The forex market is a source of unlimited earning potential. The sheer size and volume of trading that occurs on a day to day basis is matchless, with average volume traded daily hovering around $6.6 trillion. Add to it the fact that the forex market is open 24 hours a day five days a week. Traders can easily make money from the forex market anytime they want from anywhere in the world. All you need is a computer with a trading platform and an internet connection. Trading opportunities can surface anytime of the day at any day of the week. The next big trend might just around the corner.

Markets could gain momentum and start to trend anytime. Traders who were able to catch these trends stand to make money big time. However, this is just half the battle. Traders who got in at the right time and were able to hold on to the trade long enough are the ones who make the most money.

Most traders hunt for the perfect opportunity waiting for the right trade setup to take shape. However, there is another approach which makes sense in markets that tend to trend more often. This method is generally called Stop and Reverse. Stop and Reverse type of trading assumes that traders can always have a trade open depending on the direction of the trend. If the market reverses, then they could also reverse their trades. This removes the guess work out of a trader’s mindset. Instead, traders could follow the market wherever it goes. Traders can take a trade whenever the market shows signs of reversing, trail their stop loss whenever the market makes a move and automatically exit as the trend ends.

Tipu Renko

Tipu Renko is a trend following technical indicator based on the concept of a Renko Chart.

Renko Charts is a type of price charting, developed by the Japanese, which emphasizes price movements rather than the standardized time intervals, which most price charts are based on.

Renko in Japanese literally means bricks. Renko Charts plot bars that look like bricks. Instead of plotting bars based on the distance that price moved within a period, Renko Charts plot bars whenever price moves by a certain distance, regardless of time. For example, the chart may plot bars for every five pips that price moved. If price moved by 10 pips, then it will plot two bars, regardless of how fast it took to move by 10 pips. A bar may also be preset to be plotted based on a multiple of the Average True Range (ATR). This is a very logical concept since forex pairs have different characteristics, moving at speeds that vary from each other.

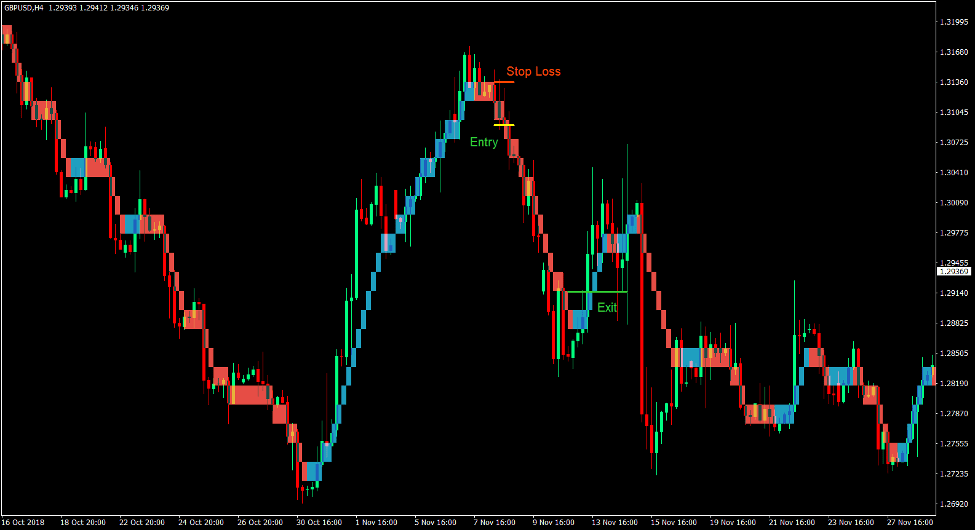

Tipu Renko on the other hand plots the same bars based on preset price movements, just as the Renko Bars. However, Tipu Renko is overlayed on a regular price chart. This creates a charting method that allows traders to identify trends based on the concept of a Renko Chart, while at the same time still have the perspective of a standard Japanese Candlestick chart.

The Tipu Renko boxes also change color based on the direction of the trend. Blue boxes indicate a bullish trend, while red boxes indicate a bearish trend.

Tipu Renko is best used as a trend following technical indicator. Traders can use the changing of the direction of the Renko bars as a basis to enter and exit trades.

Trading Strategy

This trading strategy is a simple trend following strategy based on the Tipu Renko indicator. It also attempts to keep traders in a trade whenever the market starts to trend, while at the same time help traders enter a trend early whenever it reverses.

The market is showing signs of trend reversal whenever the color of the Tipu Renko bars change and the direction of the box plotted starts to shift. The start of the third box confirms the new trend. Trades are taken at the close of the first candle on the third box.

Stop losses are trailed two Tipu Renko boxes behind the current price. Trades are kept open until price hits the trailing stop loss in profit.

Indicators:

- Tipu_renko

Preferred Time Frame: 1-hour and 4-hour charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

Buy Trade Setup

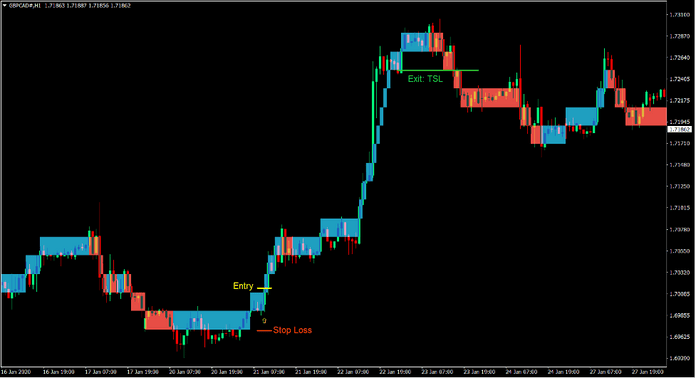

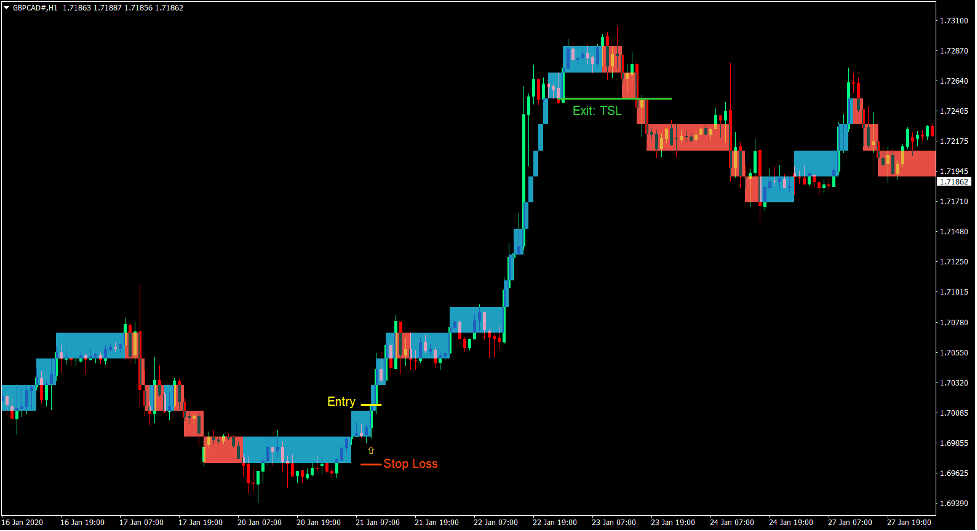

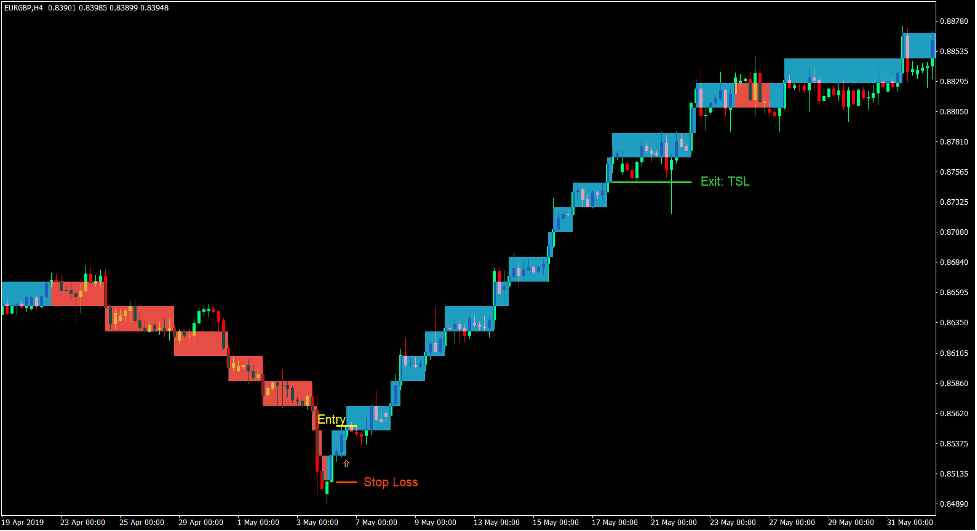

Entry

- The Tipu Renko boxes should shift to blue.

- Two consecutive blue boxes should be plotted.

- Enter a buy order at the start of the third blue box right after the close of the first candle above the second blue box.

Stop Loss

- Set the stop loss below the first blue box.

Exit

- Trail the stop loss two Tipu Renko boxes behind the current price candle.

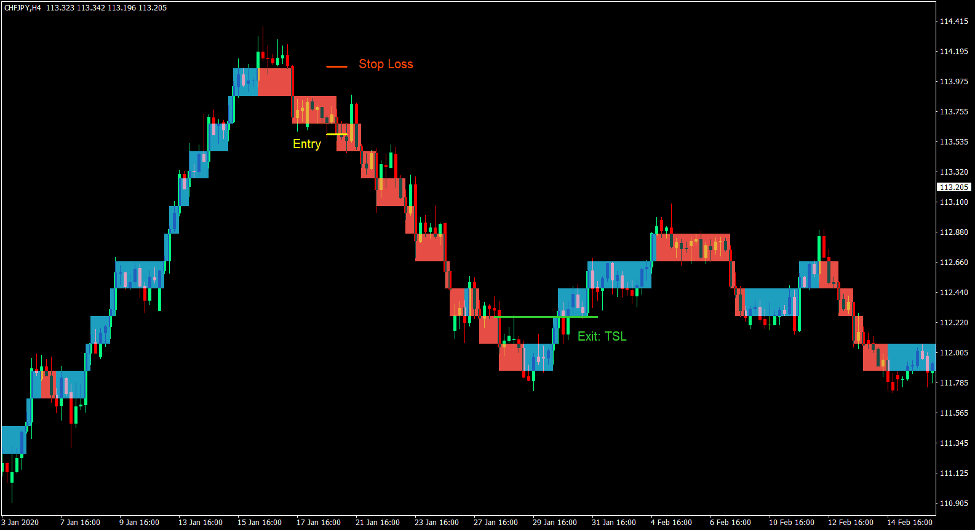

Sell Trade Setup

Entry

- The Tipu Renko boxes should shift to red.

- Two consecutive red boxes should be plotted.

- Enter a sell order at the start of the third red box right after the close of the first candle below the second red box.

Stop Loss

- Set the stop loss above the first red box.

Exit

- Trail the stop loss two Tipu Renko boxes behind the current price candle.

Conclusion

This trading strategy excels in capturing trades that result into strong momentum moves and trending markets. Using a trend following indicator that puts more emphasis on price movements rather than time allows traders to respond to trend reversals quickly. Traders can also hold on to positive trades systematically using a trailing stop loss. This allows traders to maximize profits on trending markets, while quickly cutting losses on losing trades.

This strategy works best in markets that tends to trend more often. However, it could also incur losses on markets that are ranging within a short range.

This type of trading strategy does work. Stop and Reverse strategies did work for many traders in the past. The development of the Renko Bars simplified the process of trading stop and reverse strategies.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: