Trading profitably is about timing. It is about knowing when to get in and when to get out of a trade. It is about buying when price is low and selling when price is high. Sounds simple right? Or is it?

Many would say it is quite difficult to trade and it is true. This is because every candle and price change down to the last pip is a decision-making process for traders. This wears out traders as the trading session grinds on. Towards the end of the trading session, traders are already fatigued and easily make wrong decisions.

The key to a profitable trading strategy is to have a rules-based trading strategy is not about being right all the time. It is not about buying at the lowest low or selling at the highest high all day. It is about being right most of the time, more often than you are losing or winning bigger yields than you are losing profits. To do this, traders must have a systematic trading approach in which they are not fatigued by the grind of making decisions from start to finish.

Median Price Cross Forex Trading Strategy is a rules-based systematic trading strategy that allows traders to get in and out of the market and make profits more than they are losing. This allows them to make money on most days and allows traders to steadily grow their accounts.

Donchian Channel Midline

The Donchian Channel is a very useful trading indicator. It is an indicator which makes use of bands much like the Bollinger Bands. However, the Donchian Channel is a much simpler type of channel indicator. While the Bollinger Bands start with the midline as its basis, the Donchian Channel’s computation starts with the outer bands.

The Donchian Channel is based on the highest high and lowest low of price within a certain period. It then makes use of the highest high as its upper band, while the lowest low is used as the lower band. This allows traders to easily identify the price range within a certain period. It allows traders to identify whether price has been steadily breaking highs on an uptrend or falling to lower lows in a downtrend.

The midline of the Donchian Channel is simply an average of the highest high and the lowest low. Put it simply, the Donchian Channel is the median of the range within a period. This is another way of identifying the mid-price and using it as a basis for the direction of the trend. Because it only considers two figures, the highest high and the lowest low, it responds quicker compared to the usual moving averages. Yes, it does seem a bit more jagged, however it allows for a less lagging trade signal.

Kijun-Sen Line

The Ichimoku Cloud indicator is one of the most accurate standalone indicators. It has a good balance of giving high probability trade signals while at the same time not being too lagging.

The Kijun-Sen line is a very important component of the Ichimoku Cloud indicator. It represents the Ichimoku’s mid-term trend. Together with the Tenkan-Sen, it allows traders to identify trend reversals and entry and exit points. It also allows traders to visually identify trend direction.

The Kijun-Sen line is also a simple median computation using the highest high and the lowest low within a certain period. It simply adds the highest high and the lowest low and divides the result by two. In a way, it is also another line that represents the median of price within a certain period.

MMR Indicator

The MMR Indicator is a custom oscillating indicator which is based on crossovers. Specifically, it is the difference between an Exponential Moving Average (EMA) and a Linear Weighted Moving Average (LWMA). In a way, the MMR indicator is a crossover indicator. However, instead of plotting the moving averages, the information is displayed on a different window as an oscillating indicator.

Trading Strategy

The Median Price Cross Forex Trading Strategy is a crossover strategy using median lines.

The midline of the Donchian Channel represents the short-term trend while the Kijun-Sen line represents the mid-term trend. Trade signals are generated based on the crossing over of these two median lines.

However, not all crossovers are treated as entry signals. Trades should be filtered based on the trend direction of the MMR Indicator.

Because the MMR indicator is essentially a crossover indicator, in a way the Median Price Cross Forex Trading Strategy is a confluence of a regular moving average crossover and a median price line crossover.

Indicators:

- DonchianChannels

- Ichimoku Kinko Hyo

- Kijun-Sen: 52

- MMR

Timeframe: 1-hour, 4-hour and daily charts

Currency Pairs: major and minor pairs

Trading Session: Tokyo, London and New York sessions

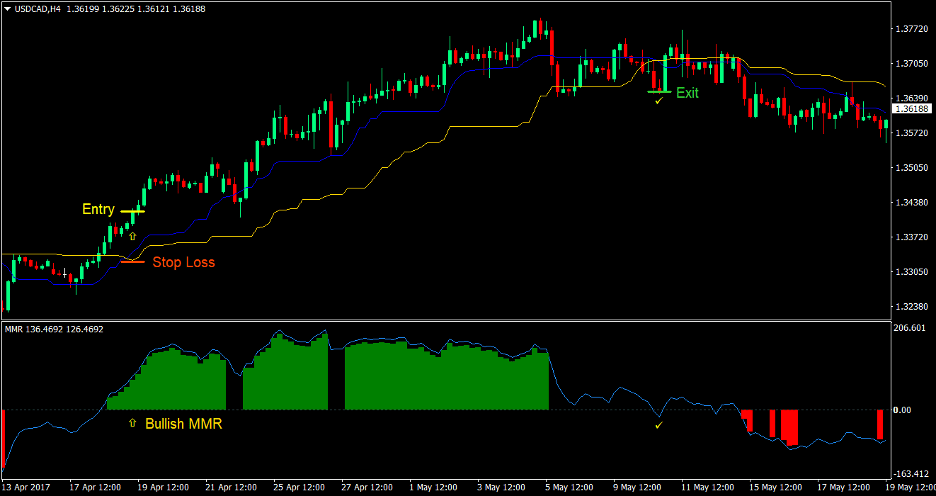

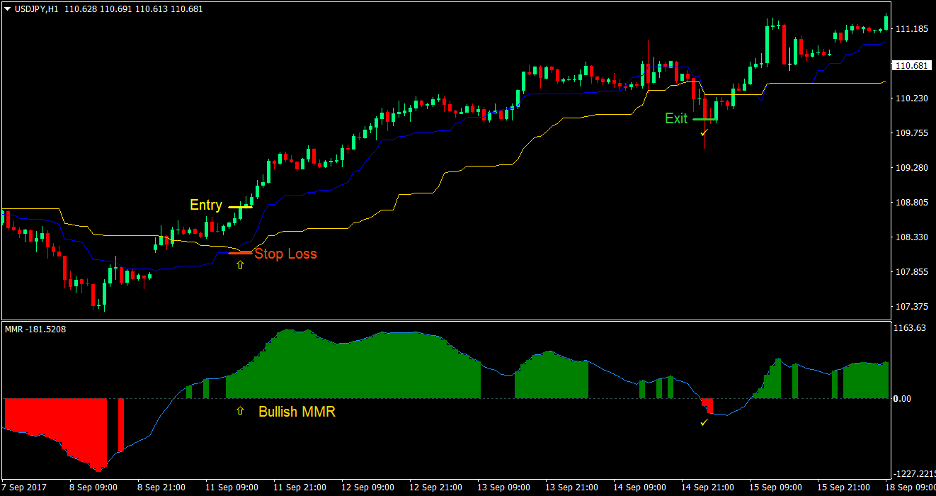

Buy Trade Setup

Entry

- The MMR indicator should be printing positive green histograms indicating a bullish long-term trend

- The Donchian Channel’s midline (blue) should cross above the Kijun-Sen line (gold) indicating a bullish trend reversal

- Enter a buy order on the confluence of the above conditions

Stop Loss

- Set the stop loss below the Kijun-Sen line

Exit

- Close the trade if the MMR indicator line crosses below zero

- Close the trade if the Donchian Channel’s midline (blue) crosses below the Kijun-Sen line (gold)

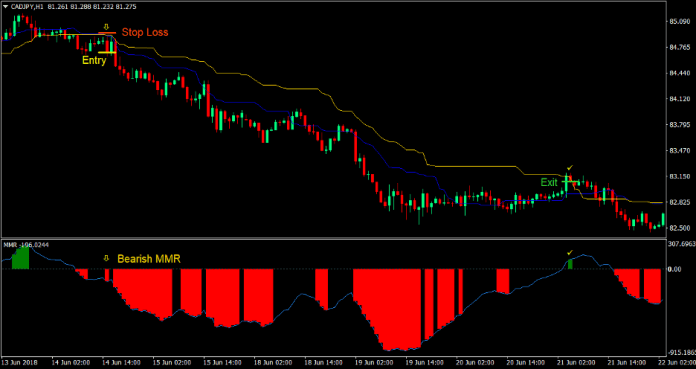

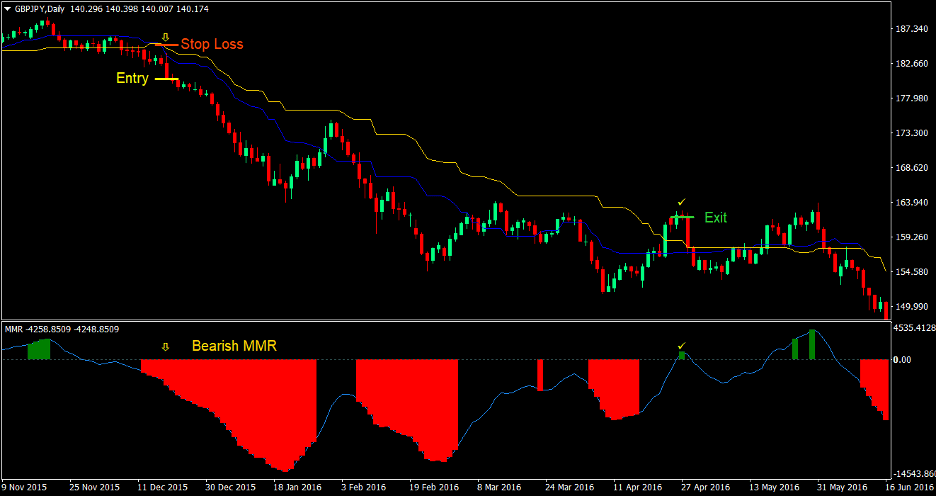

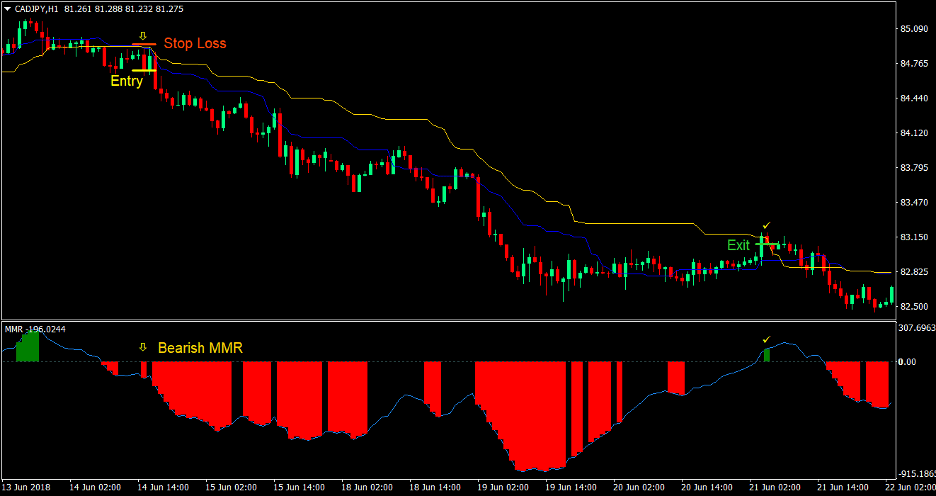

Sell Trade Setup

Entry

- The MMR indicator should be printing negative red histograms indicating a bearish long-term trend

- The Donchian Channel’s midline (blue) should cross below the Kijun-Sen line (gold) indicating a bearish trend reversal

- Enter a sell order on the confluence of the above conditions

Stop Loss

- Set the stop loss above the Kijun-Sen line

Exit

- Close the trade if the MMR indicator line crosses above zero

- Close the trade if the Donchian Channel’s midline (blue) crosses above the Kijun-Sen line (gold)

Conclusion

This simple crossover trading strategy is a working crossover strategy. It is one which allows traders to profit from the market by getting in and out of trades systematically. It is not 100% correct all the time but it has a relatively higher probability compared to other crossover strategies.

If you would observe the lines individually, price tends to respect these lines individually as a standalone technical indicator. On a trending market, price would rarely prematurely crossover the Kijun-Sen line. If used correctly with good trade management strategies, moving stop losses to breakeven and trailing stop losses at the right time, this strategy should allow traders to be profitable more often.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: