市場の開始時間は、取引セッションの中で最も混雑する時間帯の 1 つです。トレーダーは取引開始前に取引計画を準備し、取引を実行する準備ができています。誰もが市場がどこに向かうのか、どこで勢いが増すのかを観察しながら見守っています。多くの場合、取引を行う意思のあるトレーダーがまだ多くいるため、価格の上昇、上昇、ブレイクアウト、またはトレンドの開始を可能にするのに十分な量が存在します。取引日を通してほとんどのお金が儲かるのは市場が開いている間です。

このため、多くの市場公開取引戦略が開発されてきました。 1つはロンドンブレイクアウトタイプの戦略です。ただし、強度の異なる他の取引セッションにも適用される可能性があります。

市場が開いているときに取引する 1 つの方法は、勢いを探すことです。このタイプの戦略では、トレーダーは価格を観察し、勢いのブレイクアウトの重要な兆候を待ちます。トレーダーはまた、ブレイクアウトを期待して注目している特定のレベルを持っています。

オープンゾーンブレイクアウト外国為替取引戦略は、そのような状況に適用できる戦略です。特定期間の高値または安値からのブレイクアウトが勢いを増し、さらに上昇する可能性があることを前提として、これらのブレイクアウトに基づいて取引されます。

SDX ゾーンブレイクアウト

SDX ゾーン ブレイクアウト インジケーターは、特定期間の高値と安値に基づいてブレイクアウト戦略に使用されるカスタム テクニカル インジケーターです。

このインジケーターは、ローソク足の特定の範囲内の高値と安値を単に識別するだけです。次に、ブレイクアウトが予想されるポイントをマークします。また、価格チャート上で考えられるストップロスとテイクプロフィットの配置もマークします。

SDX ゾーン ブレークアウト インジケーターは、非常に順応性の高いインジケーターです。トレーダーは好みに応じて調整できます。トレーダーは、期間の高値と安値に基づいて、指標がブレイクアウト範囲を特定する時間を調整できます。トレーダーは、リスク選好度や通貨ペアのボラティリティに応じて、ストップロスとテイクプロフィットの目標距離を調整することもできます。これにより、トレーダーは市場セッションと取引を計画している通貨ペアに基づいてインジケーターを調整することができます。

素晴らしい発振器

オーサム オシレーター (AO) は、テクニカル指標に続く人気のトレンドです。これは、市場の勢いを測定し、トレンドの方向と強さを特定するために使用されます。

オーサム オシレーターは、5 バーの単純移動平均 (SMA) と 34 バーの単純移動平均 (SMA) の差に基づいて計算されます。ただし、これらの移動平均はローソク足の終値に基づいているのではなく、各バーの中央値に基づいています。

オーサムオシレーターは通常、トレンドの方向と強さを確認するために使用されます。

ヒストグラムバーをプロットするオシレーターです。トレンドの方向に応じてバーの色も変わります。正のバーは一般に強気傾向のバイアスを示し、負のバーは一般に弱気傾向のバイアスを示します。緑色の正のバーは強気傾向の強さを示し、赤色の正のバーは強気傾向の弱まりを示します。一方、負の赤いバーは弱気傾向の強まりを示し、負の緑のバーは弱気傾向の弱まりを示します。

取引戦略

この取引戦略では、SDX ゾーン ブレイクアウト インジケーターを使用して、前のバーの範囲からモメンタム ブレイクアウトを特定します。

トレーダーは、SDXゾーンブレイクアウトインジケーターがレンジを確立するまで待つ必要があります。範囲が狭い混雑ゾーンである場合、その後に強力なブレイクアウトが発生する可能性があります。そうでない場合は、幅広いレンジでの方向性のないボラティリティが強いことを意味する可能性があるため、そのペアの取引を避けることが最善です。

次に、ブレイクアウトローソク足がSDXゾーンブレイクアウトインジケーターの実線を超えて閉じるのを待ちます。

これらのブレイクアウトは、オーサムオシレーターに基づいて強い勢いがあることを確認する必要があります。トレンドの方向は AO がプラスかマイナスかに基づき、トレンドの強さは AO バーの色に基づきます。

AO は、勢いの弱まりに基づいた出口シグナルとしても使用されます。これは、AO バーの色の変更に基づいています。

インジケータ:

- SDX ゾーンブレイクアウト

- 素晴らしい

優先時間枠: 15分チャートのみ

通貨ペア: FXメジャー、マイナー、クロス

取引セッション: 東京、ロンドン、ニューヨークがオープン

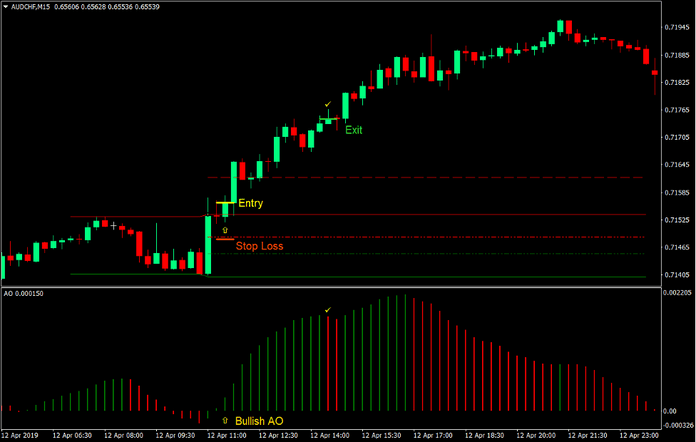

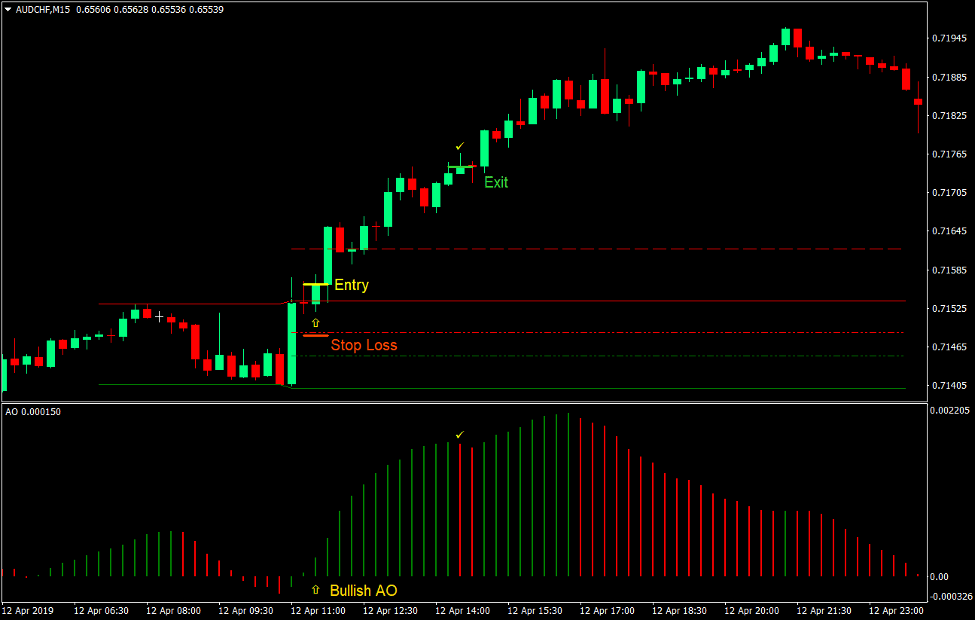

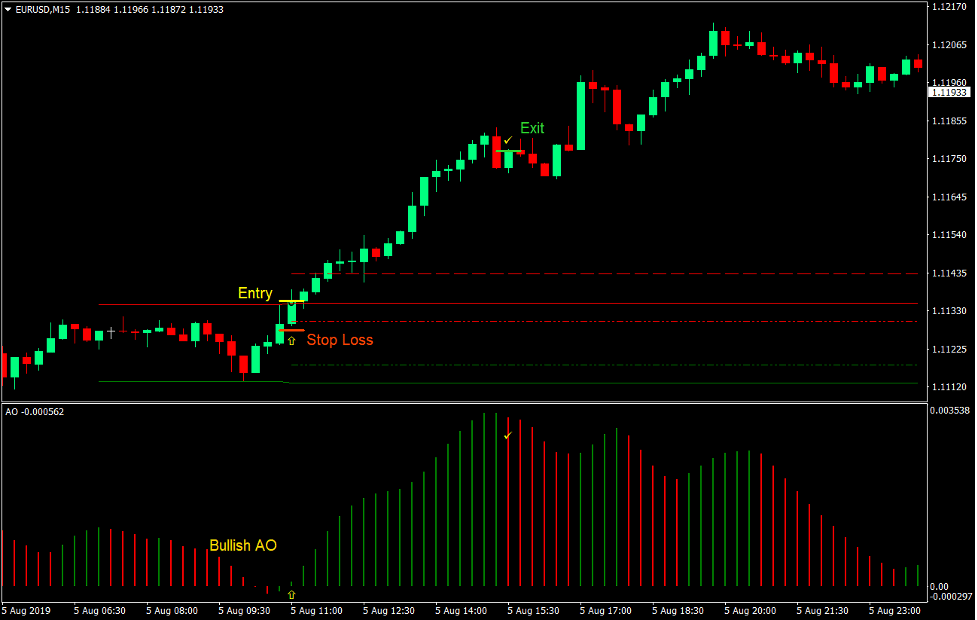

トレードセットアップを購入する

入門

- SDX ゾーン ブレークアウト インジケーターは、タイトなゾーンをマークする必要があります。

- 強い強気のブレイクアウトローソク足は、SDXゾーンブレイクアウトインジケーターの赤い実線の上で閉じる必要があります。

- Awesome Oscillator インジケーターには、正の緑色のバーが表示されます。

- 上記の条件を確認して、購入注文を入力します。

ストップロス

- ストップロスをエントリーキャンドルの下に設定します。

- SDX ゾーン ブレイクアウト インジケーターの赤い破線より下にストップロスを設定します。

出口

- 「Awesome Oscillator」バーが赤に変わったらすぐに取引を終了します。

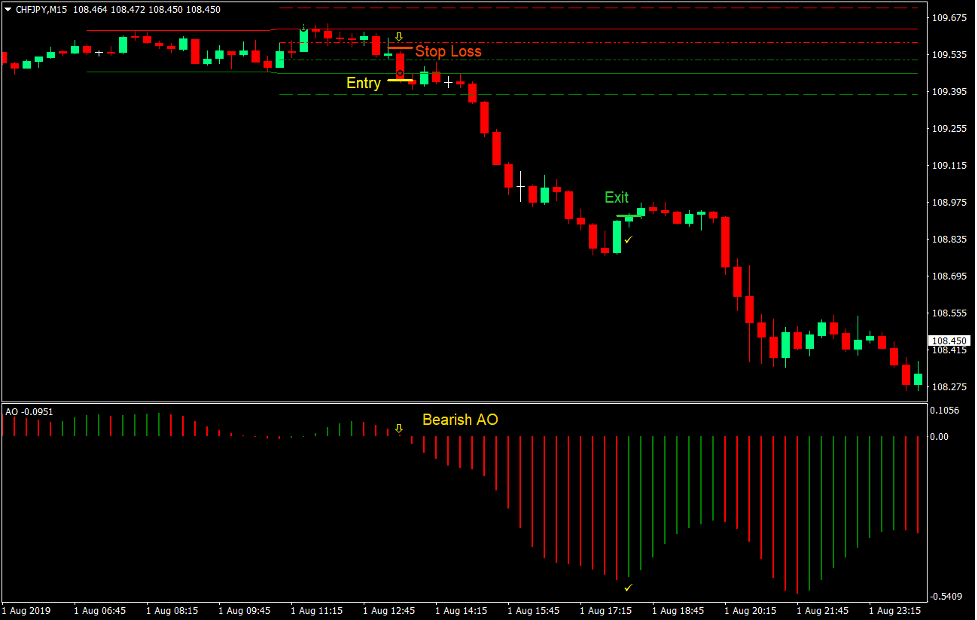

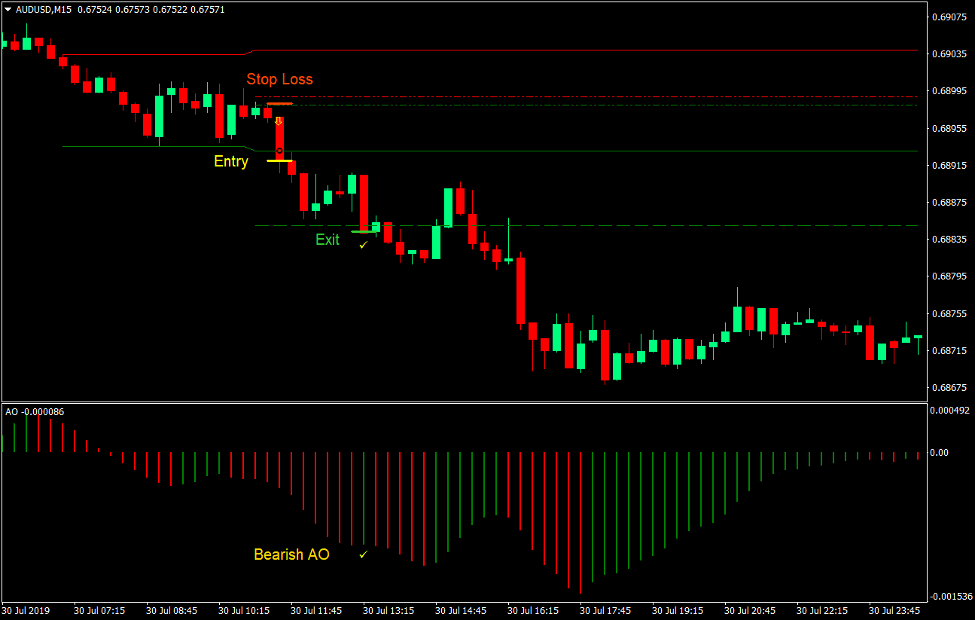

トレードセットアップを売る

入門

- SDX ゾーン ブレークアウト インジケーターは、タイトなゾーンをマークする必要があります。

- 強い弱気ブレイクアウトローソク足は、SDXゾーンブレイクアウトインジケーターの緑色の実線より下で閉じる必要があります。

- Awesome Oscillator インジケーターには、負の赤いバーが表示されます。

- 上記の条件を確認して、販売注文を入力します。

ストップロス

- エントリーキャンドルの上にストップロスを設定します。

- SDX ゾーン ブレイクアウト インジケーターの緑の破線より上にストップロスを設定します。

出口

- 「Awesome Oscillator」バーが緑色に変わったらすぐに取引を終了します。

まとめ

この取引戦略は、ロンドン ブレイクアウト戦略などの市場オープン ブレイクアウト戦略として機能します。

この戦略をうまく取引するには、取引される市場セッションに応じて SDX ゾーン ブレイクアウト インジケーターを調整するのが最善です。市場が開く前に、ローソク足を約2〜4時間販売するのが良いでしょう。

ストップロスの配置も、取引されるペアのボラティリティに基づいて調整する必要があります。これは、通貨ペアの平均トゥルー レンジに基づいている可能性があります。テイクプロフィットターゲットマーカーも調整できます。ただし、この種のブレイクアウトは相場の取り付けになることが多いため、これを無視するのが最善です。テイクプロフィットターゲットマーカーを回避し、勢いに基づいて取引を終了することで、強い勢いを得る市場を利用することができます。

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。