Traders are often caught in a conundrum when presented with a trade setup. Traders would usually want to take trades with a higher probability. This is why they would opt to wait for clearer signals, whether it is price action, an indicator signal or whatnot. However, waiting for clearer signals or confirmations would usually result in entering a trend too late. This usually results in a trade setup with low risk-reward ratio or a setup that is at the end of its momentum or trend. Traders end up either with lower yields compared to losses, or trades that immediately reverse after the trade is taken.

Traders are either too early too early in a trend reversal setup that they end up taking a trade that does not result in a reversal, or they are too late to take a trade that they end up entering the trade when the trend is about to end. Seasoned traders however strike a balance between the two. They enter a trade when there is a clear trend, yet they avoid chasing price around.

There are many ways to trade the market while striking the balance between trading with the trend and not chasing price around. One of the most efficient ways to trade a clearly trending market without chasing momentum is by trading during retracements. This allows traders to enter the market at a discount while still trading with the trend.

Trend Steps Forex Trading Strategy is a trend following strategy which trades on a mid-term trend, while at the same time taking trades on retracements that occur on the short-term trend.

Turtle Channel Indicator

The Turtle Channel indicator is a trend following indicator which is geared towards helping traders identify the mid-term trend.

The concept behind this indicator is the idea that price is considered to have reversed if it goes against the current trend direction by a certain distance based on the Average True Range (ATR).

It identifies and indicates trend direction by plotting lines opposite to the direction of the trend. These lines are based on the average movement range of price within a certain period and its difference from the high or low of the same period. If price crosses and closes against the plotted lines, the indicator will detect a trend reversal and shift the lines to the opposite side of price action.

It plots two lines, a solid line and a dashed line. The dashed line represents the shorter-term trend, while the solid line represents the longer-term trend. The solid line also changes color whenever the indicator detects a trend reversal.

Traders can use this indicator as a trend direction filter by avoiding trades that are against the current trend direction. Traders can also use it as a trend reversal entry signal and take trades whenever the solid line shifts. Lastly, traders can also use this indicator as a trailing stop loss by placing the stop loss behind any of the two lines.

Indicator Arrows

Indicator Arrows is a trend reversal signal indicator which is based on a confluence of various indicators. It bases its reading of trend direction on moving averages, Moving Average Convergence and Divergence (MACD), Oscillator of Moving Averages (OsMA), Stochastic Oscillators, Relative Strength Index (RSI), Commodity Channel Index (CCI), Relative Vigor Index (RVI), and the Average Directional Movement Index (ADX).

Since this indicator is based on the confluence of a variety of indications, the resulting trend reversal signals tend to be very reliable. Signals usually occur near the peak or trough of a swing high or swing low, while not being aggressively overreactive to price fluctuations.

The Indicator Arrows indicates trend reversals by plotting arrows pointing the direction of the trend. Traders can use these arrows as a signal to enter or exit a trade based on a short-term trend.

Trading Strategy

This trading strategy trades on clear trending markets based on the mid-term trend, while taking precise entries based on the short-term trend.

The Turtle Channel indicator will be used as the basis for the mid-term trend. Trends are simply based on where the Turtle Channel lines are plotted in relation to the current price action. Price action also must confirm the trend based on how the swing highs and swing lows are forming.

As soon as the trend is confirmed, we could then wait for a reversal and an entry signal on the short-term momentum. This is based on the entry signal arrows plotted by the Indicator Arrows. Trade signals are taken only when the Indicator Arrows align with the trend indicated by the Turtle Channel indicator.

Indicators:

- The Turtle Trading Channel

- Indicator arrows

Preferred Time Frames: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

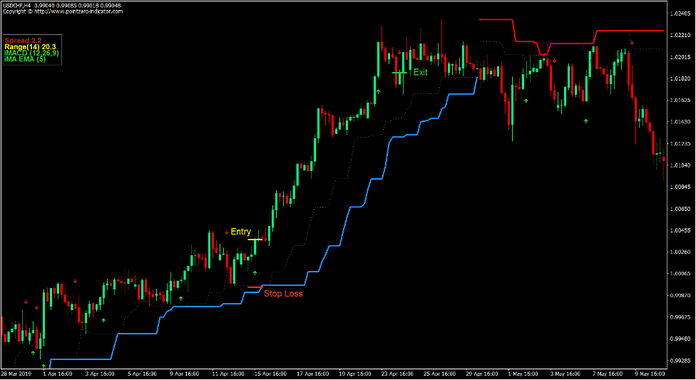

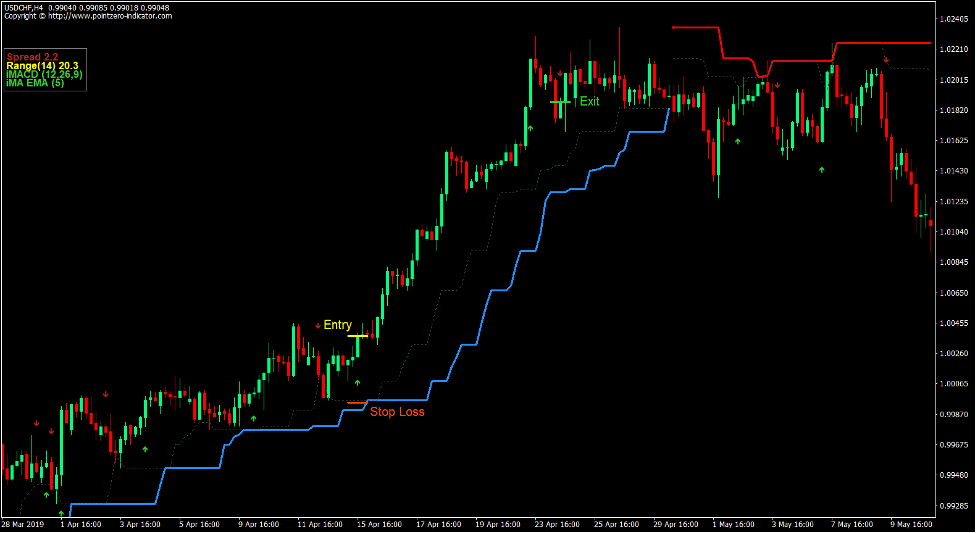

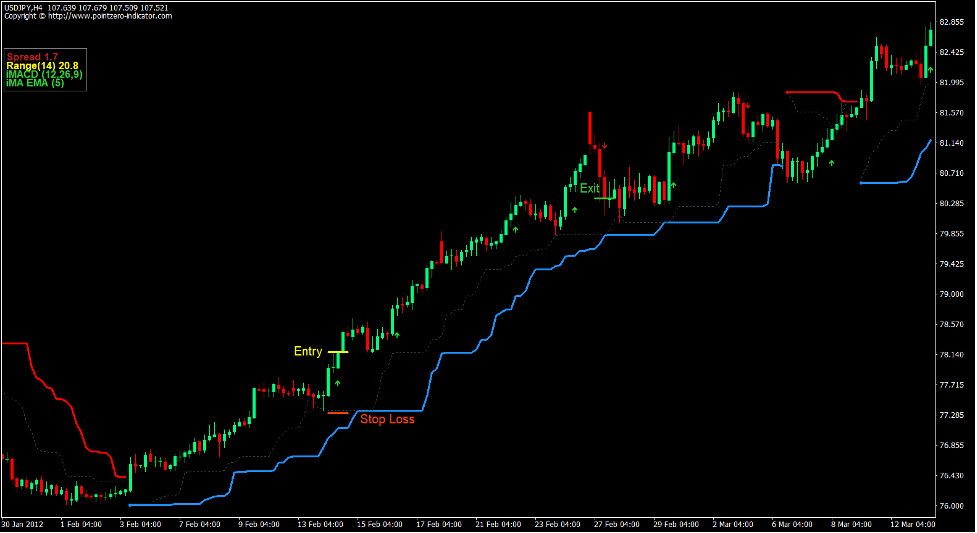

Buy Trade Setup

Entry

- The solid and dashed lines of the Turtle Channel indicator should be plotted below price action.

- Price action should be making higher swing highs and swing lows.

- Enter a buy order as soon as the Indicator Arrows plots an arrow pointing up.

Stop Loss

- Set the stop loss below the dashed line of the Turtle Channel indicator.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing down.

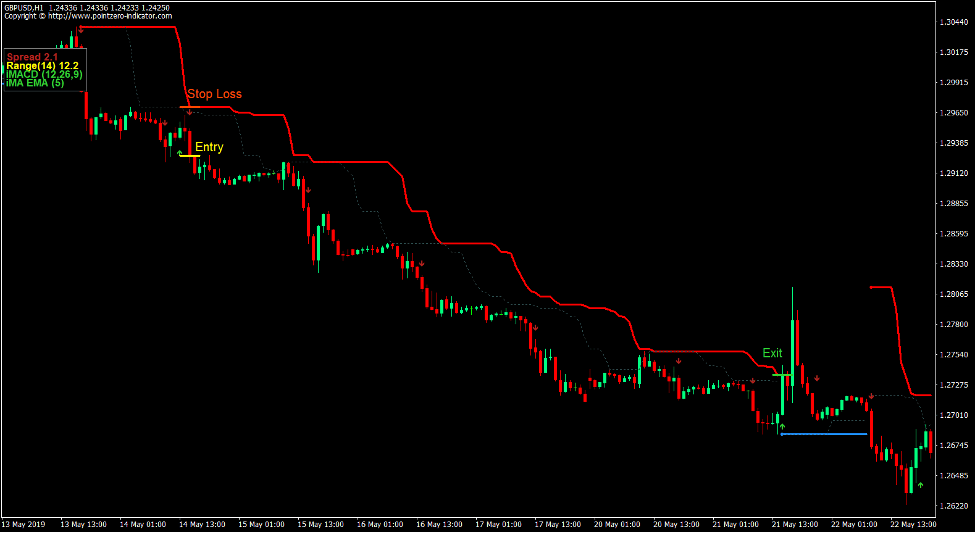

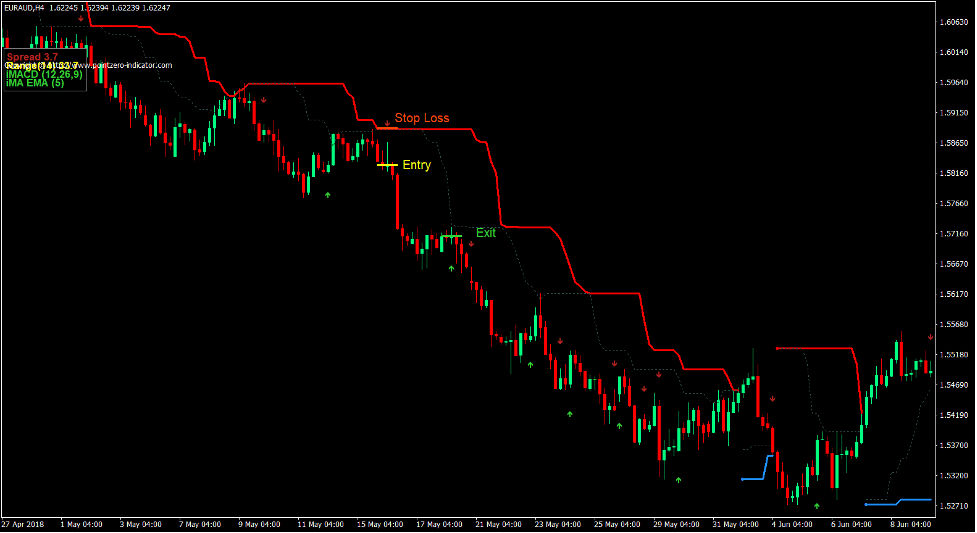

Sell Trade Setup

Entry

- The solid and dashed lines of the Turtle Channel indicator should be plotted above price action.

- Price action should be making lower swing highs and swing lows.

- Enter a sell order as soon as the Indicator Arrows plots an arrow pointing down.

Stop Loss

- Set the stop loss above the dashed line of the Turtle Channel indicator.

Exit

- Close the trade as soon as the Indicator Arrows plots an arrow pointing up.

Conclusion

This trading strategy is a good trend following strategy when used in a market where there is a clear trend. Price would usually create small retracements before pushing in the direction of the trend multiple times if the trend is established.

There will be times when the price push would not be as strong. There will also be times when the retracement occurring after a trade setup would be too deep. These scenarios are not optimal for our trade, yet it does occur in a trending market. To avoid losing out in such conditions, traders can set a fixed take profit target based on a multiple of the risk placed on the stop loss. Traders could then wait for either the stop loss or the take profit to be hit. Usually it is the take profit target that would be hit first if the target is still rational and if the market is indeed trending.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: