「上に来るものは必ず下に来る!」

買われ過ぎまたは売られ過ぎの市場レベルからの反転シグナルは、本質的に高確率のモメンタム反転取引セットアップです。 これは、このような極端な価格は持続不可能であることが多いためです。 遅かれ早かれ、市場参加者はそのような市況に不快感を覚え、価格が逆転するでしょう。

議論されている取引戦略は、XNUMX つのテクニカル指標を使用して反転取引シグナルの合流点を利用する反転取引戦略です。

スーパー パスバンド フィルター 2 インジケーター

スーパー パスバンド フィルター 2 インジケーターは、John Ehlers によって開発されたカスタマイズされたオシレーター タイプのインジケーターで、アナログ フィルターに基づく平滑化技術を利用します。 ほとんどの平滑化方法が傾向がある価格スパイクによって生成される不要な異常値を除外すると同時に、多くのインジケーターの一般的な弱点でもあるラグを減らすように設計されています。 これを達成するために、John Ehler はこの指標の背後にあるアルゴリズムを開発し、ノイズとラグの両方を最小限に抑えるために、価格データ内の高周波成分と低周波成分の両方を排除しました。

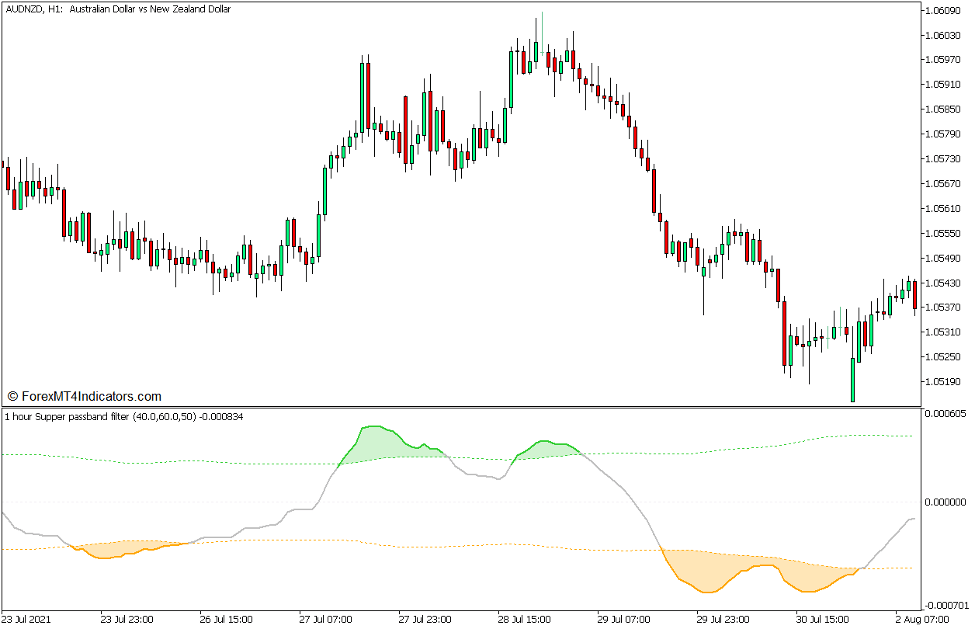

このインジケーターは、ゼロ付近で振動する平滑化されたオシレーター ラインをプロットします。 このラインはメインのスーパー パスバンド フィルター ラインです。 市場の方向性または勢いは、ラインがゼロに対してどこにあるかに基づいて観察される場合があります。 正の値は強気のモメンタム バイアスを示し、負の値は弱気のモメンタム バイアスを示します。 ラインとゼロの間のクロスオーバーは、トレンドまたはモメンタムの反転シグナルとしても使用できます。

スーパー パスバンド フィルター 2 インジケーターには、二乗平均平方根 (RMS) の概念も組み込まれており、極端な価格を示します。 ゼロを包囲する XNUMX つの線をプロットします。 上のラインが +RMS ラインで、下のラインが -RMS ラインです。 オシレーター ラインが +RMS ラインを上回っている場合は買われ過ぎ、オシレーター ラインが -RMS ラインを下回っている場合は売られ過ぎと見なされる場合があります。 そのようなトレーダーは、市場がどちらかの極端な価格にあるときはいつでも、潜在的な市場の反転を予測することもできます.

スーパー パスバンド フィルター 2 インジケーターはオシレーター型のテクニカル インジケーターであるため、ダイバージェンスに基づいて反転の可能性を識別するためにも使用できます。 トレーダーは、可能性のある市場の反転シナリオを探すときに、このパラメーターを追加の合流点として使用できます。

ピンバーインジケーター

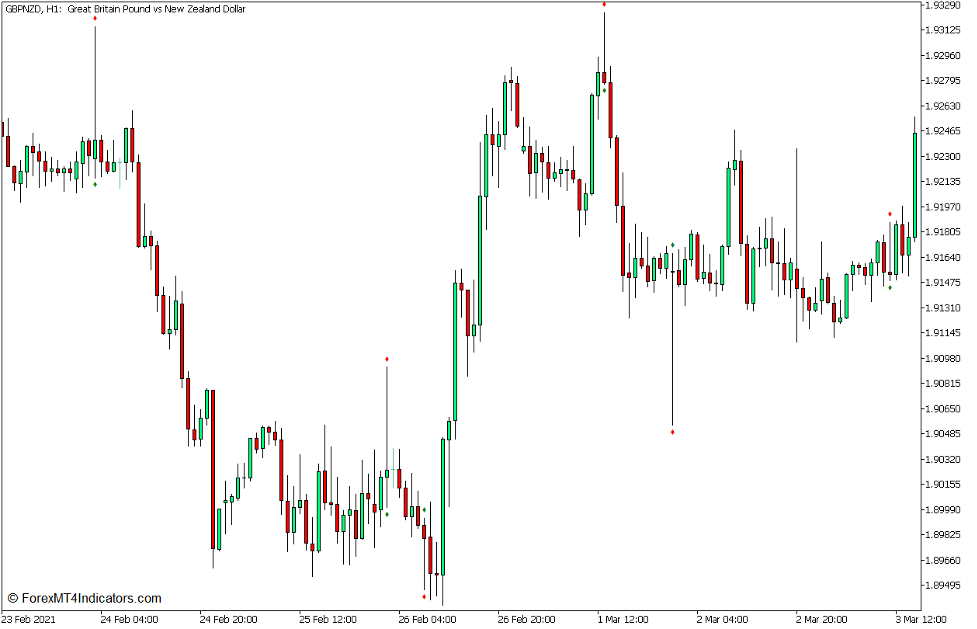

ローソク足パターンは、ローソク足チャートで観察できる繰り返し可能なパターンです。 これらのパターンは、潜在的な勢いの反転を示す効果的な指標です。 これは、ローソク足のパターンが、特定の価格レベルに関連して市場がどのように動いているかを物語っているためです。

ピンバー パターンは、その有効性から、おそらく最も広く使用されているローソク足パターンの XNUMX つです。 これは、ピン バー パターンが、価格が特定の市場の方向性または価格レベルをどのように拒否しているかを物語っているためです。

ピンバー パターンは、XNUMX つのローソク足で構成されます。 本体が小さく、片側の芯が長いキャンドルです。 運動量反転の方向は、長い芯がその小さな体に対してどこにあるかに基づいて識別できます。 長い芯がろうそくの小さな本体の下にあるときはいつでも勢いは強気であり、長い芯がろうそくの本体の上にあるときはいつでも弱気です. ろうそくの脚がサポートまたはレジスタンス レベルに逆らって蹴るのと同じように、長い芯を想像してみてください。

ピンバー インジケーターは、ピンバー パターンを自動的に識別するカスタム テクニカル インジケーターです。 ローソクがピン バー パターンであることを示すために、ローソクの上下に緑と赤のダイアモンド シンボルがプロットされます。 ピン バー パターン信号の方向は、緑色のひし形記号の位置によって示されます。 緑のひし形がろうそくの上にあるときは強気であり、緑のひし形がろうそくの下にあるときは弱気です。

取引戦略コンセプト

MT5のスーパーパスバンドフィルター発散外国為替取引戦略は、発散、価格拒否、および買われ過ぎまたは売られ過ぎの市場条件で取引する反転取引戦略です。

スーパー パスバンド フィルター 2 インジケーターは、主に買われ過ぎと売られ過ぎの市場を識別するために使用されます。 これは、メイン オシレータ ラインが +RMS ラインより上か、-RMS ラインより下かによって決まります。

買われ過ぎと売られ過ぎの状態とは別に、トレーダーはスーパー パスバンド フィルター ラインの振動に基づいて発散の可能性を観察する必要があります。

上記の条件が満たされている場合、トレーダーは可能性のある取引エントリを探すことができます。 トレード シグナルは、ピン バー インジケーターで識別できるピン バー パターンに基づいて有効と見なされます。

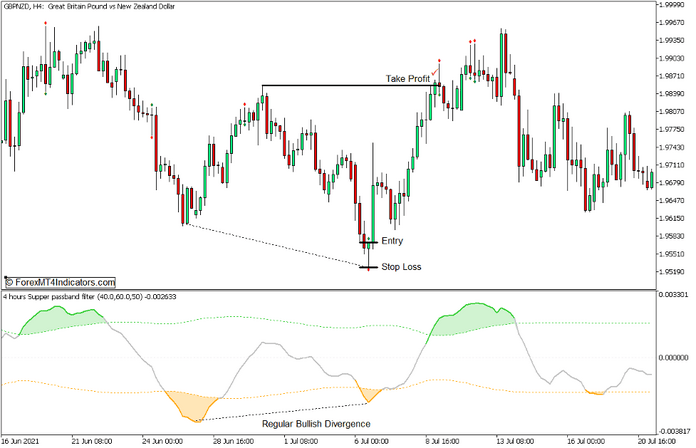

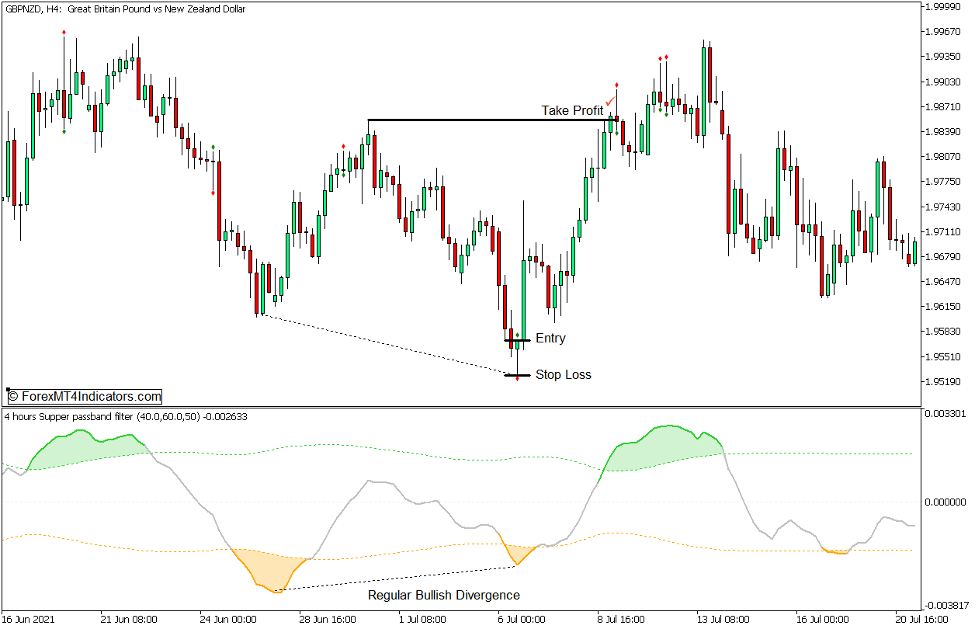

トレードセットアップを購入する

入門

- スーパー パスバンド フィルター 2 のラインは、-RMS ラインよりも低くなるはずです。

- 価格行動の振動とスーパー パスバンド フィルター 2 ラインの間に強気の発散が見られるはずです。

- ロウソクの上に緑色のひし形記号、ロウソクの下に赤いひし形記号をプロットする強気のピンバー パターンをピン バー インジケーターが識別した場合、買いトレード エントリは有効です。

ストップロス

- ピンバーパターンの下にストップロスを設定します。

出口

- エントリーキャンドルの上の次のスイングハイレベルでテイクプロフィットを設定します.

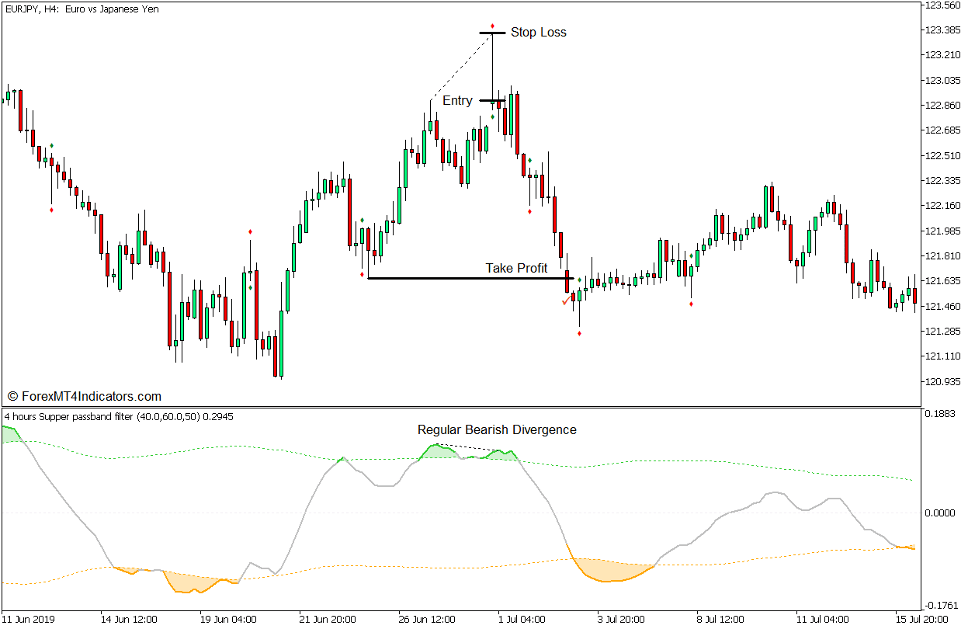

トレードセットアップを売る

入門

- スーパー パスバンド フィルター 2 のラインは、+RMS ラインを超える必要があります。

- 価格行動の振動とスーパー パスバンド フィルター 2 ラインの間に弱気の発散が見られるはずです。

- ピン バー インジケーターがローソク足の下に緑色のひし形記号をプロットし、ろうそくの上に赤いひし形記号をプロットする弱気のピン バー パターンを識別する場合、売りトレード エントリは有効です。

ストップロス

- ピンバーパターンの上にストップロスを設定します。

出口

- エントリーキャンドルの下の次のスイングローレベルでテイクプロフィットを設定します.

まとめ

個々に、買われ過ぎと売られ過ぎの市況、乖離、価格の拒否など、上記で説明した概念は、市場の逆転の可能性を強く示しています。 一部のトレーダーは、これらの個々の指標を反転トレード設定の焦点として使用することさえあります. この戦略では、XNUMX つの要素の合流点を探すことで、XNUMX つの要素を組み合わせます。 このため、この設定によって生成される取引は少なくなる可能性がありますが、多くの場合、より信頼性が高くなります。 これは、他の反転トレード設定と組み合わせれば、より信頼性を高めることができます.

おすすめのMT5ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。