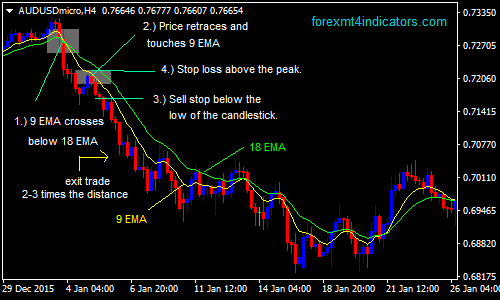

Floor Trader’s Forex Swing Trading Strategy

The floor trader’s method is a trend following system which can be used effectively as a swing trading strategy. this system has 3 concepts. First is it is a retracement continuation trading method, Second is it uses moving averages to identify the trend and trade in the direction of the trend and third is the trading setup or the trading trigger is a reversal pattern that forms after the retracement.

The indicators that will be used in this system are 9 EMA and 18 EMA and this is applicable to 1-hour or higher timeframe.

Retracements:

In a downtrend, the retracement or pullback is the minor rally upward.

In an uptrend, the retracement or pullback is the minor rally downward

Short Entry Rules:

- 9 EMA must cross below the 18 EMA. This is an indication that market is in a downtrend.

- There must be a retracement of the price, it means the price will go back up and touches the 9 EMA or both EMAs.

- Enter short on the breakout of the low of the candlestick prior to the current one.

- The stop loss should be 1-5 pips above the peak of the retracement.

Long Entry Rules:

- 9 EMA must cross above the 18 EMA. This indicates that market is in an uptrend.

- There should be a retracement or the price must go back down and touches the 9 EMA or both EMAs.

- Enter long on the breakout of the high of the candlestick prior to the current one

- The stop loss should be placed 1-5 pips below the low of the retracement.

Trade Management:

- Move the stop loss to break even when the trade moves by the amount risked.

- Consider also to take profit when the price moves twice the distance of the retracement where you took the trade on.

- Trailing the stop is another option to manage the trade. Move it to the high or low of the previous candlestick.

Target profit:

- Use the Fibonacci tool to take profit. take it on the 161.8 or 261.8 levels.

- You can also use 2 or 3 times the distance of the retracement to calculate the profit targets.

Advantages:

- This is a trend following system, so the trend is your friend.

- It’s simple and easy to understand and implement and allows you to enter a trade at the beginning of the trend.

- Higher timeframes are much more reliable and dictated by price action.

- Stop Loss is placed above the resistance or support levels and this reduces to get stopped out.

Disadvantages:

- False signals can occur. especially on a sideway market.

- Retracement will not happen in a fast moving trending market. You can miss entering a trade. The market may lose its steam and will get you stopped out.

- The retracements or pullbacks may happen away from the ema crossover.

Recommended MT4 Brokers

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Sign Up for XM Broker Account here <<

FBS Broker

- Trade 100 Bonus: Free $100 to kickstart your trading journey!

- 100% Deposit Bonus: Double your deposit up to $10,000 and trade with enhanced capital.

- Leverage up to 1:3000: Maximizing potential profits with one of the highest leverage options available.

- ‘Best Customer Service Broker Asia’ Award: Recognized excellence in customer support and service.

- Seasonal Promotions: Enjoy a variety of exclusive bonuses and promotional offers all year round.

>> Sign Up for FBS Broker Account here <<

Click here below to download: