Many traders aim to take trades at the beginning of a fresh trend and exit at or near the end of the same trend. One of the types of trading strategies that allow for such type of trading result is a trend reversal trading strategy.

Trend reversal strategy is a type of trading strategy wherein as a trend ends traders anticipate a fresh trend in the opposite direction of the prior trend. Traders then aim to enter the trade near the start of the trend and exit near the end of the trend.

Given the nature of a trend reversal strategy, it naturally follows that such type of strategy would produce trade setups with high potential returns. However, it does tend to have lower accuracy as compared to trend continuation strategies as traders are trading against the flow of the market. One of the keys to trading trend reversal strategies is in finding ways to improve accuracy while maintaining the high potential reward which is the advantage of a trend reversal strategy.

There are many ways to trend reversals. One of the most popular way is by using the crossover of moving averages as an indication of a trend reversal. Traders who can find a crossover setup with an improved accuracy yet still maintain high average yields can consistently make money out of the forex market.

In this strategy we will be looking at a confluence of crossover between two modified moving averages and a trend confirmation coming from a popular oscillator.

Mega Trend

The Mega Trend indicator is a custom trend following technical indicator which is based on a moving average. In fact, the Mega Trend line is basically a modified moving average line.

The Mega Trend line plots a moving average line which is geared towards the long-term trend. While most moving average lines exhibit a tendency to be susceptible to false signals in a choppy market environment, the Mega Trend line tends to be more stable compared to most moving average lines. This is because this line is characteristically very smooth, making it less prone to produce false signals.

The Mega Trend line also changes color whenever it detects that the trend is reversing. It plots a blue line in a bullish trend, and a red line in a bearish trend. Color changes can be used by traders as a trend reversal indication.

MUV Indicator

The MUV indicator is another custom trend following technical indicator which is also based on a modified moving average.

This indicator basically plots a unique moving average line which is characteristically very responsive to price action changes. It hugs price action quite closely which means the line is moving closely with price action. This characteristic makes the MUV line an excellent short-term trend or momentum indication.

The MUV line can be used with another moving average line to create a crossover trend reversal signal.

Relative Strength Index

The Relative Strength Index (RSI) is a popular oscillator type of technical indicator which can be used in a variety of market conditions.

This oscillator plots a line which oscillates within the range of 0 to 100. Traders may identify trend bias based on where the RSI line is in relation to its median, which is 50. The trend is bullish if the RSI line is generally above it, and bearish if the RSI line is generally below it.

The RSI also has a marker at levels 30 and 70. An RSI line dropping below 30 is indicative of an oversold market, while an RSI line breaching above 70 indicates an overbought market. Both market conditions are prime of a mean reversal.

However, momentum traders may also view drops below 30 as an indication of a bearish momentum and breaches above 70 as an indication of a bullish momentum. It all boils down to the characteristics of price action as the RSI line reaches these levels.

Many trend following traders also add levels 45 and 55 to confirm trends. In a bullish trend, the level 45 acts as a support level, while in a bearish trend, the level 55 acts as a resistance level for the RSI line. Breaches above level 55 can also be used to confirm a bullish trend reversal, while drops below 45 can be used to confirm a bearish trend reversal.

Trading Strategy

Mega Trend MUV Cross Forex Trading Strategy is a trend reversal strategy which utilizes the indicators mentioned above to confirm a moving average crossover setup.

The Mega Trend line is used as the longer-term moving average line in this setup, while the MUV line is used the shorter-term moving average line. Signals are considered whenever the two lines crossover.

However, the color of the Mega Trend line should confirm the potential trend reversal. The crossovers should also be closely aligned with the color change of the Mega Trend line.

The RSI is then used as a confirmation of the trend reversal. This is based on the RSI line breaching above 55 in a bullish trend reversal or dropping below 45 in a bearish trend reversal.

Indicators:

- Mega trend

- MUV

- Relative Strength Index

- Period: 24

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

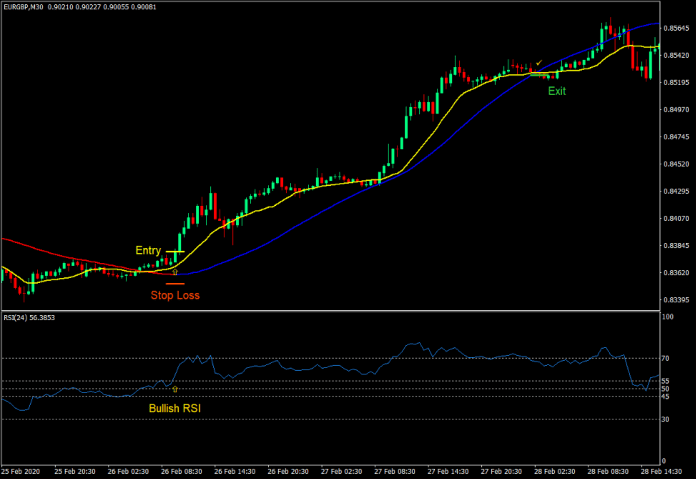

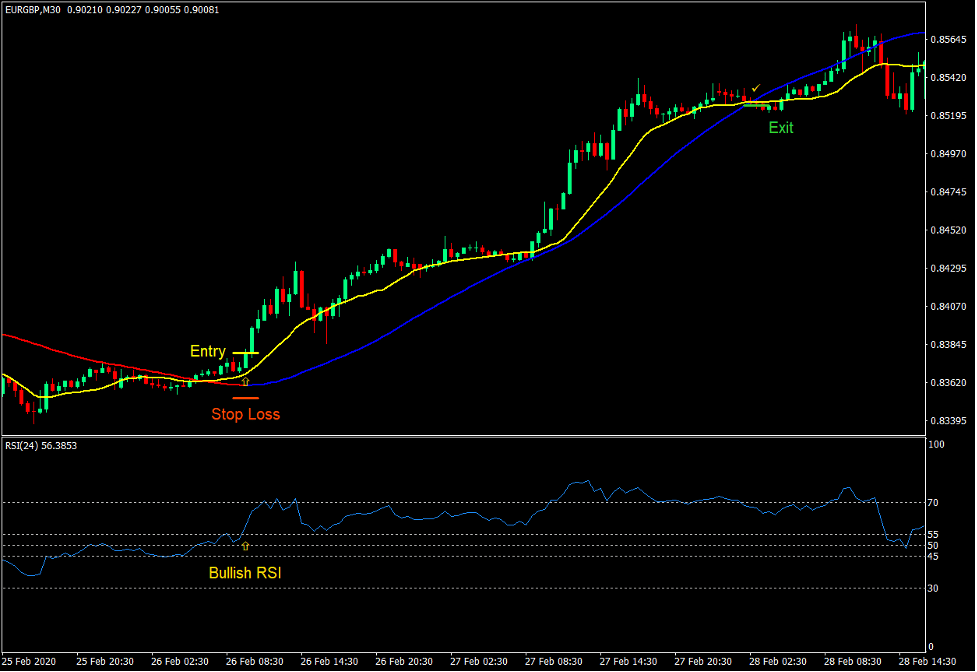

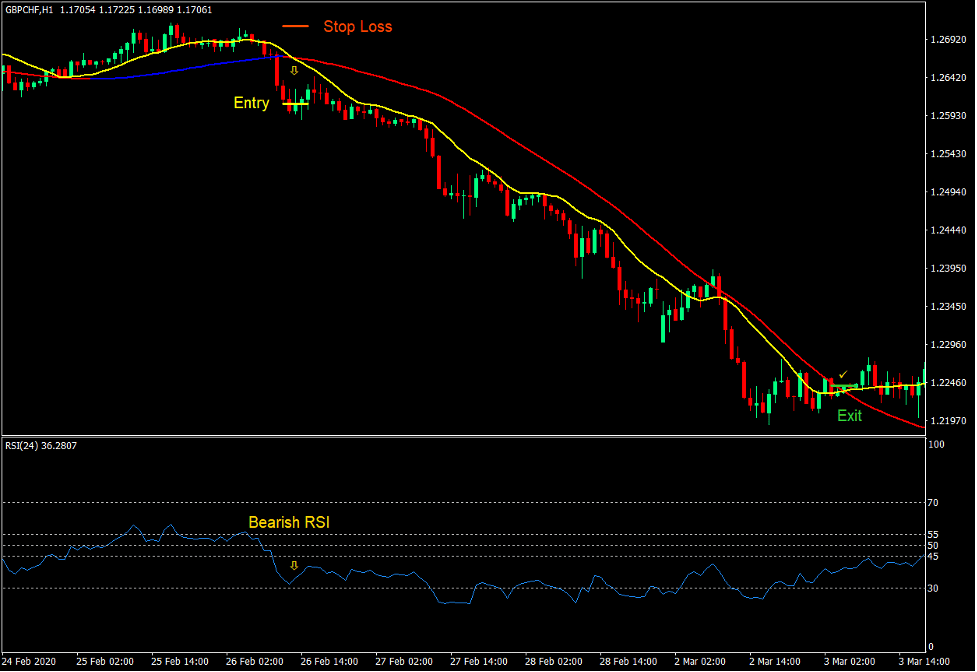

Buy Trade Setup

Entry

- The Mega Trend line should change to blue.

- The MUV line should cross above the Mega Trend line.

- The RSI line should breach above 55.

- Enter a buy order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the MUV line crosses below the Mega Trend line.

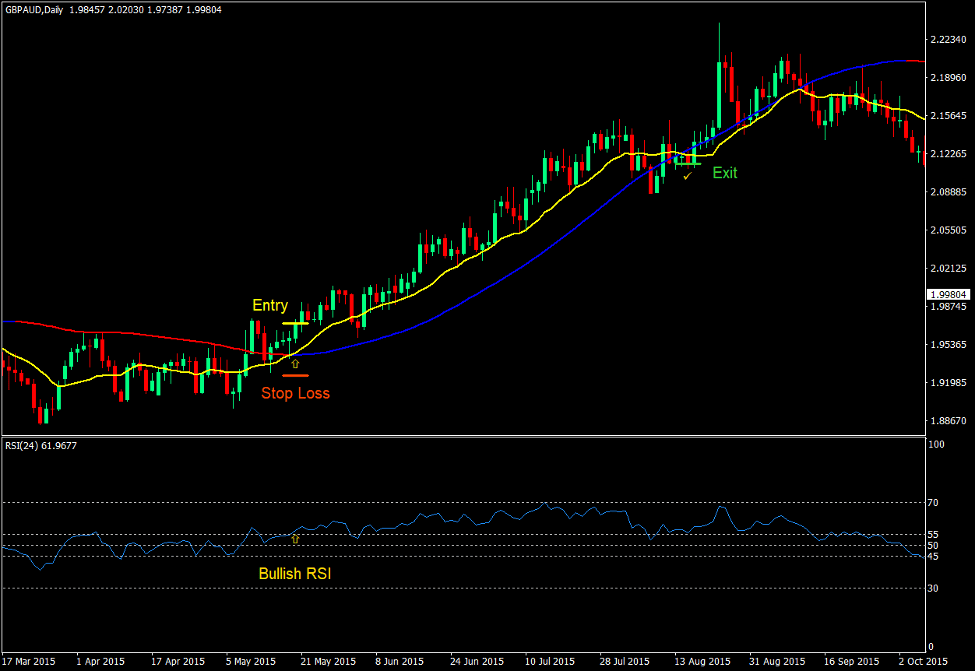

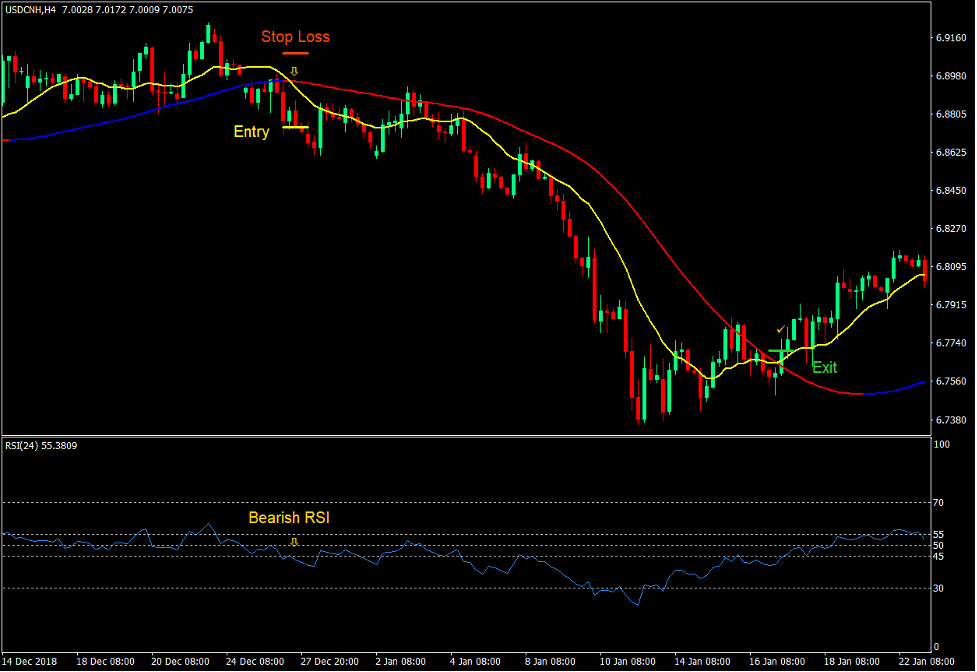

Sell Trade Setup

Entry

- The Mega Trend line should change to red.

- The MUV line should cross below the Mega Trend line.

- The RSI line should drop below 45.

- Enter a sell order on the confluence of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the MUV line crosses above the Mega Trend line.

Conclusion

This trading strategy is an excellent moving average based crossover strategy because it tends to produce trade setups with a relatively higher win probability compared to most moving average crossover setups.

There would be many crossover signals coming from the two moving average lines. However, not all will have a confluence between the color change of the Mega Trend line and the RSI trend confirmation. Traders who can identify the trend reversal setups with such confluences can use this strategy to trade trend reversal setups.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: