시장은 종종 매우 혼란스럽고 예측할 수 없습니다. 이는 외환 시장에서 특히 그렇습니다. 외환 시장은 가장 변동성이 큰 시장 중 하나이며 언제든지 어떤 방향으로든 움직일 수 있습니다. 그러나 시장 움직임을 예측하는 방법을 찾은 일부 거래자가 있습니다.

시장 움직임을 읽고 예측하는 방법에는 여러 가지가 있습니다. 가장 널리 사용되는 방법 중 하나는 엘리엇 파동 이론을 사용하는 것입니다.

엘리엇 파동 이론은 많은 거래자가 시장 움직임을 예측하기 위해 사용하는 기술적 분석 방법입니다. 이 방법의 기본 아이디어는 시장이 동일한 유형의 패턴을 반복적으로 형성한다는 것입니다. 이러한 패턴은 가격이 일정 기간 동안 특정 방향으로 밀려나다가 다시 하락하는 파동으로 구성됩니다. 몇 번의 파도가 지나면 가격은 일반적으로 반전됩니다.

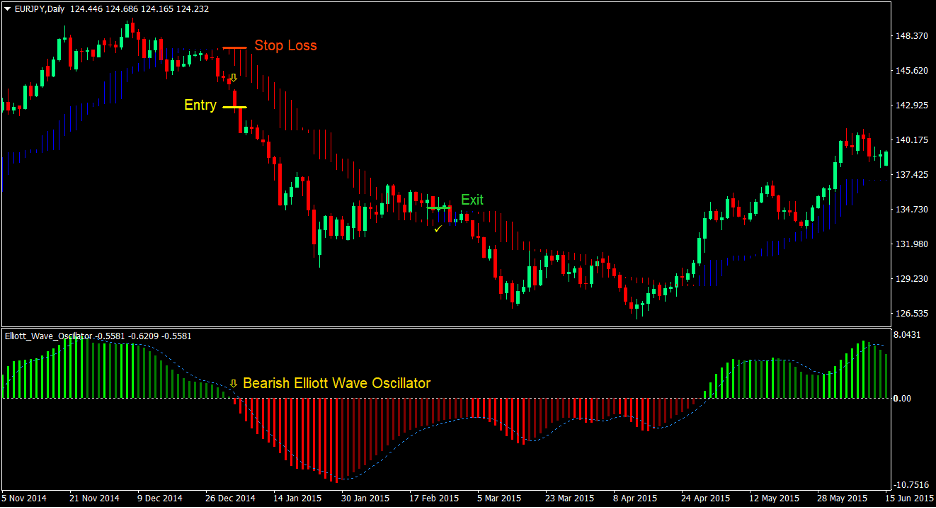

Elliot Wave Oscillator 외환 트레이딩 전략은 트레이더가 지표를 사용하여 파도의 방향을 식별하는 데 도움이 됩니다. 파동의 방향과 추세의 가능한 반전 지점에 관한 이러한 단서는 거래자에게 실행 가능한 진입점을 제공합니다. 이를 통해 트레이더는 새로운 물결이 시작될 때 시장에 진입할 수 있으며, 이는 추세를 가져올 수 있습니다.

엘리엇 파동 발진기 표시기

엘리엇 웨이브 오실레이터(Elliott Wave Oscillator)는 거래자가 추세의 일반적인 방향뿐만 아니라 파도를 식별하는 데 도움이 되는 맞춤형 지표입니다.

두 개의 단순 이동 평균(SMA) 간의 차이를 표시하여 파도와 추세를 나타냅니다. 그러면 차이가 히스토그램으로 표시됩니다.

웨이브는 히스토그램이 이전보다 더 짧은지 또는 더 높은지에 따라 결정됩니다. 점차 길어지는 히스토그램은 현재 파동이 현재 추세의 방향으로 가고 있음을 나타내고, 점점 짧아지는 히스토그램은 되돌림을 나타냅니다.

일반적인 추세 방향도 히스토그램을 기반으로 합니다. 양수 히스토그램은 강세 추세 방향을 나타내고, 음수 히스토그램은 약세 추세 방향을 나타냅니다. 따라서 양수에서 음수로 또는 그 반대로 교차하는 것은 추세 반전 신호로 간주됩니다.

추세 관리자 표시기

추세 관리자 지표는 거래자가 추세 방향을 식별하는 데 도움이 되는 모멘텀 기반 맞춤형 지표입니다.

가격 차트에 막대를 그려 추세 방향을 나타냅니다. 이 막대는 가격 조치를 그림자합니다. 가격이 추세 방향으로 밀릴 때마다 확장되고 가격이 되돌릴 때마다 단축됩니다.

또한 막대의 색상을 기준으로 추세 방향을 나타냅니다. 강세 추세에는 파란색 막대가 표시되고 약세 추세에는 빨간색 막대가 표시됩니다. 트레이더들은 막대 색상의 변화를 단기 추세 반전에 따른 진입 신호로 사용합니다.

무역 전략

이 거래 전략은 Elliott Wave Oscillator의 추세 반전과 Trend Manager 지표의 합류를 기반으로 거래 신호를 제공합니다.

Elliott Wave Oscillator는 히스토그램이 긍정적인지 부정적인지에 따라 추세에 대한 장기적인 관점을 제공합니다.

반면에 Trend Manager 지표는 막대 색상 변경을 기반으로 Elliott Wave Oscillator에 비해 단기적인 관점을 제공합니다.

이 두 지표가 밀접하게 일치하는 거래 신호를 제공할 때마다 거래 신호는 더 높은 정확도를 갖는 경향이 있으며 일반적으로 두 지표가 나타내는 방향을 따릅니다.

그런 다음 트레이더는 지표 중 하나가 반전 가능성을 나타낼 때까지 새로운 추세를 탈 수 있습니다. 이는 일반적으로 Trend Manager 표시기의 색상이 변경되는 것입니다.

지표 :

- 트렌드매니저

- TM 기간: 21

- TM 시프트: 4

- Elliott_Wave_Oscillator

- 느린 MA: 45

기간 : 바람직하게는 1시간, 4시간 및 일일 차트(더 낮은 정확도로 더 낮은 시간대에서 수행될 수 있음)

통화 페어 : 메이저 및 마이너 쌍

거래 세션 : 도쿄, 런던, 뉴욕

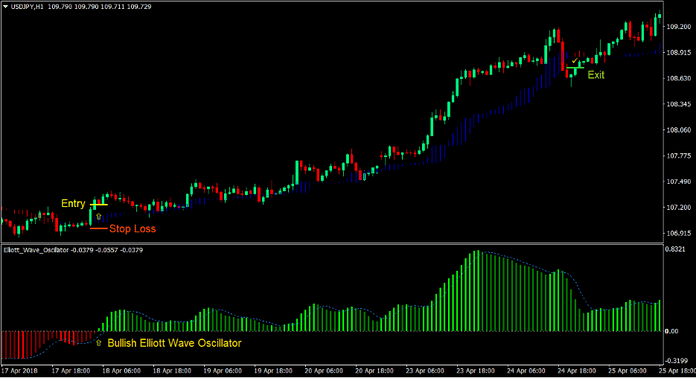

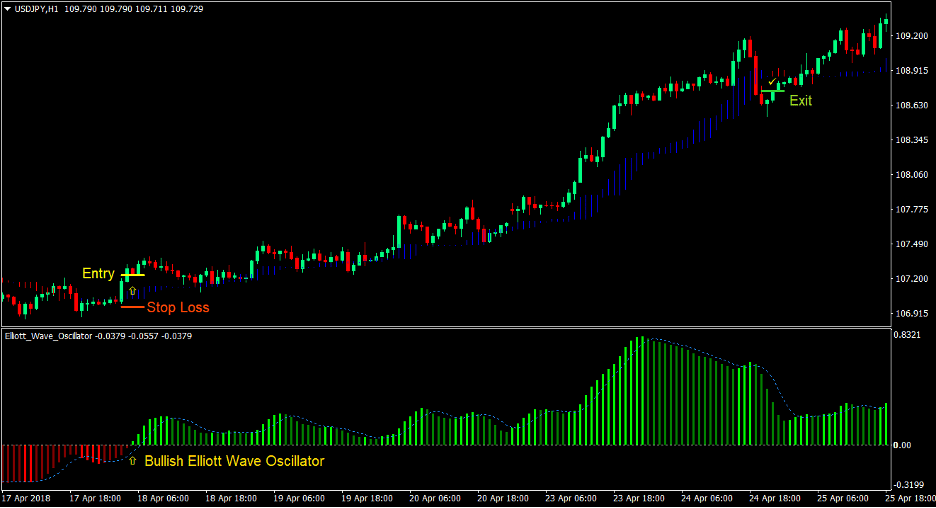

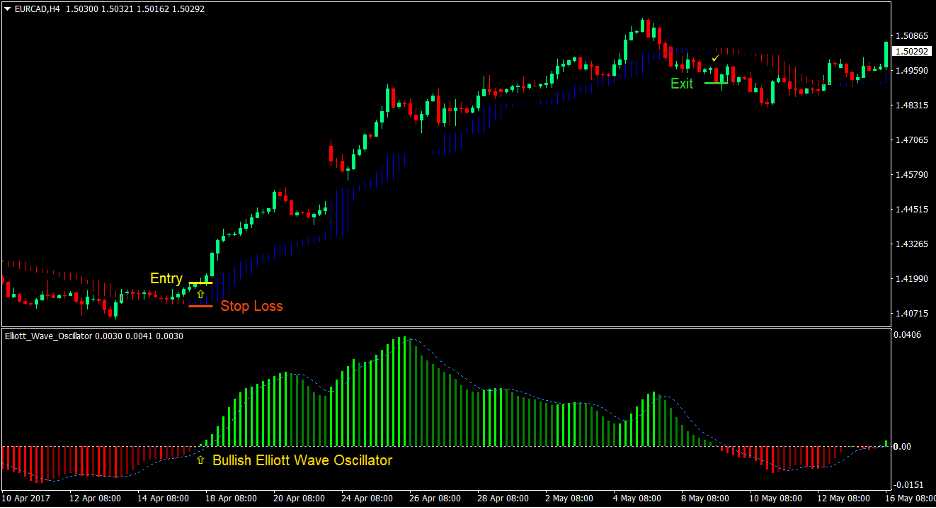

거래 설정 구매

기입

- 가격은 추세 관리자 표시기 위로 교차해야 합니다.

- 추세 관리자 표시기는 강세 추세 반전을 나타내는 파란색으로 변경되어야 합니다.

- 엘리엇 웨이브 오실레이터는 강세 추세 반전을 의미하는 XNUMX 위로 교차해야 합니다.

- 이러한 강세 추세 반전 신호는 밀접하게 정렬되어야합니다.

- 위 조건의 합류에 구매 주문을 입력하십시오

손실을 중지

- 진입 캔들 아래의 지원 수준에서 손절매 설정

출구

- 추세 관리자 표시기가 빨간색으로 변경되는 즉시 거래를 종료합니다.

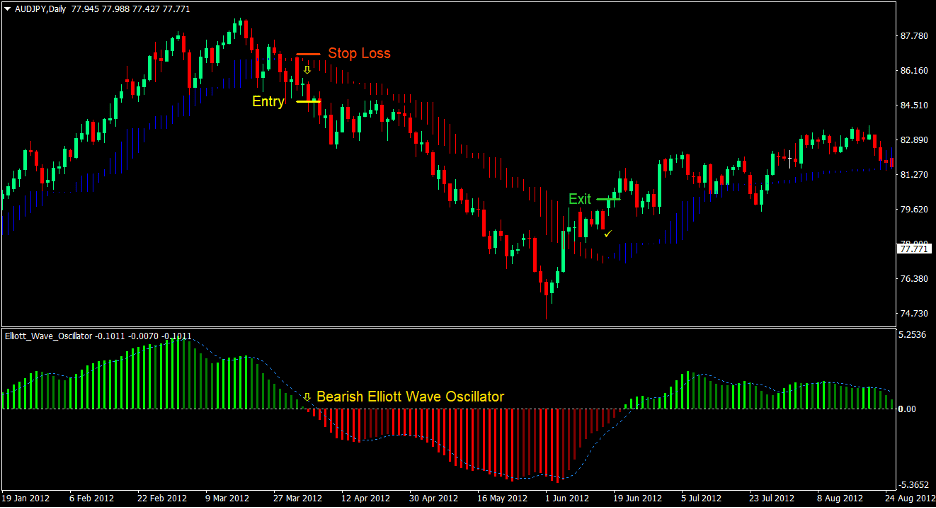

판매 거래 설정

기입

- 가격은 추세 관리자 표시 아래로 교차해야 합니다.

- 추세 관리자 표시는 약세 추세 반전을 나타내는 빨간색으로 변경되어야 합니다.

- 엘리엇 웨이브 오실레이터는 약세 추세 반전을 의미하는 XNUMX 아래로 교차해야 합니다.

- 이러한 하락 추세 반전 신호는 밀접하게 정렬되어야합니다.

- 위 조건의 합류점에 매도 주문 입력

손실을 중지

- 진입 캔들 위의 저항 수준에서 손절매 설정

출구

- 추세 관리자 표시기가 파란색으로 바뀌는 즉시 거래를 종료하세요.

결론

이 거래 전략은 추세적인 시장 환경과 잠재적인 추세 반전 설정에서 가장 잘 작동합니다. 이러한 상황에서는 장기적인 추세가 형성되어 트레이더가 단일 거래에서 최대 5배의 위험을 얻을 수 있습니다.

이 전략은 엘리엇 파동 이론을 기반으로 하지만 반드시 엘리엇 파동 패턴의 반전 지점에서 거래가 형성되어야 하는 것은 아닙니다. 명확한 엘리엇 웨이브 패턴이 없어도 엘리엇 웨이브 오실레이터가 추세 반전을 나타내는 경우가 있습니다. 핵심은 Trend Manager 지표와 Elliott Wave Oscillator 사이의 합류점을 찾는 것입니다.

개방형 이익 목표를 가지고 추세 추종 전략을 거래할 때 전략과 거래 관리 기술을 결합하는 것이 중요합니다. 거래자는 편안한 거리에서 정지 손실을 추적해야 합니다.

현명하게 거래하세요!!

추천 MT4 브로커

XM 브로커

- 무료 $ 50 즉시 거래를 시작하려면! (인출가능이익)

- 입금 보너스 최대 $5,000

- 무제한 로열티 프로그램

- 수상 경력에 빛나는 외환 브로커

- 추가 독점 보너스 일년 내내

FBS 브로커

- 거래 100 보너스: 거래 여정을 시작하려면 $100를 무료로 받으세요!

- 100% 입금 보너스: 예치금을 최대 $10,000까지 두 배로 늘리고, 강화된 자본으로 거래하세요.

- 최대 1 활용 : 3000: 이용 가능한 가장 높은 레버리지 옵션 중 하나로 잠재적 이익을 극대화합니다.

- '아시아 최고의 고객 서비스 브로커' 상: 고객 지원 및 서비스의 우수성을 인정받았습니다.

- 계절별 프로모션: 1년 내내 다양한 독점 보너스와 프로모션 혜택을 누려보세요.

다운로드하려면 여기를 클릭하십시오.