Keltner 브레이크아웃 외환 데이 외환 트레이딩 전략

채널 또는 밴드 기반 지표는 트레이더들 사이에서 가장 인기 있는 도구 중 하나이며, 여기에는 그럴만한 이유가 있을 수 있습니다. 이 전략에서는 가장 과소평가된 채널 기반 지표 중 하나인 Keltner 채널을 살펴보겠습니다.

채널 또는 대역 기반 표시기에는 여러 가지 변형이 있습니다. 우리에게는 항상 인기 있는 볼린저 밴드, Donchian 채널, Keltner 채널 등이 있습니다. 이러한 모든 지표는 몇 가지 약간의 차이점을 제외하고 유사한 기능을 가지고 있습니다. 우선, 이러한 모든 지표는 일반적으로 가격 평균 또는 이동 평균의 형태인 중간선을 기반으로 합니다. 그런 다음 중간선 역할을 하는 평균을 기준으로 외부 밴드도 중간선 위와 아래에 표시됩니다. 이 선은 다양한 계산 및 매개변수를 기반으로 그려집니다. 이는 중간선에서 벗어나거나 최근 최고점 또는 최저점을 기준으로 한 것일 수 있습니다. 마지막으로, 이 모든 것은 가격 차트 자체에 표시됩니다. 이를 통해 거래자는 가격이 이 선 주변 영역에 어떻게 반응하는지 관찰할 수 있습니다.

이러한 지표를 보는 일반적인 방법은 중간선의 터치를 평균 가격으로의 회귀 또는 추세의 변화로 간주하는 것입니다. 반면에 바깥쪽 선은 종종 가격이 반등하여 평균으로 되돌아가기 시작할 수 있는 과도하게 확장된 영역으로 간주됩니다. 어떤 면에서 외곽선은 동적 지지선과 저항선으로 간주될 수도 있습니다. 이러한 기능은 채널 및 대역 기반 표시기를 매우 다양하게 만듭니다. 중간선이 있으면 트레이더는 시장의 편향을 볼 수 있으며 동시에 외부 밴드가 있으면 평균 회귀 거래를 할 수 있습니다.

Keltner 채널 밴드 - 다른 관점

다른 밴드 및 채널 기반 지표와 마찬가지로 Keltner 채널은 일반적으로 Bollinger Bands와 동일한 방식으로 사용됩니다. 그러나 Keltner 채널은 Bollinger Bands와 약간 다릅니다. 중간선은 여전히 지수 이동 평균인 이동 평균의 한 형태입니다. 그러나 더 큰 차이점은 외부 밴드에 있습니다. 볼린저 밴드는 평균의 표준편차를 외부 밴드의 기초로 사용합니다. 반면에 Keltner 채널은 ATR(Average True Range)을 외부 대역의 기초로 사용합니다. 이렇게 하면 더 단순해지지만 여전히 매우 효과적입니다.

이를 염두에 두고 Keltner 채널의 외부 밴드를 보는 두 가지 방법이 있을 수 있습니다. 가장 일반적인 패러다임은 이것이다. 가격이 중간선 위에 있다고 가정하면 시장이 강세 편향을 갖고 있는 것으로 간주합니다. 그런 다음 추세적인 시장 환경에서 가격이 중간선에서 반등하여 상단 외부 밴드를 넘어섰다고 가정해 보겠습니다. 대부분의 평균 회귀 거래자는 가격이 이미 평균에서 상당한 거리에 있기 때문에 이미 과도하게 확장되었다고 생각할 것입니다. 그런 다음 가격이 평균으로 되돌아가기를 바라면서 평균 복귀 거래를 시작합니다. 평균 회귀를 거래하지 않는 다른 거래자들도 가격이 "과도하게 확장"되었다고 말하기 때문에 소외될 수 있습니다. 그러나 생각해보면 우리는 이미 상승 추세에 있다는 것을 확인했습니다. 가격은 또한 캔들 평균 범위의 특정 배수일 수 있는 상단 외부 밴드 위에서 마감되었습니다. 이는 양봉이 밴드 위에서 상당한 거리를 마감하는 모멘텀이 있다는 것을 의미할 수 있습니다. 추진력 없이는 그렇게 멀리 갈 수 없었습니다. 또한 양초가 상단 외부 밴드인 동적 저항에서 벗어났다고 말할 수도 있습니다.

거래 전략 개념

이 전략은 Keltner 채널의 외부 밴드를 넘어서는 강력한 마감을 강력한 모멘텀의 신호로 간주합니다. 따라서 평균 복귀 거래를 취하는 대신 모멘텀 돌파 캔들 방향으로 거래를 할 것입니다.

이 방향을 취함으로써 우리는 촛불의 모멘텀을 타고 아마도 새로운 추세의 시작점에 서게 될 것입니다.

표시

- Keltner_Channel 사용자 정의 표시기

- 길이 – 20

- 타임즈 ATR – 2

기간: 5분, 15분, 1시간 차트

통화 쌍: 모든 주요 쌍, 마이너 쌍 및 낮은 스프레드의 교차

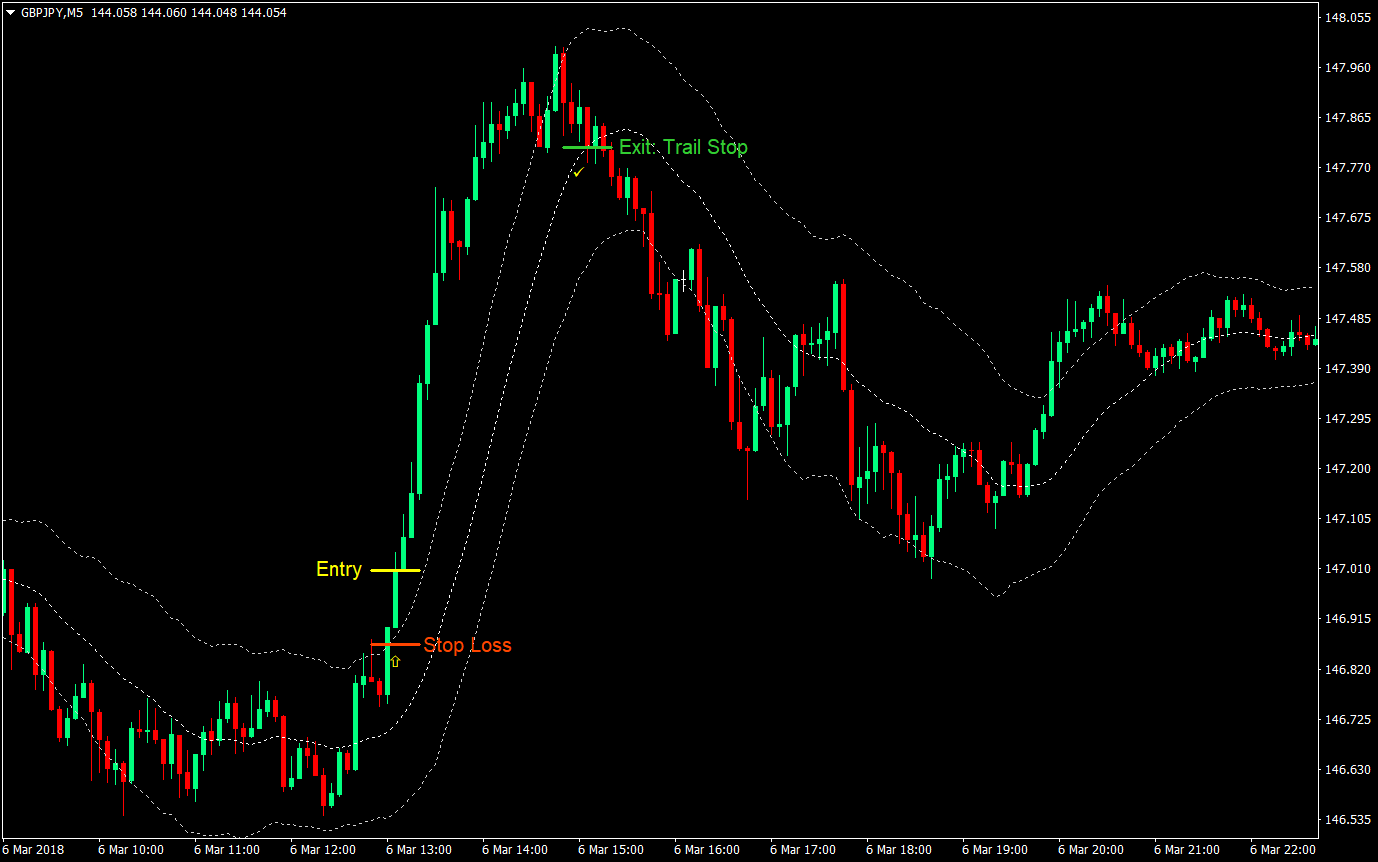

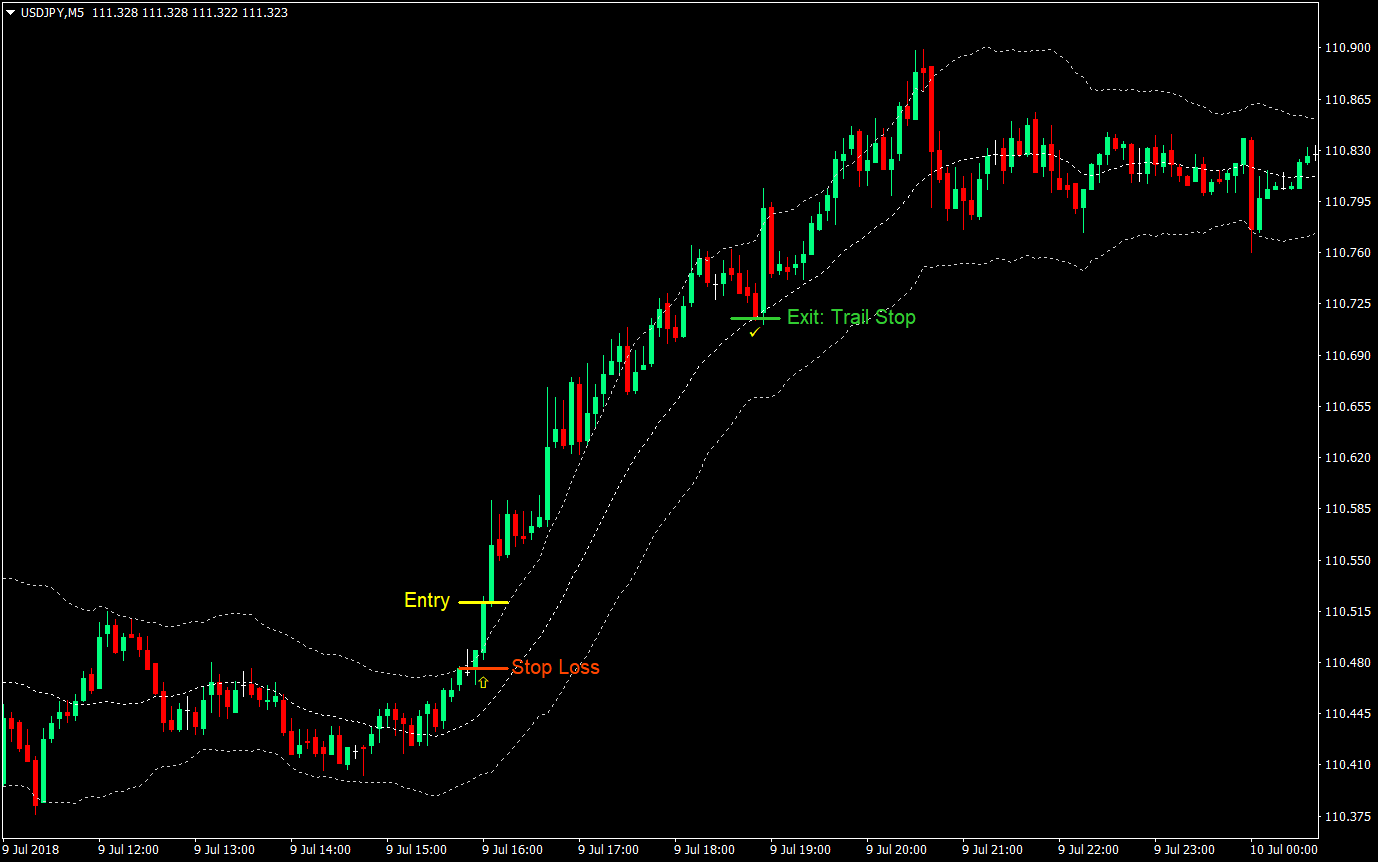

(장기) 거래 설정 규칙 구매

기입

- 가격은 중간선보다 높아야 합니다. Keltner_Channel

- 강한 모멘텀 캔들은 상단 외부 밴드 위에서 마감되어야 합니다. Keltner_Channel

- 캔들 마감 시 매수 시장 주문 입력

손실을 중지

- 진입 캔들과 상단 외부 밴드 아래에 정지 손실을 설정합니다.

출구

- 정지 손실을 중앙선 아래로 추적합니다. Keltner_Channel 수익이 중단될 때까지

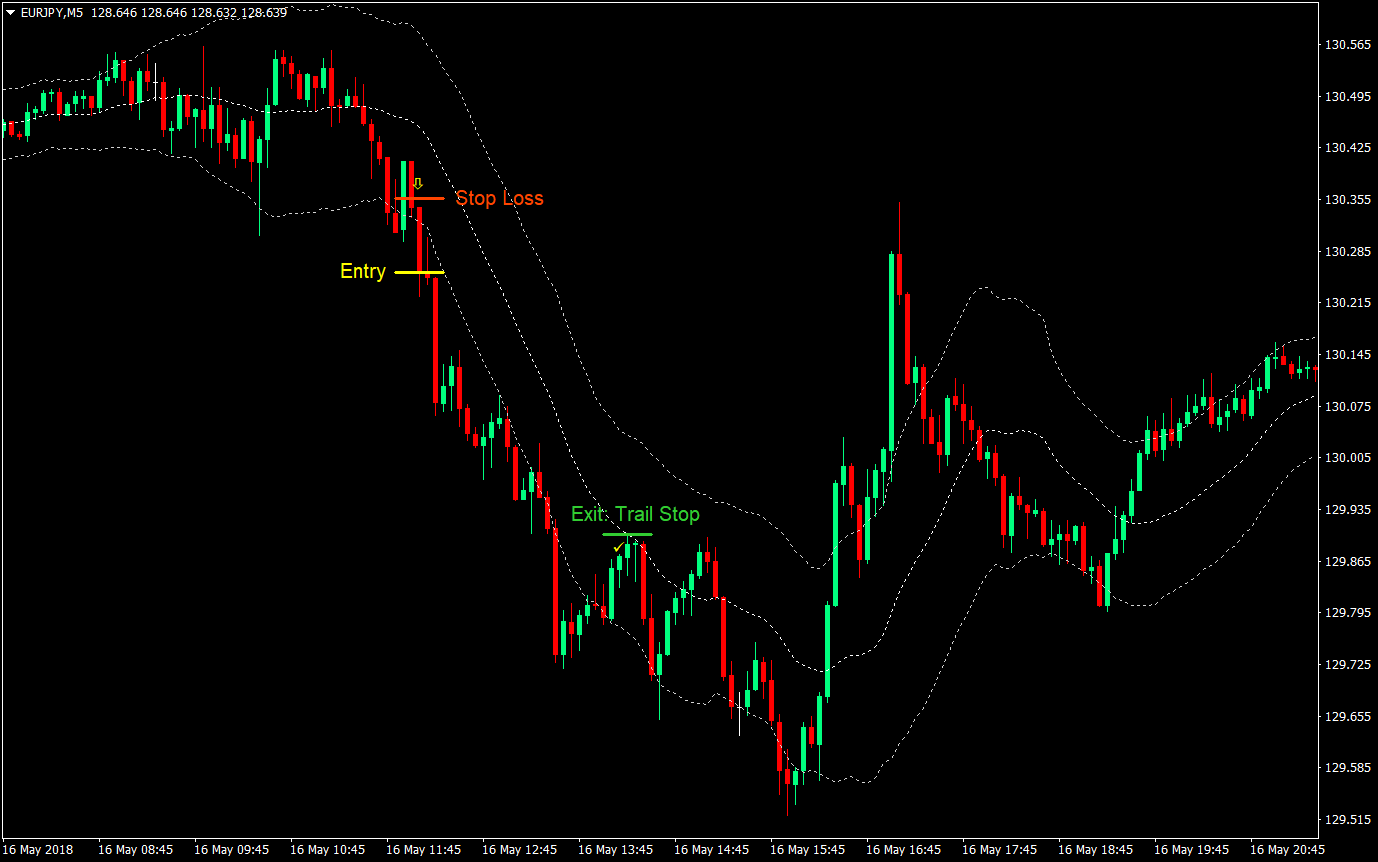

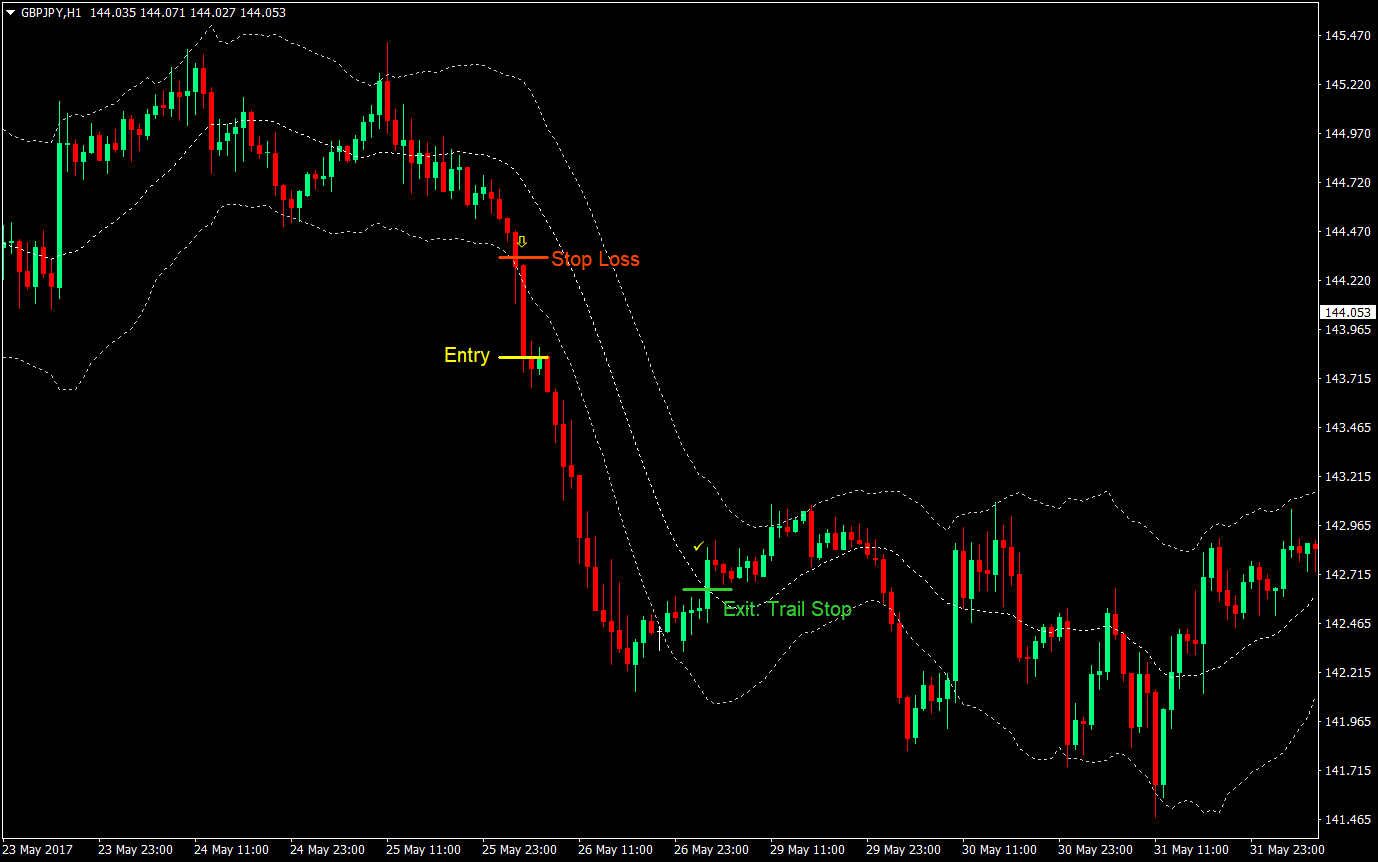

매도(매도) 거래 설정 규칙

기입

- 가격은 중간선 아래에 있어야 합니다. Keltner_Channel

- 강한 모멘텀 캔들은 하단 외부 밴드 아래에서 마감되어야 합니다. Keltner_Channel

- 캔들 마감 시 매도 시장 주문을 입력하세요.

손실을 중지

- 진입 캔들과 하단 외부 밴드 위에 정지 손실을 설정합니다.

출구

- 정지 손실을 중앙선 위로 추적합니다. Keltner_Channel 수익이 중단될 때까지

결론

이 전략의 핵심은 올바른 모멘텀 캔들 돌파를 식별하는 것입니다. 외부 밴드의 작은 피어싱만 거래하면 안 됩니다. 여전히 반등할 수 있기 때문입니다.

또한 브레이크아웃 캔들은 통합 또는 중간선의 올바른 쪽 또는 중간선에서 허용되는 가격대에서 벗어나야 합니다. 강세 거래를 하는 경우 통합은 중간선 또는 중간선 위에 있어야 합니다. 약세 거래 설정을 위해 뒤집어보세요. 이를 염두에 두고, 모멘텀 양초가 밴드 반대편의 통합에서 나온 경우 거래를 할 때 각별히 주의하십시오. 이는 모멘텀이 이미 몇 개의 양초 뒤로 시작되었고 모멘텀이 이미 소멸되고 있음을 의미할 수 있기 때문입니다.

이는 일일 거래 전략이므로 기간에 대해서도 논의해 보겠습니다. 이 특정 전략은 위에서 언급한 것 외에도 일부 설정에서도 작동할 수 있습니다. 1분 차트 또는 4시간 차트에서 이루어질 수 있습니다. 그러나 1분 차트에서는 뚜렷한 추세에도 불구하고 가격이 중간선으로 되돌아오는 경우가 많습니다. 이로 인해 거래자로서 시장에 너무 자주 들어오고 나갈 수 있으며 거래당 많은 비용이 발생할 수 있습니다. 이는 5분 차트에서 가장 잘 거래되지만 특히 모멘텀 뒤에 뉴스가 있고 거래 세션이 시작될 때 거래가 시작된 경우 15분 및 1시간 차트에서도 작동할 수 있습니다. 그럼에도 불구하고 4시간 차트 이상에서 스윙 트레이드로 사용될 수도 있지만, 날이 갈수록 반대 정서나 뉴스가 전개될 수 있기 때문에 더 높은 시간대에서는 강한 추세가 그렇게 오래 지속되지 않는 것 같습니다.

건배하시고 즐거운 거래 되세요!

추천 MT4 브로커

- 무료 $ 50 즉시 거래를 시작하려면! (인출 가능한 이익)

- 입금 보너스 최대 $5,000

- 무제한 로열티 프로그램

- 수상 경력에 빛나는 외환 브로커

- 추가 독점 보너스 일년 내내

다운로드하려면 여기를 클릭하십시오.