“Trade with the trend!” This is an age-old wisdom that has been quoted again and again by many forex traders and for a very good reason. Trading with the trend implies that traders should be trading with the flow of the market and not against it. Many successful forex traders hold this mantra in their hearts and has served them well as profitable forex traders.

However, there are also many forex traders who attempt to trade with the trend but instead end up trading at peaks and bottoms in the wrong trade direction. They often are chasing prices thinking that price is already trending when in fact the short-term move is just a blip on the price chart.

A master trader once told me that a trend is considered a trend when it is clearly trending. This statement is very confusing, but it does hold so much truth in it. Traders often assume that a trend has began when in fact price is just moving erratically. Markets that are really trending are usually considered a trend when it is already obvious on the price chart. Often, although this does confirm that the market is trending, but many times traders identify a trend only when it is already too late to trade it. Price is overbought or oversold and is due for a market correction.

So, how do we trade at the sweet spot where we could objectively confirm a trend while at the same time not being too late in the party. Truth is we often can’t. However, there are tools that could help us identify if the market is significantly moving in one direction. This could be the next best thing.

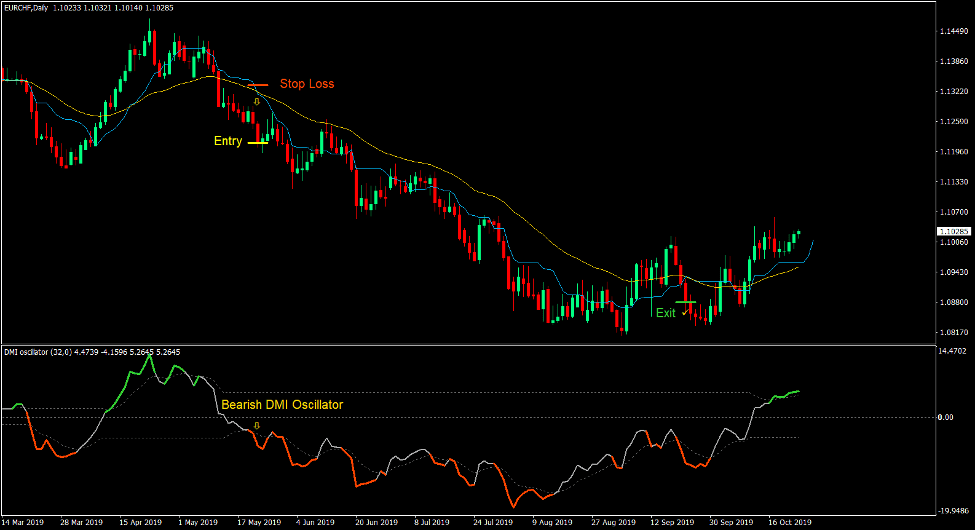

DMI Kijun Trend Forex Trading Strategy is a trend reversal trading strategy that confirms trend reversals based on the directional movement of price.

DMI Oscillator

DMI Oscillator is a momentum technical indicator which is based on the Directional Movement Index (DMI).

The classic DMI indicator was developed in order to help traders identify which direction the price of an asset is moving. It does this by comparing the prior highs and lows of price. It then plots two lines that crossover each other signaling the direction of price based on its average directional movement. Many traders often consider this indicator as the go to indicator for identifying trending and ranging markets as it also has a mechanism in which traders can objectively identify if the average directional movement of price is strong enough to be considered a trend.

The DMI Oscillator is based on this concept. However, instead of plotting two lines that crossover, it plots a line that oscillate from negative to positive or vice versa. Positive lines indicate a bullish bias, while negative lines indicate a bearish bias. However, this does not confirm if the movement is strong enough to be considered as a possible start of a trend. It plots another dotted line which is dynamic. If a positive DMI Oscillator line crosses above a positive dotted line, the DMI Oscillator line changes to lime green indicating strong bullish momentum. If a negative line drops below a negative dotted line, the DMI Oscillator line changes to orange red indicating bearish momentum.

Kijun-sen+

The Kijun-sen is a modified moving average line which is one of the most important components of the Ichimoku Kinko Hyo method of technical analysis.

