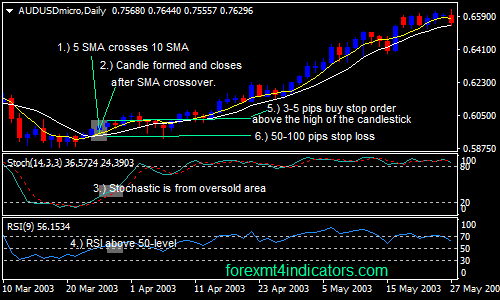

SMA, Stochastic and RSI Forex Swing Trading Strategy

This strategy uses Simple Moving Average, Stochastic and RSI indicators. This system is comprehensive and easy to use. Just set up the simple moving average on your platform with values 5 & 10. This indicator helps us to identify new trend when there is a crossover. The 5 SMA is a fast simple moving average and the 10 SMA is a slow simple moving average. When the 5 SMA crosses above 10 SMA, the trend is up. If 5 SMA crosses below the 10 SMA, then it is a downtrend.

The stochastic indicator is used to identify an oversold (20-level) or overbought (above the 80-level) market. It helps you determine if it is safe to enter a trade after the SMA have crossed. The RSI indicator is used to measure the strength of the trend. RSI must be above 50 for the trend to be considered long.

The applicable timeframes for this system are the 4-hour and daily timeframes. Stop loss depends on the timeframe you use.

Indicators and settings:

- Two Simple Moving Average (SMA) values 5 & 10

- Stochastic Indicator: 14, 3, 3 and level 20 & 80 (20 level is considered oversold market and 80 level is considered overbought market)

- RSI Indicator: period = 9

Trading Rules For Short Entry:

- 5 SMA must cross below the 10 SMA.

- The next candle must form after the SMA crossover. Wait until it closes.

- Then look at the stochastic indicator, it must be above the 80-level or heading down from the 80 -level or from the overbought condition.

- RSI indicator must be at or above the 50-level.

- Place a sell stop order at least 3-5 pips below the low of the candlestick.

- Place stop loss to 50-100 pips if you are in a daily timeframe.

- To take profit, you can hold the position until the reverse signal appears or you must have a risk and reward ratio of 1:3. You can also manage the trade by trailing the stop.

Trading Rules For Long Entry:

- 5 SMA must cross above 10 EMA.

- The next candle must form after the SMA crossover. Wait until it closes.

- Then look at the stochastic indicator, it must be below the 20-level or heading up from the 20 -level or from the oversold condition.

- RSI indicator must be at or above the 50-level.

- Place a buy stop order at least 3-5 pips above the high of the candlestick.

- Place stop loss to 50-100 pips if you are in a daily timeframe.

- To take profit, you can hold the position until the reverse signal appears or you must have a risk and reward ratio of 1:3. You can also manage the trade by trailing the stop.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: