Tokyo Daybreak 외환 트레이딩 전략

외환 시장에서 수익을 얻는 더 좋은 방법 중 하나는 주요 시장과 관련하여 통화 쌍 시장 주기를 이해하는 것입니다. 이는 통화쌍 시장 사이클을 이해함으로써 사이클 단계가 사이클 자체로 인해 비효율성을 나타낼 수 있기 때문이며, 이를 활용할 수 있습니다.

시장 주기를 식별하고 예측하는 방법에는 여러 가지가 있습니다. 일부는 시장에 대해 장기적인 관점을 갖고 시장 주기를 계절적, 연간 또는 극단적으로 수십 년으로 볼 수도 있습니다. 그들은 과거에 나타난 패턴을 바탕으로 호황과 불황을 보게 될 것입니다. 다른 사람들은 단기적인 관점을 더 많이 취하고 하루 동안 시장 주기를 관찰합니다. 그들은 하루 중 시간과 그 시간 동안 시장이 무엇을 하고 있는지를 기준으로 시장 주기를 관찰할 것입니다. 그것이 시장 개장일 수도 있고, 점심시간의 소강상태일 수도 있고, 일과 종료 후 포지션 정리가 될 수도 있습니다.

장기적인 시장 사이클에는 그 뒤에 믿을 만한 많은 연구, 관찰, 분석이 있지만 나는 그것을 피하는 경향이 있습니다. 첫째, 장기간에 걸쳐 많은 일이 발생할 수 있고 이는 시장 방향에 영향을 미칠 수 있다는 사실 때문에 예측하기가 상당히 어렵습니다. 반면에, 짧은 시장 주기는 더 짧은 기간에 발생할 수 있는 예측 불가능한 시장 혼란이 적기 때문에 평가하기가 더 쉬운 경향이 있습니다. 우리가 보고 있는 시장 주기가 짧을수록 평가하기가 더 쉬워집니다.

이제 저는 예측이라는 단어를 사용하지 않는다는 점에 유의하세요. 왜냐하면 많은 사람들이 시장의 방향을 예측할 수 있다고 주장하지만, 방향을 예측하는 것 자체만으로는 시장 움직임의 시점을 예측하는 일이 복잡하기는커녕 그 자체로도 충분히 어려운 것 같기 때문입니다. 내가 원하는 것은 현재 시장 움직임이 현재 시장 사이클의 어느 단계에 있는지 평가하는 것입니다. 어떤 사람들은 호황, 최고점, 불황, 최저점을 보고 이를 평가할 것입니다. 이는 다른 유형의 시장에 적용할 수 있는 경우가 많지만 외환 시장에는 적용할 수 없다고 생각합니다. 왜냐하면 최소한 두 개의 주요 시장이 각 통화를 끌어당기고 시장 주기를 갖고 있기 때문입니다. 나는 수축 및 확장 주기의 더 간단한 방법이 외환 시장에 더 적합하다고 제안합니다. 어떤 시장이 쌍을 더 강하게 끌어당길 수 있는지보다는 변동성의 주기를 예측하는 것이 더 쉽습니다.

일중 수준에서 시장 수축과 확장을 더 쉽게 평가할 수 있다는 점을 알고 이 수준에서 USD/JPY 쌍의 비효율성 중 하나를 살펴보겠습니다.

시장 주기는 해당 쌍의 주요 시장이 진행되는 시간에 따라 달라집니다. 이 통화 쌍의 경우 미국과 도쿄 시장을 살펴보겠습니다. 두 시장의 주기는 두 시장 모두에서 해가 뜨고 지는 것과 함께 진행됩니다. 이로 인해 지속적인 비효율성이 나타납니다. 이러한 비효율성은 두 시장이 모두 마감되는 동안 발생합니다. 이 기간 동안 시장이 수축 국면에 들어갈 것이라는 것은 매우 예측 가능합니다. 일반적인 시장 주기와 마찬가지로 다음 단계는 빠르고 폭력적인 확장이 될 것입니다. 두 쌍의 다음 주요 시장이 비즈니스를 위해 열리면 이러한 급속한 확장 단계가 빠르게 시작되어 일반적으로 강한 모멘텀을 유발합니다.

뉴욕 시장이 마감된 후 USD/JPY 쌍에 대한 주요 시장이 열리지 않는 XNUMX시간의 기간이 있습니다. 이 기간 동안 시장은 수축 단계에 진입합니다. 그러다가 도쿄 시장이 열리면서 급격한 시장 확장이 일어난다.

이는 펀더멘탈에 따른 시장 움직임으로 인해 더욱 증폭됩니다. 두 통화 모두 안전한 피난처이기 때문입니다. 한쪽이 위험에 처하면 투자자들은 안전을 위해 다른 쪽으로 몰려든다. 이는 우리가 돈을 벌 수 있는 강력한 시장 움직임을 일으킬 수 있습니다.

설정

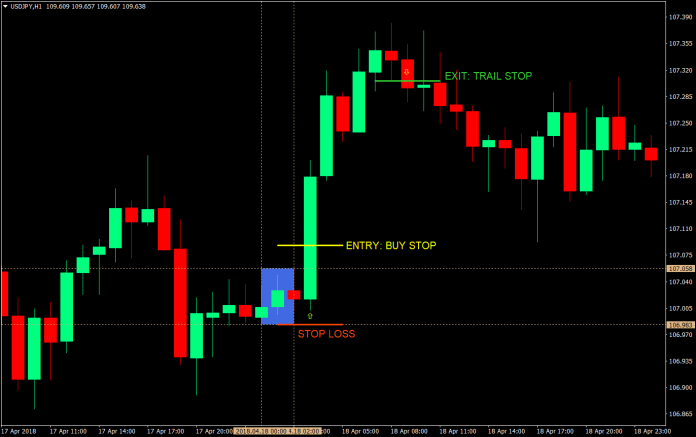

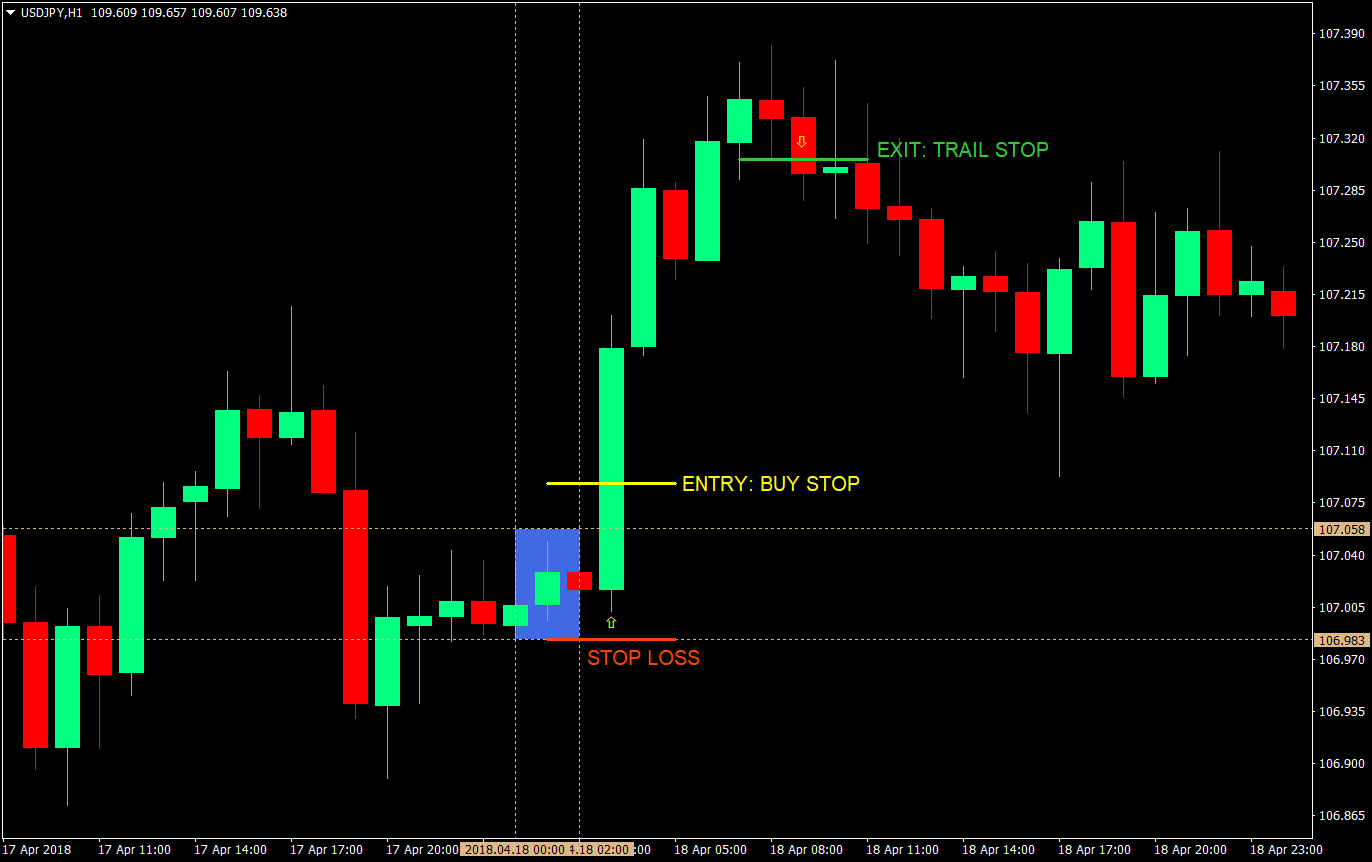

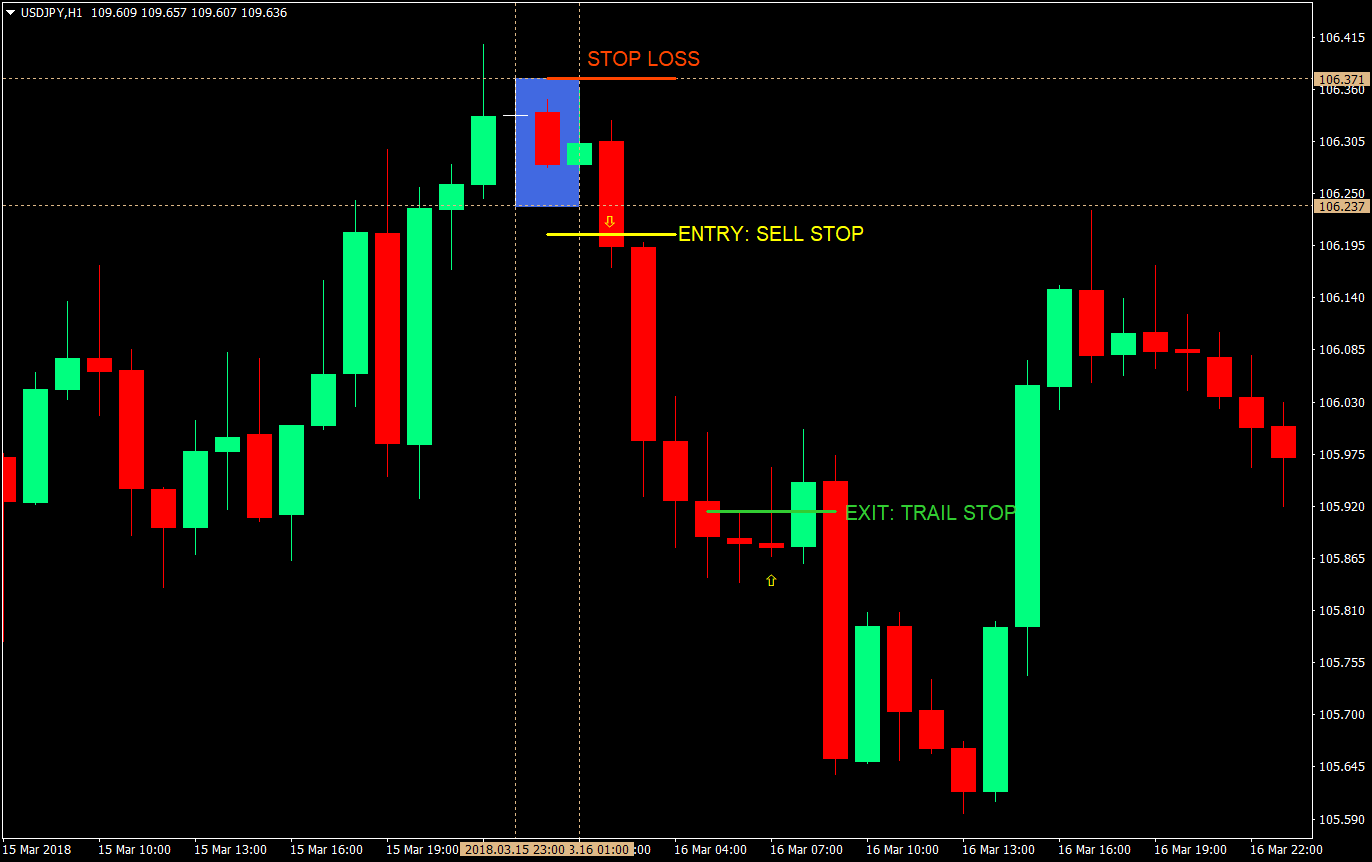

이 전략을 올바르게 수행하려면 도쿄 세션의 첫 번째 시간을 나타내는 올바른 1시간 캔들의 시간을 식별해야 합니다. 이는 브로커마다 다릅니다. 그런 다음 이 양초 앞에 있는 세 개의 양초를 표시하세요. 이 양초는 뉴욕 세션이 끝난 후 도쿄 세션 이전의 시간을 나타냅니다. 우리의 범위를 나타내기 위해 세 개의 양초의 고점과 저점을 묶습니다. 이 범위의 돌파가 우리의 시장 방향이 될 것입니다.

통화쌍: USD/JPY만 가능

기간: 1시간 차트

참가 설정:

- 도쿄 개장 XNUMX시간 전 시장의 고점과 저가를 살펴보세요.

- 고점보다 3핍 위에 매수 중지 주문을 설정하세요

- 저점보다 3핍 아래에 매도 중지 주문을 설정하세요.

손실 중지 범위의 반대쪽 끝에서 정지 손실을 설정합니다.

- 매수 정지 주문의 경우, 범위의 최저점에 정지 손실을 설정하십시오.

- 매도 중지 주문의 경우 중지 손실을 범위의 최고 수준으로 설정하십시오.

종료 : 시장이 거래 방향으로 움직일 때 중지될 때까지 중지 손실을 추적합니다.

- 매수 거래의 경우, 캔들 종가에서 매 1시간 캔들 저점에서 정지 손실을 추적합니다.

- 매도 거래의 경우, 캔들 종가에서 매 1시간 캔들 최고점에서 정지 손실을 추적합니다.

거래 샘플 구매

거래 샘플 판매

결론

이는 USD/JPY의 주요 시장 폐쇄로 인한 명확한 시장 수축 단계를 활용하는 간단한 기계적 전략입니다.

이 전략은 시장이 처음 한 시간 동안 강력한 모멘텀으로 폭발할 경우 큰 핍을 가져올 가능성이 있지만 일상적으로는 그렇지 않습니다. 첫 시간 양초가 진입 중지 주문에 닿은 후 시장이 반전되는 날이 있을 것입니다. 시장이 좁은 범위에 머무는 경우도 있을 것입니다. 이러한 유형의 시장에서는 이 전략을 사용하면 확실히 돈을 잃을 것입니다.

그러나 이러한 유형의 시장을 걸러내고 첫 시간 양초를 움직이는 모멘텀의 공통 분모를 찾을 수 있다면 이 전략은 확실히 더욱 향상될 것입니다.

추천 MT4 브로커

- 무료 $ 50 즉시 거래를 시작하려면! (인출 가능한 이익)

- 입금 보너스 최대 $5,000

- 무제한 로열티 프로그램

- 수상 경력에 빛나는 외환 브로커

- 추가 독점 보너스 일년 내내

다운로드하려면 여기를 클릭하십시오.