市場の変動とその不安定な動作は、多くのトレーダー、特に取引に不慣れなトレーダーを不意を突くことがよくあります。 一方、洞察力があり、経験豊富なトレーダーは、こうした市場の変動を探しているでしょう。 実際、経験豊富なトレーダーの中には、市場の変動が激しい市場でのみ取引する人もいます。 ボラティリティと市場スイングがなければ、トレーダーは利益を上げることができないからです。

では、どうすれば市場の変動を味方につけることができるでしょうか? すべての市場変動が不安定であるわけではないことを理解する必要があります。 市場は警告なしに反転する可能性がありますが、市場がどこに向かっているのかを示す明らかな兆候はあります。

価格変動に基づいてトレンドの方向を判断するトレーダーもいれば、テクニカル指標を使用するトレーダーもいます。 どちらのタイプの戦略も、異なるトレーダーに適しています。 どちらにも長所と短所があります。 プライスアクション取引では、トレーダーはインジケーターを使用する場合に比べて、はるかに少ないラグで取引を行うことができます。 一方で、インジケーターを使用するトレーダーは、主観的な意思決定の間違いを犯す可能性が低くなります。 これは、インジケーターがトレーディング戦略ルールに簡単に組み込める具体的な数字やデータであるためです。

MACD トレンド外国為替取引戦略は、最も基本的でありながら非常に効果的なテクニカル指標の XNUMX つに基づいた使いやすい戦略です。 トレーダーが簡単に従うことができる特定のルールを備えた客観的なものです。

2回線MACD

移動平均収束発散 (MACD) は、多くのトレーダーにとって定番の指標です。 これはおそらく最も基本的な指標の XNUMX つですが、最も広く使用されている取引指標の XNUMX つでもあります。 テクニカル アナリスト、機関投資家の「大手銀行」トレーダー、市場アナリストが使用しています。 なぜ小売トレーダーとして利用すべきではないのでしょうか?

MACD は、移動平均から派生した振動運動量インジケーターです。 XNUMX つの指数移動平均 (EMA) 間の距離を測定します。 その後、MACD ラインと呼ばれる振動ラインとして表示されます。 次に、別の指数移動平均 (EMA) が MACD ラインから導出されます。 この線は「信号線」と呼ばれます。 次に、MACD ラインがシグナル ラインから減算され、その差がヒストグラムとして表示されます。 正のヒストグラムまたはシグナル ラインの上にある MACD ラインは、強気のトレンド方向を示します。 一方、負のヒストグラムまたはシグナル ラインの下にある MACD ラインは、弱気トレンドの方向を示します。

MACD にはさまざまな用途があります。 平均回帰トレーダーは、MACD ラインが常に平均値に戻ると想定しています。 このため、彼らは MACD ラインとシグナルラインのクロスオーバーを取引シグナルとみなします。 一方、モメンタムトレーダーは、MACD ラインが導出される移動平均線の反転に基づいてトレンドが反転したと想定しているため、MACD ラインがプラスからマイナス、またはその逆に交差することをトレードシグナルとして受け取ります。

2 ライン MACD は修正された MACD で、通常の MACD と比較してよりスムーズで高品質のトレードシグナルを生成する傾向があります。

ウロヴヌイ指標

Urovny インジケーターは、修正移動平均から派生したカスタム インジケーターです。 赤と緑黄色の XNUMX 本の線が表示されます。 これらの線は、上下にシフトされた修正移動平均です。

赤と緑の黄色の線の間の領域は、価格が XNUMX つの線に対してどこに位置するかに応じて、動的なサポートとレジスタンスの領域として機能します。 トレンドの市場状況では、価格はこの領域から跳ね返る傾向があります。 ただし、サポートとレジスタンスの場合と同様、価格がこれらのラインを超えるとブレイクアウトとみなされる可能性があります。

取引戦略

この取引戦略は、MACD ラインが正中線を越えることに基づいた単純な MACD モメンタム反転戦略です。 ただし、追加の確認として、ウロヴヌイ指標を超えた価格のクロスオーバーも使用します。

MACD の勢いの反転とウロヴヌイ線を超える価格のこの合流は、市場が反転していることを示しています。

インジケータ:

- 2line_MAC

- 高速MA期間: 18

- 遅いMA期間: 36

- 信号MA期間:12

- ウロヴヌイ

時間枠: 15分足、1時間足、4時間足、日足チャート

通貨ペア: メジャーとマイナーのペア

トレーディングセッション: 東京、ロンドン、ニューヨーク。 15 分足チャートで取引する場合は、ペアのいずれかの通貨の取引セッションが望ましい

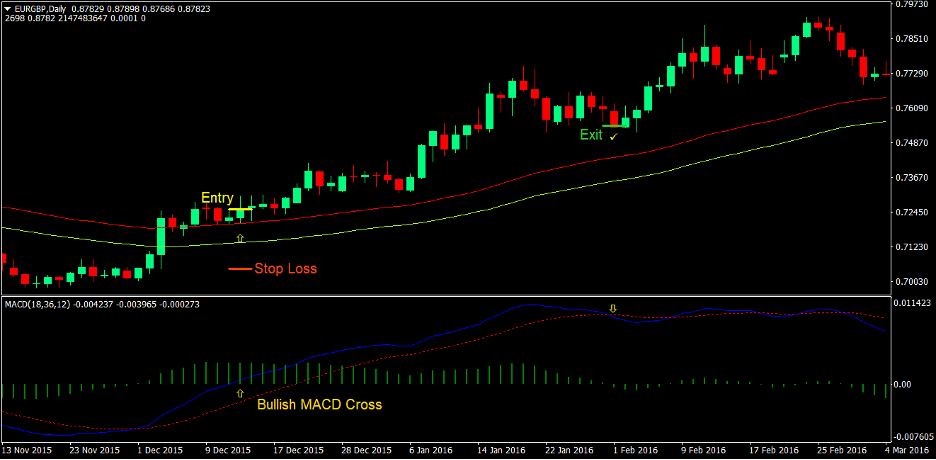

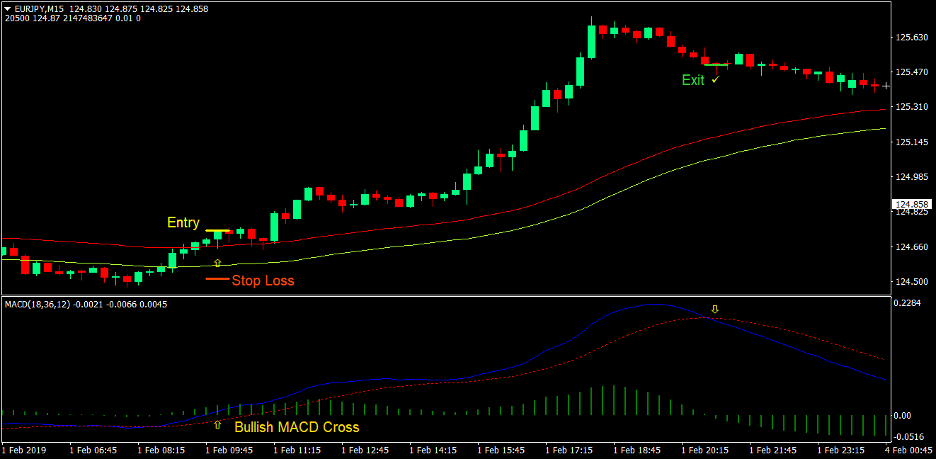

トレードセットアップを購入する

入門

- 価格は強気のレジスタンスブレイクアウトを示す赤いウロヴヌイラインを超えて終了するはずです

- 2 ライン MACD インジケーターには、強気傾向を示す正のヒストグラムが表示されるはずです。

- 青いMACDラインがゼロを上回って交差するはずで、強気トレンドの反転を示します。

- これらの強気シグナルはある程度一致するはずです

- 上記の条件の合流点で買い注文を入力します。

ストップロス

- エントリーローソクの下のサポートレベルにストップロスを設定します

出口

- 青いMACDラインが壊れた赤いシグナルラインを下抜けたらすぐに取引を終了します。

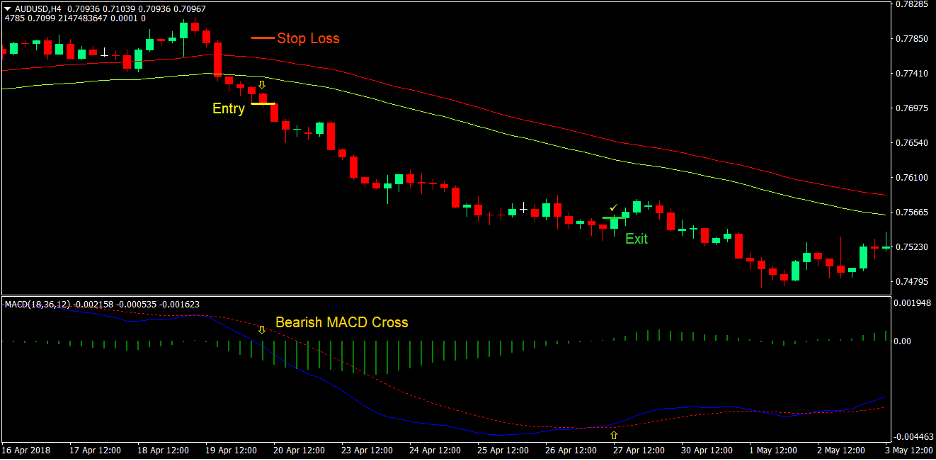

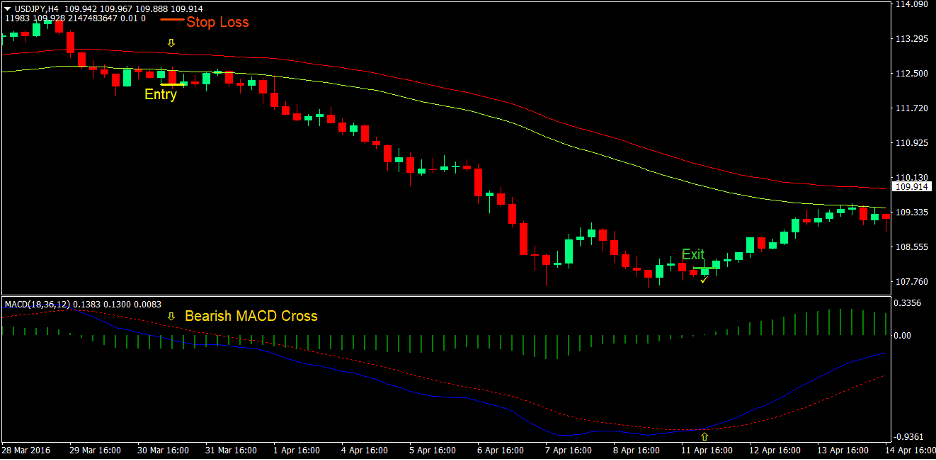

トレードセットアップを売る

入門

- 価格は弱気のサポートブレイクアウトを示す黄緑色のウロヴヌイラインを超えて下回るはずです

- 2 ライン MACD インジケーターには、弱気トレンドを示す負のヒストグラムが表示されます。

- 青いMACDラインがゼロを下回って、弱気トレンドの反転を示すはずです。

- これらの弱気シグナルはある程度一致しているはずです

- 上記の条件が合致した時点で売り注文を入力します。

ストップロス

- エントリーローソクの上の抵抗レベルにストップロスを設定します

出口

- 青いMACDラインが壊れた赤いシグナルラインを上抜けたらすぐに取引を終了します。

まとめ

MACD モメンタム反転戦略は、多くのトレーダーが使用する基本戦略です。 実際、優れた取引管理戦略と組み合わせれば、MACD シグナルだけでも収益性の高い取引戦略を提供できるはずです。 ウロヴヌイラインからのブレイクアウトの確認を追加すると、さらに高い確率のトレードセットアップが提供されます。

この戦略は、トレンド傾向が強い市場で使用すると最も効果的です。 ボラティリティが低い場合は常に、より低い時間枠でこの戦略を使用することは避けてください。 この戦略は、エントリーローソク足の前にモメンタムローソク足がある場合や、対角線のサポートやレジスタンスからのブレイクアウトが発生した場合にも最適に機能します。

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。