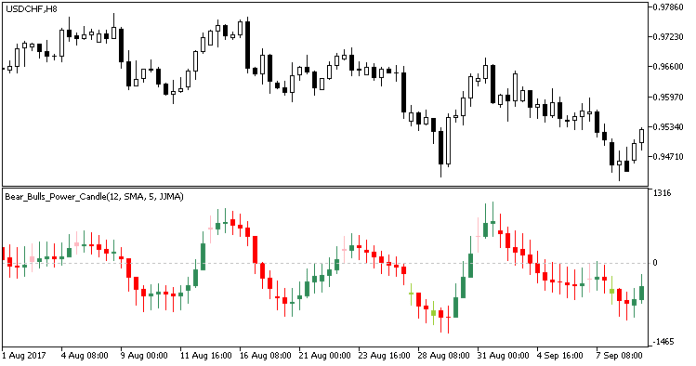

The BBPC indicator belongs to the category of oscillator indicators. Unlike trend-following indicators that highlight the direction of price movement, oscillators like BBPC focus on the momentum behind the price action.

The BBPC draws inspiration from the Elder-Ray Index, a brainchild of technical analyst Dr. Alexander Elder. At its core, the BBPC calculates two separate values: Bulls Power and Bears Power. Here’s the technical breakdown:

- Bulls Power: This value represents the difference between the current high price and a 13-period Exponential Moving Average (EMA) of the closing price. A higher Bulls Power reading suggests buyers are pushing prices upwards.

- Bears Power: Calculated as the difference between the current low price and the 13-period EMA, this value reflects the sellers’ strength. A rising Bears Power signifies bears are driving prices downward.

Interpreting the Bulls Power and Bears Power Values

The BBPC doesn’t provide a single, definitive buy or sell signal. Instead, it presents two separate values on a vertical scale, typically ranging from -100 to +100. Here’s how to interpret them:

Bulls Power

- Positive values: Indicate bullish dominance, potentially suggesting buying opportunities, especially when paired with a confirmation from a trend indicator.

- Negative values: Imply sellers are in control, potentially hinting at short-selling opportunities (selling borrowed assets) if confirmed by other indicators.

Bears Power

- Positive values: Signal bearish pressure, potentially suggesting short-selling opportunities, again, with confirmation from other indicators.

- Negative values: Indicate buyers are active, potentially hinting at buying opportunities.

Combining BBPC with Other Indicators

The BBPC is a valuable tool, but it shouldn’t be used in isolation. Here are some strategies to consider:

- Combining with Trend Indicators: As mentioned earlier, using trend indicators like MACD or RSI alongside the BBPC can help confirm the overall market direction and avoid false signals.

- Support and Resistance Levels: Overlay support and resistance levels on your chart along with the BBPC. A bullish signal from the BBPC near a support level strengthens the potential for a long position, while a bearish signal near resistance strengthens the potential for a short position.

- Volume Confirmation: Consider incorporating volume indicators to validate the BBPC signals. High trading volume alongside a BBPC signal suggests a stronger market move in that direction.

Advantages and Limitations of the BBPC

The BBPC offers several advantages:

- Simplicity: The indicator is relatively easy to understand and interpret, making it accessible to traders of all experience levels.

- Versatility: It can be used for both short-term and long-term trading strategies.

- Visually Appealing: The indicator’s presentation on the chart allows for quick identification of potential buying and selling opportunities.

However, the BBPC also has limitations to consider:

- Lagging Indicator: Like most oscillator indicators, the BBPC can lag behind price movements, potentially leading to missed or late signals.

- False Signals: Market noise and volatility can generate false signals from the BBPC. Combining it with other indicators helps mitigate this risk.

- Overreliance: Solely relying on the BBPC can be detrimental. Always consider the overall market context and risk management strategies.

How to Trade with the Bear Bulls Power Candle Indicator

Buy Entry

- Look for a scenario where the Bulls Power line makes a sustained move above the zero line. This indicates increasing buying pressure.

- To confirm the bullish trend, consider using a trend-following indicator like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI). These indicators can help ensure you’re not entering a temporary upswing.

- Once you have confirmation and a bullish signal from the BBPC, you can consider entering a long position.

Sell Entry

- Conversely, to identify potential short-selling opportunities, look for the Bears Power line to consistently stay above the zero line. This signifies ongoing selling pressure.

- Similar to entering long positions, confirm the bearish trend using a trend-following indicator like MACD or RSI. Remember, the BBPC alone might not capture short-term corrections within a downtrend.

- Once you have confirmation and a bearish signal from the BBPC, you can consider entering a short position (borrowing an asset and selling it, hoping to repurchase it later at a lower price to return it and profit on the difference).

Conclusion

The BBPC indicator offers a valuable lens through which to observe the tug-of-war between bulls and bears in the forex market. By understanding its mechanics, interpreting its signals, and combining it with other tools, you can enhance your trading strategies and navigate the ever-changing market dynamics. Remember, consistent practice, risk management, and a healthy dose of skepticism towards any single indicator are crucial for success in the forex arena.

Recommended MT5 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

(Free MT5 Indicators Download)

Click here below to download: