외환 시장은 거래자가 참여할 수 있는 가장 유동적인 시장입니다. 그 규모와 거래량이 그 자체로 말해줍니다. 이로 인해 큰 기회가 옵니다. 거래량이 충분하고, 거래 비용을 쉽게 감당할 수 있는 변동성과 XNUMX시간 내내 발생하는 거래 기회를 갖춘 시장입니다. 무한한 돈의 원천인 것 같습니다. 그러나 이로 인해 몇 가지 어려움도 따릅니다. 외환 시장은 또한 가장 불규칙한 시장 중 하나입니다. 변동성은 일부에게는 좋을 수 있지만 외환 시장의 파도를 타는 법을 배우지 못한 사람들에게는 변동성으로 인해 익사할 수 있습니다.

외환시장은 주기와 추세에 따라 움직입니다. 어느 순간 시장은 조용해지다가 예고 없이 추세를 보이기 시작합니다. 이러한 추세의 파도는 종종 많은 사람들에게 예측할 수 없습니다. 그러나 이러한 추세 주기의 시간을 매우 정확하게 맞추는 방법이 있습니다. Tenkan Trigger Cross Forex 트레이딩 전략을 통해 트레이더는 이러한 추세 단계의 가능한 시작을 식별할 수 있습니다. 트레이더는 처음부터 끝까지 이러한 추세를 타는 것을 꿈꿀 수 있었지만 이 전략을 통해 트레이더는 더 자주 그렇게 할 수 있습니다.

텐 칸센

텐칸센은 호사다 고이치가 개발한 Ichimoku Cloud 지표의 구성 요소로, 거래자가 사용할 수 있는 가장 효과적인 지표 중 하나입니다. 기준선(Kijun-sen)과 함께 자주 사용되며 전환선(Conversion Line)이라고도 합니다.

텐칸센은 기본적으로 특정 기간의 중앙값의 평균입니다. 최고가와 최저가를 더한 뒤 그 합을 XNUMX로 나누어 계산합니다. 그런 다음 결과는 가격 차트에 중첩된 이동 평균선처럼 표시됩니다.

Tenkan-sen의 특성을 관찰하면 일반적인 이동 평균에 비해 매우 들쭉날쭉하고 가격 움직임을 훨씬 더 가깝게 포옹합니다. 또한 기준선은 중기 추세를 나타내는 데 사용되는 반면 기준선은 둘의 장기 추세로 사용됩니다.

200 EMA

이동평균은 다양한 거래자들에 의해 다양한 방식으로 사용됩니다. 주요 용도 중 하나는 일반적인 추세 방향을 식별하는 것입니다. 거래자는 선호하는 이동 평균선과 관련하여 가격의 위치를 식별함으로써 이를 수행합니다. 가장 일반적으로 사용되는 이동 평균 중 하나는 200일 지수 이동 평균(EMA)입니다. 이 이동 평균선은 많은 거래자가 장기 추세 방향을 결정하는 데 사용됩니다. 많은 거래자들은 이것을 추세 필터로 사용하며 항상 200 EMA의 추세 방향에 반대되는 거래를 피합니다.

BTtrend 트리거 표시기

BTtrend Trigger 지표는 RSI(Relative Strength Index)와 같은 특성을 갖는 TTF(Trend Trigger Factor) 지표를 기반으로 하는 맞춤형 진동 지표입니다.

BTtrend 트리거 표시기는 무한한 진동 표시기입니다. 이를 통해 BTtrend 트리거 라인이 자체 창에서 자유롭게 이동할 수 있습니다. 과매수 또는 과매도 가격 상태를 식별하기 위한 고정 표시를 갖는 대신, 이 지표는 감지되는 추세에 따라 XNUMX 위와 아래로 이동하는 또 다른 선을 그립니다. 이 선을 넘어서는 교차는 진입 신호로 간주될 수 있으며 다양한 거래자가 다양한 방식으로 사용할 수 있습니다. 평균 회귀 거래자는 중간선 방향으로 진입 신호를 사용할 수 있는 반면 모멘텀 거래자는 중간선에서 멀어지는 진입 신호를 사용할 수 있습니다.

무역 전략

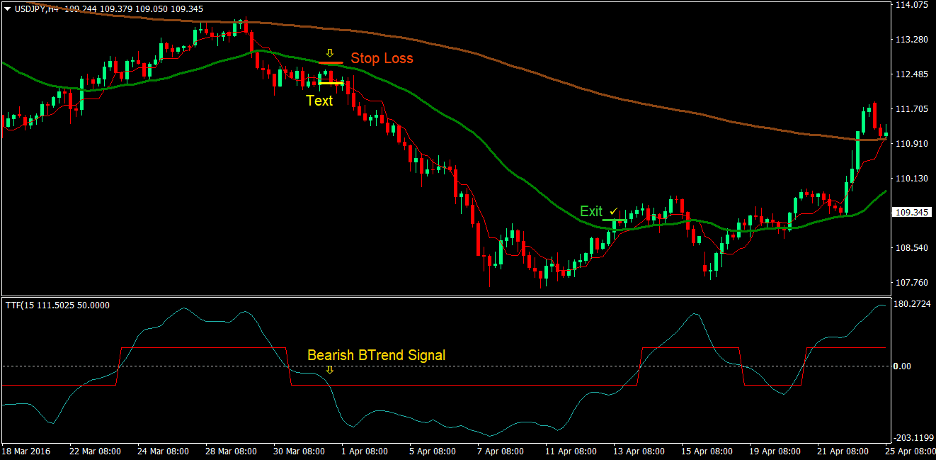

이 거래 전략은 32일 지수 이동 평균(녹색)에 대한 천칸선 교차를 기반으로 거래 항목을 작성합니다. Tenkan-sen 라인은 단기 추세를 나타내고 32 EMA는 장기 추세를 나타냅니다. 텐칸센 선이 32 EMA를 교차할 때 매수 거래가 이루어지고, 텐칸센 선이 32 EMA 아래를 교차할 때 매도 거래가 이루어집니다.

거래는 또한 200 EMA(갈색)의 장기 추세 방향을 기준으로 필터링됩니다. 200 EMA와 일치하는 거래 신호만 취할 수 있습니다.

그런 다음 거래 신호는 모멘텀을 기반으로 한 BTtrend 트리거 표시기로 확인되어야 합니다. BTtrend 트리거 선이 중앙선 위에 있는 동안 빨간색 선 위로 교차할 때 매수 거래가 이루어지며, BTtrend 트리거 선이 XNUMX 미만인 동안 빨간색 선 아래로 교차할 때 매도 거래가 이루어집니다.

지표 :

- 일목 균형표 긴코 효

- 텐칸센: 6

- 기준센: 36

- 32 EMA(녹색)

- 200EMA(갈색)

- BTtrend 트리거

기간 : 바람직하게는 4시간 및 일일 차트

통화 페어 : 바람직하게는 메이저 및 마이너 쌍

거래 세션 : 도쿄, 런던, 뉴욕

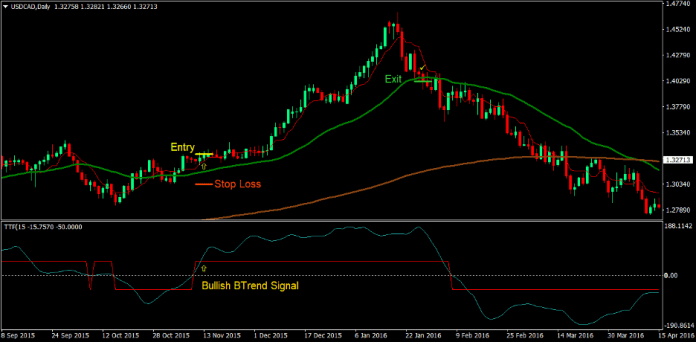

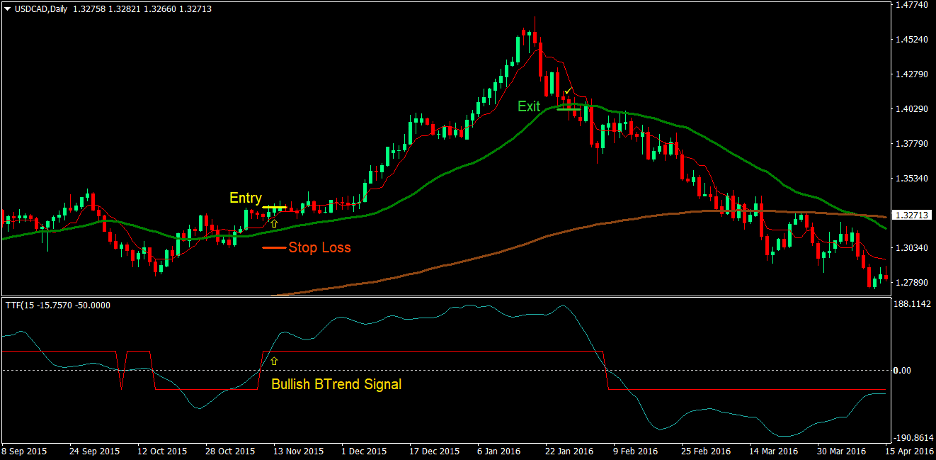

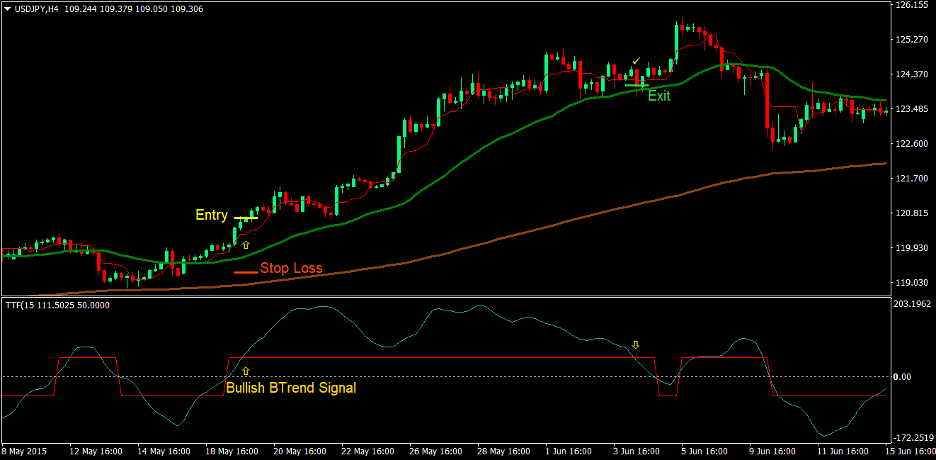

거래 설정 구매

기입

- 가격 조치는 장기적인 강세 추세를 나타내는 200 EMA 이상으로 유지되어야 합니다.

- 기준선은 32 EMA를 교차해야 하며 이는 강세 중기 추세 반전을 나타냅니다.

- BTtrend 트리거 라인(밝은 바다 녹색)은 XNUMX 위에 있으면서 빨간색 선 위로 교차해야 하며 이는 모멘텀에 따른 강세 추세 반전을 확인합니다.

- 이러한 강세 신호는 어느 정도 일치해야 합니다.

- 위 조건의 합류에 구매 주문을 입력하십시오

손실을 중지

- 진입 캔들 아래의 지원 수준에서 손절매 설정

출구

- 양초가 32 EMA 아래로 마감되는 즉시 거래를 종료하세요

- BTtrend 트리거 라인이 빨간색 라인 아래로 교차하는 즉시 거래를 종료하세요.

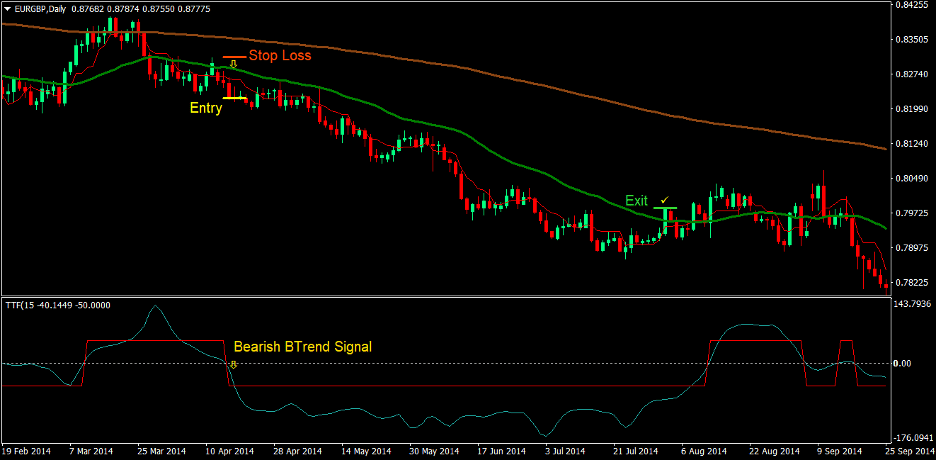

판매 거래 설정

기입

- 가격 조치는 약세 장기 추세를 나타내는 200 EMA 아래에 유지되어야 합니다.

- 기준센 선은 약세 중기 추세 반전을 나타내는 32 EMA 아래로 교차해야 합니다.

- BTtrend 트리거 라인(밝은 바다 녹색)은 XNUMX 아래에 있으면서 빨간색 선 아래로 교차하여 모멘텀에 따른 약세 추세 반전을 확인해야 합니다.

- 이러한 약세 신호는 어느 정도 정렬되어야 합니다.

- 위 조건의 합류점에 매도 주문 입력

손실을 중지

- 진입 캔들 위의 저항 수준에서 손절매 설정

출구

- 캔들이 32 EMA 위에서 닫히자마자 거래를 종료하세요

- BTtrend 트리거 라인이 빨간색 라인 위로 교차하는 즉시 거래를 종료합니다.

결론

이 거래 전략은 탁월한 크로스오버 전략입니다. Tenkan-sen과 Kijun-sen 라인 교차는 효과적인 교차 전략입니다. 그러나 이 전략에서는 더 널리 사용되는 이동평균선인 기준선 대신 32 EMA를 사용합니다. 또한 꽤 오랫동안 추세를 보일 수 있는 거래 항목도 보여줍니다. 거래 신호는 추세 필터 없이도 어느 방향으로든 작동할 수 있지만, 200 EMA를 추가하면 장기 추세에 반대하여 거래하지 않기 때문에 확률이 낮은 거래를 필터링할 수 있습니다. 그런 다음 BTtrend 트리거 신호는 거래 신호에 모멘텀이 있음을 보장합니다.

이 전략은 추세가 강한 시장에서 잘 작동합니다. 또한 진입 신호는 일반적으로 강력한 장기 추세 동안 200 EMA로 되돌린 후이기 때문에 지지 및 저항 돌파와 함께 사용할 때 훨씬 더 잘 작동합니다.

추천 MT4 브로커

XM 브로커

- 무료 $ 50 즉시 거래를 시작하려면! (인출가능이익)

- 입금 보너스 최대 $5,000

- 무제한 로열티 프로그램

- 수상 경력에 빛나는 외환 브로커

- 추가 독점 보너스 일년 내내

FBS 브로커

- 거래 100 보너스: 거래 여정을 시작하려면 $100를 무료로 받으세요!

- 100% 입금 보너스: 예치금을 최대 $10,000까지 두 배로 늘리고, 강화된 자본으로 거래하세요.

- 최대 1 활용 : 3000: 이용 가능한 가장 높은 레버리지 옵션 중 하나로 잠재적 이익을 극대화합니다.

- '아시아 최고의 고객 서비스 브로커' 상: 고객 지원 및 서비스의 우수성을 인정받았습니다.

- 계절별 프로모션: 1년 내내 다양한 독점 보너스와 프로모션 혜택을 누려보세요.

다운로드하려면 여기를 클릭하십시오.