The Kijun-sin is basically the median of price for the last 26-bars. This creates a moving average line that could represent the short- to mid-term trend direction. It is characterized by a line which is very jagged and could respond to price action very fast, yet at the same time is very reliable.

This modified moving average line, when combined with another reliable moving average line or other components of the Ichimoku Kinko Hyo indicator can produce high probability trend reversal signals. It could also reliably indicate the direction of the short- to mid-term trend.

Trading Strategy

This trading strategy is a trend reversal strategy which trades on the confluence of moving average crossovers and a trend reversal confirmation of the DMI Oscillator.

For the crossover, we will be using the Kijun-sen+ line and a 36-period Exponential Moving Average (EMA).

Trend reversal signals are considered valid whenever the Kijun-sen+ line and the 36 EMA line crosses over, while the DMI Oscillator confirms the trend direction.

On the DMI Oscillator, the DMI Oscillator line should crossover with the dotted line and change to the color that indicates the direction of the trend.

Indicators:

- Kijun-sen+

- 36 EMA

- Dsl_-_DMI_oscillator

Preferred Time Frames: 30-minute, 1-hour, 4-hour and daily charts

Currency Pairs: FX majors, minors and crosses

Trading Sessions: Tokyo, London and New York sessions

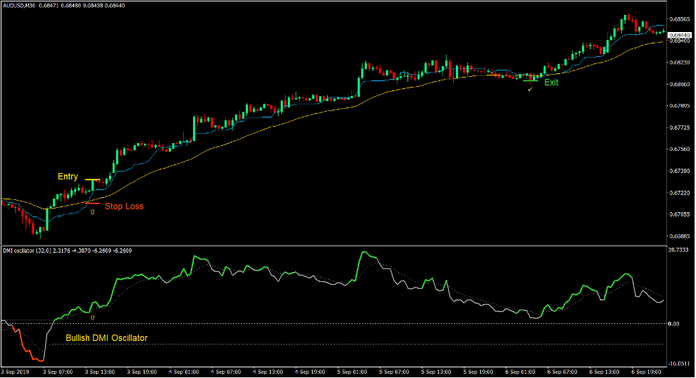

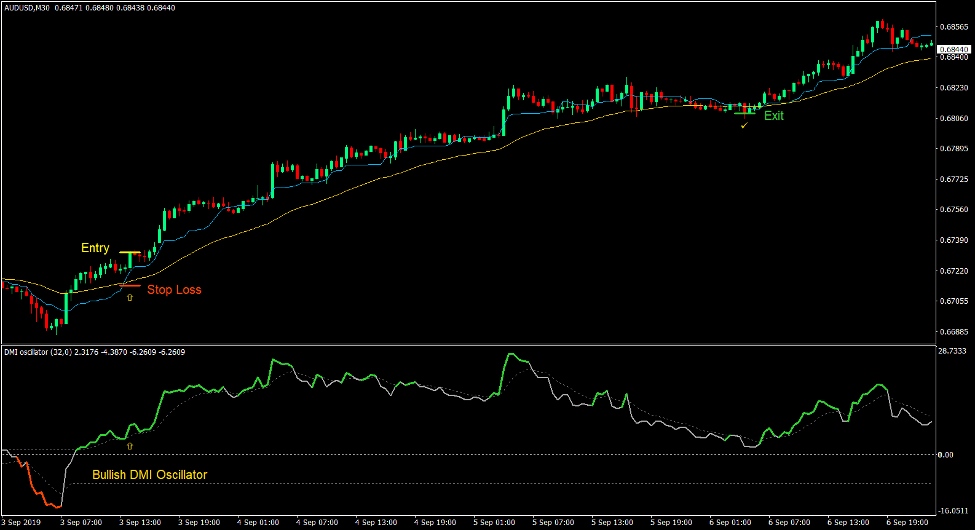

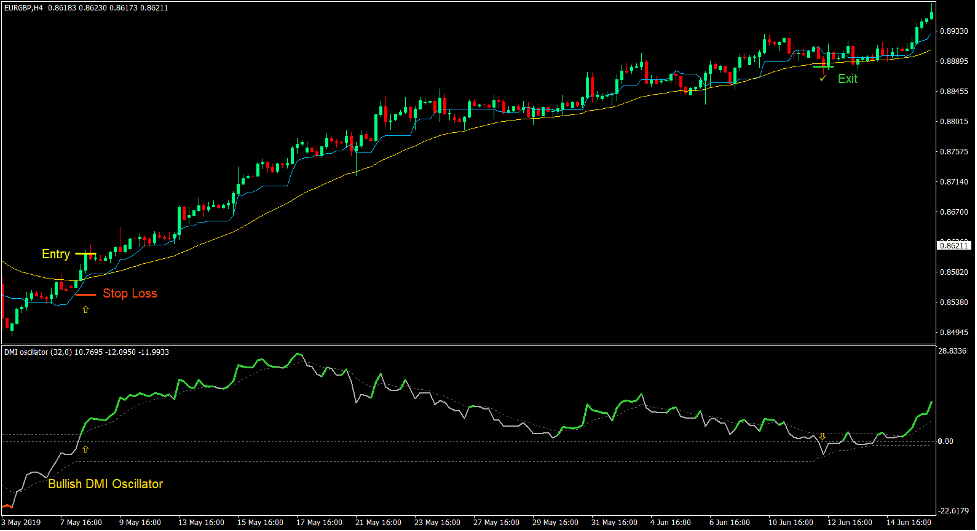

Buy Trade Setup

Entry

- The Kijun-sen+ line should cross above the 36 EMA line.

- The DMI Oscillator line should cross above the upper dotted line and should change to lime green.

- Price action should show bullish characteristics.

- Enter a buy order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the support below the entry candle.

Exit

- Close the trade as soon as the Kijun-sen+ line crosses below the 36 EMA line.

- Close the trade as soon as the DMI Oscillator line crosses below zero.

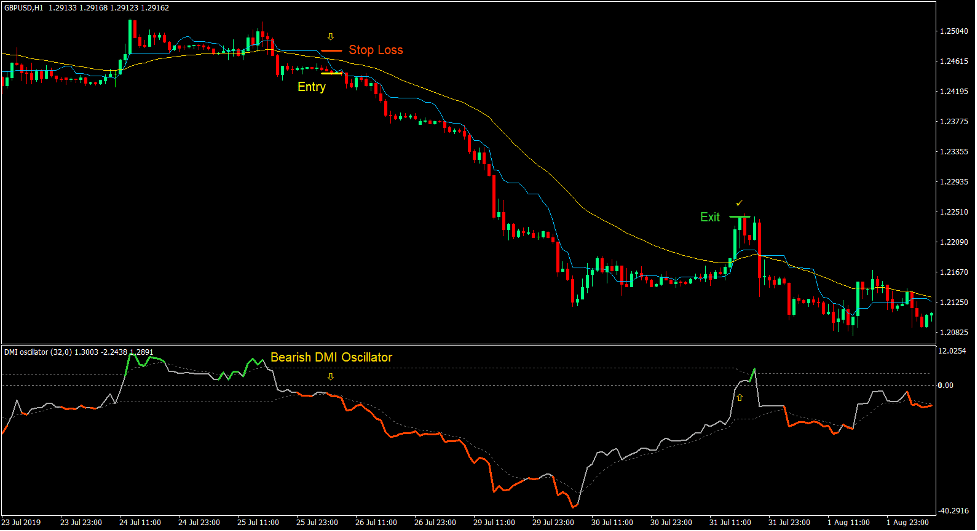

Sell Trade Setup

Entry

- The Kijun-sen+ line should cross below the 36 EMA line.

- The DMI Oscillator line should cross below the lower dotted line and should change to orange red.

- Price action should show bearish characteristics.

- Enter a sell order on the confirmation of these conditions.

Stop Loss

- Set the stop loss on the resistance above the entry candle.

Exit

- Close the trade as soon as the Kijun-sen+ line crosses above the 36 EMA line.

- Close the trade as soon as the DMI Oscillator line crosses above zero.

Conclusion

This strategy is a good trend reversal strategy. This is because on each trade setup, the trend strength is confirmed using the DMI Oscillator.

On top of this, the Kijun-sen+ and the 36 EMA crossover setup is a highly reliable trade setup.

Traders can quickly earn profits from the forex market using this strategy. It has the key ingredients which are a good risk-reward ratio on trades that do result in a trend and an improved win rate using the trade confirmations above.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: