For many forex and stock enthusiasts, the Bollinger Bands (BB) indicator is a familiar sight. This technical analysis tool, developed by John Bollinger in the 1980s, has become a staple for gauging market volatility and identifying potential trading opportunities.

But what if there was a way to enhance this well-respected indicator, making it even more effective in today’s dynamic markets? Enter the Better Bollinger Band MT5 Indicator. This improved version promises to provide traders with a more refined edge, but before we delve into its specifics, let’s revisit the core concepts behind the traditional Bollinger Bands.

A Familiar Friend: The Bollinger Bands

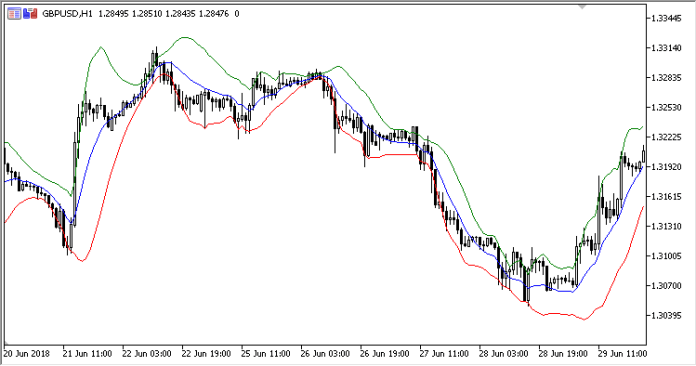

The Bollinger Bands consist of three lines plotted around a price chart:

- Moving Average Line: This central line represents the average price over a user-defined period.

- Upper Bollinger Band: This line sits a certain number of standard deviations above the moving average, typically two.

- Lower Bollinger Band: Conversely, this line is positioned the same number of standard deviations below the moving average.

The magic lies in the relationship between these lines and price action. When the Bollinger Bands contracts, it signifies a period of low volatility, potentially hinting at an upcoming breakout. Conversely, expanding bands suggest heightened volatility, which may precede a price correction or a strong directional move.

Unveiling The Better Bollinger Band MT5 Indicator

The “Better” Bollinger Band MT5 Indicator takes the core principles of the traditional BBs and injects some enhancements specifically designed for the MetaTrader 5 (MT5) platform. While the core functionality remains similar, some key differences set it apart:

Potential For Customization

Many “Better” Bollinger Band MT5 Indicators offer greater user control over various parameters, allowing traders to tailor the indicator to their specific trading style and market conditions.

Exploration Of Alternative Measures

Some variations might deviate from the standard deviation calculation, potentially using other volatility metrics for band construction.

Compatibility Considerations

It’s important to note that while some “Better” Bollinger Band versions might be exclusive to MT5, others may be adaptable to other trading platforms.

Unpacking The Functionality: A Deep Dive

Understanding how the “Better” Bollinger Band MT5 Indicator calculates its bands is crucial for interpreting its signals effectively. Here’s a breakdown of some key aspects:

Deviation With A Twist

While some variations might stick to the traditional two standard deviations, others might allow customization of this value. This empowers traders to adjust sensitivity based on their risk tolerance and market volatility.

Unveiling The Inner Workings

Standard Deviation or Alternative Measures? As mentioned earlier, some “Better” Bollinger Band MT5 Indicators might explore alternative volatility measures beyond standard deviation.

Combining With Other Indicators

Unveiling a Multifaceted Approach The “Better” Bollinger Band MT5 Indicator is a powerful tool, but it shouldn’t be used in isolation. Savvy traders often combine it with other technical indicators to strengthen their trading signals. For instance, using a relative strength index (RSI) alongside the Bollinger Bands can help confirm overbought or oversold conditions.

How to Trade with Better Bollinger Band Indicator

Buy Entry

- Look for a price breakout above the upper Bollinger Band.

- Enter long (buy) after a confirmed close above the upper Bollinger Band.

- Place a stop-loss order slightly below the breakout point (e.g., below the previous swing low).

- Target a profit level near the opposite Bollinger Band (e.g., near the lower Bollinger Band).

Sell Entry

- Look for a price reaching the upper Bollinger Band, potentially indicating overbought conditions.

- Enter short (sell) after a confirmation signal, such as a bearish candlestick pattern (e.g., bearish engulfing) near the upper Bollinger Band.

- Place a stop-loss order slightly above the breakout point (e.g., above the previous swing high).

- Target a profit level near the opposite Bollinger Band (e.g., near the upper Bollinger Band).

Conclusion

The Better Bollinger Band MT5 Indicator offers a compelling upgrade to the traditional Bollinger Bands, providing traders with greater customization and potentially more nuanced insights into market behavior. By understanding its functionalities, advanced applications, and limitations, traders can leverage this indicator to make more informed trading decisions.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: