Keserakahan adalah salah satu alasan utama mengapa trader kehilangan uang dalam trading di pasar forex. Banyak trader baru terpikat untuk trading di pasar forex karena keuntungan besar yang mereka lihat didapat oleh trader lain. Pedagang sering kali ingin segera meraih keuntungan besar. Jadi, trader sering mengincar bintang saat trading di pasar forex. Mereka akan mencoba untuk mendapatkan pengembalian besar dengan risiko paling kecil. Seringkali, trader mengincar target yang mustahil. Hal ini sering kali membuat perdagangan yang seharusnya menguntungkan berubah menjadi perdagangan yang merugikan. Ini mungkin salah satu skenario paling menyakitkan saat berdagang di pasar forex.

Namun, bertentangan dengan kepercayaan populer, perdagangan bukanlah skema cepat kaya. Sebaliknya, itu adalah kesibukan sehari-hari. Trader harus perlahan tapi pasti mengembangkan akun mereka sedikit demi sedikit. Alih-alih membidik target yang tidak mungkin, terkadang yang terbaik adalah membiarkan pasar memberi tahu Anda apa yang ingin diberikannya kepada Anda. Alih-alih berpegang pada perdagangan dengan harapan harga akan bergerak lebih jauh ke arah tertentu, pedagang harus memiliki sarana untuk mengidentifikasi lebih awal jika pasar akan berbalik arah dari posisi mereka. Pedagang yang secara mekanis dapat masuk dan keluar pasar berdasarkan kondisi logis dapat memperoleh keuntungan yang konsisten dari pasar valas.

Lilin Berhenti

Candle Stop adalah indikator teknis momentum khusus yang merupakan variasi dari jenis saluran indikator.

Indikator ini memplot garis putus-putus yang mengikuti pergerakan price action. Garis-garis ini diplot berdasarkan pergerakan historis harga ekstrem. Garis pada dasarnya adalah titik tertinggi dan terendah dari aksi harga dalam periode tertentu dan digeser ke kanan. Ini menciptakan struktur seperti saluran yang akan menandai tingkat pergerakan harga yang ekstrem.

Garis putus-putus dapat digunakan sebagai indikator volatilitas. Mengingat bahwa garis didasarkan pada harga ekstrem, pedagang sekarang dapat dengan mudah memvisualisasikan jika aksi harga berkontraksi atau meluas. Garis berkontraksi saat volatilitas pasar berkontraksi dan meluas saat volatilitas pasar meluas.

Garis juga bisa digunakan sebagai dasar untuk breakout momentum. Lilin momentum yang kuat menembus di luar saluran dapat menunjukkan bahwa pasar keluar dari fase kontraksi pasar dan mungkin mulai menjadi tren. Pengaturan ini dapat digunakan oleh trader yang memperdagangkan strategi momentum.

Garis juga dapat digunakan sebagai basis stop loss atau penanda stop loss trailing. Mengingat bahwa garis didasarkan pada harga ekstrem, pedagang dapat menghentikan kerugian pada garis yang berlawanan dengan arah perdagangan mereka.

Drive

Drive adalah indikator teknis kustom yang merupakan bagian dari keluarga indikator teknis osilator. Ini mengidentifikasi dan menunjukkan momentum berdasarkan dua garis berosilasi.

Indikator ini memplot dua garis, satu garis berwarna hijau, dan garis lainnya berwarna merah. Arah tren atau momentum diidentifikasi berdasarkan bagaimana kedua garis saling tumpang tindih.

Pasar dikatakan bullish setiap kali garis hijau di atas garis merah, dan bearish setiap kali garis hijau di bawah garis merah.

Indikator ini dapat digunakan sebagai indikator penyaring momentum, mencegah trader melakukan trading melawan arah momentum pasar saat ini. Ini juga dapat digunakan sebagai sinyal masuk asalkan sesuai dengan sinyal perdagangan komplementer lainnya.

Trading Strategy

Strategi Perdagangan Momentum Drive Forex adalah strategi perdagangan momentum sederhana berdasarkan dua indikator teknis pelengkap.

Pertama, kita harus mengidentifikasi pasar yang baru saja berbalik arah dan memulai tren baru. Hal ini diidentifikasi berdasarkan karakteristik price action, serta price action yang melintasi garis Exponential Moving Average (EMA) 50 periode.

Kemudian, kita menunggu aksi harga untuk mengkonfirmasi tren baru berdasarkan retracement kembali ke arah garis EMA 50, diikuti oleh penolakan harga dengan momentum yang kuat.

Retracement dapat diidentifikasi berdasarkan penutupan harga di dalam area garis Candle Stop.

Ini kemudian harus diikuti oleh candle momentum yang kuat yang menutup di luar garis Candle Stop menuju arah tren baru.

Penyiapan breakout momentum ini kemudian harus dikonfirmasi oleh indikator Drive. Konfirmasi didasarkan pada bagaimana garis hijau dan merah tumpang tindih, yang harus sesuai dengan arah tren aksi harga dan garis EMA 50.

Indikator:

- Lilin Berhenti

- 50 EMA

- Drive

Kerangka Waktu Pilihan: Grafik 15 menit, 30 menit, 1 jam, dan 4 jam

Pasangan Mata Uang: FX mayor, minor, dan persilangan

Sesi Perdagangan: Sesi Tokyo, London dan New York

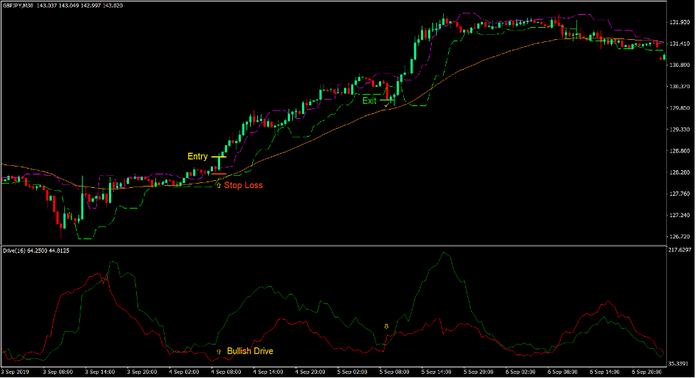

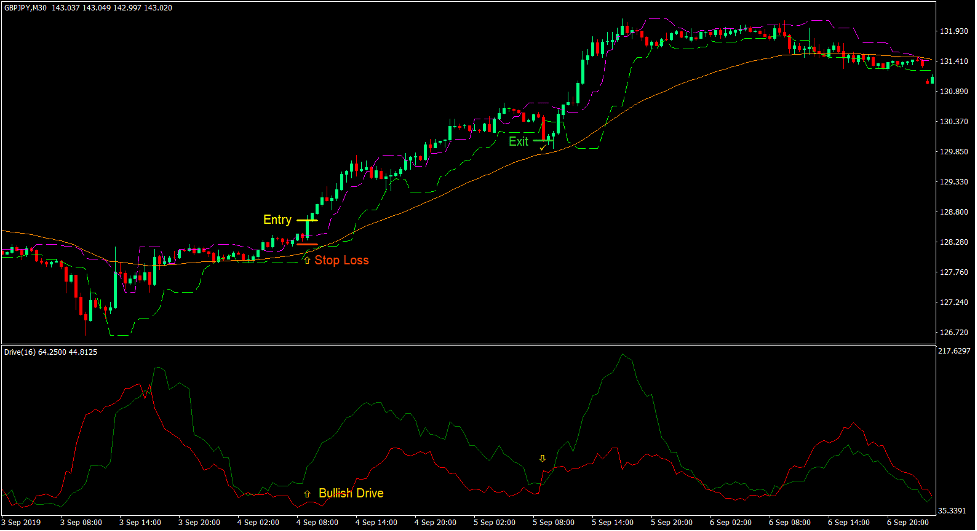

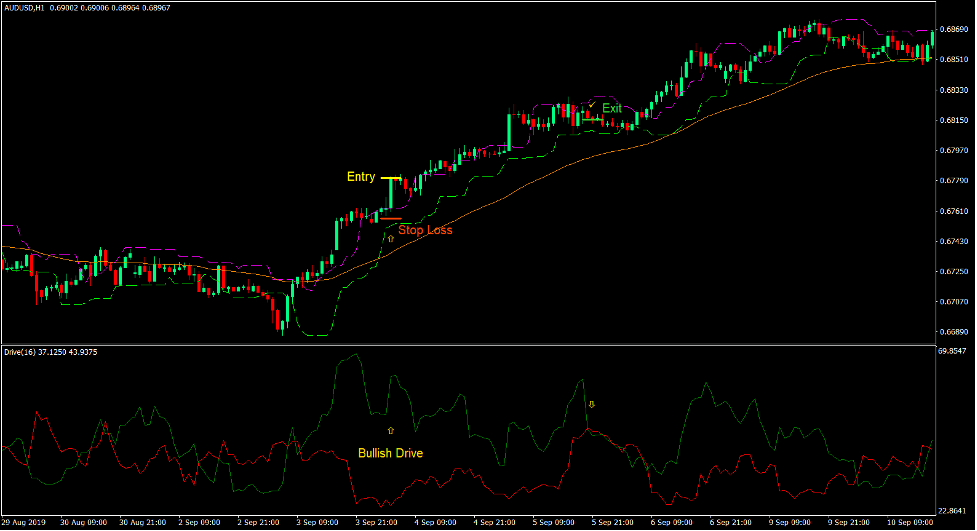

Beli Pengaturan Perdagangan

Masuk

- Tindakan harga harus melewati garis EMA 50.

- Garis 50 EMA harus mulai miring ke atas.

- Aksi harga harus menelusuri kembali ke area antara dua garis indikator Candle Stop.

- Candle momentum bullish yang kuat harus ditutup di atas garis magenta indikator Candle Stop.

- Garis hijau indikator Drive harus berada di atas garis merah.

- Masukkan pesanan beli pada konfirmasi kondisi ini.

Stop Loss

- Atur stop loss di bawah candle entri.

Exit

- Tutup perdagangan segera setelah garis hijau indikator Drive melintas di bawah garis merah.

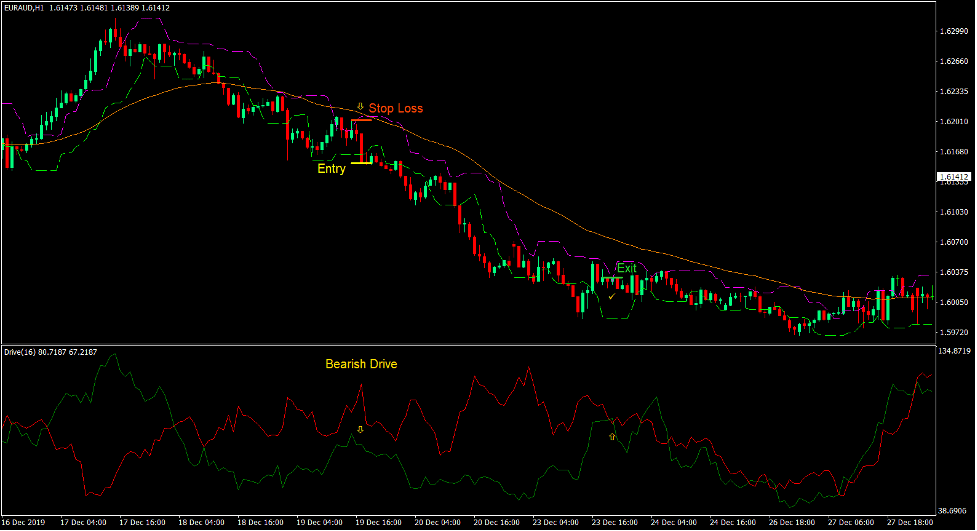

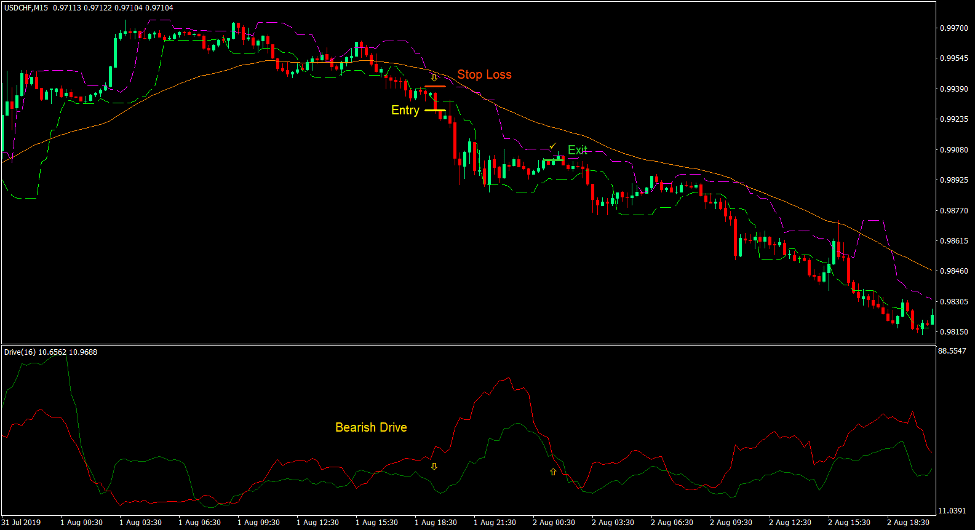

Jual Pengaturan Perdagangan

Masuk

- Tindakan harga harus melintasi di bawah garis 50 EMA.

- Garis 50 EMA harus mulai miring ke bawah.

- Aksi harga harus menelusuri kembali ke area antara dua garis indikator Candle Stop.

- Candle momentum bearish yang kuat harus ditutup di bawah garis kapur indikator Candle Stop.

- Garis hijau indikator Drive harus berada di bawah garis merah.

- Masukkan order jual pada konfirmasi kondisi ini.

Stop Loss

- Atur stop loss di atas candle entri.

Exit

- Tutup perdagangan segera setelah garis hijau indikator Drive melintas di atas garis merah.

Kesimpulan

Ini adalah strategi breakout momentum jenis baru yang didasarkan pada indikator Candle Stop.

Sama seperti strategi perdagangan breakout momentum lainnya yang menggabungkan indikator berbasis band, indikator ini juga bekerja dengan baik karena mengidentifikasi kontraksi dan ekspansi pasar.

Namun, strategi ini diarahkan pada tren jangka pendek. Itu berdagang dengan arah tren baru saat berdagang di breakout.

Saat memperdagangkan strategi ini, yang terbaik juga untuk mencatat harga menembus melampaui titik ayunan kecil sebelumnya. Ini memastikan bahwa level support atau resistance sebelumnya telah ditembus.

Broker MT4 yang Direkomendasikan

XM Broker

- Gratis $ 50 Untuk Memulai Trading Secara Instan! (Keuntungan yang Dapat Ditarik)

- Bonus Deposit hingga $5,000

- Program Loyalitas Tanpa Batas

- Pialang Forex Pemenang Penghargaan

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar Akun Broker XM di sini <

Pialang FBS

- Perdagangkan 100 Bonus: Gratis $100 untuk memulai perjalanan trading Anda!

- 100 Bonus Deposit%: Gandakan deposit Anda hingga $10,000 dan berdagang dengan modal yang ditingkatkan.

- Leverage hingga 1: 3000: Memaksimalkan potensi keuntungan dengan salah satu opsi leverage tertinggi yang tersedia.

- Penghargaan 'Broker Layanan Pelanggan Terbaik Asia': Keunggulan yang diakui dalam dukungan dan layanan pelanggan.

- Promosi Musiman: Nikmati berbagai bonus eksklusif dan penawaran promosi sepanjang tahun.

>> Daftar Akun Broker FBS di sini <

Klik di bawah ini untuk mengunduh: