IDWma AMMA Cross Forex Trading Strategy

Crossover strategies are one of the simplest trading strategies available to a forex trader. Probably most traders who first start out trading would come across a crossover strategy along the way. Now, although not all crossover strategies are profitable, there are some that could rake in some profits. It is a matter of being able to catch the big moves to cover for some losses, plus some.

But what is a crossover strategy anyway? Crossover strategy is a type of trading strategy wherein a trader takes a trade as soon as a moving average crosses each other, wherein one moving average is faster than the other. This typically signifies a change in trend direction.

The i-AMMA Indicator

AMMA stands for Average Modified Moving Average. The way this moving average works is that the AMMA is multiplied by the number of periods on the parameter minus 1. Then, the current close is added to the result. Then, it divided again with the exact number of periods in the parameter. By doing this, the moving average is quite modified.

The i-AMMA is typically used as a filter, however it could also be interpreted in different ways.

The IDWma Indicator

The IDWma on the other hand stands for Inverse Distance Weighted Moving Average. Although it isn’t stated how this indicator is coded, the creator claims that it is based on the concept of distance weighted estimator.

Comparing it with other more mainstream moving average types, it tends to be a tad smoother than the Exponential Moving Average (EMA) and even the Simple Moving Average (SMA) yet tends to hug price quite closer than the other two. This is a good thing for a moving average. Hugging price closer might be interpreted as lesser lag while smoother moving average lines could also lessen confusing false signals. Of course, this moving average isn’t perfect, but these characteristics does fit well as the faster moving average in a moving average crossover type of strategy.

Trading Strategy Concept

To trade this strategy, we will be using the i-AMMA custom indicator as the slower moving average and the IDWma indicator as the faster moving average playing on its strengths. The i-AMMA indicator being primarily used as a trend filter, tends to get trades that are well established. On the other hand, the IDWma being a moving average that hugs price closer while still maintaining smoothness, could be excellent for providing entry signals with less lag. Using both in tandem would allow for a crossover strategy that trades on more established trend while still trying to enter the trade with a little less lag.

To enter a trade, if the IDWma crosses the i-AMMA hooking up, a buy trade setup would be valid. If the IDWma crosses the i-AMMA hooking down, then a sell trade setup would be valid instead.

Lastly, we will be adding another filter to this crossover strategy. We will be using the RAVi custom indicator. It is an oscillating type of indicator that prints histogram bars around the midlevel zero. However, it has marks on level +/- 0.3. These levels determine if the market has tendencies to be bullish or bearish. The indicator also changes color indicating the direction of the trend. Green bars indicate bullish trending tendencies while red bars indicate bearish trending tendencies. Gray bars are printed if the RAVI histogram either hasn’t crossed the +/- 0.3 level yet or is closer to zero than the previous histogram bar.

Indicators:

- i-AMMA

- IDWma

- RAVI

Timeframe: 1-hour, 4-hour and daily charts

Currency Pair: any

Trading Session: any

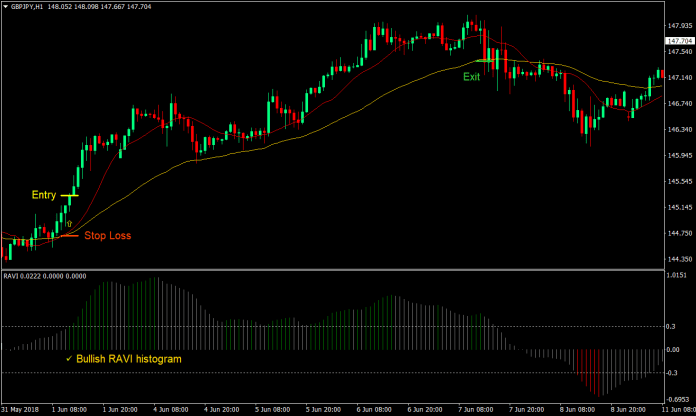

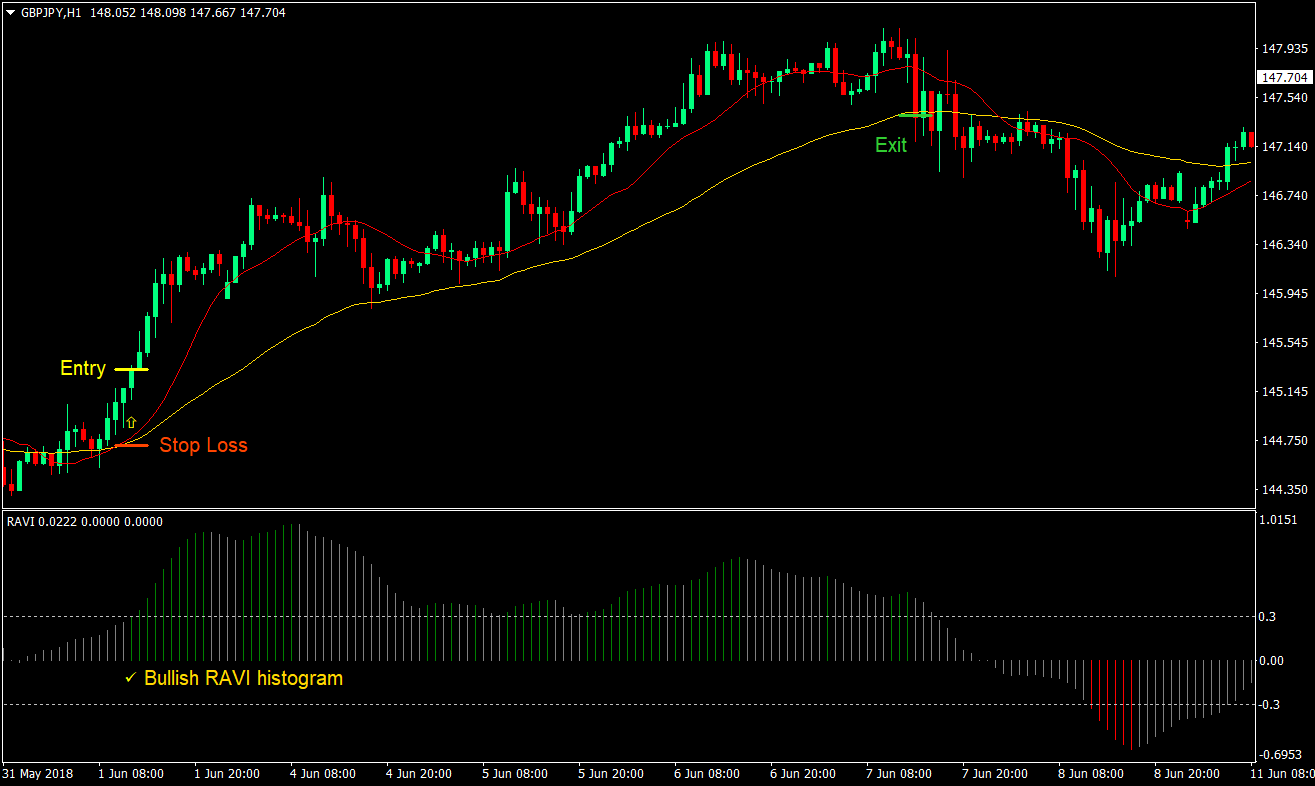

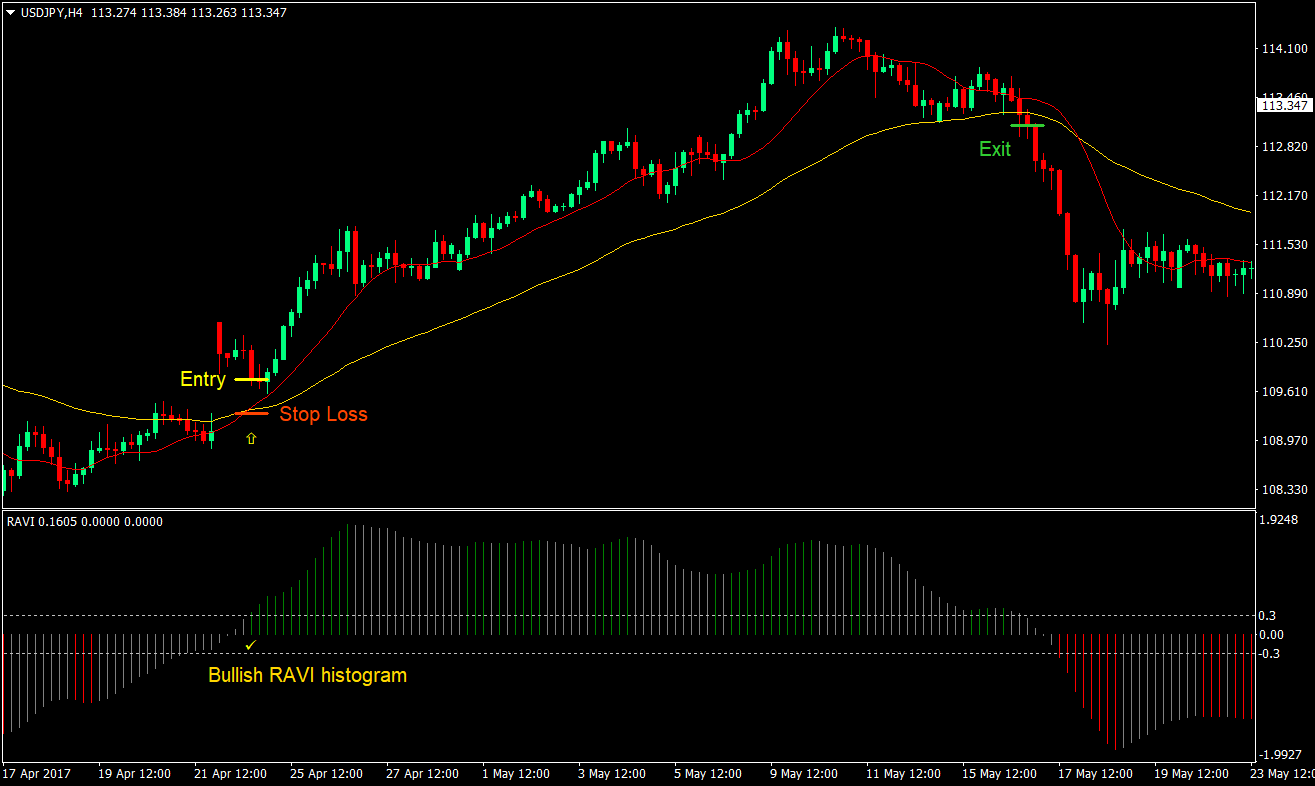

Buy (Long) Trade Setup

Entry

- The IDWma line (red) should cross above the i-AMMA indicator (gold)

- The RAVI custom indicator should print green histogram and should have recently crossed the +0.3 mark

- Enter a buy market order at the confluence of the above conditions

Stop Loss

- Set the stop loss below the two moving averages

Exit

- Close the trade as soon as price closes below the i-AMMA line, indicating that the bullish trend has ended

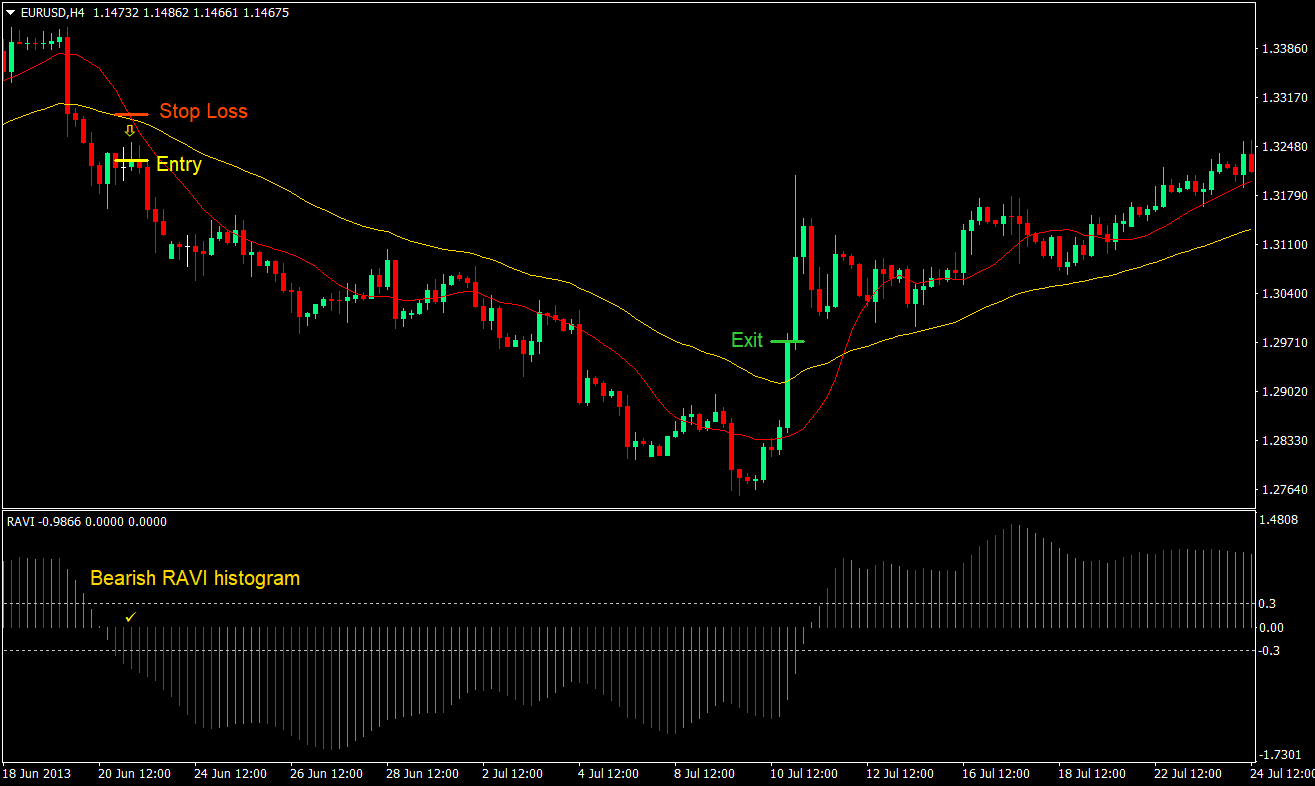

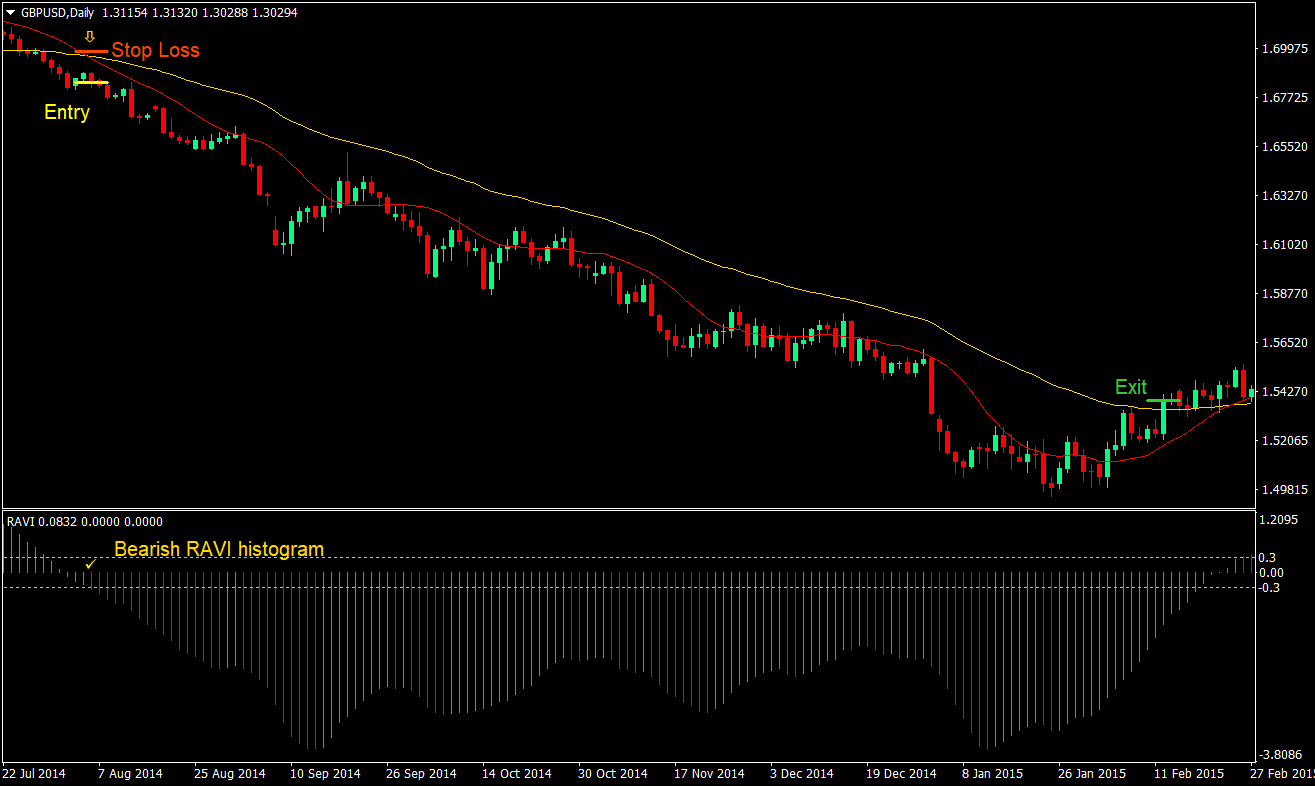

Sell (Short) Trade Setup

Entry

- The IDWma line (red) should cross below the i-AMMA indicator (gold)

- The RAVI custom indicator should print red histogram and should have recently crossed the -0.3 mark

- Enter a sell market order at the confluence of the above conditions

Stop Loss

- Set the stop loss above the two moving averages

Exit

- Close the trade as soon as price closes above the i-AMMA line, indicating that the bearish trend has ended

Conclusion

The two custom moving average indicators have their merits on their own and could be interpreted differently. By using both custom moving averages together, we get to maximize their strengths to generate excellent signals that have a good potential to be a start of a trend. Adding the RAVI indicator as a filter further increases the likelihood of a profitable trade as it also tends to confirm trend almost in line with the crossovers of the two moving averages.

Not all entry signals generated would be profitable. Some might end up a loser, while others will also generate profits. However, this type of strategy banks on a high reward-risk ratio. Because this strategy allows for exits only when price has violated the i-AMMA and closes beyond its line, it allows the trade to run as long as the trend is still in place and exit the trade as soon as the trend has died. This gives us some trades that would earn big to cover the losses plus some more. The key is just to show up in the market and be there when the big winning trade happens.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: