Le marché des changes ressemble beaucoup à un pendule. Le prix pourrait fluctuer de haut en bas sur le graphique. Les fluctuations des prix semblent chaotiques et imprévisibles, déroutant la plupart des nouveaux traders et leur faisant perdre de l'argent. Cependant, même avec ses mouvements apparemment chaotiques, le marché laisse quelques indications sur ce qu’il veut faire ensuite et vers où il veut aller.

Les tendances du marché sont cycliques. Il va et vient entre une phase d’expansion, puis une phase de contraction, et une autre phase d’expansion, et vice-versa. Toutefois, les retournements de marché sont tout à fait différents. En effet, même s’il s’agit du même schéma d’expansion et de contraction, les phases de contraction sont bien plus un épuisement. Cela signifie que le marché ne se contracte pas parce qu’il se repose avant une autre poussée, mais que la contraction est due à une perte d’élan de la tendance. Mais comment déterminer ces phases d’épuisement ?

Différencier les phases de contraction des phases d’épuisement est assez difficile. Certains pourraient être capables de le prédire en utilisant des modèles d'inversion, mais les nouveaux traders n'ont peut-être pas encore développé de telles compétences dans l'identification des modèles. La stratégie de trading Forex PSAR Super Trend est une stratégie qui aide les traders à identifier les phases d'épuisement à l'aide de certains indicateurs spécialisés dans l'identification des tendances et des inversions de tendance.

Indicateur Supertrend

L'indicateur Supertrend est un indicateur de suivi de tendance qui fonctionne bien pour identifier la direction et les inversions de tendance. Cela ressemble beaucoup aux moyennes mobiles et à la convergence et à la divergence des moyennes mobiles (MACD), qui identifient les tendances en fonction de l'évolution des prix. Cependant, il est également assez unique à certains égards. Contrairement à d'autres indicateurs techniques, l'indicateur Supertrend utilise non seulement les mouvements de l'action des prix, il intègre également l'Average True Range (ATR) dans son identification des directions de tendance. L'indicateur mesure l'ATR pour une certaine période de jours et le multiplie avec un multiplicateur. Il trace ensuite une ligne à une certaine distance de l'action des prix en fonction du produit de l'ATR et du multiplicateur. L'emplacement de la ligne est basé sur la direction de la tendance. La ligne est tracée en dessous de l'action des prix si la tendance est haussière, et au-dessus de l'action des prix si la tendance est baissière. Des signaux de tendance sont générés lorsque le prix franchit et clôture au-delà de la ligne.

Étant donné que l'indicateur Supertrend est basé sur l'ATR, la ligne a tendance à se rapprocher de l'évolution des prix chaque fois que le marché se contracte. En effet, l’ATR a également tendance à être plus faible pendant les phases de contraction. Les signaux d’inversion deviennent plus apparents à mesure que le prix se rapproche de la ligne. Cela fait de l’indicateur Supertrend un excellent indicateur d’inversion de tendance, qui intègre l’épuisement.

Arrêt et marche arrière paraboliques

L’indicateur Parabolic Stop and Reverse (PSAR) est l’un des indicateurs de suivi de tendance les plus populaires. Cela ressemble également beaucoup à l'indicateur Supertrend, qui détermine la direction de la tendance en fonction de l'élan et de l'ATR.

Le PSAR trace des points autour de l'action des prix en fonction de la direction de la tendance et de l'élan. Sur les tendances haussières, le PSAR trace les points en dessous de l'action des prix. D'un autre côté, le PSAR trace des points au-dessus de l'action des prix pendant les tendances baissières. Ces points sont initialement destinés à servir de points de placement de stop loss. En effet, l’hypothèse de cet indicateur est que la tendance devrait s’inverser chaque fois que le prix dépasse ces points.

Cependant, cet indicateur est également un excellent indicateur de retournement de tendance. Comme la Supertrend, elle détermine également la direction et les inversions de tendance en fonction de l'élan et de l'épuisement. Des signaux d’entrée d’inversion sont générés chaque fois que les points passent d’être tracés au-dessus de l’action des prix à être tracés en dessous de l’action des prix, et vice versa.

Indicateur ROR

L’indicateur MMR est un indicateur oscillant de suivi de tendance basé sur l’élan. Il mesure l'élan en fonction des croisements de moyenne mobile (MA), de la convergence et de la divergence de la moyenne mobile et de l'indice de force relative (RSI). Il trace ensuite des histogrammes et une ligne sur une fenêtre séparée. Lors d'un marché à tendance haussière, l'indicateur trace une ligne au-dessus de zéro et des histogrammes positifs peints en vert. En revanche, lors d'une tendance baissière, l'indicateur trace la ligne en dessous de zéro et les histogrammes négatifs sont peints en rouge. Certains traders utilisent le franchissement de la ligne par zéro comme signal d’entrée. Une approche plus conservatrice serait cependant de prendre le commerce lorsque les barres de l'histogramme changent de couleur.

Stratégie de négociation

Cette stratégie est basée sur la confluence de la direction de tendance et des signaux des indicateurs PSAR, Supertrend et MMR. Les indicateurs PSAR et Supertrend sont utilisés pour déterminer la direction et les inversions de tendance en fonction de l’épuisement. Cela nous permet de mieux anticiper les retournements de tendance. L'indicateur MMR est ensuite incorporé pour déterminer si les signaux d'inversion de tendance ont un élan derrière eux. Cela nous permet de capter les signaux d’inversion de tendance qui ont une forte probabilité d’évolution.

Indicateurs:

- SuperTend

- parabolique SAR

- Étape: 0.005

- MMR

Délai: Graphiques 1 heure et 4 heures

Les paires de devises: paires majeures et mineures

Session de trading: Séances à Tokyo, Londres et New York

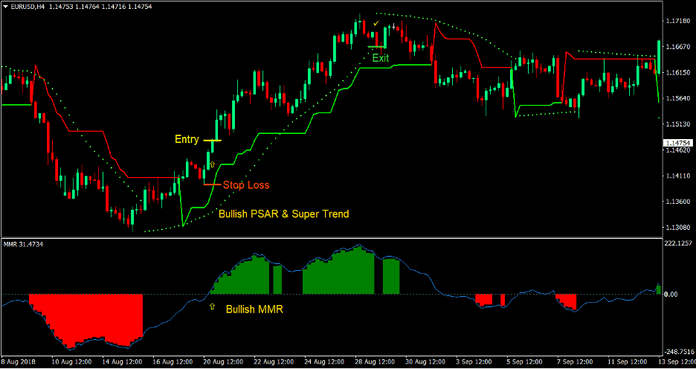

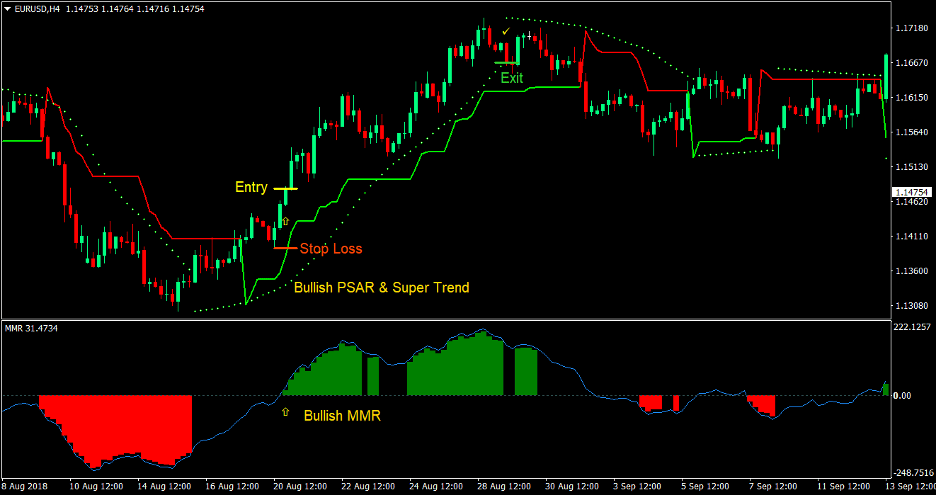

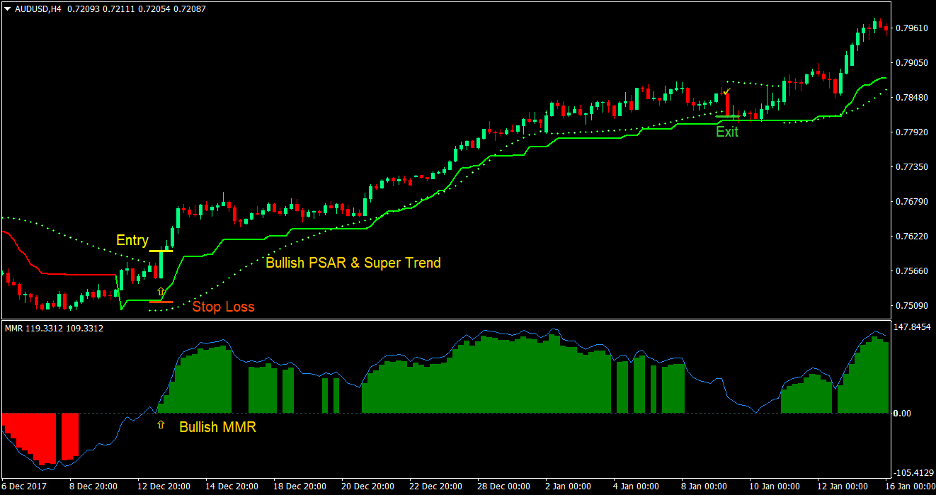

Acheter la configuration commerciale

Ouverture des inscriptions

- L'indicateur Parabolic SAR devrait tracer des points sous l'action des prix, indiquant une tendance haussière.

- L'indicateur SuperTrend devrait tracer une ligne chaux en dessous de l'action des prix, indiquant une tendance haussière.

- La ligne MMR devrait passer au-dessus de zéro et l'histogramme devrait passer au vert, indiquant une tendance haussière.

- Ces signaux d’inversion de tendance devraient être quelque peu proches les uns des autres

- Entrez un ordre d'achat sur la confluence des conditions ci-dessus

Stop Loss

- Réglez le stop loss sur le niveau de support en dessous de la bougie d'entrée

Sortie

- Clôturez la transaction si l'indicateur Parabolic SAR imprime un point au-dessus de l'action des prix

- Clôturez la transaction si la ligne indicatrice SuperTrend passe à la couleur rouge

- Fermez la transaction si l'histogramme MMR passe au rouge

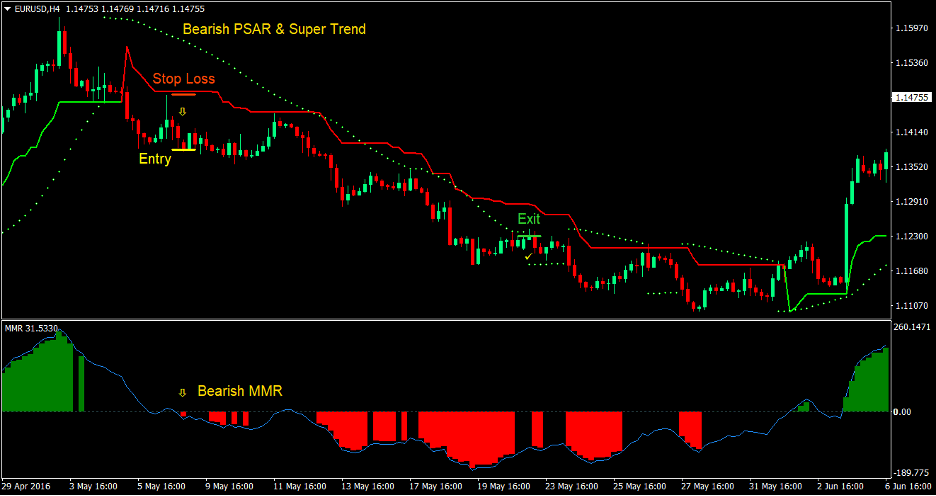

Acheter la configuration commerciale

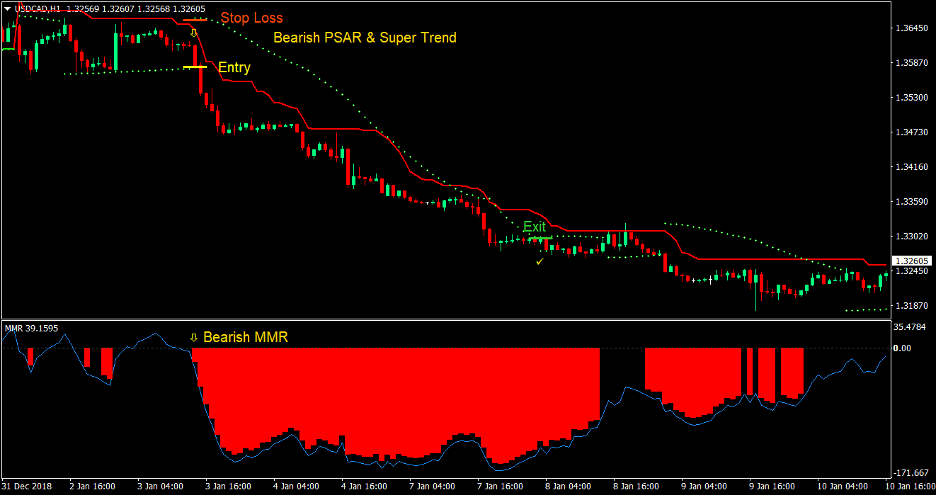

Ouverture des inscriptions

- L'indicateur Parabolic SAR devrait tracer des points au-dessus de l'action des prix, indiquant une tendance baissière.

- L'indicateur SuperTrend devrait tracer une ligne rouge au-dessus de l'action des prix, indiquant une tendance baissière.

- La ligne MMR devrait passer en dessous de zéro et l'histogramme devrait passer au rouge, indiquant une tendance baissière.

- Ces signaux d’inversion de tendance devraient être quelque peu proches les uns des autres

- Saisir un ordre de vente à la confluence des conditions ci-dessus

Stop Loss

- Réglez le stop loss sur le niveau de résistance au-dessus de la bougie d'entrée

Sortie

- Clôturez la transaction si l'indicateur Parabolic SAR imprime un point en dessous de l'action des prix

- Clôturez la transaction si la ligne indicatrice SuperTrend passe à la couleur citron vert

- Fermez la transaction si l'histogramme MMR passe au vert

Conclusion

Cette stratégie permet aux traders de détecter les inversions de tendance qui pourraient donner lieu à des transactions à haut rendement. La confluence des trois indicateurs complémentaires permet aux traders de déterminer les retournements de tendance probables en fonction de l'épuisement et du momentum.

Bien que les stratégies d'inversion de tendance ne soient pas, par nature, des transactions à haute probabilité, étant donné que l'épuisement précède généralement les inversions de tendance, le trading de cette stratégie conduit à des configurations d'inversion de tendance à haute probabilité. Ajoutez à cela le facteur d'élan derrière le commerce, ce qui donne une possibilité encore meilleure d'un renversement de tendance.

Enfin, étant donné que les renversements de tendance sont généralement le début d'une nouvelle tendance, le fait de conserver des configurations commerciales qui donneraient lieu à une tendance pourrait donner lieu à des transactions à haut rendement.

Courtiers MT4 recommandés

XM Courtier

- Gratuit $ 50 Pour commencer à trader instantanément ! (Bénéfice retirable)

- Bonus de dépôt jusqu'à $5,000

- Programme de fidélité illimité

- Courtier Forex primé

- Bonus exclusifs supplémentaires Tout au long de l'année

>> Inscrivez-vous ici pour un compte de courtier XM <

Courtier FBS

- Échangez 100 bonus: 100 $ gratuits pour démarrer votre parcours commercial !

- Bonus de dépôt 100%: Doublez votre dépôt jusqu'à 10,000 XNUMX $ et négociez avec un capital amélioré.

- Tirez parti au maximum de 1: 3000: Maximiser les profits potentiels avec l’une des options d’effet de levier les plus élevées disponibles.

- Prix « Meilleur courtier de service client d'Asie »: Excellence reconnue en matière de support et de service client.

- Promotions saisonnières: Profitez d'une variété de bonus exclusifs et d'offres promotionnelles toute l'année.

>> Inscrivez-vous ici pour un compte de courtier FBS <

Cliquez ici ci-dessous pour télécharger: