Salah satu kriteria yang menentukan trader profesional adalah konsistensi. Pedagang profesional menghasilkan uang dari perdagangan sebagai sumber pendapatan utama mereka. Banyak trader memimpikan hal itu. Namun, tidak semua trader bisa melakukan ini karena kebanyakan trader tidak cukup konsisten untuk menggantungkan harapan mereka akan pendapatan bulanan yang berasal dari trading. Pedagang profesional di sisi lain sangat konsisten dalam hal perdagangan mereka. Tentu, akan ada beberapa periode di sana-sini di mana mereka mungkin berada di zona merah. Namun, sebagian besar pedagang profesional biasanya berada di zona hijau. Itu tidak berarti bahwa semua perdagangan mereka menguntungkan. Ini hanya berarti bahwa dari periode ke periode, trader profesional sebagian besar berada di zona hijau, yang memungkinkan mereka mengharapkan pendapatan dari trading yang dapat mereka jalani.

Konsistensi dalam perdagangan berasal dari cara perdagangan pasar yang sistematis, yang memungkinkan pedagang mengulangi proses yang sama berulang kali selama pengaturan perdagangan sesuai dengan kriteria mereka. Dengan pengaturan perdagangan yang tepat, pedagang dapat secara signifikan mengurangi perdagangan yang memiliki probabilitas rendah untuk menghasilkan kemenangan dan memperdagangkan pengaturan probabilitas tinggi di sebagian besar waktu.

Salah satu jenis pengaturan perdagangan terbaik yang dapat digunakan pedagang untuk berdagang dengan probabilitas menang yang relatif tinggi adalah pengaturan mengikuti tren atau kelanjutan tren. Ini karena pengaturan kelanjutan tren diperdagangkan ke arah tren utama, yang secara signifikan meningkatkan kemungkinan perdagangan yang menang.

Buaya

Indikator Alligator Bill William adalah tren on-chart yang populer mengikuti indikator teknis yang dikembangkan untuk membantu pedagang dalam mengidentifikasi tren.

Indikator ini didasarkan pada sekumpulan rata-rata pergerakan yang dimodifikasi, khususnya rata-rata pergerakan yang dihaluskan. Garis rata-rata bergerak jangka panjang disebut garis Rahang, garis rata-rata bergerak jangka menengah adalah Gigi, dan garis rata-rata bergerak jangka pendek disebut bibir.

Arah tren didasarkan pada bagaimana garis tumpang tindih. Jika garis jangka pendek berada di atas dua garis lainnya, pasar dianggap bullish. Namun, pasar dianggap bearish jika garis jangka pendek berada di bawah dua garis lainnya. Jika garis tidak ditumpuk dengan benar, maka pasar tersebut bisa berada dalam kondisi mulai. Crossover antara garis menunjukkan kemungkinan pembalikan tren.

Pasar dianggap berada dalam fase tren penguatan setiap kali tiga garis rata-rata bergerak mulai meluas. Namun, jika ketiga garis mulai berkontraksi satu sama lain, maka pasar dianggap berada dalam fase kontraksi pasar. Adalah bijaksana bagi trader untuk berdagang hanya ketika pasar mulai memperkuat arah trennya dan keluar dari perdagangan saat pasar mulai mendingin.

CCI di Saluran Langkah

CCI di Step Channel adalah indikator teknis khusus yang sama seperti namanya. Itu didasarkan pada Commodity Channel Index (CCI) namun dimodifikasi berdasarkan indikator Step Channel.

Indikator CCI klasik adalah osilator berbasis momentum yang digunakan untuk membantu pedagang mengidentifikasi pergerakan siklus aksi harga, termasuk kondisi overbought dan oversold, yang sering mengarah pada pembalikan rata-rata. CCI adalah osilator yang diturunkan dari rata-rata pergerakan Harga Khas.

Indikator Step Channel di sisi lain adalah tren mengikuti indikator teknis adalah indikator on-chart yang memplot struktur seperti saluran berdasarkan volatilitas aksi harga.

CCI pada indikator Step Channel menggabungkan kedua konsep menjadi satu. Ini memplot osilator CCI seperti CCI dasar. Namun, alih-alih menggunakan Harga Khas sebagai dasarnya, ia menghitung menggunakan median dari indikator Step Channel.

Indikator ini memplot bar yang dapat berosilasi dari positif ke negatif atau sebaliknya. Bar positif mengindikasikan bias momentum bullish, sementara bar negatif mengindikasikan bias momentum bearish. Itu juga memiliki penanda di level +/-80. Batang yang menembus di luar kisaran ini dapat mengindikasikan tren atau momentum penguatan.

Indikator PPO

Indikator PPO, juga dikenal sebagai Percentage Price Oscillator, adalah indikator momentum teknis yang juga merupakan bagian dari rangkaian indikator osilator. Ini juga sangat mirip dengan osilator MACD yang populer.

Seperti MACD, indikator ini didasarkan pada hubungan antara dua rata-rata bergerak, yang dihitung dalam bentuk persentase. Ini juga memiliki garis sinyal yang juga berasal dari garis PPO asli. Yang membuatnya unik adalah berdasarkan garis Exponential Moving Average (EMA), yang membuatnya sangat responsif terhadap pergerakan harga.

Indikator ini memplot dua garis yang berosilasi di sekitar nol. Bias tren dapat diidentifikasi berdasarkan apakah garisnya positif atau negatif. Sinyal pembalikan juga dapat dihasilkan berdasarkan persimpangan garis PPO utama dan garis sinyal.

Trading Strategy

Alligator CCI Step Forex Trading Strategy adalah strategi mengikuti tren yang diperdagangkan pada pertemuan sinyal kelanjutan tren yang berasal dari CCI pada indikator Step Channel dan indikator PPO.

Arah tren diidentifikasi berdasarkan indikator Alligator. Ini didasarkan pada bagaimana tiga garis rata-rata bergerak yang dimodifikasi ditumpuk.

Selama tren tersebut, fase kontraksi pasar dan retracement memang terjadi. Ini sering menyebabkan CCI di Step Channel menunjukkan tren yang melemah dan indikator PPO menunjukkan tanda-tanda pembalikan sementara.

Penyiapan perdagangan dianggap valid segera setelah indikator CCI pada Saluran Langkah menunjukkan dimulainya kembali kekuatan atau momentum tren, dan indikator PPO menunjukkan tanda-tanda kemungkinan kelanjutan tren berdasarkan persilangan dua garis.

Indikator:

- Buaya

- CCI_

- PPO

Kerangka Waktu Pilihan:Grafik 15 menit, 30 menit, 1 jam, dan 4 jam

Pasangan Mata Uang: FX mayor, minor, dan persilangan

Sesi Perdagangan: Sesi Tokyo, London dan New York

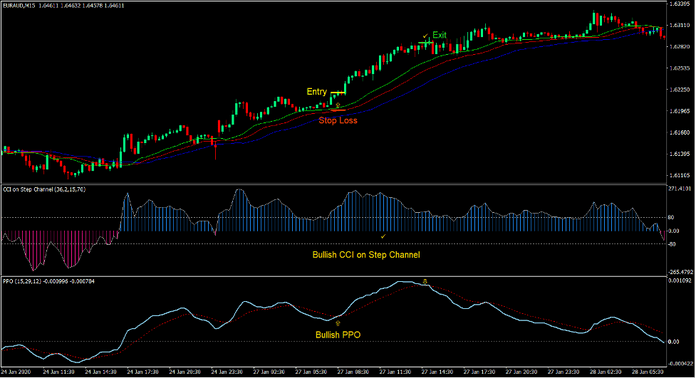

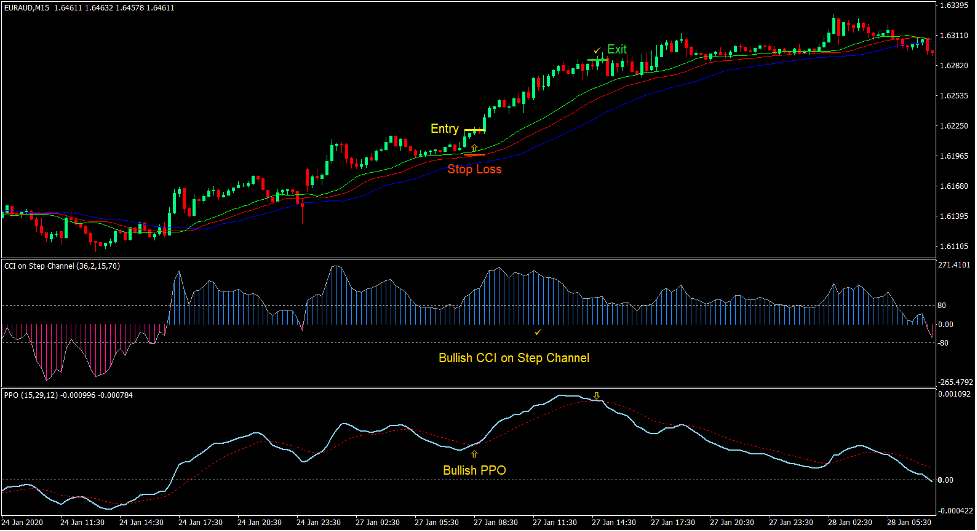

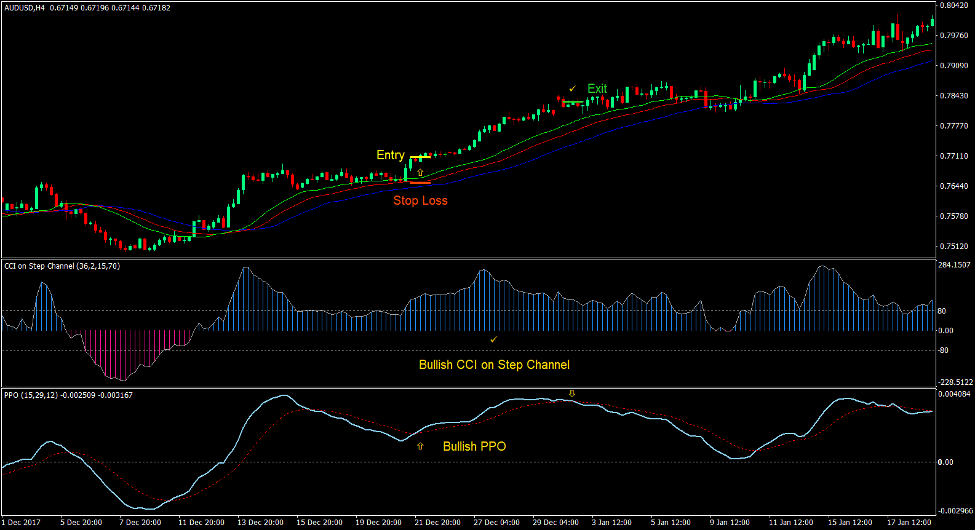

Beli Pengaturan Perdagangan

Masuk

- Garis Alligator harus ditumpuk dengan urutan sebagai berikut:

- Bibir: atas

- Gigi: tengah

- Rahang: bawah

- CCI pada bilah Step Channel harus positif.

- Garis PPO harus positif.

- Harga harus menelusuri kembali ke arah garis Alligator yang menyebabkan CCI pada bar Step Channel turun di bawah 80 dan garis PPO melintas di bawah garis sinyal.

- CCI pada bilah Step Channel harus melintasi di atas 80.

- Garis PPO harus melintas di atas garis sinyal.

- Masukkan pesanan beli pada konfirmasi kondisi ini.

Stop Loss

- Tetapkan stop loss pada support di bawah entry candle.

Exit

- Tutup perdagangan segera setelah garis PPO melintas di bawah garis sinyal.

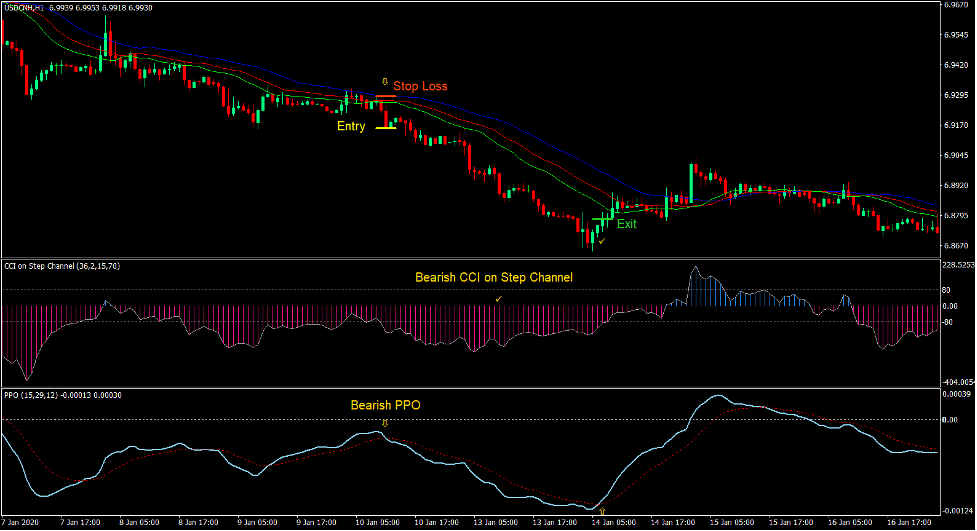

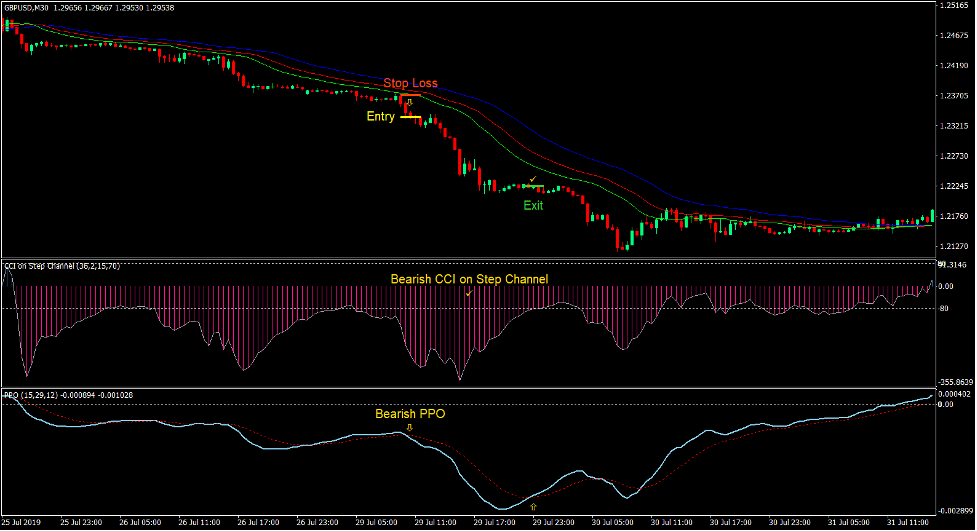

Jual Pengaturan Perdagangan

Masuk

- Garis Alligator harus ditumpuk dengan urutan sebagai berikut:

- Bibir: bawah

- Gigi: tengah

- Rahang: atas

- CCI pada bilah Step Channel harus negatif.

- Garis PPO harus negatif.

- Harga harus menelusuri kembali ke arah garis Alligator yang menyebabkan CCI pada bar Step Channel menembus di atas -80 dan garis PPO melintas di atas garis sinyal.

- CCI pada bilah Step Channel harus melewati di bawah -80.

- Garis PPO harus melintas di bawah garis sinyal.

- Masukkan order jual pada konfirmasi kondisi ini.

Stop Loss

- Tetapkan stop loss pada resistance di atas entry candle.

Exit

- Tutup perdagangan segera setelah garis PPO melintas di atas garis sinyal.

Kesimpulan

Strategi perdagangan ini adalah tren mengikuti strategi sederhana yang didasarkan pada pertemuan indikator teknis kustom probabilitas tinggi.

Pengaturan yang dapat dihasilkan oleh strategi ini cenderung menghasilkan persentase kemenangan yang tinggi asalkan strategi tersebut digunakan di lingkungan pasar yang benar.

Dengan demikian, strategi ini paling baik digunakan hanya selama kondisi pasar yang sedang tren karena memberikan pedagang cara yang sistematis untuk memasuki pasar yang sedang tren ke arah tren.

Broker MT4 yang Direkomendasikan

XM Broker

- Gratis $ 50 Untuk Memulai Trading Secara Instan! (Keuntungan yang Dapat Ditarik)

- Bonus Deposit hingga $5,000

- Program Loyalitas Tanpa Batas

- Pialang Forex Pemenang Penghargaan

- Bonus Eksklusif Tambahan Sepanjang tahun

>> Daftar Akun Broker XM di sini <

Pialang FBS

- Perdagangkan 100 Bonus: Gratis $100 untuk memulai perjalanan trading Anda!

- 100 Bonus Deposit%: Gandakan deposit Anda hingga $10,000 dan berdagang dengan modal yang ditingkatkan.

- Leverage hingga 1: 3000: Memaksimalkan potensi keuntungan dengan salah satu opsi leverage tertinggi yang tersedia.

- Penghargaan 'Broker Layanan Pelanggan Terbaik Asia': Keunggulan yang diakui dalam dukungan dan layanan pelanggan.

- Promosi Musiman: Nikmati berbagai bonus eksklusif dan penawaran promosi sepanjang tahun.

>> Daftar Akun Broker FBS di sini <

Klik di bawah ini untuk mengunduh: