Le marché des changes est l’un des marchés les plus turbulents en matière de trading. Les nouveaux traders qui se lanceraient tête première dans le trading du Forex découvriraient rapidement que le trading sur ce marché n'est pas aussi facile qu'ils le pensent. Le marché des changes est souvent très chaotique. Il se déplace de manière erratique de haut en bas sur le graphique, sans apparemment aucune direction claire. Mais de temps en temps, le marché des changes présentait une opportunité. Le marché montrerait des signes indiquant qu’il est prêt à se redresser ou à plonger. Ces mouvements aboutissent souvent à des tendances qui durent suffisamment longtemps pour que les traders puissent profiter de beaucoup plus que ce qu'ils risqueraient. Cependant, pour un œil non averti, ces indices d’une tendance imminente sont assez difficiles à déchiffrer.

Il existe de nombreuses façons de déterminer que le marché est sur le point d’évoluer. L’un des meilleurs moyens d’anticiper une tendance consiste à identifier les convergences. La stratégie de trading Forex Awesome Oscillator Cloud aide les traders à identifier les convergences qui ont une forte probabilité d'aboutir à une tendance.

Oscillateur génial

L'Awesome Oscillator est un indicateur oscillant basé sur l'élan qui est utilisé pour indiquer la direction de la tendance.

Le concept derrière cet indicateur est assez simple, mais même avec sa simplicité, il est également très efficace. Il calcule la différence entre deux moyennes mobiles simples (SMA). Cependant, la moyenne mobile n'est pas calculée sur la base de la clôture de la bougie mais plutôt sur sa médiane. La différence entre les moyennes mobiles est ensuite tracée sous forme de barre d'histogramme dans une fenêtre séparée. Les barres d'histogramme positives indiquent une tendance haussière tandis que les barres d'histogramme négatives indiquent une tendance baissière. Une indication à plus court terme serait la hausse et la baisse des histogrammes. Ceci est utile lorsque l'on tente d'identifier les pics et les creux, en particulier lors des divergences de trading.

Nuage Ichimoku – Kumo

L'indicateur Ichimoku Cloud est un indicateur technique utilisé pour déterminer la direction de la tendance en fonction de l'élan. Il détermine simultanément la tendance à court, moyen et long terme sur la base d'une variété de moyennes mobiles modifiées et de l'évolution des prix. Il comporte cinq lignes au total.

Le Chikou Span ou Lagging Span est en fait une version retardée de l’action des prix. Il est destiné à suivre l'évolution des prix en fonction de la clôture de chaque bougie, tout en étant tracé à une certaine distance derrière elle. Le Tenkan-sen ou ligne de conversion est une moyenne mobile basée sur la médiane de chaque bougie et représente la tendance à court terme. Le Kijun-sen représente la tendance à moyen terme et est également basé sur la médiane de chaque bougie sur une période plus longue. Le Senkou Span A ou Leading Span A est la moyenne du Tenkan-sen et du Kijun-sen tandis que le Senkou Span B est une moyenne de la médiane sur une période encore plus longue et est tracé avant l'évolution des prix.

Le Kumo ou Cloud est composé du Senkou Span A et du Senkou Span B, et représente la tendance à long terme. La tendance à long terme est déterminée en fonction de l'emplacement du Senkou Span A par rapport au Senkou Span B. Si le Senkou Span A est supérieur au Senkou Span B, le marché est considéré comme haussier. S'il est superposé à l'inverse, le marché est alors considéré comme baissier. La tendance à long terme est considérée comme s’étant inversée à chaque croisement des deux lignes.

Stratégie de négociation

La stratégie de trading Forex Awesome Oscillator Cloud est basée sur la confluence de l'Awesome Oscillator et du Kumo de l'indicateur Ichimoku Cloud. Ces indicateurs sont basés sur des croisements de moyennes mobiles basées sur la médiane et représentent une tendance à long terme.

Bien que les signaux d’entrée de ces indicateurs ne convergent généralement pas, les signaux qui se produisent à proximité les uns des autres ont tendance à avoir une forte probabilité d’aboutir à une tendance.

Les signaux commerciaux sont basés sur le croisement des histogrammes de l'Awesome Oscillator sur la ligne médiane et le croisement des lignes du Kumo.

Indicateurs:

- Ichimoku

- impressionnants

Délai: Graphiques quotidiens et sur 4 heures

Les paires de devises: paires majeures et mineures

Session de trading: Tokyo, Londres et New York

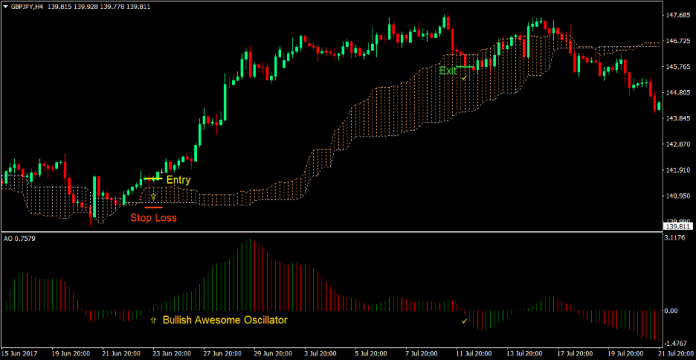

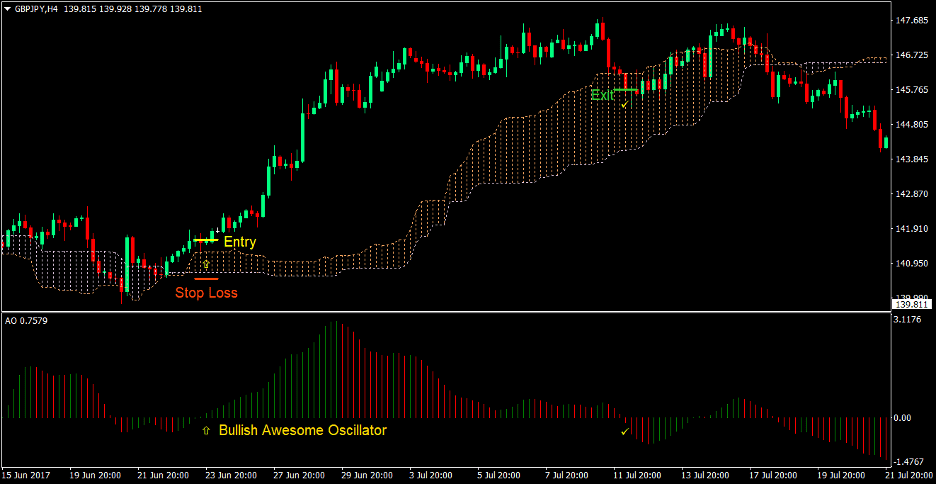

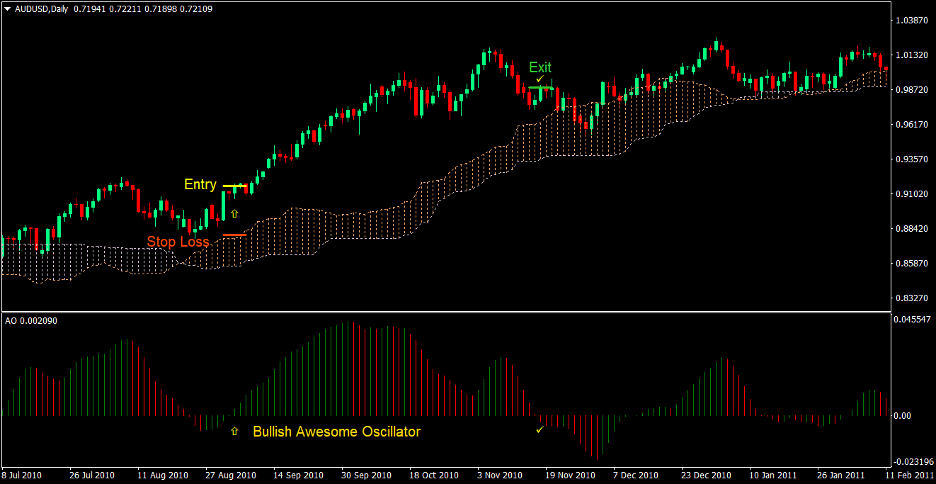

Acheter la configuration commerciale

Ouverture des inscriptions

- Senkou Span A devrait dépasser Senkou Span B, indiquant un croisement de tendance haussière à long terme basé sur le Kumo.

- Les histogrammes de l'Awesome Oscillator devraient passer au-dessus de la ligne médiane, indiquant une tendance haussière.

- Ces signaux d'entrée doivent se produire quelque peu près les uns des autres

- Entrez un ordre d'achat sur la confluence des conditions ci-dessus

Stop Loss

- Réglez le stop loss sur le niveau de support en dessous de la bougie d'entrée

Sortie

- Fermez la transaction dès que les histogrammes deviennent négatifs

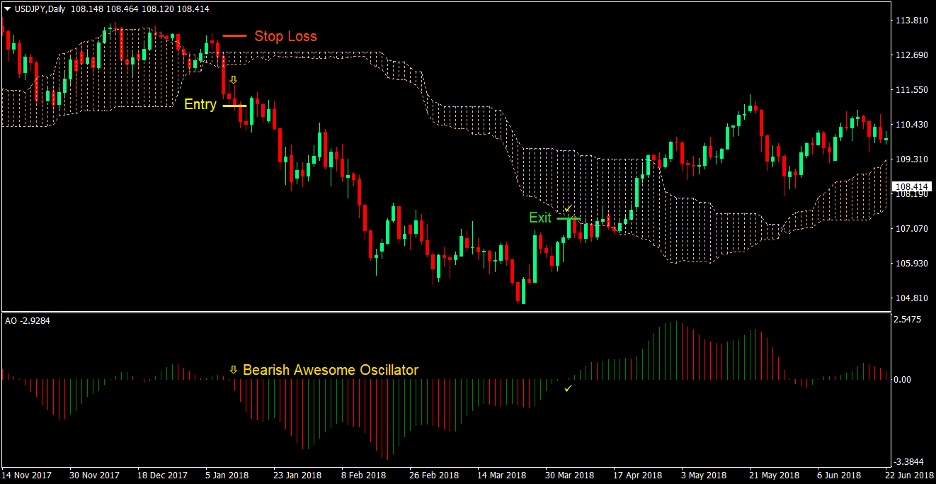

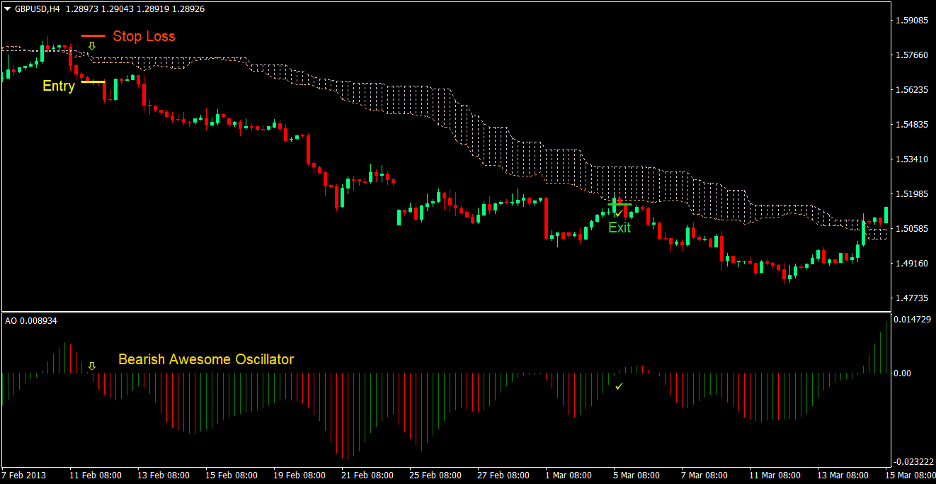

Vendre la configuration du commerce

Ouverture des inscriptions

- Senkou Span A devrait passer en dessous de Senkou Span B, indiquant un croisement de tendance baissière à long terme basé sur le Kumo.

- Les histogrammes de l'Awesome Oscillator devraient passer en dessous de la ligne médiane, indiquant une tendance baissière.

- Ces signaux d'entrée doivent se produire quelque peu près les uns des autres

- Saisir un ordre de vente à la confluence des conditions ci-dessus

Stop Loss

- Réglez le stop loss sur le niveau de résistance au-dessus de la bougie d'entrée

Sortie

- Fermez le commerce dès que les histogrammes deviennent positifs

Conclusion

Cette stratégie de trading est une stratégie de trading de tendance à long terme. En tant que tel, il est destiné à négocier sur des transactions à plus long terme qui aboutissent souvent à des gains plus importants basés sur les pips. Les traders pourraient effectuer des transactions swing trading beaucoup plus longtemps sur la base de cette stratégie. Les transactions pourraient durer plusieurs jours, permettant au marché d'évoluer sur plusieurs pips.

Les traders qui utiliseraient cette stratégie devraient la combiner avec d'excellentes compétences en gestion commerciale. Ils doivent apprendre à déplacer le stop loss jusqu’au seuil de rentabilité au bon moment et à le suivre à une distance optimale.

Il y aura des cas où le signal d'inversion de l'Awesome Oscillator se produira plus tard que l'action des prix. Afin de compenser cela, les traders pourraient choisir de clôturer la transaction dès qu'une bougie se ferme à l'intérieur du Kumo (Cloud).

Cette stratégie est une stratégie efficace qui pourrait fournir des rendements stables si elle est utilisée correctement.

Courtiers MT4 recommandés

XM Courtier

- Gratuit $ 50 Pour commencer à trader instantanément ! (Bénéfice retirable)

- Bonus de dépôt jusqu'à $5,000

- Programme de fidélité illimité

- Courtier Forex primé

- Bonus exclusifs supplémentaires Tout au long de l'année

>> Inscrivez-vous ici pour un compte de courtier XM <

Courtier FBS

- Échangez 100 bonus: 100 $ gratuits pour démarrer votre parcours commercial !

- Bonus de dépôt 100%: Doublez votre dépôt jusqu'à 10,000 XNUMX $ et négociez avec un capital amélioré.

- Tirez parti au maximum de 1: 3000: Maximiser les profits potentiels avec l’une des options d’effet de levier les plus élevées disponibles.

- Prix « Meilleur courtier de service client d'Asie »: Excellence reconnue en matière de support et de service client.

- Promotions saisonnières: Profitez d'une variété de bonus exclusifs et d'offres promotionnelles toute l'année.

>> Inscrivez-vous ici pour un compte de courtier FBS <

Cliquez ici ci-dessous pour télécharger: