Donchian Trend Rider Forex Trading Strategy

As traders, many of us would love to catch one of those big waves every now and then. By this I mean catching trades that starts out as a trend and continues for quite some time. Often these trades are very elusive. But there are ways to trade the market that would increase our chances of catching these big ones and it need not be complicated.

Donchian Bands

The Donchian Channel or Bands is one of the most underrated technical indicators. We’ve all heard of the moving averages in all shapes and forms, the MACD and other oscillators, and the Bollinger Bands, but Donchian Channels isn’t as popular. Probably due to its simplicity.

The Donchina Channel is a simple technical indicator developed by Richard Donchian. Much like the Bollinger Bands, it also has the same features, a midline and a couple of outer bands, which represent an extreme in price. However, where it differs is in the way it is computed. While the Bollinger Bands is based on a moving average and a standard deviation from the average, the Donchian Channel is simply based on the highest high and lowest low for a specified period of time and its midline is the average of the high and low.

This simplistic technical indicator is a great tool in determining probable reversals of a strong trend or a break from a range, using the break of the break of the midline as a basis of a shift in market sentiment.

Trading Strategy Concept

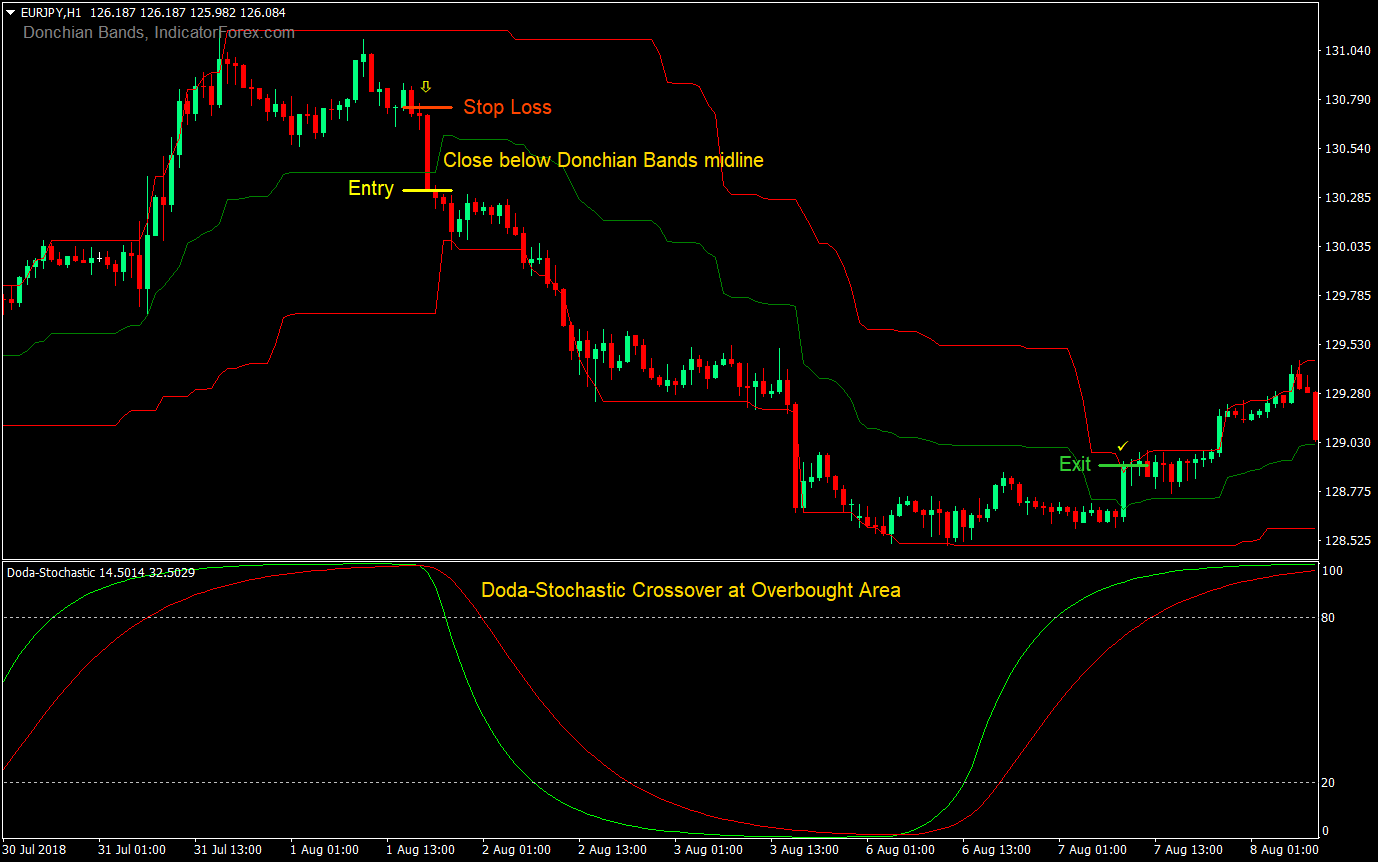

This strategy is a simple strategy that allows traders to catch probable trend reversals and a start of a fresh trend using the Donchian Bands indicator combined with the Doda-Stochastic custom indicator.

The Doda-Stochastic indicator will serve as our initial filter. We will only be taking trades whenever the market is on an extreme market condition. This could either be at an overbought or an oversold market scenario. During an overbought market condition, we will be looking trade for a reversal to the downside, while on an oversold market condition, we will be looking to trade bullish reversals. This is determined by the location of the two Doda-Stochastic lines. If above 80, we are said to be on an overbought market condition, while below 20, we will consider the market as oversold. Then, we wait for the Doda-Stochastic lines to crossover indicating that the market is reversing.

Ones we determine that the market is on an overextended condition using the Doda-Stochastic indicator, we then use the Donchian Bands as our trigger. If the market is overbought, we would wait for a break and close below the midline of the Donchian Bands. If the market is oversold, we would wait for a break and close above the midline. These conditions would indicate that the market could be reversing and could start a new trend.

Indicators

- Donchian Bands

- IPeriod: 36

- Doda-Stochastic

- Slw: 16

- Pds: 26

- Slwsignal18

Timeframe: 5-minute, 15-minute, 1-hour and 4-hour charts

Currency Pair: any

Trading Session: any

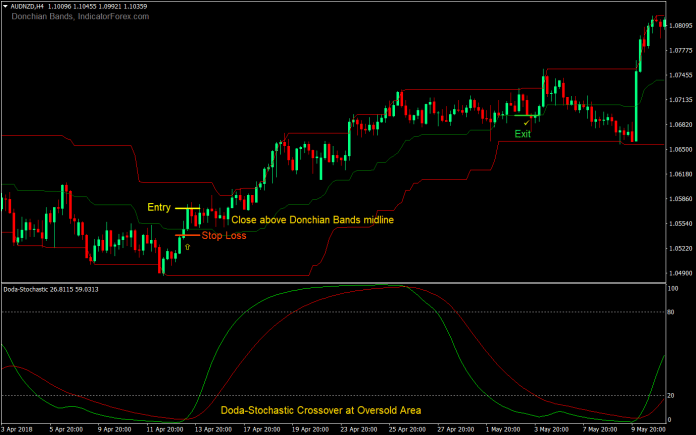

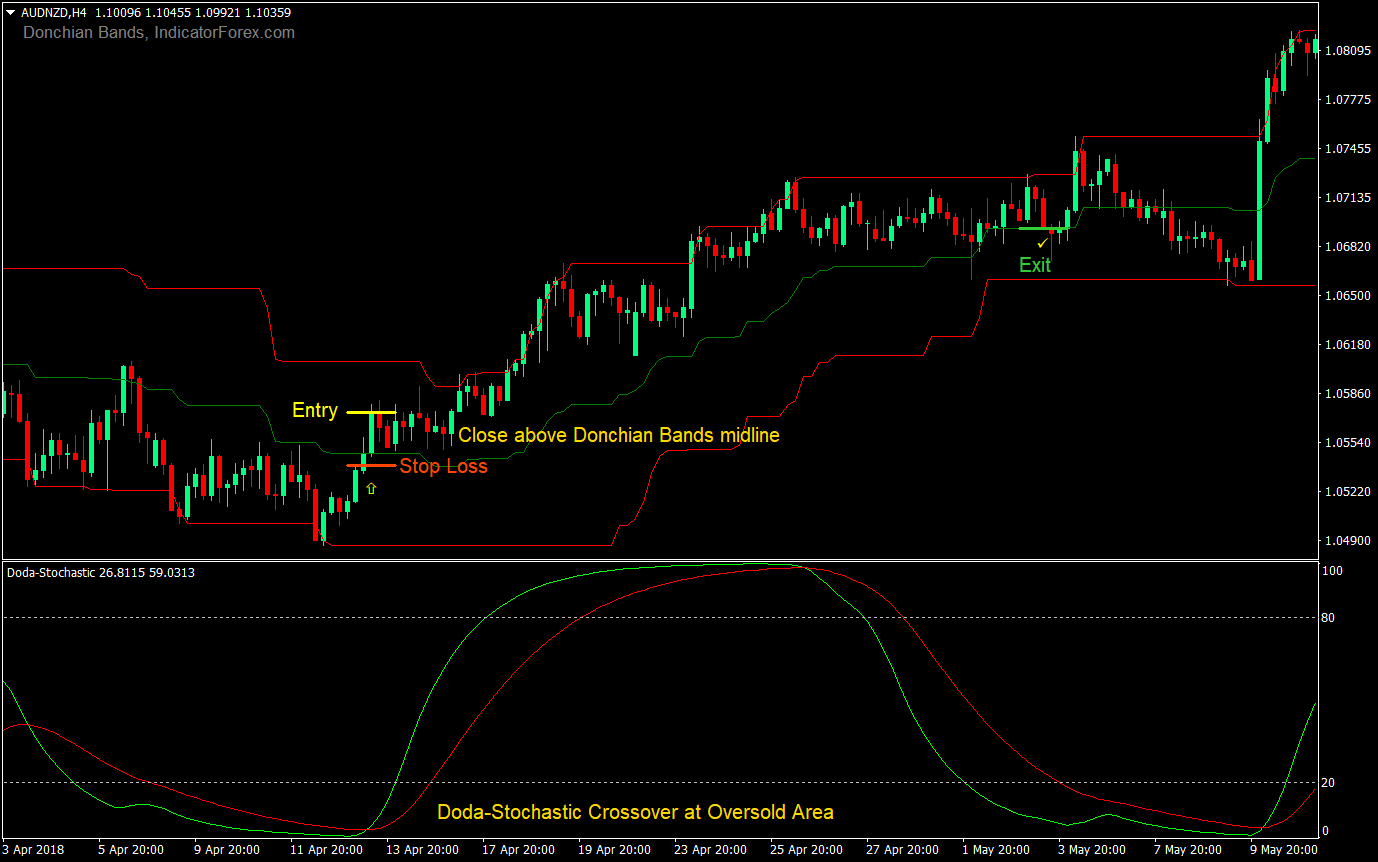

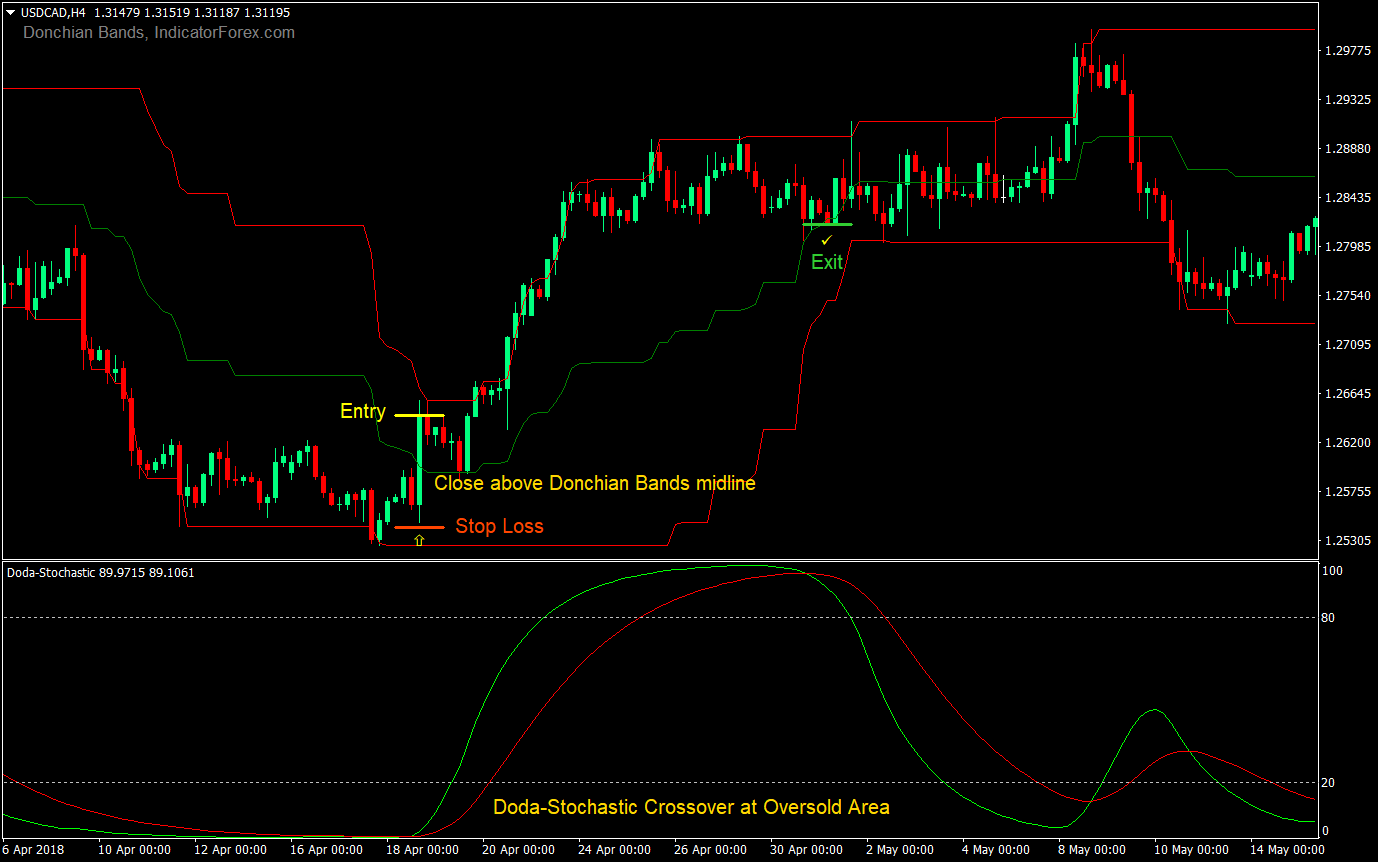

Buy (Long) Trade Setup Rules

Entry

- Doda-Stochastic lines should be below 20 indicating an oversold market condition

- Doda-Stochastic fast line (lime) should cross above the slow line (red)

- Wait for price to break and close above the Donchian Bands midline

- Don’t take trades where the Donchian Bands’ midline cross is far from the Doda-Stochastic lines crossover

- If the above rules are met, enter a buy market order at the close of the candle

Stop Loss

- Set the stop loss a few pips below the entry candle

Exit

- Close the trade as price crosses and closes below the midline of the Donchian Bands midline

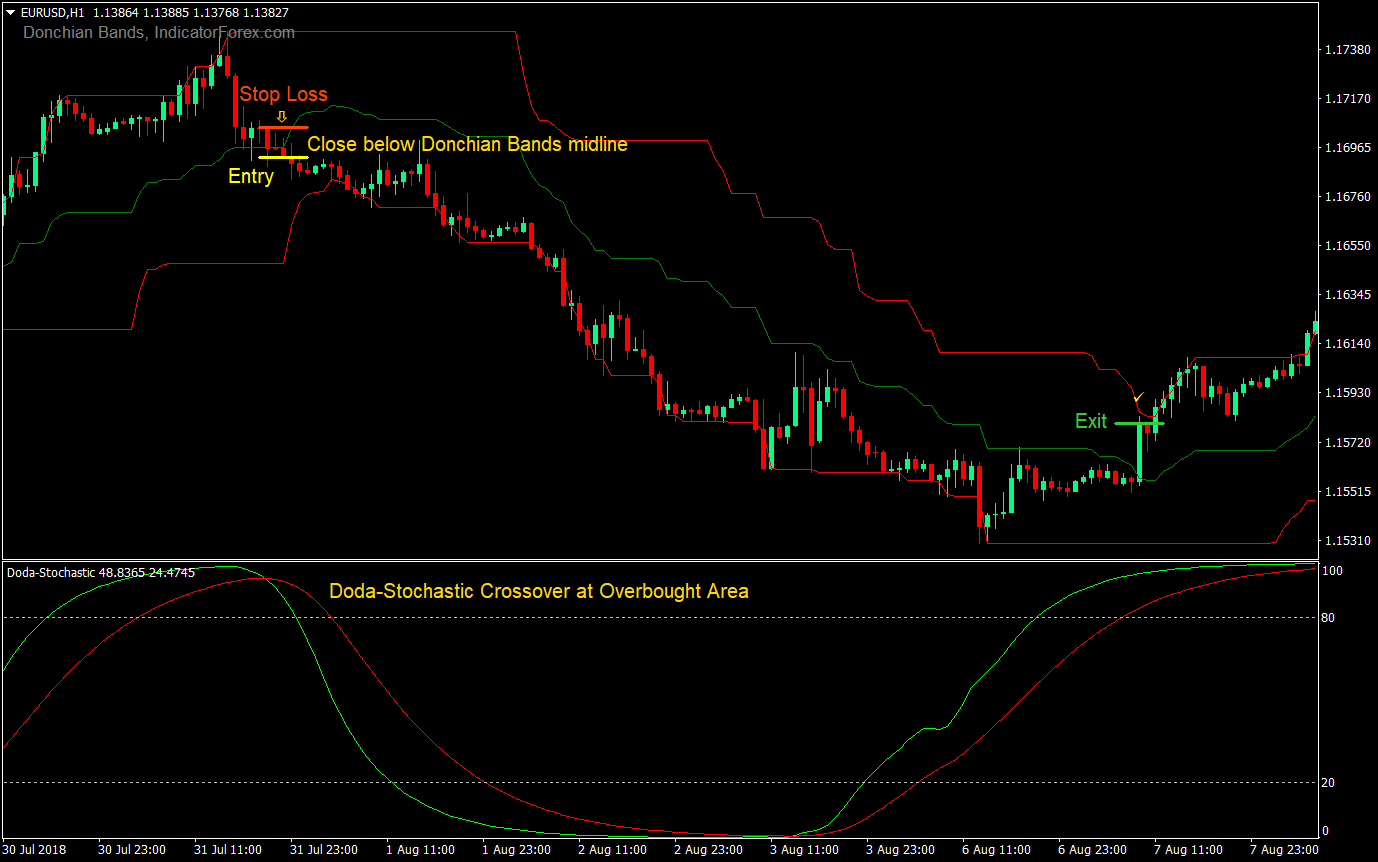

Sell (Short) Trade Setup Rules

Entry

- Doda-Stochastic lines should be above 80 indicating an overbought market condition

- Doda-Stochastic fast line (lime) should cross below the slow line (red)

- Wait for price to break and close below the Donchian Bands midline

- Don’t take trades where the Donchian Bands’ midline cross is far from the Doda-Stochastic lines crossover

- If the above rules are met, enter a sell market order at the close of the candle

Stop Loss

- Set the stop loss a few pips above the entry candle

Exit

- Close the trade as price crosses and closes above the midline of the Donchian Bands midline

Conclusion

This is an excellent strategy for catching big trends from start to finish. This type of trade could allow you to have a higher reward-risk ratio.

It would also help if you could determine that there is a strong momentum behind the candle that crosses the midline or the candle itself is a momentum candle. This is a strong indication that there are bulls or bears behind your trade and that the tides could be shifting.

You could also use a trailing stop to exit the trade. This could be done by trailing the stop loss behind the midline. The advantage to this is that you are able to exit the trade at a better price if the reversal candle that goes against your trade is a strong momentum candle. The disadvantage though is that there are instances when price would just test the midline then continue the direction of the trade.

You should also move the stop loss to breakeven after the first strong impulse going the direction of your trade. This way, you are protecting yourself from a reversal or from a choppy market.

Trade wisely!!!

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: