Quando i nuovi trader guardano per la prima volta i grafici, spesso vedono un movimento senza senso di barre e linee che vanno su e giù. Le opportunità non vengono individuate facilmente dai nuovi trader perché la maggior parte non ha ancora sviluppato la capacità di coglierle. Ma cosa stiamo cercando in primo luogo? Come vedono i trader le opportunità in un grafico apparentemente caotico?

La storia si ripete. Questo è il concetto che consente ai trader tecnici di guadagnare costantemente dal mercato Forex. Il mercato si muove secondo schemi e cicli. Questi modelli e cicli presentano prevedibilità. Ciò consente ai trader esperti di avere un'ipotesi intelligente su dove potrebbe andare il mercato. Per loro, ogni volta che questi modelli e cicli si presentano è un’opportunità per fare soldi.

La strategia di trading Forex a media mobile modificata direzionale consente ai trader di identificare facilmente questi cicli utilizzando una serie di indicatori tecnici. Questi indicatori potrebbero facilmente mostrare i punti in cui i cicli di tendenza si stanno invertendo, aiutando i trader a dare un senso a un grafico altrimenti caotico.

Indice medio di movimento direzionale

L'indice medio del movimento direzionale (ADX) è un indicatore tecnico sviluppato da Welles Wilder. Questo indicatore aiuta i trader a determinare la direzione del trend in base allo slancio e alla forza del trend.

L'indice del movimento direzionale medio è composto dall'indicatore direzionale più (+DI), dall'indicatore direzionale meno (-DI) e dalla linea dell'indice direzionale medio (ADX). L'indicatore direzionale più (+DI) e l'indicatore direzionale meno (-DI) sono chiamati collettivamente indicatore del movimento direzionale (DMI).

Il DMI viene utilizzato per determinare la direzione del trend. Ciò si basa sulla posizione del +DI rispetto al -DI. In un trend rialzista, la linea +DI sarebbe sopra la linea -DI, mentre la linea -DI sarebbe sopra la linea +DI durante un trend ribassista. Pertanto, gli incroci tra le due linee sono considerati un segnale di inversione di tendenza.

La linea ADX rappresenta la forza del trend. I trader tecnici interpretano le cifre ADX superiori a 25 come aventi una forte tendenza, mentre le cifre inferiori a 20 sono considerate rappresentare condizioni di mercato senza tendenza.

L'indicatore i-AMA Optimum e i-AMMA

Sebbene questi indicatori possano avere nomi quasi simili, differiscono negli approcci. Questi due indicatori sono praticamente una versione modificata di una media mobile, tuttavia le loro modifiche hanno lo scopo di fornire una caratteristica diversa rispetto ad altre medie mobili.

L'i-AMA Optimum è una media mobile adattiva (AMA). Questo tipo di media mobile è ottimizzato per fornire una linea di media mobile meno sensibile. Ciò rende la linea meno suscettibile ai movimenti instabili del mercato. Ciò rende l'i-AMA anche un'eccellente linea della media mobile del filtro di tendenza.

L'indicatore i-AMMA d'altra parte è una media mobile modificata media (AMMA). Questa versione di una media mobile è pensata per essere più reattiva ai movimenti dell’azione dei prezzi. Ciò fa sì che la linea segua l’azione dei prezzi molto più vicino rispetto ad altre medie mobili. Fornisce anche un segnale meno ritardato. Queste caratteristiche rendono l'indicatore i-AMMA un'eccellente media mobile della linea di segnale.

Trading Strategia

Questa strategia è una strategia di inversione di tendenza incrociata basata su due medie mobili progettate per scopi opposti. L'indicatore i-AMA Optimum verrebbe utilizzato come media mobile ritardata mentre l'indicatore i-AMMA verrebbe utilizzato come linea della media mobile principale. I segnali commerciali vengono generati ogni volta che le due linee si incrociano.

Tuttavia, i segnali commerciali prodotti dalle due medie mobili di cui sopra dovrebbero essere in confluenza con le linee DMI dell’indicatore ADX. I segnali crossover rialzisti dovrebbero coincidere con un crossover DMI rialzista mentre i segnali crossover ribassisti dovrebbero coincidere con un crossover DMI ribassista.

La linea ADX servirebbe come conferma del segnale commerciale. Le operazioni redditizie di solito si traducono in una linea ADX che supera 25. Tuttavia, non limiteremo le nostre operazioni in base a ciò. Questo perché il mercato tende ad iniziare una fase di contrazione prima di un trend. Durante le fasi di contrazione, la linea ADX è solitamente inferiore a 25.

Indicatori:

- Indice medio di movimento direzionale

- Periodo: 28

- i-AMMA

- Periodo MA: 14

- i-AMA-ottimale

Lasso di tempo: preferibilmente grafici a 4 ore e giornalieri

Coppie di valute: coppie maggiori e minori

Sessione di trading: Tokio, Londra e New York

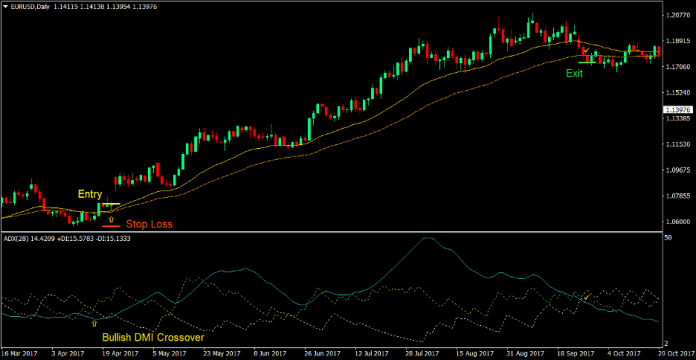

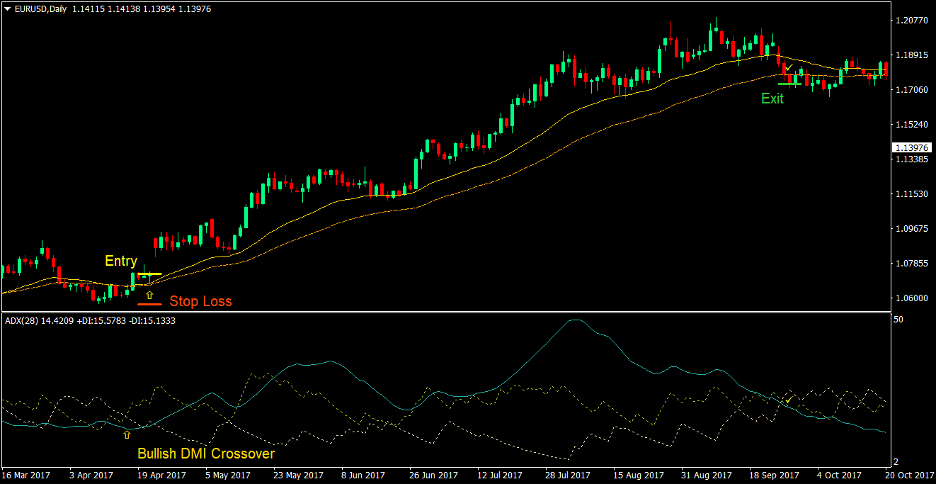

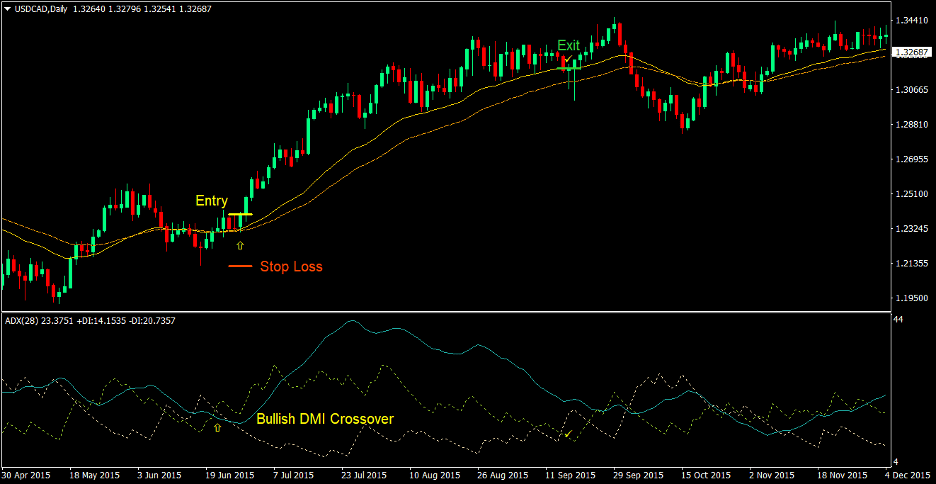

Acquista Trade Setup

Iscrizione

- La linea +DI (giallo verde) dovrebbe incrociarsi sopra la linea -DI (grano) indicando un'inversione di tendenza rialzista

- La linea i-AMMA (linea continua) dovrebbe incrociarsi sopra la linea i-AMA Optimum (linea tratteggiata) indicando un'inversione di tendenza rialzista

- I segnali di inversione di tendenza rialzista dovrebbero essere in qualche modo allineati

- Inserisci un ordine di acquisto alla confluenza delle condizioni di cui sopra

Stop Loss

- Imposta lo stop loss al livello di supporto sotto la candela di entrata

uscita

- Chiudi l'operazione non appena le linee DMI si invertono

- Chiudi l'operazione non appena il prezzo chiude al di sotto della linea ottimale i-AMA

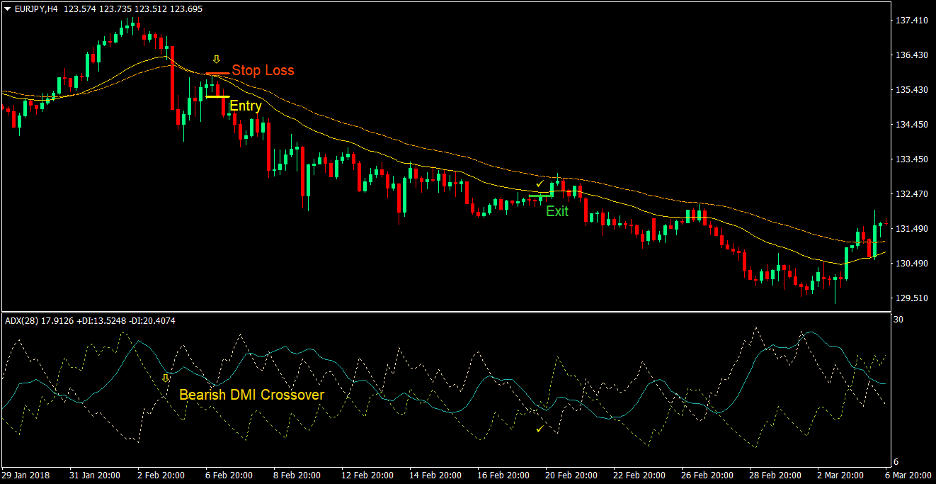

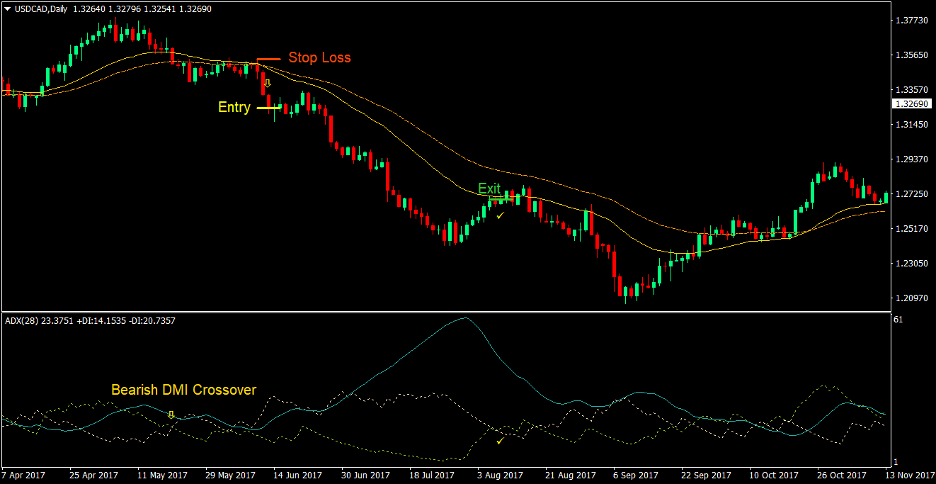

Vendi configurazione commerciale

Iscrizione

- La linea +DI (giallo verde) dovrebbe incrociare sotto la linea -DI (grano) indicando un'inversione di tendenza ribassista

- La linea i-AMMA (linea continua) dovrebbe incrociare sotto la linea i-AMA Optimum (linea tratteggiata) indicando un'inversione di tendenza ribassista

- I segnali di inversione del trend ribassista dovrebbero essere in qualche modo allineati

- Inserisci un ordine di vendita alla confluenza delle condizioni di cui sopra

Stop Loss

- Imposta lo stop loss al livello di resistenza sopra la candela di entrata

uscita

- Chiudi l'operazione non appena le linee DMI si invertono

- Chiudi l'operazione non appena il prezzo chiude al di sopra della linea i-AMA Optimum

Conclusione

Questa strategia di trading è una strategia crossover funzionante che produce segnali commerciali di buona qualità. Molti dei segnali commerciali prodotti da questa strategia potrebbero sfociare in una tendenza. Ciò consentirebbe ai trader di guadagnare da operazioni ad alto rendimento che potrebbero guadagnare fino a un rapporto rischio-rendimento compreso tra 2:1 e 5:1.

Questa strategia funziona bene in una coppia di valute con molta volatilità e ha una forte tendenza al trend. Evita di negoziare questa strategia in una coppia di valute o in un mercato che tende ad essere instabile o piatto.

Anche il crossover DMI tende a volte ad essere più reattivo rispetto alle linee della media mobile. Ci sarebbero momenti in cui un ritracciamento temporaneo potrebbe causare un crossover sulle linee DMI. Questi scenari potrebbero causare un’uscita prematura dal commercio e ridurre i profitti più rapidamente di quanto avrebbe potuto essere. Tuttavia, è meglio attenersi all’uscita anticipata piuttosto che restituire tutti i profitti se il crossover del DMI si traduce in un’effettiva inversione di tendenza. I trader che scelgono di mantenere l'operazione potrebbero utilizzare una strategia di gestione commerciale intelligente, impiegando trailing stop e spostando gli stop loss al pareggio.

Broker MT4 consigliati

XM Broker

- Free $ 50 Per iniziare a fare trading all'istante! (Profitto prelevabile)

- Bonus di deposito fino a $5,000

- Programma fedeltà illimitato

- Broker Forex pluripremiato

- Bonus esclusivi aggiuntivi Durante tutto l'anno

>> Registrati per un conto broker XM qui <

Broker FBS

- Scambia 100 bonus: $ 100 gratuiti per iniziare il tuo viaggio nel trading!

- 100% Bonus: Raddoppia il tuo deposito fino a $ 10,000 e fai trading con un capitale maggiore.

- Utilizza fino a 1: 3000: Massimizzare i profitti potenziali con una delle opzioni di leva finanziaria più elevate disponibili.

- Premio "Miglior broker di assistenza clienti in Asia".: Eccellenza riconosciuta nell'assistenza e nel servizio clienti.

- Promozioni stagionali: Approfitta di una varietà di bonus esclusivi e offerte promozionali tutto l'anno.

>> Registrati per un conto broker FBS qui <

Clicca qui sotto per scaricare: