Le trading sur les marchés est avant tout une question de sentiments. Il s'agit de la nature humaine et de la psychologie de la foule. Qu’il s’agisse de transactions boursières, d’or, de pétrole, de matières premières, de crypto-monnaies ou de forex. Il y aura toujours ceux qui seront optimistes à propos d’un produit donné et ceux qui seront pessimistes à son sujet. On les appelle les taureaux et les ours. Celui qui se montrerait le plus fort à un certain moment gagnerait. En tant que traders, il ne nous appartient pas de deviner dans quelle direction évolue le marché. Notre travail consiste à avoir une idée du marché. Qui est actuellement le plus fort ? Est-ce les taureaux ou les ours ?

La stratégie de trading Bulls Bears Stop Forex est une stratégie de trading centrée sur l'idée de déterminer le sentiment du marché. Cette stratégie vise à profiter du marché des changes en évaluant objectivement la force des haussiers et celle des baissiers. Cela nous donne une indication sur la direction que nous devrions prendre afin de profiter de manière cohérente du marché des changes. Tant que nous avons une idée de la direction que veut prendre le marché, la bataille est à moitié terminée.

Indicateurs de puissance haussiers et baissiers

Les indicateurs Bulls and Bears sont des indicateurs qui tentent de mesurer la force des Bulls et des Bears sur un marché. Ce faisant, nous pouvons avoir une idée de la direction que prend le marché en fonction de leurs forces respectives.

Les indicateurs Bulls and Bears sont de simples indicateurs oscillants qui mesurent la distance entre le haut et le bas et la comparent à une moyenne mobile exponentielle (EMA). Les hausses et les baisses positives indiquent que les hauts et les bas des prix augmentent par rapport au prix moyen. Cela signifie que le sentiment du marché est haussier. D’un autre côté, si l’indicateur haussier et baissier est négatif, cela signifie que les hauts et les bas de l’action des prix sont en baisse par rapport au prix moyen, ce qui signifie que le marché est baissier.

Arrêts de lustre ou sorties de lustre

L'indicateur Chandelier Stops, également connu sous le nom de Chandelier Exits, est un indicateur de stop suiveur qui aide les traders à identifier le placement idéal des stop loss. Il ressemble beaucoup à l'indicateur parabolique d'arrêt et de marche arrière (PSAR), mais il s'agit d'une version plus simple.

L’indicateur Chandelier Stops mesure les points d’arrêt des pertes en fonction de la valeur maximale du haut et du bas. D'autres versions utilisent la valeur maximale de clôture. Il place ensuite un tampon entre la valeur maximale en calculant la plage réelle moyenne (ATR) pour une certaine période et en l'ajoutant au-dessus du maximum maximum ou en le soustrayant du maximum minimum. Cela permet aux traders d'identifier la distance de sécurité dans laquelle suivre leurs stop loss. L’argument est que si jamais le prix devait s’inverser d’un multiple de l’ATR, alors la tendance serait déjà inversée.

Stratégie de négociation

Cette stratégie de trading est une stratégie basée sur la force du sentiment du marché qui tente de déterminer la tendance en fonction de la force des haussiers et des baissiers. Pour ce faire, il utilise les indicateurs Bulls and Bears Power.

Les transactions sont effectuées en fonction de la direction des indicateurs haussiers et baissiers. Si les indicateurs haussiers et baissiers sont positifs, alors une transaction d’achat pourrait être déclenchée. En revanche, si ces indicateurs sont négatifs, une transaction de vente pourrait alors être déclenchée.

L’indicateur Chandelier Stops, qui est un indicateur de stop suiveur, serait utilisé comme indicateur de direction de tendance. Cette version particulière des Chandelier Stops ne fait que tracer la ligne opposée à la direction de la tendance. Chaque fois que la tendance est haussière, l’indicateur ne trace que la ligne inférieure. Lorsque la tendance est baissière, elle ne trace que la ligne supérieure. Cela nous indique commodément dans quelle direction la tendance est basée sur l'indicateur.

Enfin, bien que les signaux d’entrée ci-dessus soient de haute qualité, nous filtrerons toujours les transactions qui vont à contre-courant de la tendance à long terme. Pour ce faire, nous utiliserons la moyenne mobile exponentielle (EMA) sur 200 périodes. Cette moyenne mobile est un indicateur de tendance à long terme largement utilisé. Les transactions ne doivent être effectuées que si les trois autres indicateurs sont en accord avec le 200 EMA.

Indicateurs:

- 200 EMA (or)

- LustreStops-v1

- Longueur: 28

- Période ATR : 18

- Kv : 3.5

- Bulls

- Période: 50

- Ours

- Période: 50

Délai: Graphiques quotidiens et sur 4 heures

Les paires de devises: paires majeures et mineures

Session de trading: Tokyo, Londres et New York

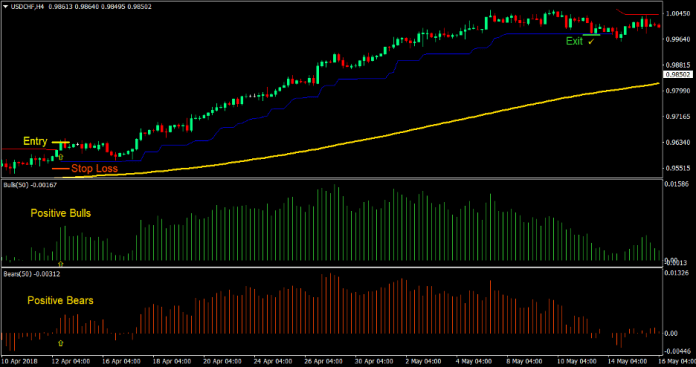

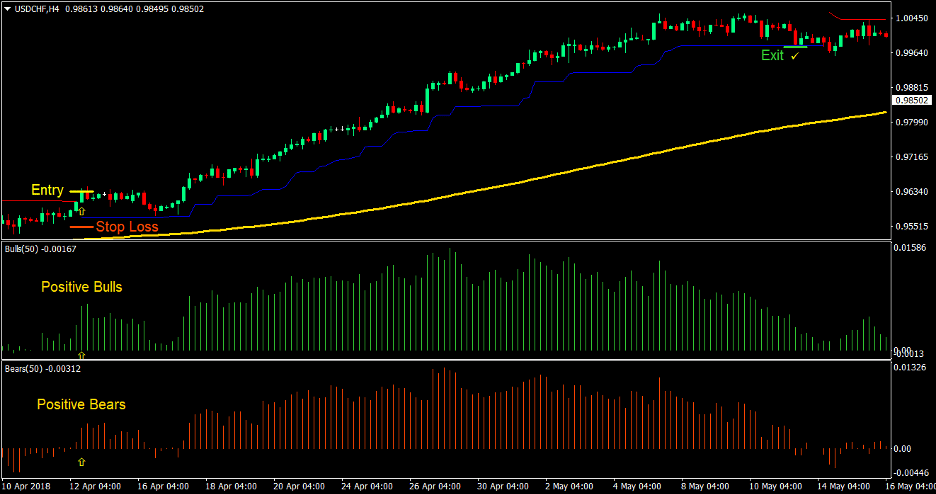

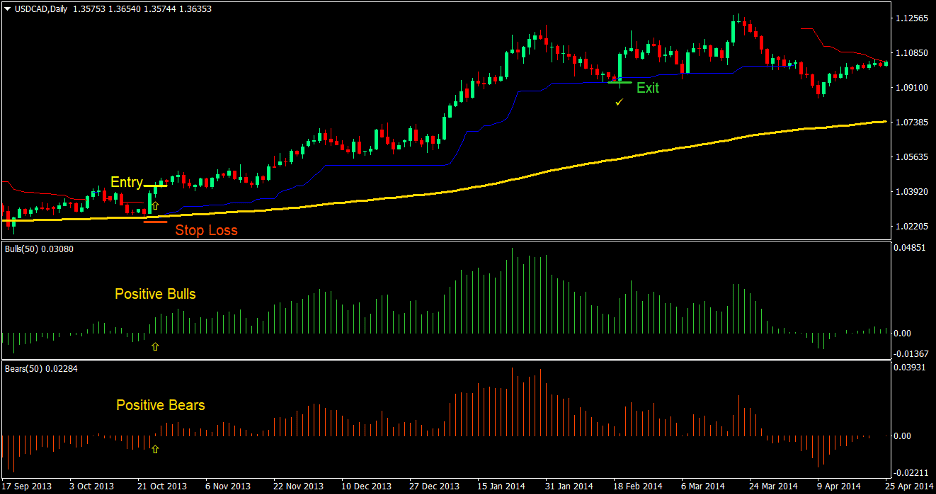

Acheter la configuration commerciale

Ouverture des inscriptions

- Le prix devrait être supérieur à 200 EMA, indiquant une tendance haussière à long terme

- Les indicateurs Bulls et Bears Power devraient être positifs, indiquant un sentiment haussier du marché.

- L'indicateur Chandelier Stops devrait imprimer une ligne bleue sous l'action des prix, indiquant une tendance haussière.

- Entrez un ordre d'achat à la confluence des conditions de marché ci-dessus

Stop Loss

- Réglez le stop loss au niveau de support en dessous de la bougie d'entrée

Sortie

- Suivez le stop loss en dessous de la ligne bleue Chandelier Stops jusqu'à ce que vous vous arrêtiez en profit.

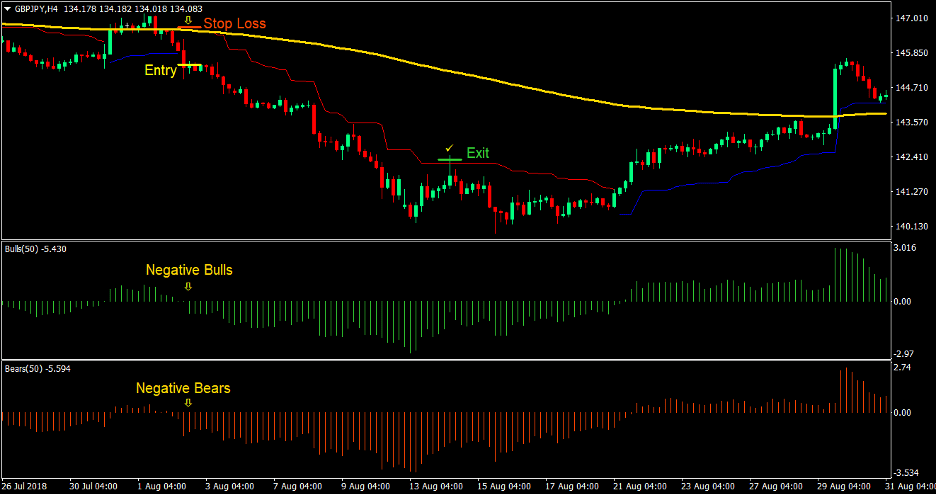

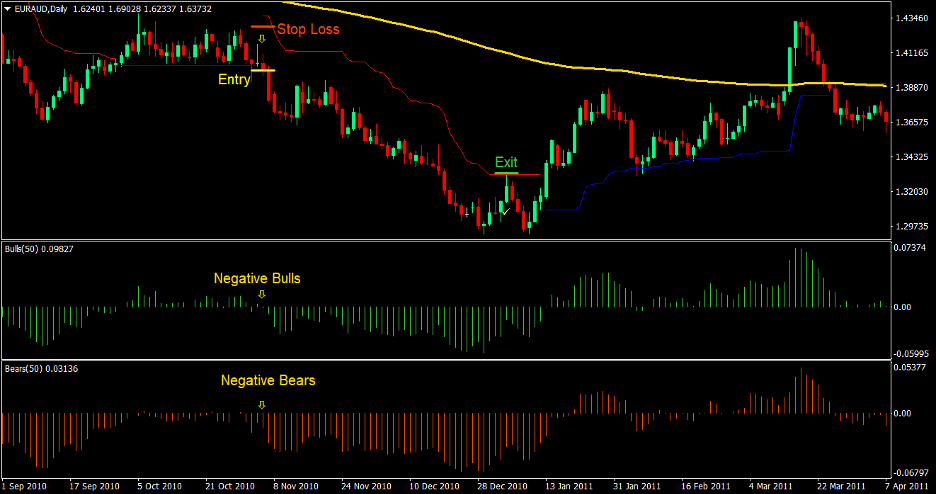

Vendre la configuration du commerce

Ouverture des inscriptions

- Le prix devrait être inférieur à 200 EMA, indiquant une tendance baissière à long terme

- Les indicateurs Bulls and Bears Power devraient être négatifs, indiquant un sentiment baissier du marché.

- L'indicateur Chandelier Stops devrait imprimer une ligne rouge au-dessus de l'action des prix, indiquant une tendance baissière.

- Entrez un ordre de vente à la confluence des conditions de marché ci-dessus

Stop Loss

- Réglez le stop loss au niveau de résistance au-dessus de la bougie d'entrée

Sortie

- Suivez le stop loss au-dessus de la ligne rouge Chandelier Stops jusqu'à ce que vous vous arrêtiez en profit

Conclusion

Cette stratégie de trading est une stratégie de trading décemment rentable. Son taux de réussite est assez décent car la tendance est basée sur le sentiment du marché et les transactions sont filtrées afin de s'aligner sur la tendance à long terme. Ce faisant, nous prenons des transactions qui sont plus susceptibles d'évoluer dans la direction de notre transaction, car les transactions doivent surmonter moins de supports dynamiques et de résistances. Cette stratégie de trading présente également un juste rapport récompense-risque qui peut passer de 2:1 à 4:1 en fonction des conditions du marché.

Courtiers MT4 recommandés

XM Courtier

- Gratuit $ 50 Pour commencer à trader instantanément ! (Bénéfice retirable)

- Bonus de dépôt jusqu'à $5,000

- Programme de fidélité illimité

- Courtier Forex primé

- Bonus exclusifs supplémentaires Tout au long de l'année

>> Inscrivez-vous ici pour un compte de courtier XM <

Courtier FBS

- Échangez 100 bonus: 100 $ gratuits pour démarrer votre parcours commercial !

- Bonus de dépôt 100%: Doublez votre dépôt jusqu'à 10,000 XNUMX $ et négociez avec un capital amélioré.

- Tirez parti au maximum de 1: 3000: Maximiser les profits potentiels avec l’une des options d’effet de levier les plus élevées disponibles.

- Prix « Meilleur courtier de service client d'Asie »: Excellence reconnue en matière de support et de service client.

- Promotions saisonnières: Profitez d'une variété de bonus exclusifs et d'offres promotionnelles toute l'année.

>> Inscrivez-vous ici pour un compte de courtier FBS <

Cliquez ici ci-dessous pour télécharger: