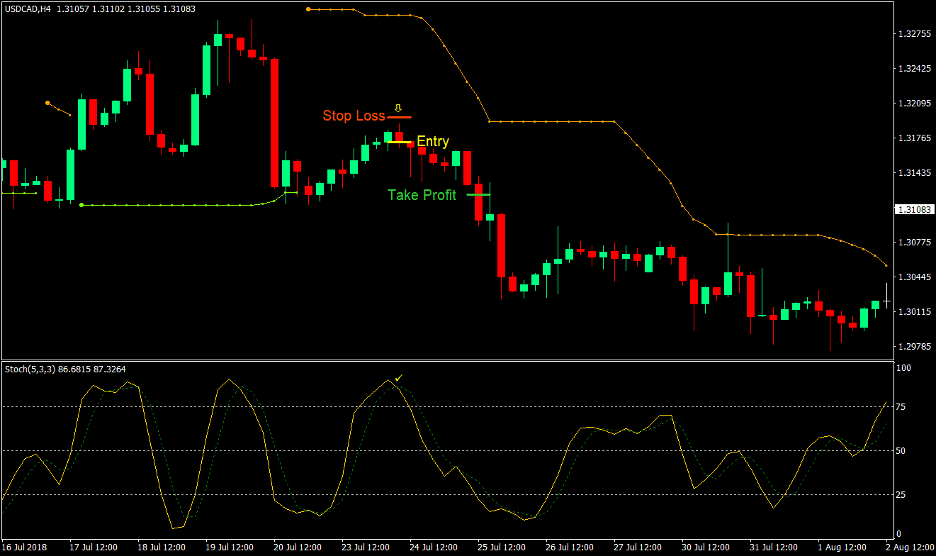

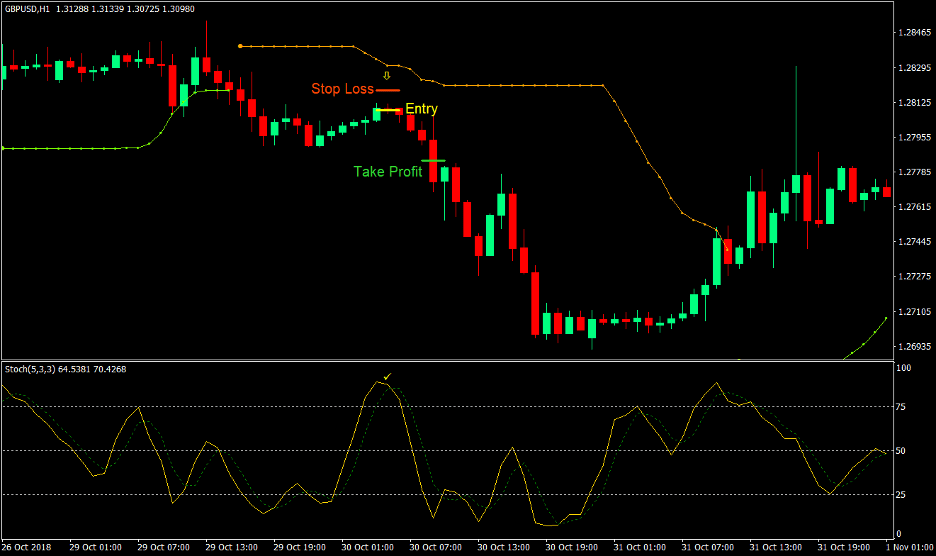

Sell (Short) Trade Setup

Entry

- Price should be above the B Bands Stop BO indicator signifying that the mid-term trend is bearish

- Wait for price to retrace

- Wait for the stochastic oscillators to go above 75 during the retracement indicating an overbought market condition on the short-term

- Enter a sell market order as the fast stochastic line crosses below the slow stochastic line above the 75 mark

Stop Loss

- Set the stop loss a little above the entry candle

Take Profit

- Set the take profit target at 2x the risk on the stop loss

Conclusion

This strategy is an aggressive trend trading strategy. This aggressive characteristic is mainly due to the tight stop loss usually made as the signals on the stochastic oscillator are also usually fractals. This allows the strategy to be extra aggressive allowing for a reward-risk ratio of 2:1. This could even be set much higher depending on the trader’s risk appetite. The bigger the preset reward-risk ratio, the higher the probable profit but the probability of hitting the take profit target could be higher.

If you would observe the trade examples above, most of the trades have enough room to allow for a higher target take profit.

Another option that could be taken is to set the stop loss a bit farther from the candlestick. At times, although the stochastic oscillator already made a valid entry signal, the momentum behind the retrace could push price a bit further before going the direction of the trade, hitting a tight stop loss prematurely. By placing the stop loss a bit further from the candle, the trade setup would have some wiggle room in case this happens. However, the reward-risk ratio could be a little lesser. The key is to have the stop loss at the right distance and set the take profit target at a logical distance, which price would probably hit.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: