공급 및 수요 거래는 거래자가 가격 차트의 특정 가격대에 가격이 어떻게 반응하는지에 따라 공급 및 수요 영역을 식별하려고 시도하는 기술 거래 기술의 한 유형입니다.

수요 구역은 스윙 로우를 생성하는 가격 수준에서 빠르게 반전되는 가격 조치를 기반으로 식별됩니다. 그것은 그 가격 수준에서 거래를 할 의향이 있는 많은 낙관적인 거래자들이 있다고 가정합니다. 반면에 공급 구역은 가격 변동을 기반으로 식별되며 빠르게 후퇴하여 스윙 하이를 생성합니다. 해당 가격 수준에서 약세 거래를 할 의향이 있는 약세 거래자가 많다고 가정합니다.

어떤 면에서 공급과 수요는 스윙 고점과 스윙 저점을 기반으로 수평 지지선과 저항을 식별하는 시장 흐름 거래와 밀접한 관련이 있습니다.

수요와 공급 거래는 매우 효과적인 거래 기법입니다. 실제로 공급 및 수요 설정에 따라 독점적으로 거래하는 많은 전문 거래자가 있습니다. 이 거래자들은 매월 시장에서 지속적으로 이익을 얻을 수 있습니다.

수요와 공급 거래는 매우 효과적이지만 신규 거래자에게는 매우 어려울 수도 있습니다. 수요와 공급 지역을 파악하는 데는 많은 기술이 필요하기 때문입니다.

그러나이 전략에서는 지그재그 표시기를 사용하여 공급 및 수요 구역을 효과적으로 식별하는 데 도움이 되는 방법을 살펴볼 것입니다.

지그재그 표시기

Zigzag 지표는 트레이더가 스윙 최고점과 최저점을 식별하는 데 도움을 주기 위해 개발된 기술 지표입니다.

기본 계산에서 미리 설정된 비율 임계값보다 큰 비율로 가격 반전을 감지할 때마다 차트에 포인트를 표시합니다. 그런 다음 스윙 고점과 스윙 저점이 연결될 때 패턴과 같은 지그재그를 생성하는 이러한 점을 연결합니다.

지그재그 지표는 주로 트레이더가 스윙 고점과 스윙 저점을 식별하는 데 도움이 되는 도구로 사용됩니다. 따라서 가격 행동 거래자는 이를 사용하여 스윙 최고점과 스윙 최저점을 객관적으로 식별할 수 있습니다. 또한 트레이더가 시장 변동을 기반으로 추세 시장을 식별하는 데 도움이 될 수 있습니다. 스윙 고점과 스윙 저점이 지속적으로 높게 표시되면 시장은 강세로 간주되고 지속적으로 낮게 표시되면 약세로 간주됩니다.

확률 적 교차 경고

Stochastic Cross Alert 지표는 Stochastic Oscillator를 기반으로 하는 맞춤형 신호 지표입니다.

스토캐스틱 오실레이터는 0~100 범위 내에서 진동하는 두 개의 선을 그리는 인기 있는 모멘텀 오실레이터입니다. 모멘텀 방향은 두 오실레이터 라인이 쌓인 방식에 따라 식별되며, 이와 같이 모멘텀 반전은 교차점을 기반으로 식별됩니다. 두 줄. 또한 일반적으로 레벨 20과 80에 마커가 있습니다. 20 미만의 확률 선은 과매도 시장을 나타내고 80 이상의 선은 과매수 시장을 나타냅니다. 이 수준에서 발생하는 교차는 평균 반전 조건을 나타냅니다. 평균 반전 신호는 모멘텀과 평균 반전을 모두 결합하기 때문에 승리 확률이 높은 경향이 있습니다.

Stochastic Cross Alert 지표는 이 개념을 기반으로 합니다. 그러나 지표가 모멘텀 반전 신호를 감지할 때마다 자동으로 화살표를 플로팅하여 트레이더의 프로세스를 단순화합니다. 화살표는 캔들과 반전 방향을 편리하게 가리킵니다.

무역 전략

이 매매전략은 지그재그 지표를 기반으로 한 수급전략에 따른 기본적인 추세입니다.

먼저, 지그재그 지표로 식별되는 스윙 고점과 스윙 저점을 기반으로 시장이 추세인지, 어떤 방향인지 파악해야 합니다.

시장이 강세이면 가장 최근의 저점을 기준으로 수요 구역을 식별합니다. 시장이 약세일 경우 스윙 최고치를 기준으로 공급 구역을 식별합니다. 이 영역은 스윙 포인트를 형성하는 양초의 심지를 기준으로 표시됩니다.

그런 다음 현재 가격 조치에 더 가까운 이 영역의 가장자리에 대기 중인 지정가 입력 주문을 설정할 수 있으며, 손절매는 가격 조치 반대 영역 외부에 설정됩니다.

Stochastic Cross Alert 지표는 거래의 반대 방향을 가리키는 화살표를 기준으로 출구 신호로 사용됩니다.

지표 :

- 지그재그

- Stochastic_Cross_Alert

선호하는 시간 프레임 : 1 시간 및 4 시간 차트

통화 페어 : FX 메이저, 마이너 및 크로스

거래 세션 : 도쿄, 런던, 뉴욕 세션

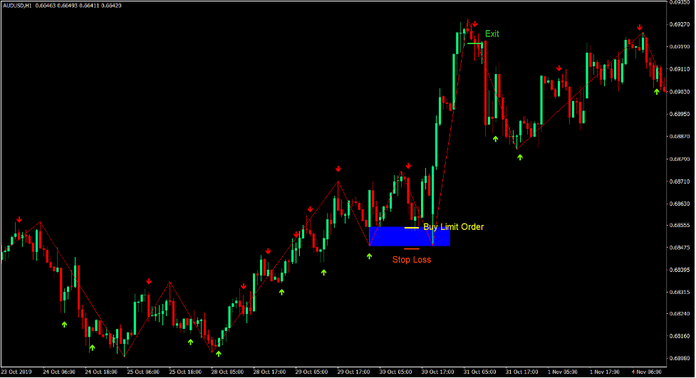

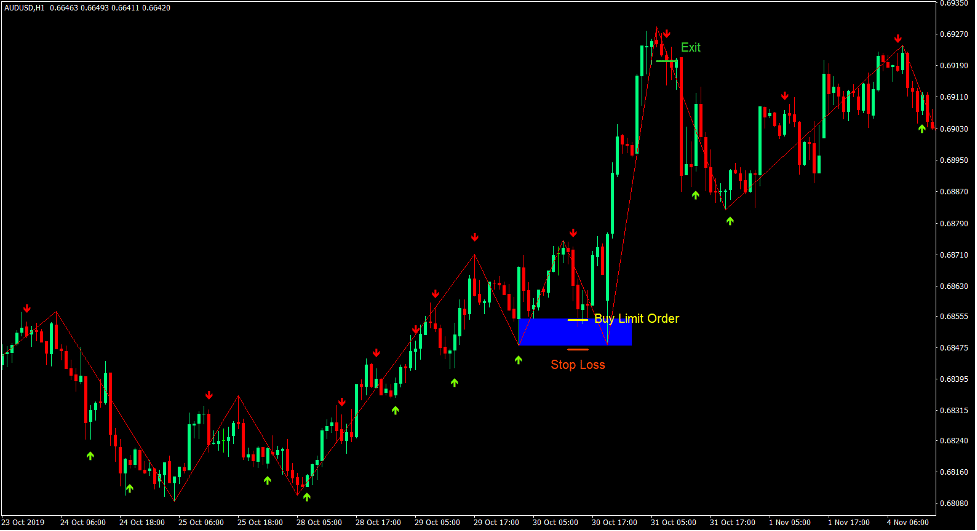

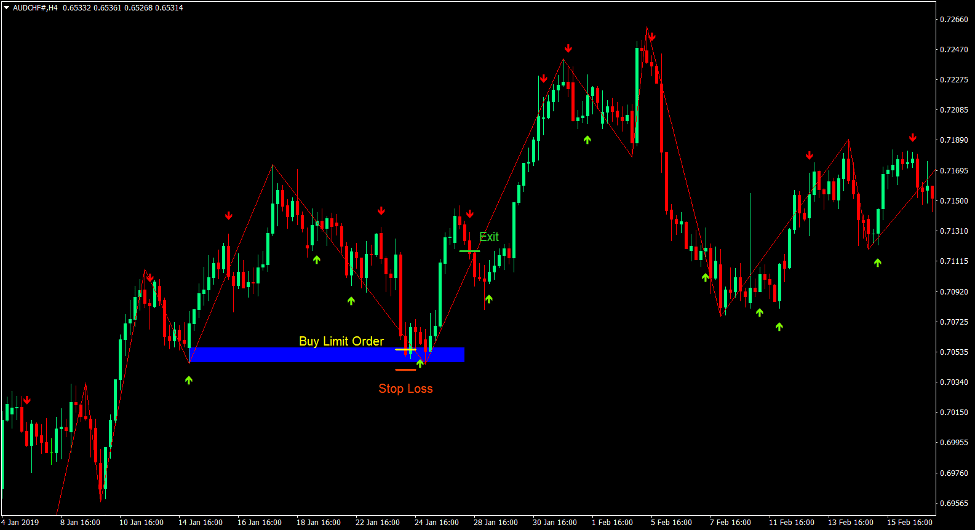

거래 설정 구매

기입

- 가격 행동은 강세 추세를 나타내는 더 높은 스윙 고점과 스윙 저점을 계획해야 합니다.

- 가장 최근의 저점 스윙을 형성하는 캔들의 심지를 기준으로 수요 영역을 식별합니다.

- 수요 구역의 상단 가장자리에 매수 지정가 주문을 설정합니다.

손실을 중지

- 수요 구역의 하단 가장자리 아래에 손절매를 설정합니다.

출구

- 스토캐스틱 교차 경보 표시기가 아래를 가리키는 화살표를 표시하는 즉시 거래를 닫으십시오.

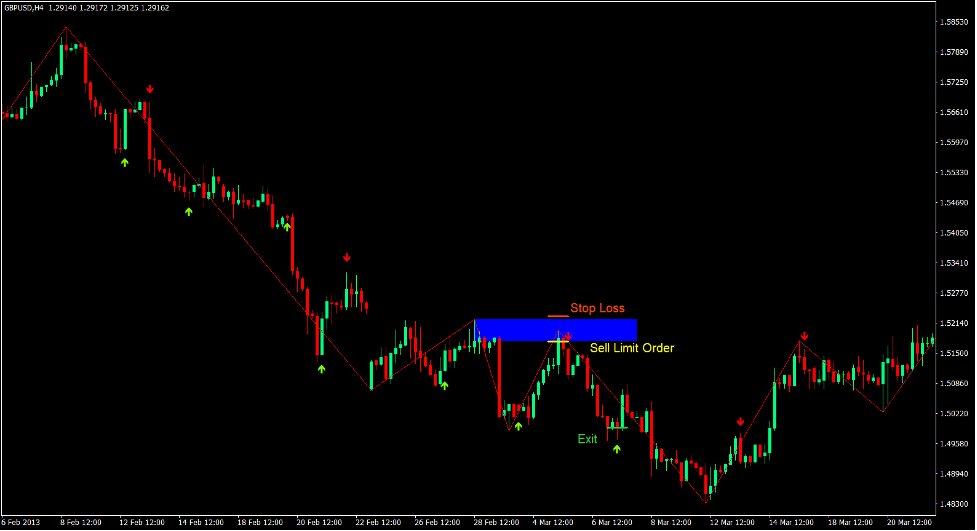

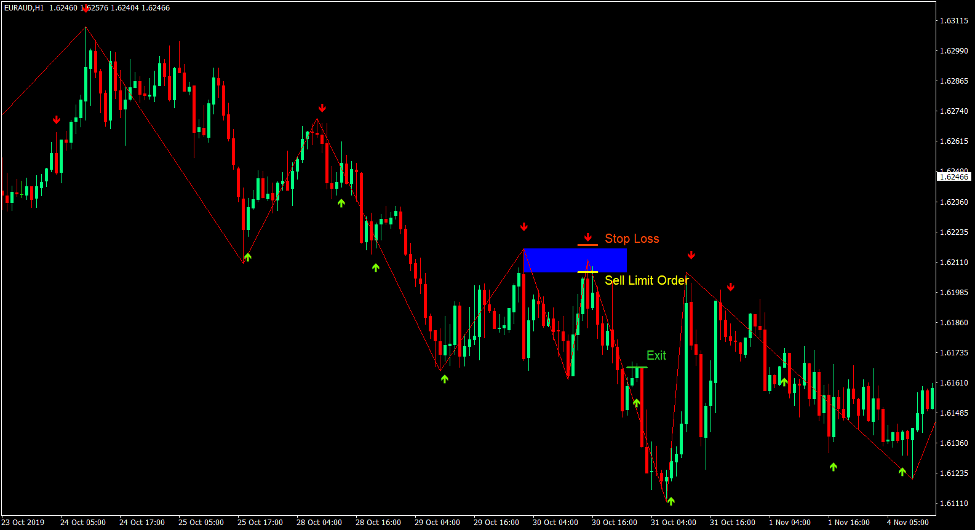

판매 거래 설정

기입

- 가격 행동은 약세 추세를 나타내는 더 낮은 스윙 고점과 스윙 저점을 구성해야 합니다.

- 가장 최근의 스윙 고점을 형성하는 캔들의 심지를 기준으로 공급 영역을 식별합니다.

- 공급 구역 하단 가장자리에 매도 지정가 주문을 설정합니다.

손실을 중지

- 공급 영역의 상단 가장자리 위에 손절매를 설정합니다.

출구

- 스토캐스틱 교차 경고 표시기가 위를 가리키는 화살표를 표시하는 즉시 거래를 닫으십시오.

결론

추세 방향에 기반한 공급 및 수요 거래는 트레이더가 외환 시장에서 지속적으로 이익을 얻을 수 있도록 도와주는 높은 확률의 거래 전략입니다. 그러나 공급 및 수요 구역을 식별하는 것은 어려운 부분입니다.

이 거래 전략은 지그재그 표시기를 사용하여 공급 및 수요 구역을 식별하는 프로세스를 단순화했습니다.

출구 전략은 다를 수 있습니다. 이 설정에서 우리는 Stochastic Cross Alert를 사용하여 시장이 되돌리기 전에 얼마나 사용할 의향이 있는지 알려줍니다. 그러나 이전 스윙 포인트에 테이크 이익 목표를 설정하려는 일부 공급 및 수요 거래자가 있습니다. 이것의 장점은 거래자에게 위험 보상 비율을 계산할 수 있는 고정된 목표를 제공한다는 것입니다. 그러나 시장이 범위를 벗어나기 시작하지 않는 한 가격이 추세 시장의 이전 스윙 포인트를 초과하는 경향이 있기 때문에 각 거래의 수익 잠재력도 제한됩니다.

추천 MT4 브로커

XM 브로커

- 무료 $ 50 즉시 거래를 시작하려면! (인출가능이익)

- 입금 보너스 최대 $5,000

- 무제한 로열티 프로그램

- 수상 경력에 빛나는 외환 브로커

- 추가 독점 보너스 일년 내내

FBS 브로커

- 거래 100 보너스: 거래 여정을 시작하려면 $100를 무료로 받으세요!

- 100% 입금 보너스: 예치금을 최대 $10,000까지 두 배로 늘리고, 강화된 자본으로 거래하세요.

- 최대 1 활용 : 3000: 이용 가능한 가장 높은 레버리지 옵션 중 하나로 잠재적 이익을 극대화합니다.

- '아시아 최고의 고객 서비스 브로커' 상: 고객 지원 및 서비스의 우수성을 인정받았습니다.

- 계절별 프로모션: 1년 내내 다양한 독점 보너스와 프로모션 혜택을 누려보세요.

다운로드하려면 여기를 클릭하십시오.