Banyak orang mendengar tentang perdagangan valas dan bagaimana ia mampu menumbuhkan uang orang beberapa kali lipat hanya dalam waktu singkat. Ini biasanya akan menarik minat orang. Namun, orang juga memiliki anggapan bahwa perdagangan sangat sulit dan hanya boleh dicoba oleh orang-orang yang sangat intelektual.

Gagasan ini tidak bisa jauh dari kebenaran. Meskipun pedagang harus memiliki tingkat kecerdasan tertentu yang memungkinkan mereka untuk memahami apa yang mereka lakukan, tetapi tidak banyak yang diperlukan untuk menjadi seorang pedagang. Faktanya, strategi sederhana telah terbukti berhasil berkali-kali. Trader yang dapat berpegang pada rencana sederhana seperti itu sering menuai hasil dari mendapatkan keuntungan dari pasar forex.

Strategi crossover adalah beberapa strategi perdagangan paling sederhana yang dapat diterapkan oleh seorang pedagang. Faktanya, banyak trader baru yang diperkenalkan dengan jenis strategi ini ketika mereka pertama kali memulai trading. Namun, banyak yang akan memiliki hasil yang beragam. Ini karena strategi crossover bekerja dengan baik di pasar yang memiliki kecenderungan kuat untuk tren namun akan gagal jika digunakan dalam kondisi pasar yang berkisar.

Salah satu cara untuk meningkatkan kemungkinan mendapatkan pengaturan perdagangan yang menang menggunakan (Strategi Perdagangan Lintas Forex MA MACD Ideal) strategi persilangan adalah menggunakan pullback atau pengujian ulang. Hal ini memungkinkan para pedagang untuk memiliki lebih banyak konfirmasi tentang tren baru daripada mengikuti strategi persilangan secara membabi buta.

2PB Idealnya 3 MA

2PB Ideal 3 MA adalah indikator teknis khusus berdasarkan rata-rata bergerak.

Rata-rata bergerak adalah beberapa indikator teknis yang paling berguna yang digunakan oleh pedagang mengikuti tren dan pembalikan tren. Ini karena rata-rata bergerak sangat ideal untuk mengidentifikasi tren.

Salah satu cara trader menggunakan rata-rata bergerak untuk mengidentifikasi tren adalah dengan mengamati arah kemiringan garis rata-rata bergerak. Jika kemiringannya ke atas, maka pasar dalam tren naik. Jika kemiringannya ke bawah, maka pasar dalam tren turun. Lain adalah dengan melihat lokasi aksi harga dalam kaitannya dengan garis rata-rata bergerak. Jika price action berada di atas moving average, maka bias pasar adalah bullish. Jika price action berada di bawah moving average, maka bias pasar adalah bearish. Pedagang juga menggunakan crossover rata-rata bergerak untuk mengidentifikasi pembalikan tren. Cross up akan menunjukkan kemungkinan pembalikan tren bullish. Cross down akan menunjukkan kemungkinan pembalikan tren bearish.

Rata-rata bergerak sangat berguna, namun, rata-rata bergerak juga cenderung mudah rentan terhadap tipuan selama pasar berombak. Rata-rata pergerakan yang baik akan memiliki keseimbangan antara responsif terhadap pergerakan harga namun pada saat yang sama kurang rentan terhadap tipuan.

2PB Ideal 3 MA dimodifikasi untuk memuluskan respon dari garis rata-rata bergerak. Ini menciptakan garis rata-rata bergerak yang kurang rentan terhadap tipuan. Ketika dipasangkan dengan garis rata-rata bergerak komplementer, MA 2PB Ideal 3 dapat menghasilkan sinyal pembalikan tren yang sangat baik.

OsMACD

OsMACD adalah indikator teknis khusus lainnya yang merupakan bagian dari keluarga indikator osilator. Ini juga didasarkan pada indikator Moving Average Convergence and Divergence (MACD) yang banyak digunakan.

OsMACD didasarkan pada divergensi dan konvergensi dari dua rata-rata bergerak. Ini pada dasarnya adalah perbedaan antara dua rata-rata bergerak. Indikator ini menggunakan Exponential Moving Averages (EMA) untuk mencapai perbedaan dan disetel dengan EMA yang lebih cepat di 12 bar dan EMA yang lebih lambat di 26 bar. Hasilnya kemudian diplot sebagai batang histogram. Kemudian, Garis Sinyal diturunkan dari batang histogram. Garis sinyal pada dasarnya adalah Simple Moving Average (SMA) dari batang histogram MACD. Indikator ini juga memungkinkan trader untuk mengubah sumber harga, apakah itu penutupan candle, high, low atau median.

Batang dan garis di atas nol menunjukkan bias arah bullish, sedangkan batang dan garis di bawah nol menunjukkan bias arah bearish. Pedagang juga dapat mengidentifikasi kemungkinan pembalikan tren berdasarkan persilangan antara batang histogram dan garis sinyal. Titik juga diplot yang menunjukkan perbedaan antara batang histogram MACD dan garis sinyal. Titik-titik positif menunjukkan bahwa bias arah adalah bullish, sedangkan titik-titik negatif menunjukkan bahwa bias arah adalah bearish. Batang, garis, dan titik juga berubah warna untuk menunjukkan momentum. Ini didasarkan pada nilai saat ini dibandingkan dengan nilai sebelumnya. Biru menunjukkan momentum bullish yang menguat, sedangkan merah menunjukkan momentum bearish yang menguat.

Trading Strategy

Strategi perdagangan ini adalah strategi pembalikan tren crossover sederhana.

Sinyal pembalikan tren dihasilkan setiap kali Rata-Rata Pergerakan Eksponensial 20 periode melintasi garis 2PB Ideal 3 MA. Pembalikan tren ini juga harus dikonfirmasi oleh batang histogram OsMACD dan garis yang melintasi garis tengah, yaitu nol.

Namun, alih-alih langsung melakukan perdagangan, kita harus menunggu konfirmasi aksi harga. Ini pada dasarnya adalah kemunduran menuju garis rata-rata bergerak diikuti oleh penolakan harga di area garis rata-rata bergerak.

Jika kondisi ini terpenuhi, maka kita memiliki pengaturan pembalikan tren yang valid.

Indikator:

- 2pbIdeal3MA

- OsMACD

- 20 EMA

Kerangka Waktu Pilihan: Grafik 1 jam, 4 jam, dan harian

Pasangan Mata Uang: FX mayor, minor, dan persilangan

Sesi Perdagangan: Sesi Tokyo, London dan New York

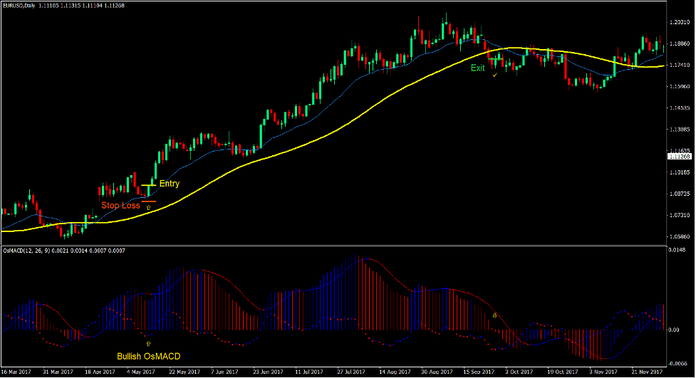

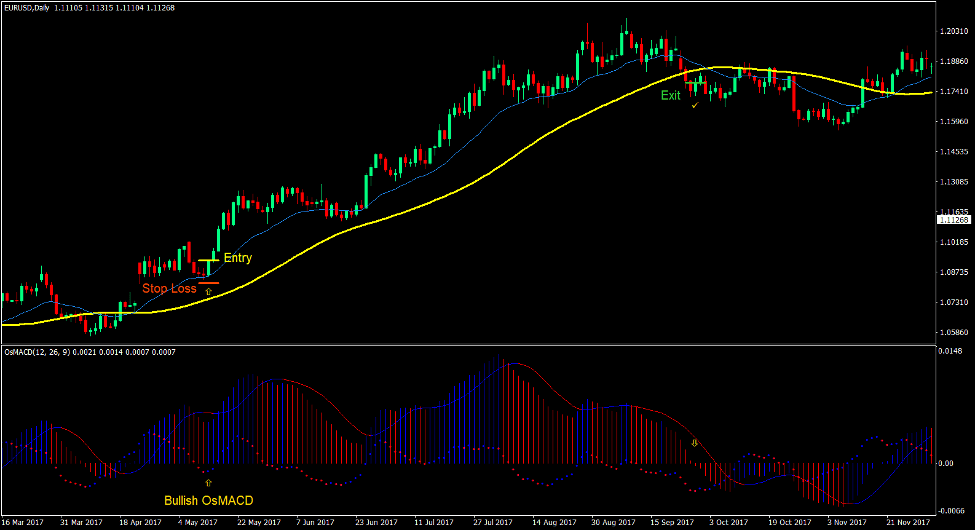

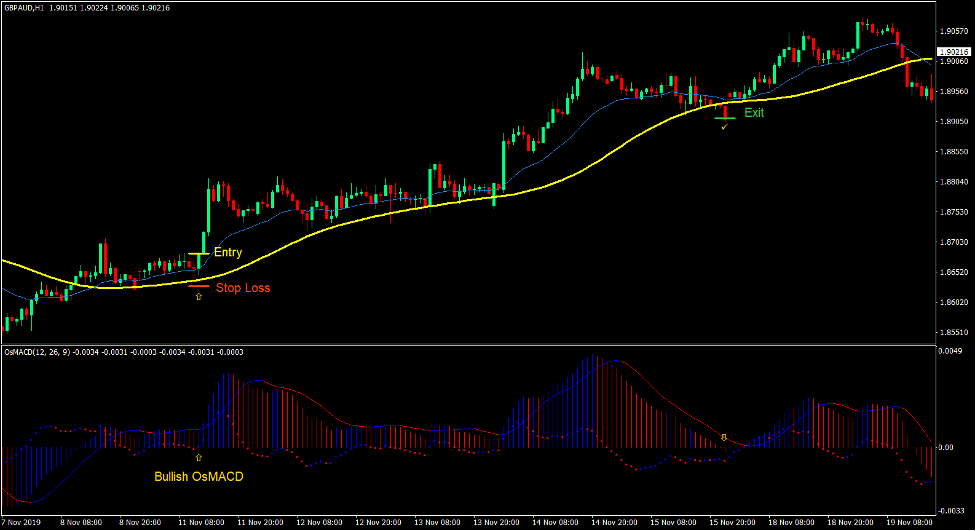

Beli Pengaturan Perdagangan

Masuk

- Tindakan harga harus melintasi di atas garis rata-rata bergerak.

- Garis 20 EMA harus melintasi di atas garis 2PB Ideal 3 MA.

- Bilah dan garis OsMACD harus melintasi di atas nol.

- Tindakan harga harus mundur ke arah garis rata-rata bergerak dan menolak area tersebut.

- Bilah OsMACD harus berubah menjadi biru.

- Masukkan pesanan beli pada konfirmasi kondisi ini.

Stop Loss

- Atur stop loss pada fraktal di bawah candle entri.

Exit

- Tutup perdagangan segera setelah batang OsMACD melintasi di bawah nol.

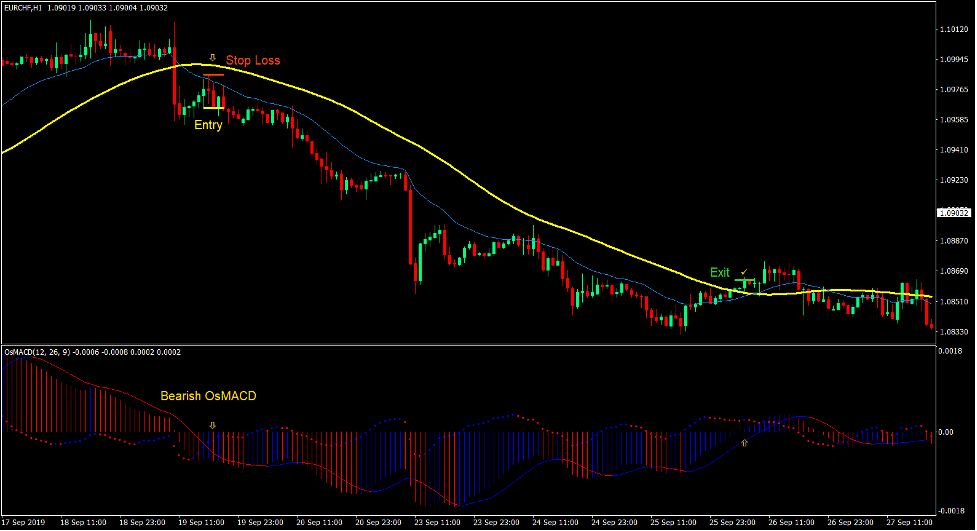

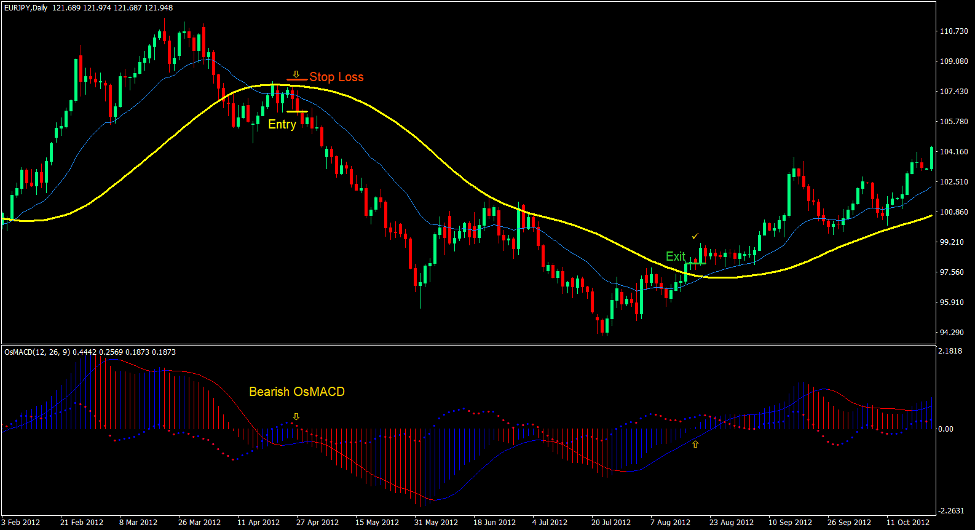

Jual Pengaturan Perdagangan

Masuk

- Tindakan harga harus melintasi di bawah garis rata-rata bergerak.

- Garis 20 EMA harus melintasi di bawah garis 2PB Ideal 3 MA.

- Batang dan garis OsMACD harus bersilangan di bawah nol.

- Tindakan harga harus mundur ke arah garis rata-rata bergerak dan menolak area tersebut.

- Bilah OsMACD harus berubah menjadi merah.

- Masukkan order jual pada konfirmasi kondisi ini.

Stop Loss

- Atur stop loss pada fraktal di atas candle entri.

Exit

- Tutup perdagangan segera setelah batang OsMACD melintasi di atas nol.

Kesimpulan

Strategi perdagangan ini bekerja dengan baik bila digunakan di pasar atau pasangan mata uang yang memiliki kecenderungan kuat untuk tren. Ini karena strategi ini memungkinkan pedagang untuk mengidentifikasi pembalikan tren dan mengonfirmasinya berdasarkan aksi harga di dekat awal tren.

Trader yang dapat mengamati pergerakan harga secara objektif dapat menggunakan strategi ini untuk mendapatkan keuntungan dari pembalikan tren di pasar forex.

Broker MT4 yang Direkomendasikan

XM Broker

- Gratis $ 50 Untuk Memulai Trading Secara Instan! (Keuntungan yang Dapat Ditarik)

- Bonus Deposit hingga $5,000

- Program Loyalitas Tanpa Batas

- Pialang Forex Pemenang Penghargaan

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar Akun Broker XM di sini <

Pialang FBS

- Perdagangkan 100 Bonus: Gratis $100 untuk memulai perjalanan trading Anda!

- 100 Bonus Deposit%: Gandakan deposit Anda hingga $10,000 dan berdagang dengan modal yang ditingkatkan.

- Leverage hingga 1: 3000: Memaksimalkan potensi keuntungan dengan salah satu opsi leverage tertinggi yang tersedia.

- Penghargaan 'Broker Layanan Pelanggan Terbaik Asia': Keunggulan yang diakui dalam dukungan dan layanan pelanggan.

- Promosi Musiman: Nikmati berbagai bonus eksklusif dan penawaran promosi sepanjang tahun.

>> Daftar Akun Broker FBS di sini <

Klik di bawah ini untuk mengunduh: