利益を上げているトレーダーもいれば、常に正しいことをしているように見えるトレーダーもいます。 彼らが取引を開始するときはいつでも、価格は常に彼らの取引の方向に進むように思われますか、それともそうでしょうか? これらのトレーダーの取引を詳しく調べてみると、取引が自分の方向に進まないときは常に、価格が自分の方向に進むまでただ取引を続けているように見えることに気づくでしょう。 彼らは価格が遅かれ早かれ自分たちの取引の方向に向かうだろうと確信しているようだ。 なぜそうなるのでしょうか? これは、最初に取引を開始したときに、短期、中期、長期のトレンドが合流して取引していることを知っているためです。 そのため、短期取引が失敗するたびに、長期トレンドはまだ良好であり、したがって価格は依然として取引の方向に戻るであろうことを知っています。

ディレクショナルテンカンクロス外国為替取引戦略は、取引をあまりにも長く続けることを推奨するタイプの戦略ではありません。 その代わりに、短期、中期、長期のトレンドの合流点に頼って、目標価格に到達する可能性が非常に高い取引を行うことになります。 これにより、当社に有利な傾向が見られる可能性が高い取引を捉えることができます。

天下線

Tenkan-Sen ラインは、最も収益性の高いスタンドアロン テクニカル指標の XNUMX つである一目雲指標のコンポーネントです。

Tenkan-Senは、一目雲インジケーターの変換ラインを指します。 これは、期間内の最高値と最低値の単純な平均です。 一目雲の線の短期的なトレンドも表しています。

移動平均

移動平均は、トレーダーが利用できる最もシンプルでありながら最も強力なテクニカル取引ツールの XNUMX つです。 これは、移動平均が市場の動きの最も重要な特性の XNUMX つであるトレンドを表すために使用されるためです。

移動平均が異なれば、傾向も異なります。 平均する期間が短ければ短いほど、それが表す期間は短くなります。 短期移動平均の期間は通常、5、10、15、20 です。一方、中期移動平均は通常 30 および 50 期間であり、長期移動平均は通常 100 または 200 期間の移動平均です。 。

移動平均を使用してトレンドを解釈する方法はたくさんあります。 短期移動平均の位置を長期移動平均と比較する人もいます。 移動平均の傾きに注目する人もいるでしょう。 おそらく、移動平均を使用してトレンドを観察する最も簡単な方法は、移動平均に対する価格変動の位置を特定することです。

平均方向運動指数

Average Directional Movement Index (ADX) は、私のお気に入りの取引指標の XNUMX つです。 これは、トレンドの方向と反転も決定する振動インジケーターです。 ただし、他の振動指標やトレンド追従指標とは異なり、ADX は非常に独特です。 トレンドの強さも測れるからです。

ADX は XNUMX つのラインで構成されます。 そのうちの XNUMX つのラインは、Directional Movement Index (DMI) と呼ばれます。 XNUMX つはポジティブ (+DMI)、もう XNUMX つはネガティブ (-DMI) です。 これら XNUMX つの線は、XNUMX つの線がどのように積み重なるかに基づいて、トレンドの方向と反転を決定します。 プラスの DMI がマイナスの DMI を上回っている場合、市場は強気とみなされます。 XNUMX 本の線が逆に重なっている場合、市場は弱気であると考えられます。

次に、ADX ラインがあります。 ADX ラインは無方向です。 トレンドの方向性を決定するものではありませんが、トレンドの強さを測定することはできます。 ADX が 30 未満の場合、市場にはトレンドがないと見なされますが、30 を超える場合、市場には強いトレンドがあると見なされます。

取引戦略

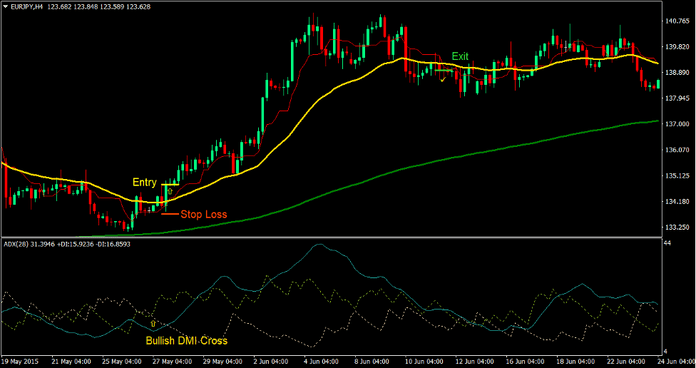

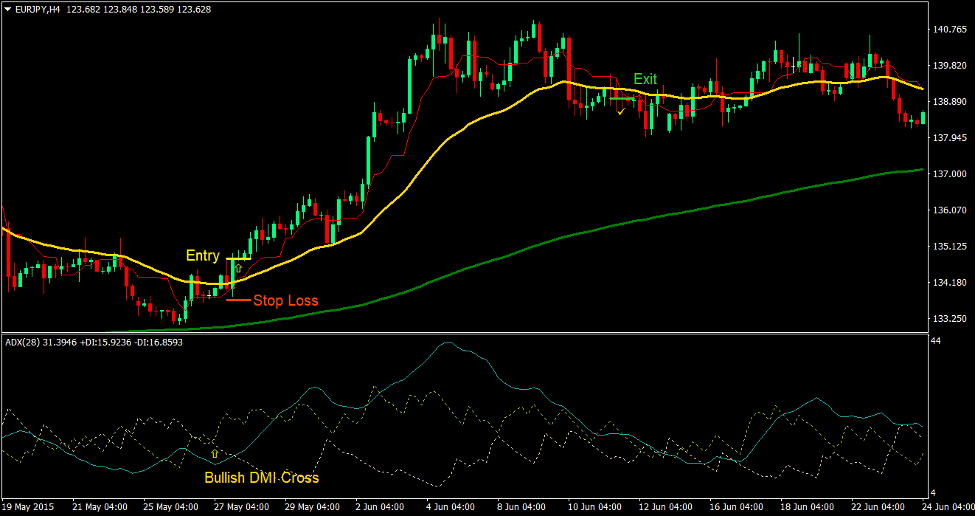

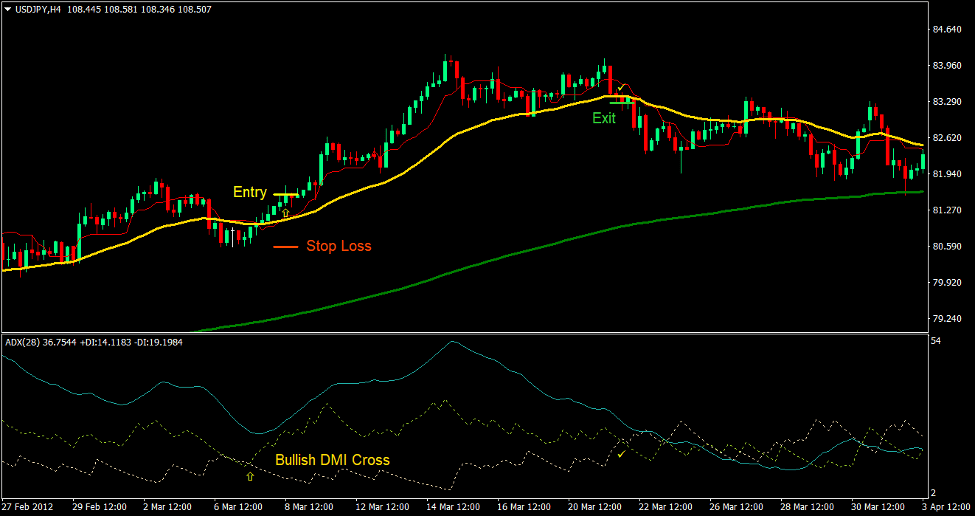

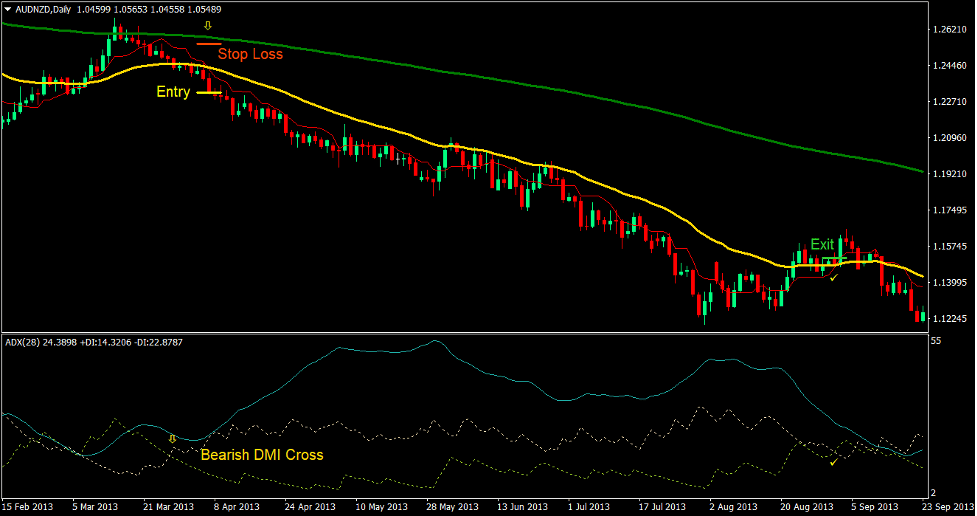

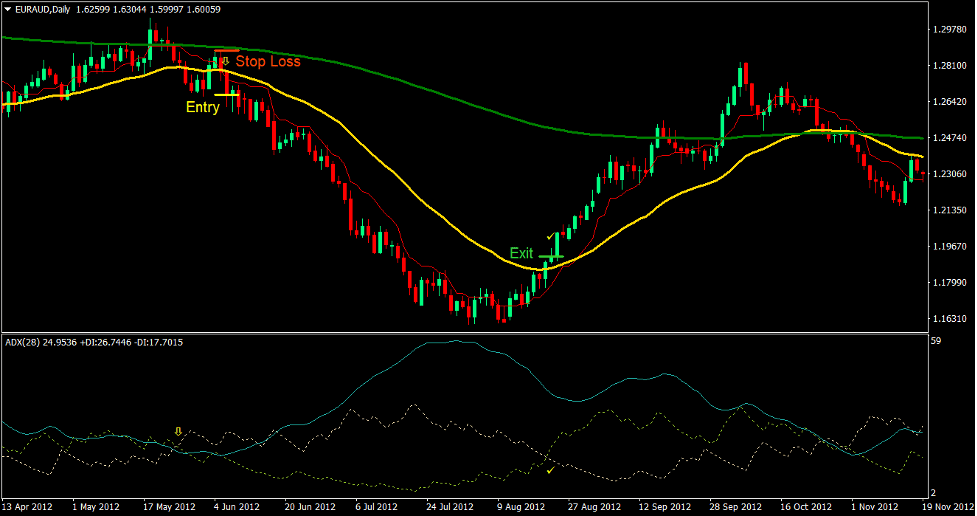

この戦略は、一目雲指標の天下線と 32 期間の指数移動平均 (EMA) を使用したクロスオーバー戦略です。 Tenkan-Sen は短期トレンドを表し、32 EMA は中期トレンドを表します。 ただし、このクロスオーバー シグナルは、一般的に使用される長期トレンドである 200 期間の指数移動平均 (EMA) によって除外されます。 この平均価格の組み合わせを使用して短期、中期、長期のトレンドを調整することで、より高い勝率の取引が可能になります。

それに加えて、クロスオーバー信号と長期トレンドフィルターを、ADXインジケーターのDMIクロスオーバーとの合流点に合わせます。 これにより、勝率がさらに向上します。

通常、市場がトレンドになり始めると上昇するため、ADX ラインは確認として機能します。 ただし、ADX ラインが上昇する前の縮小段階で始まる取引もあります。 これは、縮小と拡大のサイクルという市場の自然なサイクルによるものです。

インジケータ:

- 一木キンコーズ·ヒョリ

- テンカンセン:9

- 32EMA(ゴールド)

- 200 EMA (緑)

- 平均方向運動指数

- 期間:28

時間枠: 4時間と日別のチャート

通貨ペア: メジャーとマイナーのペア

トレーディングセッション: 東京、ロンドン、ニューヨークのセッション

トレードセットアップを購入する

入門

- 価格は長期的な強気傾向を示す 200 EMA を上回るはずです

- ADX インジケーターの +DMI ラインは、強気トレンドの反転を示す -DMI ラインの上を横切る必要があります。

- テンカンセンラインは32EMAを上回って強気トレンドの反転を示すはずです

- 上記の条件が交わった時点で買い注文を入力します。

ストップロス

- エントリーローソクの下のサポートレベルにストップロスを設定します

出口

- Tekan-senラインが32EMAを下抜けたらすぐに取引を終了します

- +DMIラインが-DMIラインを下抜けたらすぐに取引を終了します

トレードセットアップを売る

入門

- 価格は長期弱気傾向を示す 200 EMA を下回るはずです

- ADX インジケーターの -DMI ラインは、弱気トレンドの反転を示す +DMI ラインの上を横切る必要があります。

- テンカンセンラインは32EMAを下回って弱気トレンドの反転を示すはずです

- 上記の条件が交わった時点で売り注文を入力します。

ストップロス

- エントリーローソクの上の抵抗レベルにストップロスを設定します

出口

- Tekan-senラインが32EMAを上抜けたらすぐに取引を終了します

- -DMIラインが+DMIラインを下抜けたらすぐに取引を終了します

まとめ

この戦略は、ほとんどの交叉戦略と比較して比較的確率の高い交叉戦略です。 これは、短期、中期、長期のトレンドに加え、ADX インジケーターの DMI ラインが一致しているためです。

さらに高い時間枠で見てみると、これらの取引設定が実際にはより高い時間枠でのリトレースメントであることに気づくでしょう。 一部のトレーダーはこれらの設定をより高い時間枠でリトレースメントとして取引する可能性がありますが、より低い時間枠でクロスオーバー戦略として取引することで、より正確なエントリーポイントが得られます。

おすすめのMT4ブローカー

XMブローカー

- 無料$ 50 すぐに取引を開始するには! (出金可能利益)

- までのデポジットボーナス $5,000

- 無制限のロイヤルティプログラム

- 受賞歴のある外国為替ブローカー

- 追加の独占ボーナス 年間を通じて

>> ここからXMブローカーアカウントにサインアップしてください<

FBSブローカー

- トレード100ボーナス: 100 ドルを無料で取引の旅を始めましょう!

- 100%の入金ボーナス: 入金額を最大 $10,000 まで XNUMX 倍にし、強化された資本で取引します。

- 1まで活用する:3000: 利用可能な最高のレバレッジ オプションの 1 つで潜在的な利益を最大化します。

- 「アジアのベストカスタマーサービスブローカー」賞: カスタマーサポートとサービスの優秀性が認められています。

- 季節のプロモーション: 一年中、さまざまな限定ボーナスやプロモーション特典をお楽しみいただけます。

>> ここからFBSブローカーアカウントにサインアップしてください<

ダウンロードするには、以下をクリックしてください。