多くの人が外国為替取引について耳にし、短期間で人々のお金を何倍にも増やすことができる方法について耳にします。 これは通常、人々の関心をピークにします。 しかし、人々はまた、取引は非常に困難であり、非常に知的な人々だけが手を出す必要があるという考えも持っています.

この概念は、真実から遠く離れることはできません。 トレーダーは、自分が何をしているのかを理解できる一定レベルの知性を持っている必要がありますが、トレーダーになるのにそれほど多くは必要ありません。 実際、単純な戦略がうまくいくことが何度も証明されています。 このような単純な計画に固執できるトレーダーは、多くの場合、外国為替市場から利益を得るという報酬を獲得します.

クロスオーバー戦略は、トレーダーが実装できる最も単純な取引戦略の一部です。 実際、多くの新しいトレーダーは、最初に取引を開始するときにこのタイプの戦略を紹介されます。 ただし、多くの場合、さまざまな結果が得られます。 これは、クロスオーバー戦略はトレンド傾向が強い市場ではうまく機能しますが、さまざまな市場条件で使用すると失敗するためです.

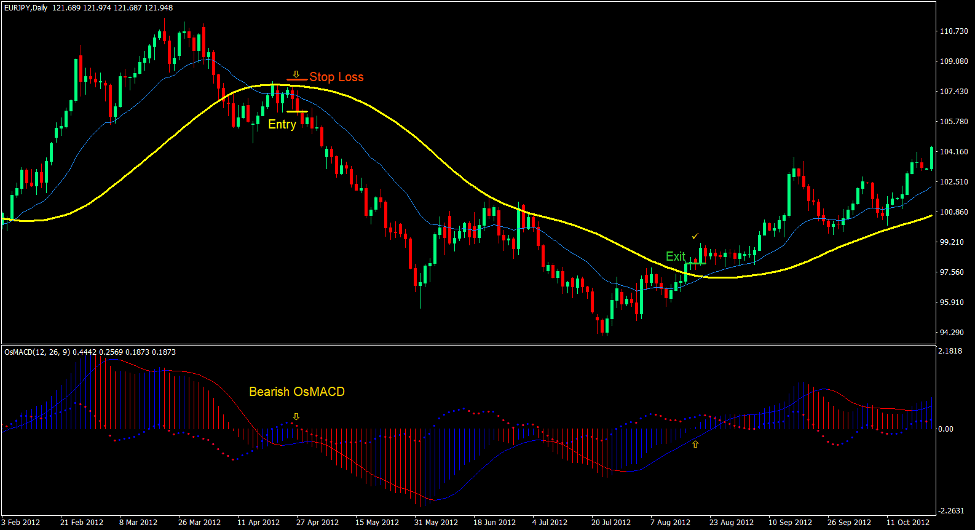

クロスオーバー戦略 (理想的な MA MACD クロス外国為替取引戦略) を使用して勝利トレードのセットアップを取得する確率を向上させる方法の XNUMX つは、プルバックまたは再テストを使用することです。 これにより、トレーダーは盲目的にクロスオーバー戦略に従うのではなく、新しいトレンドをより確実に確認できます。

2PB 理想 3MA

2PB 理想の 3 MA は、移動平均に基づくカスタム テクニカル インジケーターです。

移動平均は、トレンドフォローとトレンド反転トレーダーが使用する最も有用なテクニカル指標の一部です。 これは、移動平均線がトレンドを特定するのに非常に適しているためです。

トレーダーが移動平均線を使用してトレンドを特定する方法の XNUMX つは、移動平均線の傾きの方向を観察することです。 傾きが上向きの場合、市場は上昇傾向にあります。 傾きが下向きの場合、市場は下降トレンドにあります。 もう XNUMX つは、移動平均線に関連する価格アクションの位置を調べることです。 値動きが移動平均線を上回っている場合、市場バイアスは強気です。 価格行動が移動平均線を下回っている場合、市場バイアスは弱気です。 トレーダーはまた、移動平均クロスオーバーを使用してトレンドの反転を識別します。 クロスアップは強気トレンドの反転の可能性を示します。 クロスダウンは、弱気トレンドの反転の可能性を示します。

移動平均線は非常に便利ですが、移動平均線は市場が不安定な時期に簡単に影響を受けやすい傾向があります。 優れた移動平均線は、価格の動きに敏感であると同時に、ウィップソーの影響を受けにくいというバランスをとっています。

2PB Ideal 3 MA は、移動平均線の反応を滑らかにするために修正されています。 これにより、ウィップソーの影響を受けにくい移動平均線が作成されます。 補完的な移動平均線と組み合わせると、2PB の理想的な 3 MA は、優れたトレンド反転シグナルを生成できます。

OsMACD

OsMACD は、インジケーターのオシレーター ファミリーの一部である別のカスタム テクニカル インジケーターです。 また、広く使用されている移動平均収束発散 (MACD) 指標にも基づいています。

OsMACD は、12 つの移動平均の発散と収束に基づいています。 これは、基本的に 26 つの移動平均の差です。 この指標は指数移動平均 (EMA) を使用して差を求め、XNUMX バーでより速い EMA を、XNUMX バーでより遅い EMA を設定します。 結果は、ヒストグラム バーとしてプロットされます。 次に、シグナル ラインがヒストグラム バーから導き出されます。 シグナル ラインは、基本的に MACD ヒストグラム バーの単純移動平均 (SMA) です。 この指標により、トレーダーは、ローソク足の終値、高値、安値、中央値など、価格のソースを変更することもできます。

ゼロより上のバーとラインは強気の方向性バイアスを示し、ゼロより下のバーとラインは弱気な方向性バイアスを示します。 トレーダーは、ヒストグラム バーとシグナル ラインのクロスオーバーに基づいて、トレンドの反転の可能性を特定することもできます。 MACD ヒストグラム バーとシグナル線の違いを示すドットもプロットされます。 正の点は方向性バイアスが強気であることを示し、負の点は方向性バイアスが弱気であることを示します。 バー、ライン、ドットの色も変わり、勢いを示します。 これは、以前の値と比較した現在の値に基づいています。 青は強気の勢いが強まっていることを示し、赤は弱気の勢いが強まっていることを示します。

取引戦略

この取引戦略は、単純なクロスオーバー トレンド反転戦略です。

トレンド反転シグナルは、20 期間の指数移動平均が 2PB の理想的な 3 MA ラインを超えるたびに生成されます。 この傾向の反転は、OsMACD ヒストグラム バーと正中線 (ゼロ) を横切る線によっても確認する必要があります。

ただし、すぐに取引を行うのではなく、価格アクションの確認を待つ必要があります. これは基本的に移動平均線への引き戻しであり、その後に移動平均線の領域で価格が拒否されます。

これらの条件が満たされている場合、有効なトレンド反転の設定があります。

インジケータ:

- 2pb理想3MA

- OsMACD

- 20 EMA

優先時間枠: 1時間、4時間、および毎日のチャート

通貨ペア: FXメジャー、マイナー、クロス

取引セッション: 東京、ロンドン、ニューヨークのセッション

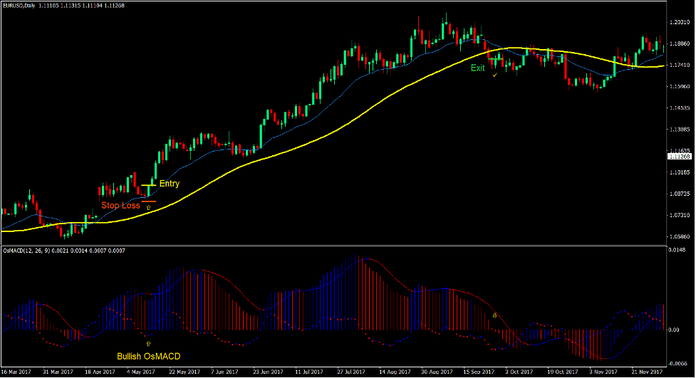

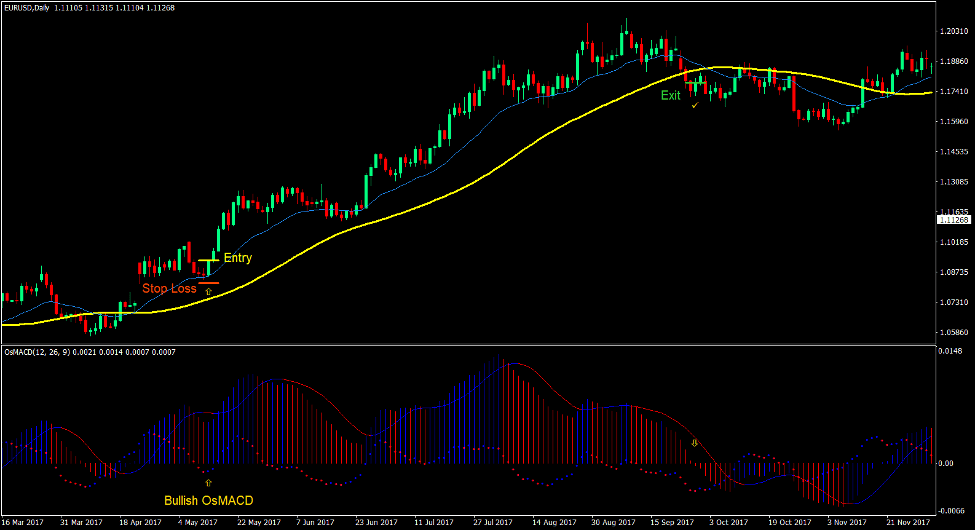

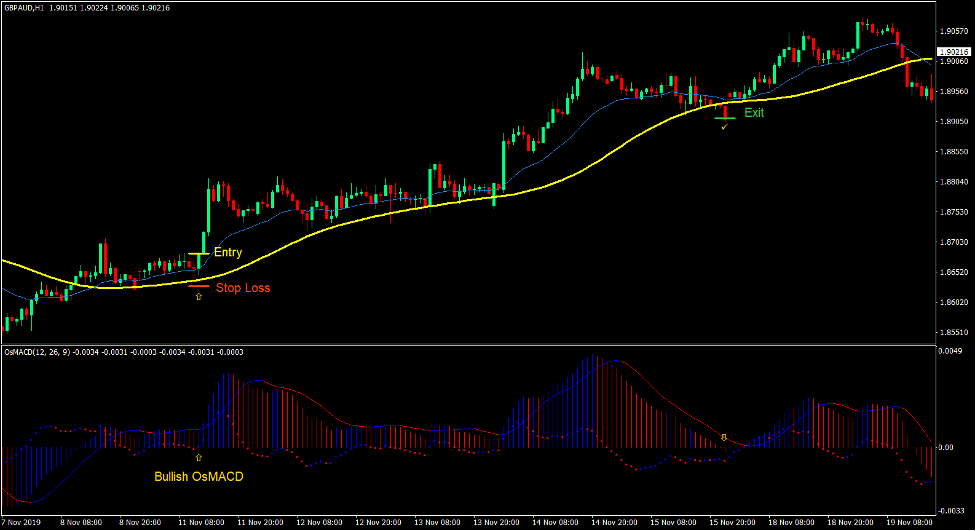

トレードセットアップを購入する

入門

- 価格アクションは、移動平均線を超える必要があります。

- 20 EMA ラインは、2PB 理想の 3 MA ラインを超える必要があります。

- OsMACD のバーとラインはゼロを超える必要があります。

- 価格アクションは、移動平均線に向かって引き戻し、エリアを拒否する必要があります.

- OsMACD バーが青色に変わります。

- これらの条件を確認して、購入注文を入力します。

ストップロス

- エントリーキャンドルの下のフラクタルにストップロスを設定します。

出口

- OsMACD バーがゼロを下回ったらすぐに取引を終了します。

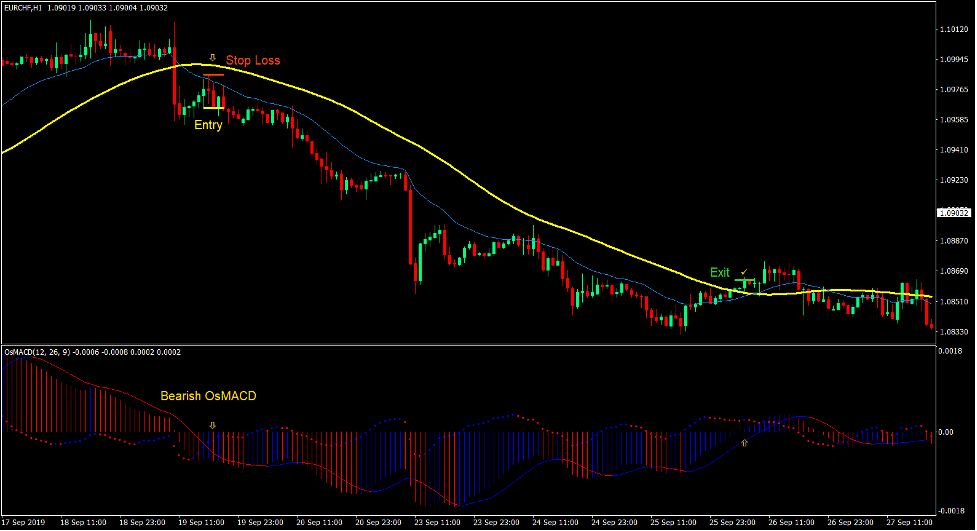

トレードセットアップを売る

入門

- 価格アクションは移動平均線を下回らなければなりません。

- 20 EMA ラインは、2PB 理想の 3 MA ラインを下回ります。

- OsMACD のバーとラインはゼロを下回るはずです.

- 価格アクションは、移動平均線に向かって引き戻し、エリアを拒否する必要があります.

- OsMACD バーが赤に変わります。

- これらの条件を確認して、販売注文を入力します。

ストップロス

- エントリーキャンドルの上のフラクタルにストップロスを設定します。

出口

- OsMACD バーがゼロを超えたらすぐに取引を終了します。

まとめ

この取引戦略は、トレンド傾向が強い市場または通貨ペアで使用するとうまく機能します。 これは、この戦略により、トレーダーはトレンドの反転を特定し、トレンドの始まり近くの価格行動に基づいてそれを確認できるためです.

価格行動を客観的に観察できるトレーダーは、この戦略を使用して、外国為替市場でのトレンド反転から利益を得ることができます.

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。