新規トレーダーがFXを始めたばかりの頃はビギナーズラッキーと感じるケースが多いです。 このような場合、新しいトレーダーは一連の勝利取引を経験します。 彼らが良い取引戦略に出くわしたからかもしれませんし、単に運が良かっただけかもしれません. ほとんどの場合、これらのトレーダーは、自分が無敵であり、市場がどこに行くかを正確に予測できると感じ始めるか、さらに悪いことに、外国為替市場を支配できると考えるようになります。

外国為替市場は、世界最大の取引市場です。 5.1日の平均取引量は約XNUMX兆ドルと推定されています。 これらの数千、さらには数百万のトレーダーが何をするかを予測することは、それ自体がすでに偉業です。 この規模で市場の流れを左右できると考えるのは正気ではありません。 個人トレーダーのボリュームが外国為替市場の流れを決定する方法はありません。 ベテランのトレーダーは、これが不可能であることを知っており、市場の方向性を誤って読んだ場合はいつでも損失を受け入れるのに十分謙虚です.

小売トレーダーには XNUMX つの仕事があり、それは市場の流れに乗ることです。 市場の流れに乗る最善の方法の XNUMX つは、市場の勢いに合わせて取引することです。 モメンタムの強い市場または通貨ペアは、停止するのが非常に難しく、モメンタム価格の動きの方向を継続する可能性が高くなります。

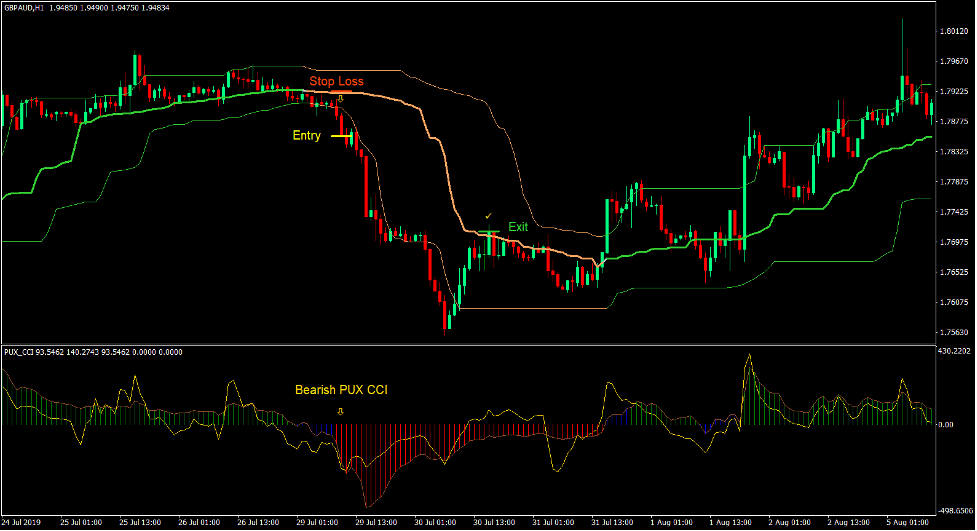

PUX CCI Momentum Breakout Forex Trading Strategy は、トレーダーが強力なモメンタム ブレイクアウトの価格アクションを特定できるようにするモメンタム戦略です。 これにより、新しい勢いが確認されると、トレーダーは取引に参加できます。 トレーダーは、勢いのある価格の動きによって開始された市場のトレンドや流れに乗ることができます.

分位バンド

Quantile Bands インジケーターは、統計における確率論に基づくテクニカル インジケーターです。 分位点は基本的に、確率分布の範囲を、確率が等しい連続した分布に分割するカット ポイントです。 作成されるグループの数は、確率分布を分割する分位数より常に XNUMX つ多くなります。 この指標の場合、可能性の高い価格変動の範囲が XNUMX 分位分カットされ、XNUMX つのグループまたは領域が作成されます。

分位帯は XNUMX つの線をプロットします。 正中線は分位数です。 これは、修正移動平均に基づいています。 外側のバンドは、非常に可能性の高い価格変動の範囲を示します。 これらの XNUMX つのラインは、XNUMX つの領域を持つバンドのような構造を形成します。

トレンドの方向またはバイアスは通常、正中線の傾きに基づいて識別されます。 ボラティリティは、バンドの収縮と拡大に基づいて観察されます。 トレンドのモメンタムも、モメンタムの方向が強化されている外側の線の拡大に基づいて識別されます。

PUX CCI

PUX CCI は、コモディティ チャネル インデックス (CCI) インジケーターに基づくカスタム テクニカル インジケーターです。

その名前にもかかわらず、CCI インジケーターは、取引可能な資産または外国為替通貨ペアで使用できます。 CCI は、トレンドの方向またはバイアスの長期的な変化を見つけるために開発されましたが、より低い時間枠でも使用できます。

CCI は、正または負のいずれかになる可能性がある線をプロットするオシレーター タイプのテクニカル インジケーターです。 この行は、 典型的な価格 および単純移動平均 (SMA) を 0.15 の積で割り、 平均偏差.

PUX CCI は、メインの CCI ラインから派生した別のラインを追加することにより、元の CCI インジケーターを変更します。 CCI ラインは特徴的にギザギザです。 これは、CCI ラインが価格の動きに非常に敏感であるためです。 ただし、価格の急上昇の影響も受けやすくなります。 CCI ラインから派生した XNUMX 番目のラインは、価格スパイクの影響を受けにくい、よりスムーズなラインです。

正の線は強気の方向性バイアスを示し、負の線は弱気の方向性バイアスを示します。

取引戦略

この取引戦略は、市場の混雑からのブレイクアウトで取引するモメンタム取引戦略です。

まず、PUX CCI インジケーターを使用して方向性トレンド バイアスを特定します。 傾向は、ゼロである正中線に対する XNUMX つの線の一般的な位置に基づいて識別されます。

次に、方向バイアスが特定されるとすぐに、Quantile Bands インジケーターを使用して混雑ゾーンからのブレイクアウトを探すことができます。 分位帯の輻輳に基づいて、輻輳ゾーンを特定できます。 モメンタム ブレイクアウトは、クォンタイル バンドの外側で強くクローズするモメンタム ローソク足に基づいて識別されます。

インジケータ:

- 分位バンド 3

- PUX_CCI

- CCI期間: 60

- TCCI期間: 18

優先時間枠: 1時間、4時間、および毎日のチャート

通貨ペア: FXメジャー、マイナー、クロス

取引セッション: 東京、ロンドン、ニューヨークのセッション

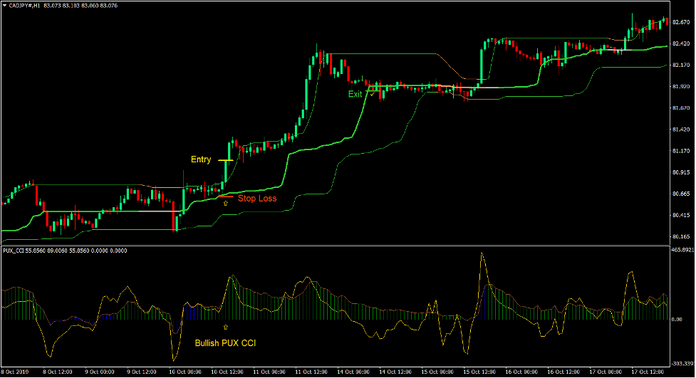

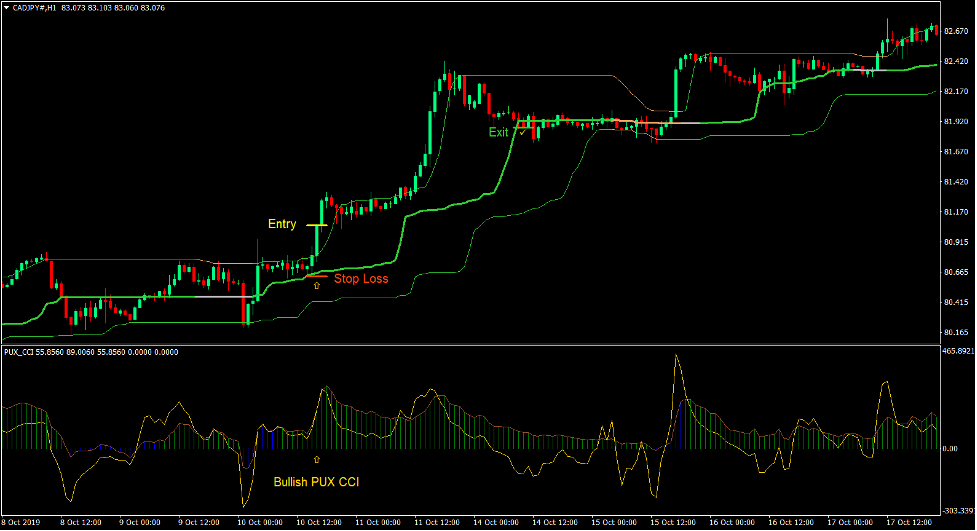

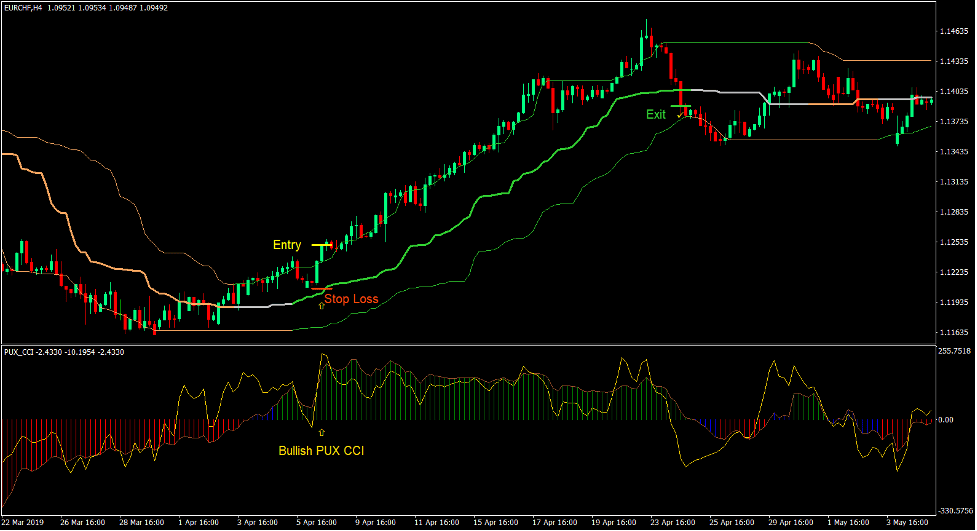

トレードセットアップを購入する

入門

- PUX CCI ラインは、一般に正である必要があります。

- 分位帯は輻輳フェーズに入る必要があります。

- 強気のモメンタム キャンドルは、クォンタイル バンドの上部ラインの上で強く閉じる必要があります。

- これらの条件を確認して、購入注文を入力します。

ストップロス

- エントリーキャンドルの下のサポートにストップロスを設定します。

出口

- 価格がクォンタイル バンドの中央線を下回ったらすぐに取引を終了します。

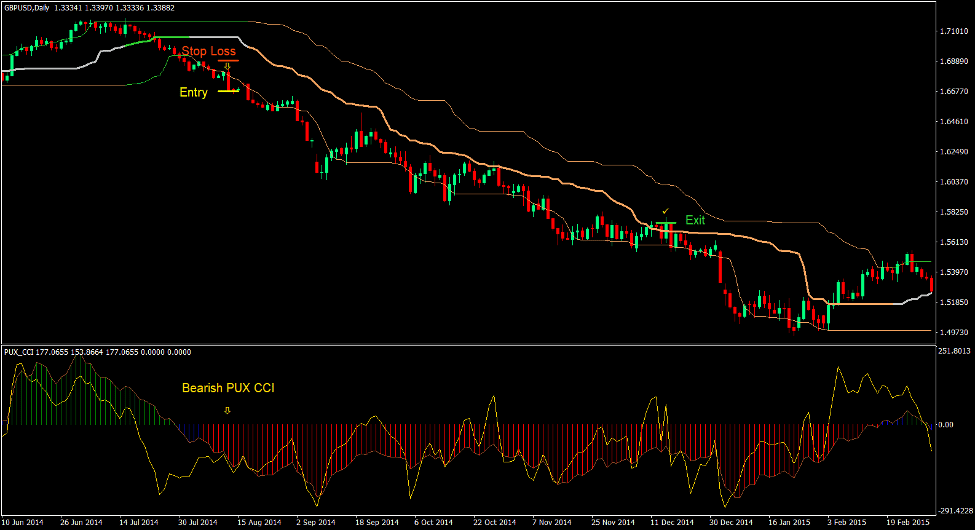

トレードセットアップを売る

入門

- PUX CCI ラインは通常、負の値にする必要があります。

- 分位帯は輻輳フェーズに入る必要があります。

- 弱気のモメンタム キャンドルは、クォンタイル バンド ラインの下で強く閉じる必要があります。

- これらの条件を確認して、販売注文を入力します。

ストップロス

- エントリーキャンドルの上の抵抗にストップロスを設定します。

出口

- 価格がクォンタイル バンドの中央線を超えたらすぐに取引を終了します。

まとめ

この取引戦略は、勢いのあるブレークアウトタイプの戦略です. これは、トレーダーがトレンドの方向性バイアスと一致しない取引を最初に除外できるためです。 トレーダーは、クォンタイル バンドを使用して有効なモメンタム ブレイクアウトを客観的に特定することもできます。

分位帯などのバンドのような構造を使用したモメンタム ブレイクアウトは、有効なトレーディング戦略です。 ただし、トレーダーは、モメンタムキャンドルが形成されるにつれて、価格を追い続けないように注意する必要があります. 価格がすでに大きく動いている場合は、取引を追跡するのではなく、手放すことをお勧めします。

モメンタムの価格行動に基づいて、モメンタムの良い取引機会を特定できるトレーダーは、この戦略を利用して市場から利益を得ることができます。

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。